The market performance is lower than expected. Is Trump's encryption policy underestimated?

Reprinted from panewslab

02/14/2025·3MAuthor | Fire

Produced by|Plain language blockchain

At the end of last year to the beginning of this year, the newly elected US President Trump made many promises to the Bitcoin and crypto industry during the election and before taking office, which directly boosted the wave after wave of the crypto market, although Trump After taking office, he did not "destroy bridges" like some comments, but constructively implemented the favorable encryption policies he had promised. However, the market was superimposed by the Memecoin roller coaster market such as TRUMP and other complex environments such as tariffs. The emotions then turned from fanaticism to panic, causing a lot of controversy.

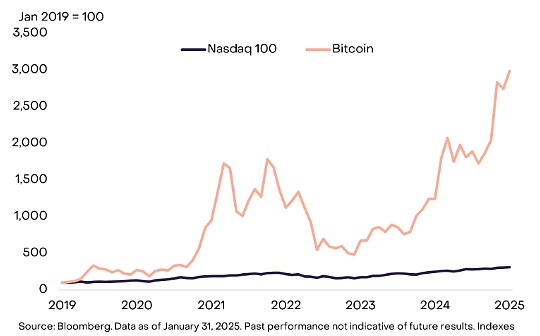

The current crypto market performance is lower than expected and does not seem to have a long-term impact on Trump's series of Bitcoin/crypto policies. Are these really undervalued?

01. Implementation of Trump's top ten crypto policy commitments

During his 2024 presidential campaign, Trump put forward the top 10 cryptocurrency policy commitments, making it clear that he will promote the development of the U.S. crypto industry and develop a friendly regulatory framework for it.

However, Trump did not mention encryption in his inaugural speech on January 20. However, David Bailey, CEO of Bitcoin Magazine, later issued a statement saying that executive orders related to Bitcoin and cryptocurrencies have been included in Trump's inauguration. The first 200 executive orders indicate that crypto policy will still be promoted.

As time goes by, Trump has been in office for almost a month. How is the implementation of these ten policies?

1) Build the United States into the global cryptocurrency capital

On January 23, 2025, Trump signed an executive order aimed at promoting the U.S. leadership in crypto assets and financial technology, emphasizing support for the development of blockchain and crypto assets. "We want to make the United States the world capital of artificial intelligence and bring considerable economic benefits to the country," said David Sacks, a Trump-appointed AI and cryptocurrency commissioner, made it clear.

2) Stop suppressing the crypto industry within one hour

On January 23, Trump signed an executive order expressing his intention to set up a cryptocurrency working group, aiming to propose a new regulatory framework for crypto assets and explore the creation of Bitcoin national reserves.

3) Prevent the U.S. government from further developing central bank digital currency (CBDC)

The executive order of January 23 explicitly prohibits the establishment, issuance or promotion of CBDCs within the United States and requires the immediate termination of any related programs.

4) Establish strategic Bitcoin reserves

Currently, the government is evaluating the possibility of establishing a reserve of crypto assets, but no final decision has been made. However, on January 23, Senator Cynthia Lummis, who proposed the Bitcoin Act, was appointed chairman of the Senate Banking Crypto Assets Subcommittee, and should push the bill again.

5) Dismissal of SEC Chairman Gary Gensler

Gary Gensler has resigned on January 20, and Trump announced on January 21 that SEC Republican member Mark T. Uyeda will serve as acting chairman to Paul Atkins (Trump nominates the official candidate to replace Gensler) Senate confirmation process. On the same day, Mark announced the establishment of a cryptocurrency working group to develop a clear and clear regulatory framework for the United States crypto assets.

In addition, according to reports on February 4, the Trump administration is reducing members of the SEC cryptocurrency law enforcement team, which was specifically responsible for crypto law enforcement operations, consisting of more than 50 lawyers and staff, but there is no definite news for the number of layoffs.

6) Prevent the US from selling held Bitcoins

There is no official statement yet to clarify the situation of the US government holding Bitcoin, so we have to see if there is any new news in the future.

7) It is recommended to use cryptocurrency to solve the US debt problem

There is currently no public information showing that the government has taken specific measures to use crypto assets to resolve state debts.

