Pantera Partner: DAT Inspur

Reprinted from jinse

06/04/2025·12DAuthor: Paul Veradittakit, partner at Pantera Capital; translated by AIMan@Golden Finance

Everyone believes that Bitcoin ETFs will replace Microstrategy as the best way to invest in Bitcoin in the open market. In January last year, analysts predicted that “the premium of Microstrategy stock relative to Bitcoin could drop from about 40% to between 15% and 25%.”

But that's not the case. Today, Microstrategy has a market capitalization of $104 billion, just $24 billion less than the total market capitalization of all Bitcoin ETFs. Microstrategy is trading at 70% higher than Bitcoin’s net worth. Obviously, the open market believes that Microstrategy provides unparalleled opportunities for investing in Bitcoin.

Two months ago, Nasdaq listed company Janover was acquired and renamed DeFi Development Corp. The company, whose stock code is DFDV, announced that they are "the first public company focused on Solana (SOL) cumulative compounding interest." A month ago, SharpLink Gaming announced the completion of a $425 million private equity financing. The company, whose stock code is SBET, announced that it will "adopt ETH, the native asset of the Ethereum blockchain, as its main reserve asset."

In the past two months, two Microstrategy-like products have entered the open market—DFDV for Solana and Sharplink for Ethereum. As a leader in DFDV and Sharplink, Pantera Capital firmly believes that corporate crypto vault products can bring unique cryptocurrency investment opportunities to the open market. Now, let's analyze what crypto vault (DAT) companies are and what Pantera Capital thinks of them.

Interpretation of Digital Asset Treasury (DAT)

To explain the type of exposure of DAT stocks to cryptocurrencies and how their exposure to cryptocurrencies differs from ETFs, we must first understand how Digital Asset Vaults (DATs) work.

The creation of DAT is fairly simple on paper. The company only needs

-

Raise funds from investors in the form of debt or equity

-

Use the funds raised to buy the vault assets of your choice. In the case of DFDV, you can buy Solana

Since vault assets are part of a company's balance sheet, owning a company's equity gives you access to financial assets; owning DFDV stock allows you to hold a position in Solana.

A smaller scale in operating business helps investors focus on the value of the vault rather than the operational business itself. Therefore, there is little or no operation of non-treasury-related businesses in Nasdaq listed companies, which is best suited to adopt such strategies, since most of the equity value of these companies stems from vault assets.

Deeply explore DAT

As of the end of May, Microstrategy had a price-to-earnings ratio of 1.7 times the value of its Bitcoin coin holdings, DFDV had a price-to-earnings ratio of 5.6 times, and Sharplink had a price-to-earnings ratio of 8.1 times. If a company's value depends on its vault, why does its stock trade higher than its inventory value? How do we evaluate the value of DAT?

Important indicators

Pantera focuses on two valuation indicators—Net Asset Premium and Average Asset Per Share Growth.

Net asset premium

NAV represents the net asset value of the vault held by the company. For DFDV, NAV refers to the value of Solana it holds. The NAV premium indicator indicates the price an investor is willing to pay for the stocks in the digital asset vault compared to the direct purchase of their underlying digital assets. The calculation method is to divide the stock market value by NAV.

Average growth rate of underlying assets per share

To understand the meaning of these indicators, we must first understand how the net asset (NAV) premium is generated. As Pantera's previous briefing wrote, the reason why MSTR has a premium is because investors believe that through MSTR, over time, the amount of Bitcoin (BPS) per share may be held more than buying a single BTC directly. Let's do a simple mathematical calculation:

If you buy MSTR at twice the net worth (2.00 times the net worth) you will buy 0.5 BTC instead of 1.0 BTC through spot. But if MSTR is able to raise funds and BPS grows 50% per year (74% last year), you will have 1.1 BTC by the end of the second year – more than you buy spot directly.

In the above example, the average growth rate of the underlying asset per share is 50%. The growth of 0.5BPS to 1.1BPS is the gain you get, which justifies you buying MSTR at a price twice as high as NAV.

Therefore, the average growth in underlying assets per share reflects the vault growth of token value standardized by the number of shares issued.

