Trump's promised strategic Bitcoin reserves are here! Confiscation storage is less than expected, or get more Bitcoin in a way that does not increase taxpayer burden

Reprinted from panewslab

03/07/2025·2M

Author: Weilin, PANews

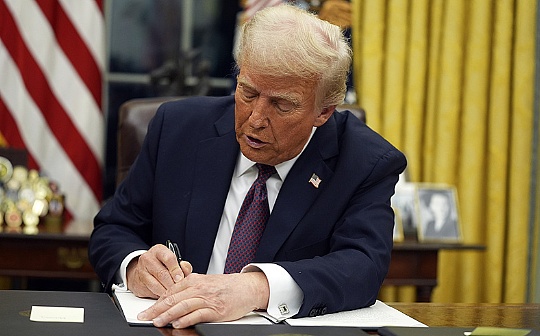

At 8:00 a.m. on March 7, White House director of artificial intelligence and crypto policy, David Sacks, announced on the X platform that US President Trump has officially signed an executive order to establish strategic Bitcoin reserves and digital asset reserves. However, since both reserves mainly rely on "income forfeiture of criminal or civil assets" for financial support, the market responded negatively in the short term. The price of Bitcoin fell below $85,000 for a time, down 4.21% in 24 hours, and then rebounded slightly.

It is reported that the president's executive order is not a law, and the scope of effect is limited. Some analysts pointed out that there may still be favorable to the "Bitcoin Strategic Reserve" in Congress legislation in the future. At the same time, some industry insiders believe that the impact of Trump's market on the market is expected to gradually weaken, the crypto industry will enter a new stage, and attention should return to the application layer.

Bitcoin strategic reserve: Based on the confiscation of assets, audit and

budget neutrality will be implemented

"The reserve will be funded by federally held bitcoins, which are earned through criminal or civil asset forfeiture procedures," David Sacks, director of artificial intelligence and crypto policy at the White House, said in a statement. "This means taxpayers are not responsible for any costs."

He noted that it is estimated that the U.S. government holds about 200,000 bitcoins, but has never had a complete audit before. This executive order requires a comprehensive verification of the federal government's digital asset holdings. The United States will not sell Bitcoins deposited in this reserve, but instead uses it as a means of store of value. This reserve is similar to the "digital gold" version of Fort Knox in the cryptocurrency space. ”

Additionally, Sacks mentioned that premature sales of Bitcoin have resulted in US taxpayers losing more than $17 billion in value. Now the federal government will develop strategies to maximize the value of its holdings. The Treasury Secretary and Commerce Secretary are authorized to develop budget-neutral strategies to acquire more bitcoin provided that these strategies do not bring additional costs to U.S. taxpayers.

The executive order also establishes a U.S. digital asset reserve, which includes digital assets confiscated in criminal or civil lawsuits in addition to Bitcoin. The government will not acquire additional assets in the reserve, and its sources are limited to the seizure of proceeds. The goal of the reserve is to be responsible for the government-held digital assets by the Ministry of Finance.

Sacks concluded his statement thanked Trump for his efforts to build strategic Bitcoin reserves and thanked his colleagues in the administration: “President Trump’s commitment to creating strategic Bitcoin reserves and digital asset reserves, which have now been fulfilled. This executive order highlights President Trump’s commitment to making the United States a ‘global crypto capital’. I want to thank the President for his leadership and vision in supporting this cutting-edge technology and his efficient execution in promoting the digital asset industry.”

“I would also like to thank the President’s Digital Asset Markets Working Group, especially Finance Minister Scott Bessent and Commerce Secretary Howard Lutnick, for their important support for achieving this goal. Finally, Bo Hines played a key role as Executive Director of the Working Group,” he said.

Establish two asset holding mechanisms, and there is also Bitcoin

strategic reserves to promote legislation in Congress

According to the division of the executive order, Trump's executive order establishes two different digital asset holding mechanisms:

- 1. Strategic Reserve, which stores only Bitcoin (BTC), is the initial source of funds from about 200,000 Bitcoins obtained by the government over the years through criminal and civil confiscations. It authorizes Finance Minister Bessent and Commerce Minister Lutnick to be allowed to explore ways to obtain more Bitcoin without increasing the burden on taxpayers, and is positioned as a national digital value reserve.

- 2. Digital Asset Stockpile, which contains other digital assets other than Bitcoin—may include XRP, ADA, ETH, SOL and other assets. The Ministry of Finance is responsible for "responsible management" of digital assets held by the government. The government will only explore using a budget neutral way to buy more Bitcoin, and will not actively seek to increase the number of other digital assets in the reserve. The executive order also requires a comprehensive audit of all digital assets currently held by the government to ensure transparency in asset management.

In fact, as early as March 3, Trump said that the US crypto strategic reserves will include XRP, Solana (SOL), Cardano (ADA), Bitcoin (BTC) and Ethereum (ETH), and these assets may appear in the digital asset reserves required by this executive order. However, some industry insiders questioned the inclusion of XRP and ADA, believing that they lack the developer activity and decentralized characteristics of BTC and ETH.

