Novice popular science post: What is token economics?

Reprinted from panewslab

03/04/2025·2MWhy do we study token economics?

For all types of Web3 projects, a complete token economic model is the key to success. Therefore, when developing projects, the token economic model should be carefully designed to ensure the long-term sustainable development of the project.

For ordinary users, carefully evaluating the token economics of the project before deciding to participate in the project is a very critical step. Only by fully understanding the project itself can you improve the success rate of your investment.

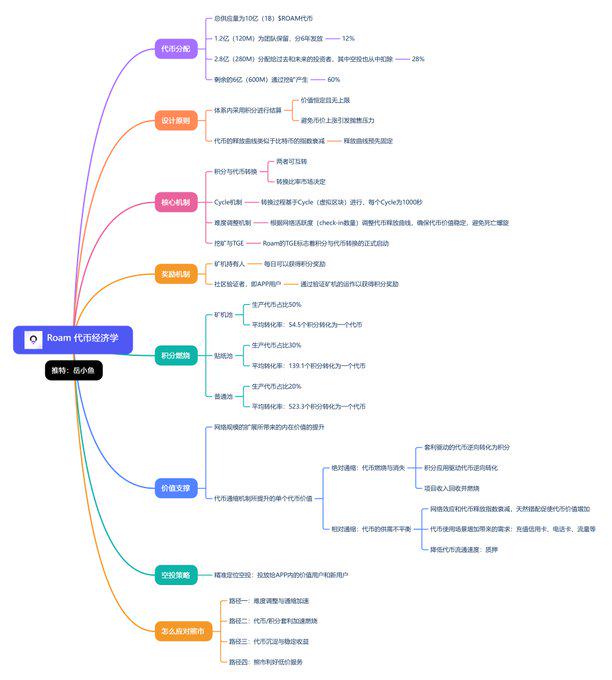

Roam, the leading DePin project that has been analyzed before, has announced token economics. We can use this project to see how to analyze the pros and cons of a token model. @weRoamxyz

(The following mind map is a summary of Roam token economics)

For the token economic model, it can be mainly analyzed through 4 dimensions: token supply (supply side), token utility (demand side), token distribution (holding object), and token governance (long-term ecology).

1. Token supply

To evaluate the supply of tokens, there are 4 core indicators:

(1) Maximum supply: that is, the upper limit of the token quantity specified by the preset code;

(2) Circulation volume: that is, the number of tokens in circulation; (Circulation tokens are mainly affected by two factors: the timetable for unblocking of development teams and investors and the incentive for ecosystem)

(3) Current market value: Current price* circulation volume

(4) Completely diluted market value: Current price * maximum supply (if the price of a new project is very high, or even the fully diluted market value exceeds the industry benchmark Bitcoin, it means that this price is difficult to maintain)

Another important dimension that affects the supply of tokens is the token destruction mechanism: continuously reducing the supply of tokens is deflation; on the contrary, continuously expanding the supply of tokens is inflation.

Let's take a look at Roam again,

Total supply is 1 billion (1B) $ROAM tokens;

120 million (120M) are reserved for the team and distributed in 6 years, which shows that the team wants to do this project for a long time;

280 million (280M) are allocated to past and future investors, from which airdrops are also deducted, which is the actual initial circulation;

The remaining 600 million (600M) is generated through mining, which means that you can continue to participate in this project in the future to avoid the subsequent wave of currency flow.

The project party also mentioned that tokens will be repurchased through business revenue in the future.

Therefore, overall, Roam is deflated, which is also a very strong value support.

2. Token utility

The utility of tokens represents the value of tokens, whether there are actual usage scenarios, and whether it can attract more people to join, that is, the demand side of the token.

Token utility can be divided into three aspects:

(1) Practicality: Gas fees (typical represents Ether, used to pay for computing power consumption), real-world payments (typical represents Bitcoin, which can be used for actual payments)

(2) Value accumulation: pledge (security tokens, which can obtain part of the product's income), governance (governance tokens, the holder of the governance token has the right to vote on changes to the token agreement)

(3) meme and narrative: meme refers to the culture and concepts widely spread on the Internet due to popularity. Dogecoin is the most typical meme coin. It has no practical value and becomes popular just because of spoof emoticons.

Let’s take a look at Roam. Its token utility is mainly used for related services within the ecosystem, which can be used to pay for network service fees, exchange for free roaming data or participate in other functions.

Relatively speaking, it is still very valuable and is not an air coin that has no use.

3. Token distribution

There are two ways to launch and allocate tokens:

(1) Fair launch: Fair launch means that no one starts or makes a small distribution before the token is minted and distributed to the public. Typically, it is Bitcoin;

(2) Pre-mine and launch: Pre-mine means that before providing cryptocurrencies to the public, they are minted and allocated to a specific group (founding team or investment institution), and Ethereum performs pre-mining;

Let’s look at Roam again. Obviously, it is not a fair launch, but an early distribution. This is also in line with the business logic of VC coins, and investors still have to make money.

We also need to pay attention to the tokens held: the behaviors taken by large institutions and individual investors are different.

After understanding the type of entity that holds tokens, you can further infer how the holders may trade, and their trading methods will affect the value of the token.

On the other hand, we need to pay attention to whether the tokens are allocated evenly: usually, holding the vast majority of tokens by some large institutions means greater risks.

If patient investors and founding teams hold most tokens, the interests of holders will be more consistent and are more likely to achieve long-term success.

The Web3 industry standard is to allocate at least 50% of the tokens to the community, which effectively dilutes the ownership that founding teams and investors can retain.

We also need to understand the token locking and release schedule: see if a large number of tokens will enter circulation, which will put downward pressure on the token's value.

4. Token governance

How to motivate participants to ensure long-term sustainability is a central issue in token economics.

Many Web3 projects will also add staking mechanisms to the token economic model.

Staking tokens can increase their token value in two ways:

First, staking incentives mean locking the token to obtain passive income, so the minimum value of the token is a multiple of the value of the future reward;

Secondly, locking the tokens so that they cannot be exchanged has the auxiliary effect of reducing market supply and increasing token prices.

Let’s take a look at Roam again. In order to reduce the selling pressure after launch and reduce the actual circulation, pledge services are also provided, which can be said to be standard.

Finally, let’s summarize:

In the case, Roam's economic model design is still very reasonable, and the overall compliance with the principle of long-termism is continuous.

Only by controlling supply, increasing demand, and supplementing with governance mechanisms can the value of tokens be maintained for a long time.

We can find that a good token economic model must have three major elements.

(1) Reasonable pledge mechanism: pledge can bind the user's interests to the project value and adjust the supply of tokens. Curve's VE pledge model has been proven to be relatively better;

(2) More application scenarios: This is the biggest problem faced by each project, and the expansion of application scenarios must be based on the growth of the business itself;

(3) Steady growing business revenue: Although token incentives can attract new users, the Ponzi model will collapse sooner or later, so the key is whether the business itself can create value;

The token economic model is very important, but everything depends on the business value itself, otherwise it is just a "air coin" with no value.

At present, the token economic model is still rapidly innovating and changing very quickly. You can continue to pay attention to whether there are new token models on the market.

However, in general, no matter how things change, the token economic model can be analyzed from the four dimensions of supply, demand, distribution and governance.