Detailed explanation of Ethereum's dominance in the RWA market

Reprinted from jinse

06/04/2025·12DAuthor: Chi Anh, Ryan Yoon Source: Tiger Research Translation: Shan Oppa, Golden Finance

TL;DR

-

Ethereum is currently leading the RWA market, thanks to its first-mover advantage, past institutional experiments, deep on-chain liquidity and decentralized architecture.

-

However, the faster and cheaper general blockchain, as well as the RWA-specific chain designed for compliance, are filling Ethereum’s cost and performance limitations. These emerging platforms position themselves as the next generation infrastructure by providing superior technology scalability or built-in compliance capabilities.

-

The next phase of RWA growth will be led by a chain that successfully integrates three elements: on-chain regulatory compatibility, a service ecosystem built around real-world assets, and meaningful on-chain liquidity.

1. In what aspects is the RWA market developing at present?

Tokenization of real-world assets (RWA) has become one of the most prominent themes in the blockchain industry. Global consulting firms such as Boston Consulting (BCG) have released extensive market forecasts, and Tiger Research has conducted in-depth analysis of emerging markets such as Indonesia, highlighting the growing importance of the industry.

So, what exactly is a risk-weighted asset (RWA)? They refer to the conversion of tangible assets such as real estate, bonds and commodities into digital tokens. This tokenization process requires blockchain infrastructure. Currently, Ethereum is the leading infrastructure to support such transactions.

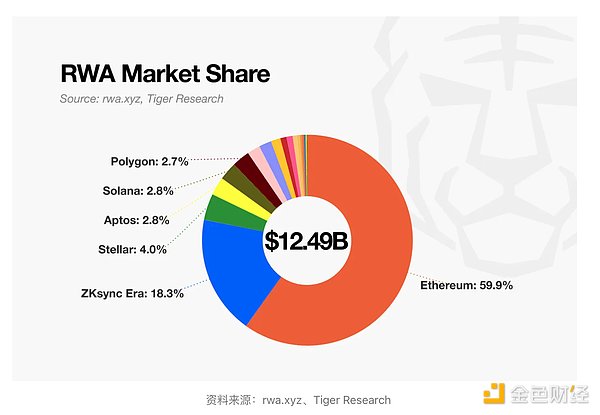

Despite increasingly fierce competition, Ethereum still maintains a dominant position in the risk asset management (RWA) market. Some specialized RWA blockchains have emerged, and platforms like Solana that have gained a foothold in the DeFi field are also expanding into the RWA field. Even so, Ethereum still accounts for more than 50% of market activity, highlighting its solid market position.

This report examines the key factors that Ethereum currently dominates the RWA market and explores changing conditions that may affect the next phase of growth and competition.

2. Why does Ethereum stay ahead?

2.1. First-mover advantage and institutional trust

The reason why Ethereum has become the default platform for institutional tokenization is obvious. It is the first to introduce smart contracts and actively prepares for the risk-weighted asset market.

Supported by a highly active developer community, Ethereum established key tokenization standards such as ERC-1400 and ERC-3643 long before the advent of competing platforms. This early foundation provides the necessary technical and regulatory foundation for pilot projects.

Therefore, many institutions start evaluating Ethereum before considering alternatives. Some important measures in the late 2010s helped verify Ethereum’s position in institutional finance:

-

JPMorgan’s Quorum and JPM Coin (2016-2017): To support enterprise use cases, JPMorgan developed Quorum, a licensed fork for Ethereum. The launch of JPM Coin for interbank transfers shows that Ethereum’s architecture – even in its private form – can meet regulatory requirements in data protection and compliance.

-

Societek Bond Issuance (2019): Societek FORGE issued 100 million euros in collateral bonds on the Ethereum public main network. This suggests that regulated securities can be issued and settled on public blockchains while minimizing intermediary participation.

-

European Investment Bank Digital Bonds (2021): EITB has issued 100 million euros of digital bonds on Ethereum in partnership with Goldman Sachs, Santander and Societe Generale. The bond is settled using the Central Bank Digital Currency (CBDC) issued by the French Bank, highlighting Ethereum’s potential in a fully integrated capital market.