In addition to Trump's executive order, the strategic Bitcoin reserves promoted by Senator Lummis are still underway to advance the Congress. Alex Xu, research partner at Mint Ventures, wrote that this "Strategic Bitcoin Reserve" is not the same as the "Strategic Federal Reserve" bill promoted by Senator Cythia Lummis at the federal level. The former can be directly controlled by the government, while the latter needs to pass Congress legislation; the former itself does not have a separate budget for purchasing BTC (if it is necessary to increase it, it requires Congressional approval), and the latter will provide a separate budget for purchasing BTC. The goal of the bill is to buy 1 million in five years. The source of the budget may come from the revaluation of the value of the existing US gold reserves, thereby expanding the Federal Reserve's asset count and providing a budget for the Treasury Department to purchase BTC. What David Sacks said, "The government will not acquire other assets for reserve assets" does not mean that the strategic Bitcoin reserves in the public's impression suddenly become something that only relies on fines and does not spend money alone to purchase BTC.

Market reaction: Bitcoin price rebounds after a short-term decline, and

worrying that law enforcement may be strengthened

Although the U.S. government claims to develop budget-neutral strategies to acquire Bitcoin, the statement also explains that the premise is that these strategies will not bring incremental costs to U.S. taxpayers, which has failed market expectations and put pressure on Bitcoin prices. Previously, the market once expected that the United States might take the initiative to purchase more Bitcoins to supplement its reserves. As of the morning of March 7, the price of Bitcoin once fell below $85,000, down 4.21% in 24 hours, and then rebounded slightly.

According to Arkham Intelligence data, the U.S. government currently holds about $18.28 billion in seizure crypto assets, of which Bitcoin accounts for the vast majority, with a total of 198,109 pieces worth about $17.87 billion. In addition, the government holds $122 million in USDT and $119 million in ETH, while XRP, SOL and ADA are not on the asset list.

"The U.S. government holds 198,109 bitcoins, and this executive order means that the selling pressure of about $18 billion will be reduced," said Coinbase executive Conor Grogan on the X platform.

But Alex Thorn, head of research at Galaxy Digital, said on X: "The balance of Bitcoin that can be used as strategic reserves for the U.S. government is currently at most 88,000 BTC, accounting for only 43% of the current government's holdings. This is because of the 198,000 BTC currently held by the U.S. government, 112,000 BTC will be returned to Bitfinex."

Some markets have a pessimistic interpretation of this policy. Technology and Crypto KOL @realwuzhe posted: "Trump just ordered the establishment of a national reserve of Bitcoin. But he just managed the bitcoins he had collected before and ensured that he would not smash the market. He also emphasized that he would not use taxpayers' money to buy new Bitcoins. It was equivalent to having a huge name, but no new buying. The thunder was huge, the raindrops were extremely small, and Bitcoin plummeted."

He expressed concerns about the U.S. government's efforts to increase law enforcement. "The United States has now established Bitcoin reserves, but it is not ready to use taxpayers' money to buy coins. Where does the new currency come from? It must be continued to be obtained through law enforcement. Next, the United States has great motivation to carry out law enforcement actions on overseas exchanges and currency holders."

Chen Mo, KOL of the crypto industry, said: "Although the US strategic reserves are implemented, it will not take the initiative to buy BTC, at least the formal purpose has been achieved, and other countries are not ruled out to buy. Judging from the price reaction, it is less than market expectations. It is expected that the impact of Trump's market on the market will gradually weaken, and there will be fewer and fewer expected events in the future. The crypto industry will enter a new stage. Attention should return to the application layer. The loose compliance and regulatory easing in the next 1-2 years can create more opportunities."

Meanwhile, Bitwise chief investment officer Matt Hougan is more optimistic, analyzing the executive order may have the following impact:

- It significantly reduces the possibility that the US government will "ban" Bitcoin in the future;

- Significantly increase the possibility of other countries establishing strategic Bitcoin reserves;

- Accelerate the process by which other countries consider building strategic Bitcoin reserves, as this provides countries with a short-term window to allow them to make a pre-launch layout before the U.S. may further purchase Bitcoin;

- Making it harder for institutions to portray Bitcoin as an asset that is “dangerous” or “unsuitable for holding” – this includes from the national account advisory platform to quasi-governmental agencies such as the International Monetary Fund (IMF).

On the first day of the executive order, several crypto industry executives will attend the "Digital Assets Summit" hosted by Trump in Washington, DC in the early morning of March 8, Beijing time. Earlier, Mike Alfred, founder of Eaglebrook Advisors, a digital asset investment platform, posted on X platform: "There are reports that the Trump administration is preparing to announce the zero capital gains tax policy for cryptocurrency sales at Friday's cryptocurrency summit (i.e., cryptocurrency sales will be exempt from capital gains tax).

jinse

jinse