8) Propose a comprehensive encryption policy

There is currently no comprehensive cryptocurrency policy. The cryptocurrency team established by the new executive order signed below is instructed to submit regulatory and legislative recommendations on cryptocurrency assets within 180 days to formulate a comprehensive cryptocurrency policy.

9) Establish a cryptocurrency advisory committee

A working group composed of senior officials from multiple departments has been established to propose a regulatory framework for crypto assets.

10) Reduce the sentence of Ross Ubrich, founder of the Silk Road

On January 23, Trump signed a pardon order, releasing Ross Ublich, who served 11 years in prison.

Up to now, most of the ten crypto-friendly policies promised by Trump have been implemented, especially in the formulation of regulatory frameworks and policy support. It only takes time to verify that some policies are fully implemented.

02. Other encryption dynamics of Trump

However, in addition to the portion of the cryptocurrency involved in the first 200 executive orders after inauguration, as well as the previously promised cryptocurrency policy, Trump has conducted many other explorations about cryptocurrency around the age of his tenure.

1) Support the launch of the DeFi platform World Liberty Financial

World Liberty Financial (WLFI) is a decentralized finance (DeFi) project supported by the Trump family, launched in September 2024 to provide blockchain financial services such as borrowing, transactions and income. Despite active promotion by Trump and his children, WLFI has no direct legal relationship with the Trump family and is only authorized to use its brand for promotion. This vague relationship has caused market doubts, and Token WLFI only has governance functions and does not have economic rights and interests, and initial Token sales are mediocre.

However, with the inauguration of Trump and the spread of the TRUMP Memecoin effect, the market popularity of WLFI has increased. After January 20, its 20% (20 billion) token sales were completed, raising a total of US$1 billion. Driven by market demand, WLFI sold another 5% (5 billion) tokens, priced at US$0.05, up from the initial price, and 81% sold as of February 12.

WLFI not only relies on the Trump brand, but its team also includes veterans in the crypto industry and has established cooperation with institutions such as Aave and Ethena Labs. Its multi-signature address currently holds more than US$74.5 million in crypto assets, mainly investing in ETH, WBTC, AAVE, etc.

2) Release TRUMP Memecoin

On January 17, three days before the president was sworn in, Trump launched "TRUMP Memecoin" in Solana. His market value soared to $14.5 billion in just two days, and drove Bitcoin to exceed $109,000. However, the craze quickly receded, and by January 30, the market value fell by two-thirds, while transaction fees reached 86 million to 100 million US dollars. Trump's wife Melania then launched "MELANIA Memecoin", which also suffered a plunge. TRUMP fell by 64.7% in one week, and MELANIA fell by more than 80%.

Price trend of TRUMP Memecoin since its issuance, Source: CoinmarketCap

TRUMP is led by Trump's CIC Digital company and mainly makes profits through transaction fees. The specific income and ownership are still opaque. On-chain data analysis shows that TRUMP was originally launched on DEX Meteora, with at least 50 big investors in the early stage holders of the Memecoin each making more than 10 million US dollars, while about 200,000 small investors suffered losses.

It is worth noting that the issuance of TRUMP has caused a "blood-sucking effect" in the market in the short term, extracting liquidity, and causing a general decline in cryptocurrencies outside the Solana ecosystem. Subsequently, the WLFI project supported by Trump began to buy ETH assets in batches.

3) Establish a cryptocurrency working group

On January 23, 2025, a new special project was established in the executive order signed by Trump, the Cryptocurrency Working Group, aiming to propose new crypto asset regulatory regulations and explore the possibility of establishing national cryptocurrency reserves. The task force is led by Trump-appointed AI and Cryptocurrency Commissioner David Sacks, and includes senior government officials such as the Treasury Secretary, Attorney General, Commerce Secretary, SEC Chairman and CFTC Chairman.

According to the executive order, the working group will submit a report within 180 days, put forward regulatory recommendations on stablecoin management, market structure, consumer protection, etc., and evaluate the feasibility of establishing national crypto asset reserves. "We want to make the United States the world capital of artificial intelligence and bring considerable economic benefits to the country," Sacks said.

This move focuses on the integration of artificial intelligence and crypto assets, which is something Trump has not mentioned in his election commitments. At present, Trump has proposed to allow the United States to occupy a global leadership position in these key technology fields, and attempt to further promote the United States' dominant position in global technology competition through the coordinated development of artificial intelligence and crypto assets.

