Powell "slaps" Trump's Bitcoin reserve strategy, BTC plunges 5% to barely touch the $100,000 mark

Reprinted from panewslab

12/19/2024·6MOn Wednesday afternoon local time, the Federal Reserve announced that it would cut its benchmark policy interest rate by 25 basis points, but suggested that the number of interest rate cuts in 2025 may be less than previously expected. U.S. stocks and cryptocurrency markets plunged.

The Fed's latest quarterly economic forecast shows that it may cut interest rates only twice in 2025 - down from the four forecast in September and down from the three that markets expected before the meeting, which means they will be more cautious in balancing inflation and economic growth. relationship between. Fed members' forecasts for next year's personal consumption expenditures (PCE) and core PCE inflation rose to 2.5%, respectively, from 2.1% and 2.2% forecast in September.

Powell described the shift as a "new phase" in monetary policy and emphasized that after a 100 basis point cut in 2024, interest rates are now significantly closer to a neutral stance.

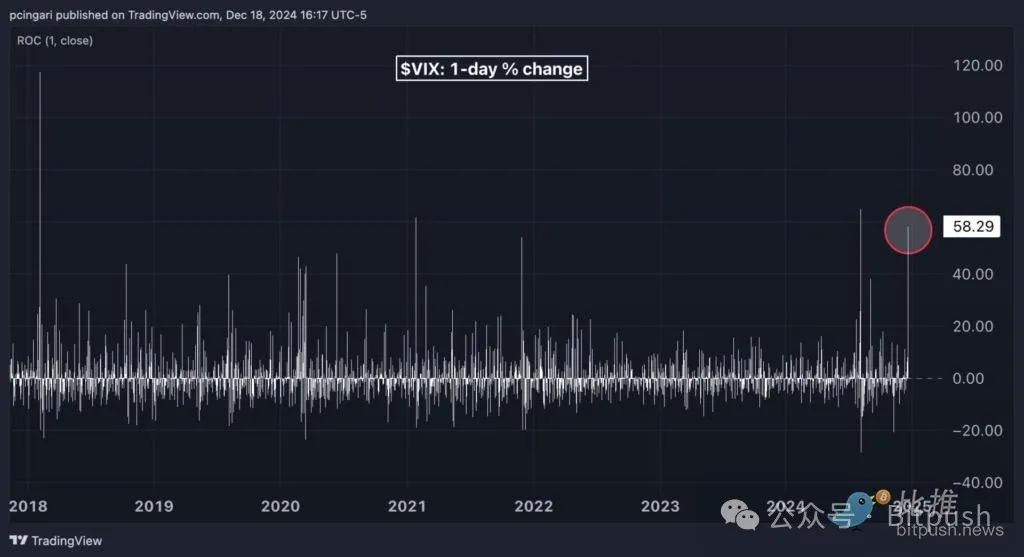

As of the close of the day, all three major stock indexes fell. The Dow initially closed down 2.59%, setting a record for the longest single-day losing streak in 50 years (the 10th consecutive trading day of declines); the S&P 500 closed down 2.95%, and the Nasdaq closed down. 3.56%. The U.S. dollar surged to a two-year high and the CBOE Volatility Index, also known as the VIX and Wall Street Fear Gauge, soared 58% to 25, reflecting rising investor uncertainty and growing anxiety about future interest rates.

Powell's remarks "slap" Trump in the face?

At a press conference on Wednesday, in response to an Axios reporter’s question about Trump’s idea of establishing a strategic Bitcoin reserve after taking office, Powell said: “We (the Federal Reserve) are not allowed to own Bitcoin, and the Federal Reserve Act stipulates that we can What we have is, we don't want the law to change. That's something for Congress to consider, but we don't want the Fed to change the law."

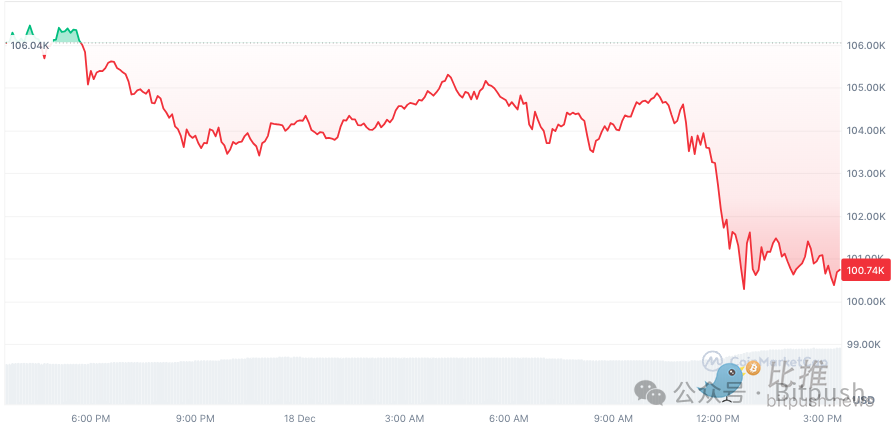

Bitcoin fell to $104,000 after the Fed announcement, then fell back to a low of around $100,256 after Powell's speech, falling nearly 5% in 24 hours. Altcoins fell even more, with XRP, ADA, and LTC down nearly 10%.