DAT Valuation

What is the target asset?

In order for DAT to be attractive to investors, vault assets should meet the following conditions:

-

Well-known assets.

-

The assets that people want to reach.

-

Hard to obtain assets.

Bitcoin, Solana and Ethereum all meet the first two points. Regarding the third point, although cryptocurrencies are difficult to enter in the open market, they are not impossible. However, for a large number of investors, including stock mutual funds and ETFs, their authorization only allows them to purchase operating companies and not directly purchase assets, which makes them unable to purchase BTC but can purchase BTC-DAT.

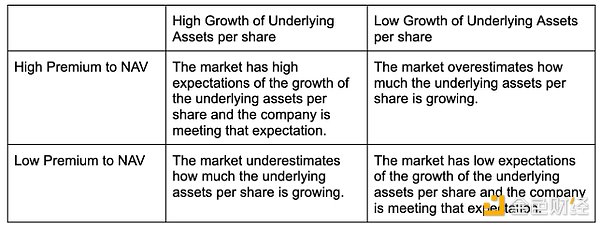

Are the net asset value premium and the average growth rate of underlying

assets per share reasonable?

As mentioned in the previous section, people buy DAT at a price higher than their net assets in the vault, hoping that the company will accumulate more tokens so that your shares will hold more tokens in the future than 1 unit of underlying token to buy.

We can see that the best choices are those DATs that have a lower premium relative to NAV and have a higher growth rate per share. But how do we quantify the growth of underlying assets per share? What are the common ways to increase vaults by DAT?

Buy more cryptocurrencies

One of the easiest ways to raise more money is to expand the vault assets. There are many ways to raise funds; two common ways include convertible bonds and private equity investment (PIPE). Private investors can purchase bonds and choose to convert into equity when the stock price reaches a specific price, or they can purchase equity.

If a company issues bonds, the number of outstanding shares will not increase, so the number of underlying assets per share will increase. If a company issues equity, as long as its issuance price is higher than its net asset value, the number of underlying assets per share will increase.

It is worth noting that due to the size of DATs, they have opportunities that retail investors cannot get. For example, last month Upexi bought 77,879 locked SOLs for $151.50 per share, totaling $11.8 million. At SOL's current price of $178.26, this brings investors a built-in return of $2.1 million (17.7%). Locked tokens are usually held by institutional investors who are willing to sell their tokens at discounted prices to free up liquidity. DATs like Upexi can take advantage of their liquidity demand to buy tokens at discounted prices.

Verifiers and network participation

Another way a company can increase its funds is to pledge and use its funds to trade. DFDV is a DAT platform that adopts this strategy - they acquired a staking business company and pledged 500,000 Solana tokens, generating the agreement-native cash flow through self-staking. Since all the proceeds from the pledge are returned to their funds, the pledge increases the underlying asset per share.

What are the risks?

The situation you want to avoid is that DAT is forced to sell its vault, thereby reducing the value of the underlying asset per share. Two main reasons why DAT is forced to sell military pants are: repaying maturing debts or making up for negative operating cash flow.

Therefore, it is important to examine how much of the funds raised are debts and carefully review the debt maturity structure. Operating companies must be self-sufficient, rather than being caught in a burning situation. The ability and reputation of managing teams are also crucial as they need to effectively apply a variety of capital market tools and effectively market to a wider range of investors.

What's unique about DAT

They don't sell

While ETFs are designed to track asset prices and may rebalance or liquidate positions to meet redemption or regulatory requirements, DAT companies buy and hold assets such as Bitcoin, Solana or Ethereum and use it as a long-term strategy. For example, MicroStrategy always adds Bitcoin to its vault regardless of market cycles. This belief-based approach is in sharp contrast with the more passive management method of ETFs.

Get special opportunities

DAT companies may also offer special opportunities that ETFs often do not have. DFDV uses its holdings Solana to participate in staking and validator operations to generate revenue and support network growth. SharpLink’s Ethereum strategy, supported by industry leaders such as ConsenSys, opens the door to protocol-level activities such as staking and DeFi participation that are not available to ETF investors.

chaincatcher

chaincatcher