These successful pilot cases enhance Ethereum’s credibility. For institutions, trust is based on proven use cases and recommendations from other regulated participants. Ethereum’s good track record continues to attract people’s interest and forms a continuously strengthened cycle of adoption.

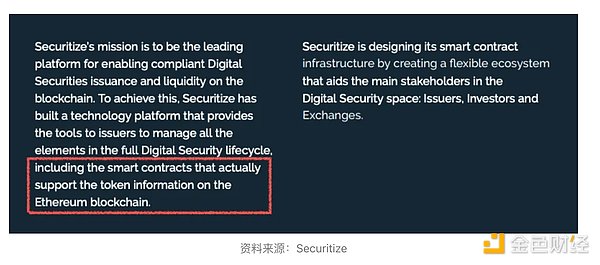

For example, in 2018, Securities announced in its official filing that it would build tools on Ethereum to manage the full life cycle of digital securities. This move laid the foundation for BlackRock’s final launch of BUIDL, the largest tokenized fund currently issued on Ethereum.

2.2. Platform for physical capital flow

Another key reason why Ethereum continues to dominate the risk-weighted assets (RWA) market is its ability to convert on-chain liquidity into actual purchasing power. Tokenizing real-world assets is not just a technical process. A functioning market requires capital that can actively invest and trade these assets. In this regard, Ethereum stands out as the only platform with deep and deployable on-chain liquidity.

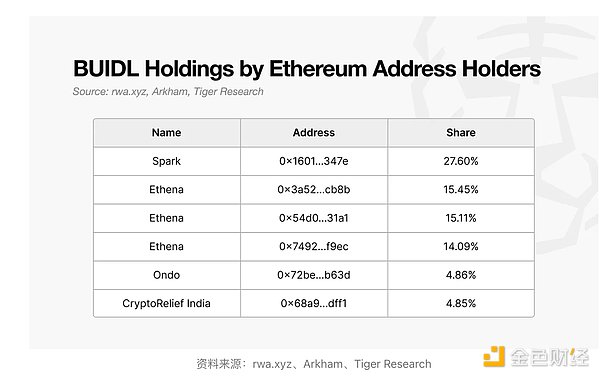

This is particularly evident on platforms such as Ondo, Spark and Ethena, which all hold a large number of tokenized BUIDL funds on Ethereum. These platforms have attracted hundreds of millions of dollars in funding by providing products based on tokenized U.S. Treasury bonds, stablecoin-based lending, and synthetic yield-based dollar tools.

-

Ondo Finance has accumulated over $600 million in total locked value (TVL) through its Treasury-backed products USDY and OUSG.

-

Spark Protocol uses MakerDAO's DAI liquidity to purchase real-world Treasury bonds worth more than $2.4 billion.

-

Ethena uses its synthetic stablecoins USDe and sUSDe to build a bankless income infrastructure on Ethereum, attracting institutional demand and DeFi liquidity.

These examples show that Ethereum is more than just a platform for asset tokenization. It provides a strong liquidity base that supports real investment and asset management. In contrast, many emerging risk asset management platforms have difficulty ensuring capital inflows or secondary market activity after the initial stage of token issuance.

The reasons for this difference are obvious. Ethereum has integrated stablecoins, DeFi protocols and compliant infrastructure. This creates a comprehensive financial environment in which issuance, transactions and settlements can all be performed on-chain.

Therefore, Ethereum is the most efficient environment for converting tokenized assets into actual purchasing activities. This gives it a structural advantage over simple market share.

2.3. Achieve trust through decentralization

Decentralization plays a crucial role in building trust. Tokenizing real- world assets requires transferring ownership and transaction records of high- value assets to digital systems. In this process, the organization focuses on the reliability and transparency of the system. And this is the unique advantage of Ethereum’s decentralized architecture.

Ethereum is a public chain supported by thousands of independent nodes around the world. The network is open to everyone and all changes are determined by participant consensus rather than centralized control. Therefore, it can avoid single point of failure, ensure resistance to hacker attacks and censorship, and maintain uninterrupted uptime.

In the risk-weighted assets (RWA) market, this structure creates tangible value. Transactions are recorded on an untampered ledger, thus reducing the risk of fraud. Smart contracts enable trustless transactions without intermediaries. Users can access services, sign agreements and participate in financial activities without centralized approval.