Trump has repeatedly stated that he will establish a strategic Bitcoin reserve. He mentioned in a CNBC interview last week: "We are going to do great things in the cryptocurrency field because we don't want any other country to embrace cryptocurrency, we want to be the leader."

BiTui previously reported that Wyoming Republican Senator Cynthia Lummis is drafting a bill that will direct the U.S. Treasury Department to purchase 1 million Bitcoins within five years, and the purchase funds will come from Federal Reserve bank deposits and gold reserves.

Bills to invest in Bitcoin have also been proposed in other U.S. states, with Pennsylvania Republican lawmakers introducing a bill in November that would allow the Pennsylvania Department of the Treasury to invest in Bitcoin, digital assets and cryptocurrency-based exchange-traded products.

The idea of establishing a strategic Bitcoin reserve has also been met with some criticism. Former New York Fed President Bill Dudley said in an opinion piece published by Bloomberg last week that this was a "bad deal" for Americans.

An analysis report released this week by Barclays argued that funding strategic Bitcoin reserves may require congressional approval and the issuance of new Treasury bonds. Analysts at Barclays said "we suspect the plan will face strong resistance from the Fed" given the likely means of building such reserves.

What will happen next?

The crypto market is currently overly optimistic that the United States may establish a strategic Bitcoin reserve, while ignoring other countries. Grayscale Research research shows that sovereign wealth funds in Asia and the Middle East are the more likely next driving force.

Zach Pandl, director of research at Grayscale, said: “The plunge in Bitcoin prices after Fed Chairman Powell’s speech suggests that investors may be too focused on the theoretical possibility of Bitcoin’s strategic reserve. Grayscale Research expects more nation-states to adopt Bitcoin, but next A more likely step would be sovereign wealth funds in Asia or the Middle East, which already manage highly diversified asset pools.”

Andre Dragosch, Head of European Research at Bitwise, believes: “I think the biggest trouble for the Fed right now is that despite the Fed’s interest rate cuts, financial conditions are still tight. Since 9 Since last month, long-term bond yields and mortgage rates have been rising, and the dollar has appreciated, which also means that financial conditions have tightened. The continued appreciation of the dollar also poses macro risks to Bitcoin, because the appreciation of the dollar is also related to the contraction of the global money supply. , which tends to be detrimental to Bitcoin and other crypto assets, in fact, the continued reduction in Fed net liquidity, in my opinion, tighter liquidity and a stronger US dollar are also the biggest risks to BTC...On the other hand, BTC's on-chain. Factors continue to be very favorable, especially the continued decline in exchange balances, which supports BTC The supply gap continues to grow."

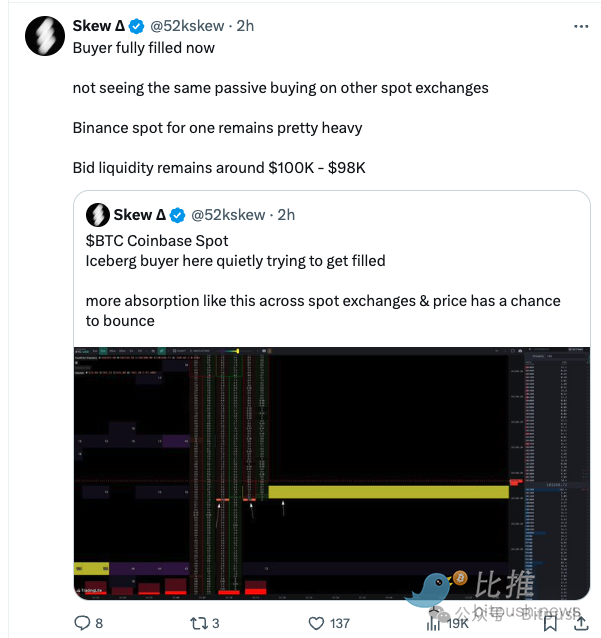

The decline in Bitcoin has led to drastic changes in the positions of both long and short parties. According to a chart by crypto analyst Skew, bulls stopped losses and shorts took profits, and the price of Bitcoin fell to the $100,000 to $98,000 range to seek support. Skew emphasized that if it wants to reverse the decline, Bitcoin price must regain the $100,000 to $101,400 range through spot buying and gain a firm foothold on the daily chart.

Additionally, the 4-hour chart shows that BTC bulls need Bitcoin to show strong buying power near $100,000 and successfully close above $101,400 to consolidate gains. Failure to hold this level could lead to a retest of support and buying zones near $98,000.

Analysts from the blockchain analysis platform Santiment expressed optimism and posted on Stabilizing within 24-48 hours, this can actually be interpreted as a strong signal.”

jinse

jinse