03. What do you think of encrypted KOLs?

KOL's views on Trump's crypto policy show diversity and complexity. Based on some discussions and analysis on the Internet, the following are a summary category of some major views:

1) Optimist

Some KOLs believe Trump's policies will have a positive impact on the cryptocurrency industry. They pointed out that Trump's executive orders may mark a shift from regulatory suppression to supporting policies, such as stopping the SEC's suppression of cryptocurrencies, making the government more receptive to crypto technology, and entrepreneurs' participation in policy making, which are considered as industry Bring more innovation opportunities and regulatory clarity.

For example, a16z co-founder Marc Andreessen said Trump's policies are good for the cryptocurrency industry. He expressed confidence in the possible regulatory easing and policy support that the Trump administration could bring in in various interviews and public discussions.

Crypto analyst @skydegencall said that not only did not stop supporting cryptocurrencies after the election, Trump instead included Ethereum in his economic plan, believing that this would change the game and that crypto assets would become part of Trump's legacy.

Solana community leader @sol_jingou believes Trump's executive order will trigger a series of ripple effects, including stopping the SEC's suppression of cryptocurrencies, allowing government agencies to accept crypto technology, allowing entrepreneurs to participate in policy making and the government itself as the participation of the crypto market , believe that the winner this time will not be short-term speculators.

Cryptotechnical expert @0xCheshire also mentioned that Trump's executive order will lead to the SEC relaxing its suppression of cryptocurrencies, and the government accepts cryptotechnology, and also pointed out that this policy shift is very beneficial to the industry, believing that from high-pressure regulation to full support is 180 A big turn.

2) Skeptic and Criticism

Some KOLs are also skeptical of these policies. They fear that Trump's policies may be more of a political or personal interest than a real understanding and support of crypto. Especially in the discussion about Trump’s own cryptocurrency releases such as TRUMP, there are opinions that question whether this will lead to market manipulation or conflict of interest.

For example, Coinbase CEO Brian Armstrong said he welcomes the possible regulatory easing that Trump’s policy may bring, but expressed concerns about whether the policy can truly serve the industry, avoid conflicts of interest, and provide long-term stability. He repeatedly stressed in public that any policy must truly understand and support the basic principles of cryptocurrencies, such as decentralization and user privacy.

Associate Professor of Finance @Larisa Yarovaya In an article published by The Guardian, he is critical of Trump's crypto policy, believing that Trump's policy may lead to investors being unprotected and vulnerable to financial manipulation, misconduct and bubble bursting Influence.

Bloomberg investigative reporter @ZekeFaux expressed concerns about Trump and his family entering the crypto space in an interview with NPR, especially about the conflict of interest that Trump may have caused when launching his own cryptocurrency.

U.S. Senator @ElizabethWarren expressed concerns about Trump's crypto policy, stressing that such policies may be for the personal benefit rather than the public interest.

Overall, KOLs’ perceptions reflect the duality of expectations and concerns about Trump’s crypto policy. Most of them acknowledge that policy changes may bring opportunities, but at the same time, there are many voices reminding us that we need to carefully observe the actual implementation and impact of policies.

04. Summary

On the one hand, many of Trump's ten crypto policy commitments have begun to be implemented, such as establishing a cryptocurrency working group, stopping suppression of the crypto industry, and exploring the establishment of Bitcoin reserves. However, some of the commitments have not been fully realized, such as solving national debt problems through cryptocurrencies and introducing comprehensive crypto policies.

On the other hand, Trump's active participation in the crypto field is not limited to policy support, but also includes actual business operations. He set up a cryptocurrency working group, released TRUMP coins, and supported projects such as the decentralized finance (DeFi) platform World Liberty Financial. This shows that Trump's participation in cryptocurrency is not just about rhetoric. He promotes market innovation through specific projects and policies, and strives to establish his own influence in the cryptocurrency field.

In addition, these measures also reflect Trump's hope to enhance the United States' leadership in the global crypto market and financial technology through the potential of cryptocurrencies and related technologies. Whether it is through his own cryptocurrency or supporting decentralized financial platforms, he is bringing more policy support and market opportunities to the cryptocurrency industry. However, these actions have also sparked market doubts about its potential conflict of interest and transparency, especially Trump and his family’s role in crypto projects, which has caused some criticism.

chaincatcher

chaincatcher

jinse

jinse