Meme stock GameStop also wants to "stopping coins"? A listed company that purchases BTC may add another one

Reprinted from panewslab

02/14/2025·3MOriginal author: BitpushNews Mary Liu

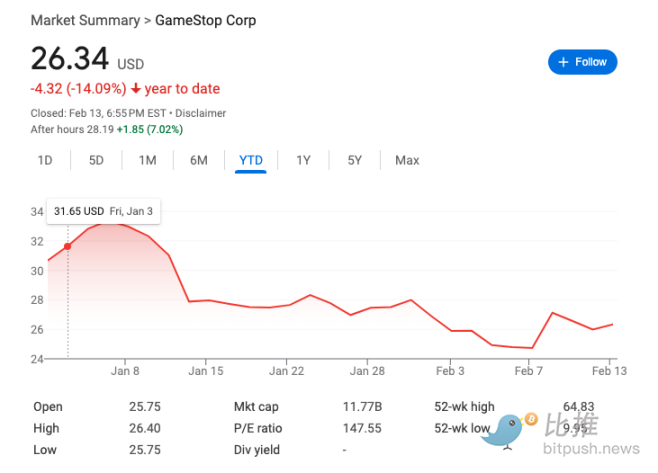

On the afternoon of February 13, New York time, the share price of game retailer GameStop rose sharply in after-hours trading due to a possible investment in Bitcoin and other cryptocurrencies.

According to CNBC, citing sources, GameStop is considering investing in cryptocurrencies such as Bitcoin. After the news broke out, its stock price soared 20% in after-hours trading before falling back to around $26.34.

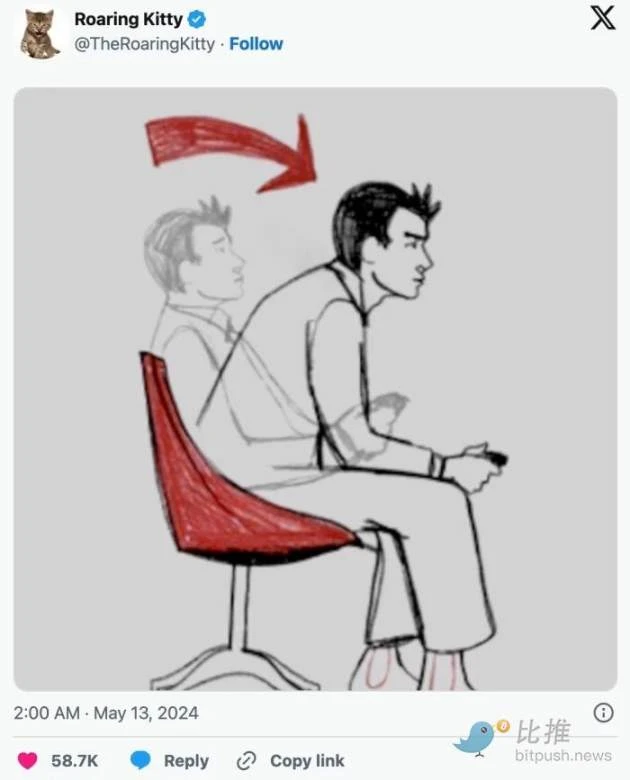

GameStop has been known as an "Internet celebrity stock" in recent years. In 2021, due to the promotion of the retail investors' order leader (Keith "Roaring Kitty" Gill), the stock price soared and then entered a period of decline. In 2024, Gill's multiple appearances once again drove the rebound in GameStop's stock price. However, despite the volatile stock price, GameStop's actual business performance is not optimistic.

Bad performance, GameStop faces transformation pressure

As a game and collectibles retailer mainly in physical stores, GameStop has struggled in the wave of the overall transformation of the industry to digital in recent years.

Wall Street has a low focus on GameStop, and Wedbush analyst Michael Pachter reiterated his “under-market” rating on GameStop in a recent report and set its target price of $10, meaning after deducting cash, The actual value of the company is almost zero.

"The company plans to return to the growth track, but faces insurmountable obstacles," Pachter noted. GameStop's core business—physical game sales—is being hit by digital downloads and cloud gaming, causing its revenue and profits to continue to decline. Although the company achieved short-term profits by cutting costs and optimizing operations, its long-term growth prospects remain bleak.

Bitcoin investment may become a hope for a comeback?

GameStop’s crypto exploration began in 2022 when the company launched a crypto wallet that allows users to manage cryptocurrencies and NFTs. It also works with industry partners such as gaming network Immutable to plan to support the transaction of in-game assets, avatars and other digital collectibles.

However, due to “regulatory uncertainty,” the company closed the NFT market in early 2024. Still, GameStop has not completely abandoned its interest in the crypto space.

The news of investing in Bitcoin comes after US President Trump took office. Trump’s pledge to support the cryptocurrency industry during his campaign could be one of the reasons GameStop reconsidered investment in the crypto space.

It is worth noting that GameStop CEO Ryan Cohen took a photo with MicroStrategy co-founder and executive chairman last week, further sparking speculation.

MicroStrategy is the world's largest corporate Bitcoin holder with a Bitcoin reserve worth over $46 billion. MicroStrategy has made great returns since starting Bitcoin stockpiling in 2020 and has inspired more and more companies to include Bitcoin on their balance sheets.

Sherwood analyst Luke Kawa pointed out that GameStop shares rose after Ryan Cohen's tweet, and investors may be betting GameStop will follow Strategy's Bitcoin buying model.

"The market's enthusiastic reaction to Cohen's tweets shows that traders want Cohen to use GameStop's $4.6 billion cash and cash-like securities to follow Michael Saylor's approach. (That strategy has only one rule: Buy Bitcoin," said analysts. )”.

Whether GameStop will officially enter the cryptocurrency field has not been officially confirmed yet, but this news has undoubtedly added new room for imagination to the market.

With $4.6 billion in cash reserves, how did Ryan Cohen lead GameStop out

of trouble?

Ryan Cohen is the co-founder of e-commerce company Chewy, who bought GameStop shares in 2020 and joined the board in 2021. Under his leadership, GameStop has begun to focus on cutting costs and streamlining operations to ensure the business’s profitability, although its growth remains weak. As of November 2, 2023, GameStop has accumulated $4.6 billion in cash reserves and has been using these funds to invest.

In December 2023, GameStop’s board of directors approved a new “investment policy” that would allow Cohen, two independent board members and other essential personnel to manage the company’s securities portfolio. These investments must comply with policy guidelines or be approved by a unanimous vote of the committee or a majority vote of the board.

Although the company is currently facing the dual pressure of decline in performance and industry transformation, Bitcoin, as a highly volatile and high-return emerging asset, may provide GameStop with a new growth path. Can GameStop make a beautiful move by storing coins? The turnaround is still full of uncertainty.

jinse

jinse

chaincatcher

chaincatcher