Optimists cheer, pessimists worry: How does the market view the US crypto strategic reserves?

Reprinted from chaincatcher

03/07/2025·2MAuthor: Fairy, ChainCatcher

Edited by: TB, ChainCatcher

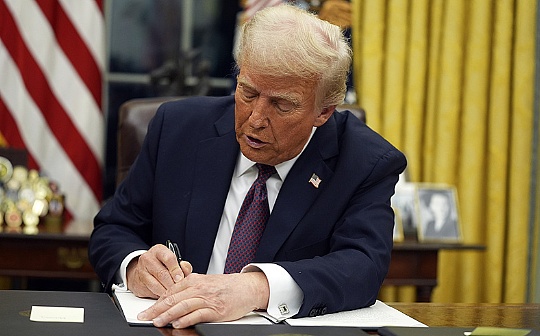

This morning, President Trump signed an executive order to establish strategic Bitcoin reserves and US digital assets reserves.

White House AI and crypto czar David Sacks pointed out that over the past decade, the U.S. government has sold about 1.95 million bitcoins, earning only $366 million. If these Bitcoins are held for a long time, their current value has exceeded US$17 billion.

Sacks said bluntly: “This is the price that American taxpayers do not have a long-term strategy!”

So, how exactly does the strategic reserve of cryptocurrency work? How will this policy affect the market? Let's take a look at different interpretations of the market.

Two reserves: one can be ****actively increased, and the

other can be purely stored****

President Trump's executive order involves two different concepts -Strategic Reserve and Digital Assets Reserve .

Bitcoin strategic reserve : only Bitcoin is included. The reserve will consist of approximately 200,000 bitcoins currently held by the U.S. government, which are collected through criminal or civil asset confiscation procedures. The government will conduct a comprehensive audit of it.

Finance Minister Scott Bessent and Commerce Secretary Howard Lutnick are authorized to explore ways to acquire additional bitcoins , provided that there is no increased taxpayer burden .

Digital Asset Reserve : Related to other digital assets (except Bitcoin) obtained through criminal or civil asset forfeiture procedures. For example, Ethereum (ETH), Ripple (XRP), Cardano (ADA), Solana (SOL), etc. Digital Asset Reserves specialize in managing these assets.

Core differences:

- Bitcoin Strategic Reserves : Governments may look for budget-neutral ways to acquire additional Bitcoin .

- Digital Asset Reserve : The government will not actively purchase these assets and only manage digital assets obtained through the confiscation process .

****Market Interpretation: Bitcoin’s short-term sharp drop, is it good or

bad?****

As soon as the news came out, the price of Bitcoin fell by more than 5%. There is a clear differentiation in market views. One side believes that this will start a global Bitcoin reserve race, which is long-term positive; the other side believes that the policy intensity is lower than expected, and the market is disappointed.

Positive: This will change everything!

Bitwise Research Director said the real meaning of the United States in establishing a strategic Bitcoin reserve lies in:

- Other countries will buy Bitcoin;

- Wealth managers have no excuses;

- Financial institutions have no excuses;

- There are no excuses for pensions/endowments;

- Worries about the sale of Bitcoin in the United States disappear;

- The United States may buy more bitcoins;

- The likelihood of buying Bitcoins in each state increases;

- The possibility of a government banning Bitcoin is zero.

" This will change everything. Looking far, it 's just the beginning. "

Encryption KOL @bitfool1 likens this move to "nuclear bomb-level favorable":

- From the US government holding Bitcoin to countries around the world competing to buying, this is a long-term evolutionary process;

- Bitcoin has been established as a global reserve asset similar to gold, and its value will be subject to a historic revaluation.

Encryption KOL @0xNing0x proposes another interpretation:

- The establishment of Bitcoin’s national reserves is essentially to maintain the hegemony of the US dollar ;

- The Trump administration may redesign the game rules of the crypto market and incorporate it into the bubble regulation mechanism of the dollar system;

- The market needs to digest excessively optimistic expectations in the short term, but in the long run, the new order of the US-led crypto market may become the core driver of the next wave of rise .

Negatives: ****The market has been falsified, short-term

expectations have failed****

Crypto KOL AB Kuai.Dong believes: "This is very Trump-style, but it is also a bit pessimistic." He is worried that the government 's holding of Bitcoin may become a kind of fiscal policy strategy , and it is still uncertain whether there will be more radical means in the future.

Charles Edwards, CEO of Capriole Investments, said that the market’s disappointment stems from:

- The market originally expected the government to take the initiative to buy more Bitcoin , but the actual policy did not involve large-scale increase in holdings;

- The possibility of the US government directly purchasing Bitcoin in 2025 has been greatly reduced , and short-term positives are not fully realized .

There are also views that the United States may increase its enforcement of overseas exchanges and large currency holding institutions to strengthen its control over the market. As the impact of the "Trump market" on the market gradually fades, the expected policy catalysts are also decreasing, and the crypto industry may enter a new stage. In the next 1-2 years, under the background of a relatively loose regulatory environment, application-level innovation is expected to usher in more opportunities, and the industry's focus will also shift from policy games to actual implementation and growth.

Short-term fluctuations have far-reaching impacts in the long term. The U.S. government recognizes the strategic value of Bitcoin, which means that the legitimacy, institutionalization process and global competition in the crypto market have just begun. This may be a historic turning point, and the real impact will gradually emerge in the next few years.

panewslab

panewslab

jinse

jinse