Market recovery - Trump concept coin hotspots are on the rise again

Reprinted from jinse

03/26/2025·1MAuthor: Spirit, Golden Finance

Due to the gradual decline in tariff concerns and the improvement of the macroeconomic environment, coupled with the Federal Reserve's adjustment of balance sheet reduction policy, the crypto market has rebounded significantly in the past 48 hours. Overall, market sentiment has begun to pick up and the attractiveness of risky assets has increased, and this background has also driven the rise of Trump's concept coin. The following article starts from the macro-financial environment and analyzes the performance of several types of Trump-related crypto assets one by one.

1. Macro Market Analysis

First, due to the US government's policy adjustments to tariffs on some imported goods, the uncertainty brought by the market to tariffs has eased, which has injected positive expectations into global trade and economic activities. At the same time, the Federal Reserve's recent adjustments to its balance sheet reduction policy indicate a release of liquidity and provides investors with more funds to allocate risk assets. The Fed's policy signals and adjustment expectations have driven a rebound in market risk appetite, which has led to a rebound in the overall crypto market, with some assets rising by about 5% in the past 48 hours.

2. Performance and analysis of Trump 's concept currency

1. OFFICIAL TRUMP (TRUMP)

Data shows that the price of OFFICIAL TRUMP has been between about US$10.97 and US$11.83 recently, with a 24-hour trading volume in the range of US$298 million to US$1.5 billion, and a circulating market value of approximately US$2.19 billion to US$2.36 billion. Trump posted a post on his real social platform to "bring goods" TRUMP, which had a positive impact on his market exposure and liquidity. Strong trading volume and significant market cap show that investors are keen toward Trump’s political influence behind it, and may also be optimistic about the possibility that the Trump administration will adopt more favorable policies in the crypto industry in the future.

2. MAGA (TRUMP)

The price of MAGA tokens is stable between $0.27 and $0.28, with a 24-hour trading volume between $47,000 and $83,000, and a circulating market value of about $11 million to $12 million. As MEME coins, the extremely low trading volume also reveals the risks related to political celebrity tokens to the market. Due to some environmental conditions, the surge and pullback of celebrity tokens are more intense, and investors need to remain vigilant.

3. Melania Token (MELANIA)

MELANIA price trends are still strongly related to TRUMP, with different data sources showing prices between $0.68 and $0.73, and the Canadian market price reaches $1.00. Its 24-hour trading volume ranges from $15 million to $18 million, and its market value for circulation is approximately $368 million to $390 million. The token is closely related to the image of First Lady Melania, and has attracted many investors with this unique narrative. Although MEME coins tend to fluctuate greatly, Melania Token currently shows high market recognition and liquidity, and still has upward potential under the driving force of political sentiment in the future, but the risks cannot be ignored.

4. DJT and CRO

According to market information, affected by the news that "Trump Media Group plans to cooperate with Crypto.com to launch ETFs", Trump Media Technology Group (DJT) rose 8.09% before the market, with the highest increase reaching 14.61%. At the same time, the token CRO of the crypto trading platform Crypto.com platform also achieved an increase of more than 30%.

Trump Media Technology Group (TMTG, NASDAQ: DJT) recently signed a non-binding agreement with crypto trading platform Crypto.com, planning to launch a series of exchange-traded funds (ETFs) and related products under the Truth.Fi brand. These ETFs are provided by Foris Capital US LLC, a broker of Crypto.com. They are expected to cover digital assets and securities mainly made in the United States, covering multiple industries such as energy; the crypto asset ETF basket may include Bitcoin, Cronos, etc. The fund is scheduled to launch later this year, subject to regulatory approval, and its products will operate through a Truth.Fi independent management account (SMA) and invested by TMTG with a cash reserve of up to $250 million, held by Schwab. Devin Nunes, CEO and Chairman of TMTG, said that the move will promote the United States to prioritize investment in products and support American companies focusing on rapid growth and technological innovation; at the same time, Crypto.com co- founder Kris Marszalek also said that these new ETFs will provide more options for more than 140 million users around the world, further expanding the application scenarios of crypto assets.

It is worth noting that CRO destroyed 70% of the tokens earlier, and this recovery process has caused some discussion in the community.

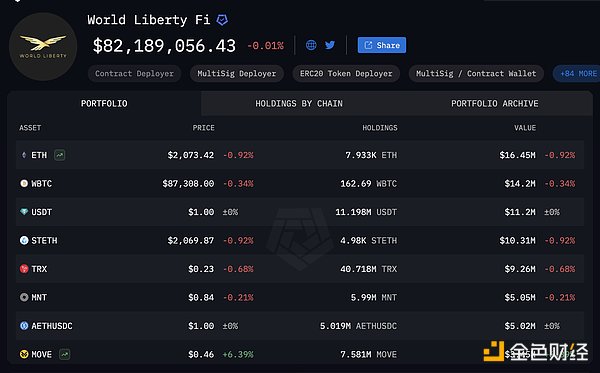

5. WLFI (World Liberty Financial)

WLFI is a crypto project of the Trump family, raising $550 million through two token sales. WLFI's holding assets mainly include a variety of cryptocurrencies. According to public information, WLFI's investment portfolio includes tokens such as Bitcoin (BTC), Ethereum (ETH), Tron (TRX), Chainlink (LINK), Aave (AAVE), Ethena (ENA), Movement (MOVE), Ondo (ONDO), Sei (SEI), Avalanche (AVAX) and Mantle (MNT), with a total value of approximately US$343 million, but the overall floating loss is currently about tens of millions. Among them, ETH and WBTC (encapsulated Bitcoin) account for the vast majority of the investment portfolio.

summary

The title "America First Concept Coin" mainly reflects the market's expectations of American political and policy tendencies. Although a unified token list has not been formed yet, the above categories of Trump concept coins reflect this concept to varying degrees. Investors generally believe that the performance of such tokens will depend closely on the Trump administration's relevant policies, trade issues and macroeconomic trends. If Trump continues to introduce policy support that is conducive to encryption in the future, such tokens may benefit; on the contrary, if there is negative news or the macroeconomic situation deteriorates, it may face large fluctuations.

Overall, Trump's concept currency shows high volatility and speculation. OFFICIAL TRUMP showed strong trading activity, MAGA and Melania Token maintained relatively stable relying on a stable community base, while TrumpCoin appeared bleak due to insufficient liquidity. Although WLFI has strong funds, it mainly plays the role of an investment fund, and its holding value is affected by the overall crypto market. In the future, the trend of these tokens will be closely related to Trump and his policy dynamics, US economic data and the Fed's policy trend. Investors should pay close attention to relevant policy and market data when participating in such assets, especially in the context of frequent and recurring Trump's policies, and should be highly cautious.

chaincatcher

chaincatcher