Transparency, security and accessibility make Ethereum an ideal choice for institutions exploring asset tokenization. Its decentralized system meets the key requirements for operating in a high-risk financial environment.

3. Emerging Challengers Reshape the Pattern

The Ethereum main network proves the feasibility of tokenized finance. However, while achieving success, it also exposed some structural limitations that prevented its adoption by a wider organization. Key obstacles include limited transaction throughput, latency issues, and unpredictable fee structures.

To address these challenges, Layer 2 Rollup solutions such as Arbitrum, Optimism, and Polygon zkEVM came into being. Major upgrades including Merge (2022), Dencun (2024), and the upcoming Pectra (2025) enhance scalability. However, the network still cannot match traditional financial infrastructure. For example, Visa processes more than 65,000 transactions per second, and Ethereum has not yet reached this level. These performance gaps remain a key constraint for institutions that require high-frequency trading or real-time settlement.

Delays and final confirmation also pose challenges. Block generation takes an average of 12 seconds, plus the additional confirmation required for secure settlement, which usually takes up to three minutes. In the case of network congestion, delays may further increase, posing challenges to time-sensitive financial services.

More importantly, the volatility of Gas fees continues to be worrying. At peak times, transaction fees exceed $50, and even under normal circumstances, fees often exceed $20. This fee uncertainty complicates business planning and may undermine the competitiveness of Ethereum-based services.

Securitize is an example. After experiencing the limitations of Ethereum, the company expanded to other platforms such as Solana and Polygon, while also developing its own blockchain Converage. Although Ethereum played a crucial role in early institutional experiments, it is now under increasing pressure to meet the needs of a more mature and performance-sensitive market.

3.1. The rise of fast and cost-effective general blockchain

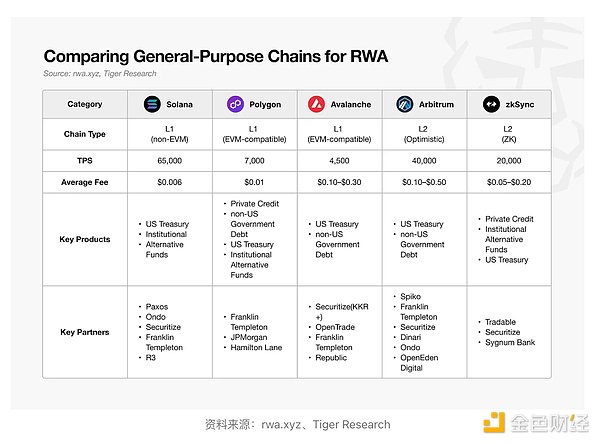

As the limitations of Ethereum become increasingly prominent, more and more institutions are exploring general blockchains that can replace Ethereum. These platforms can cover key performance bottlenecks in Ethereum, especially in terms of transaction speed, fee stability and finalization time.

However, despite continuing cooperation with institutional investors, the actual size of tokenized assets (excluding stablecoins) on these platforms is still much lower than Ethereum. In many cases, tokenized assets launched on general chains remain part of Ethereum-led multi-chain deployment strategy.

Even so, there are some signs that meaningful progress has been made. In the private credit field, new tokenization initiatives are emerging. For example, on zkSync, the Tradable platform has gained attention, accounting for more than 18% of the activity share in the field, second only to Ethereum.

At this stage, general blockchain has just begun to gain a foothold. Platforms like Solana, whose DeFi ecosystem has achieved rapid growth, now faces a strategic question: how to translate this momentum into a sustainable position in the RWA field. It is not enough to have excellent technical performance. Competing with Ethereum requires infrastructure and services that meet the trust and compliance expectations of institutional investors.

Ultimately, the success of these blockchains in the RWA market will no longer depend on the original throughput but more on their ability to provide tangible value. The differentiated ecosystems built around the unique strengths of each chain will determine their long-term positioning in this emerging field.

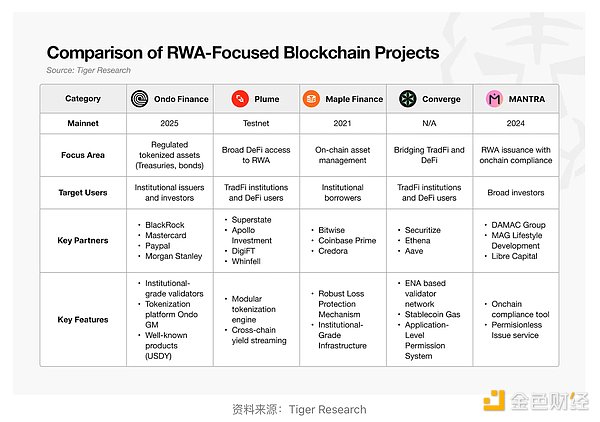

3.2. The emergence of RWA dedicated blockchain

More and more blockchain platforms are abandoning universal design and focusing on specific areas. This trend is also evident in the RWA field, with a new wave of dedicated chains emerging that are optimized specifically for the tokenization of real-world assets.

The concept of RWA dedicated blockchain is very clear. Tokenizing real-world assets requires direct connection with existing financial regulations, which makes it seem incompetent to use general blockchain infrastructure in many cases. Specialized technical requirements must be fundamentally addressed, especially in regulatory compliance.

Compliance processing is a key area. KYC and AML programs are critical to tokenization workflows, but these programs are traditionally processed off- chain. This approach limits innovation because it simply wraps traditional financial assets in a blockchain format without redesigning the underlying compliance logic.

The current transition is to fully link these compliance features. There is a growing demand for blockchain networks that not only record ownership but also enforce regulatory requirements natively at the protocol level.

In response, some RWA-focused blockchains have begun to offer on-chain scale blocks. For example, MANTRA includes decentralized identity (DID) capabilities that support compliance execution at the infrastructure level. Other professional blockchains are expected to take similar steps.

In addition to compliance, many of these platforms target specific asset classes and rely on deep domain expertise. Maple Finance focuses on institutional lending and asset management, Centrifuge focuses on trade financing, and Polymesh focuses on regulated securities. Instead of tokenizing widely held assets such as sovereign bonds or stablecoins, these blockchains use vertical specialization as a competitive strategy.

Still, many such platforms are still in their early stages. Some platforms have not yet launched mainnets, and most platforms are still limited in size and adoption. If universal chains are just beginning to gain attention in the RWA field, then special chains are still at the starting line.

4. Who will lead the next stage?

Ethereum's dominance in the risk-weighted asset (RWA) market is unlikely to maintain its status quo. Currently, the tokenized asset market is less than 2% of its expected potential, indicating that the industry is still in its early stages. Ethereum’s advantages to date are largely due to its early discovery of product market fit (PMF). However, as the market matures and expands in scale, the competitive landscape is expected to undergo significant changes.

Signs of this transformation have emerged. Institutions no longer focus on Ethereum only. Both general blockchain and RWA dedicated blockchain are under evaluation, and more and more services are exploring customized chain deployments. Tokenized assets originally issued on Ethereum are now expanding to a multi-chain ecosystem, breaking the previous monopoly pattern.

A key turning point will be the use of on-chain compliance. In order for blockchain finance to truly reflect innovation, regulatory processes such as KYC and AML must be carried out directly on the chain. If the Professional Chain can successfully provide scalable protocol-level compliance and drive industry-wide adoption, the current market landscape may be completely overturned.

It is also important that the existence of actual purchasing power is present. They are only of investment value when active capital is willing to purchase tokenized assets. Regardless of the technology adopted, the utility of tokenization will be limited without effective liquidity. Therefore, the next generation of RWA platforms must build a strong service ecosystem based on tokenized assets and ensure users have strong liquidity participation.

In short, the conditions for success are becoming clearer and clearer. The next leading RWA platform is likely to achieve the following three goals at the same time:

-

Fully integrated on-chain compliance framework

-

Service ecosystem built on tokenized assets

-

Deep and sustainable liquidity promotes real investment

The RWA market is still in its infancy. Ethereum has verified this concept. Now, the opportunity lies in platforms that provide excellent solutions—those that meet institutional needs and unlock new value in a tokenized economy.

chaincatcher

chaincatcher