Bitwise: Bitcoin’s last major risk has been eliminated

Reprinted from jinse

03/26/2025·1MAuthor: Matt Hougan, Chief Investment Officer of Bitwise; Translated by: 0xjs@Golden Finance

I first heard of Bitcoin in February 2011.

At that time, I worked at ETF.com, managing a team of young financial analysts, and operating the world's first ETF data and analytics service. We meet every week to discuss what is going on in the market. In February 2011, the price of Bitcoin exceeded $1 for the first time, and one of my analysts mentioned this historic "dollar threshold". He then led a great discussion about what Bitcoin is, how it works, and what it might develop into.

If I invested $1,000 in Bitcoin after that meeting, the investment would be worth $88 million now. However, I left the office and went to buy a cup of coffee.

I share this story because everyone - really everyone - feels like that. We all hope that we can buy bitcoin earlier.

But we overlook one thing in these stories, that is, Bitcoin was facing huge risks at that time.

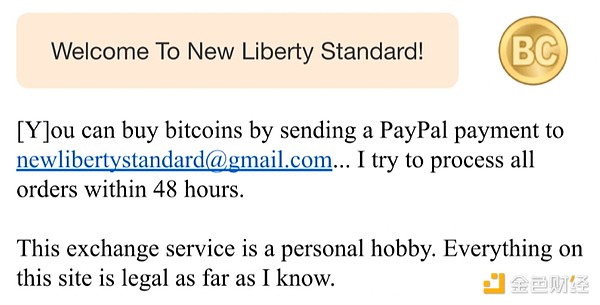

For example, on the day I attended that $1 Bitcoin conference, the world's largest cryptocurrency exchange was New Liberty Financial. Below are their terms of service. ¹

In hindsight, it was easy to say that I should have bought $1,000 in Bitcoin at the time. But at the time, that meant sending $1,000 to a random PayPal account. Adding to the risks of custody, regulation, technology and government... Putting $1,000 on Bitcoin in 2011 was a huge gamble.

I'm sharing this story now for two reasons: first, it doesn't have to blame yourself for missing out on investing in Bitcoin; second, it makes you believe that the situation is different now.

In fact, I believe that in terms of risk-adjusted situations, today – at this moment – is the best time to buy Bitcoin ever.

We just eliminated the last major survival risk of Bitcoin

Every investment requires a trade-off between risks and returns. A lottery can turn 1 dollar into 1 billion dollars, but your expected return is zero.

At the beginning of Bitcoin, it was a bit like a lottery: there was huge room for upwards, but the risks were equally huge.

For example, when Bitcoin was first launched, it could not even be guaranteed that it would work normally. Yes, its white paper is excellent. Logically, it seems to work. But before Bitcoin was launched, there were many attempts to build an electronic cash system, and all failed. (For example, you can take a look at this paper written by the NSA in 1997, “ How to Mine Coins: Cryptography of Anonymous Electronic Cash .”)

But in the early days of Bitcoin, besides the technology itself, there were other major risks. Trading has been a risk factor for years – early trading platforms were either unreliable or trapped by low transaction volume and poor operation. It was not until the establishment of Coinbase at the end of 2011 that the situation changed.

For a time, hosting was also a risk factor—until established blue-chip companies like Fidelity began to provide self-hosting and institutional hosting services.

In the initial stages of Bitcoin’s birth, people also had reasonable concerns about money laundering, criminal activities, regulatory standards, and centralized mining.

What’s amazing about Bitcoin is that over time, it has slowly but really eliminated every such significant survival risk.

The launch of the Bitcoin spot ETF in January 2024 has allowed us to overcome another major hurdle, providing clear regulatory guidance for US institutional investors interested in entering this field.

But even after the launch of the ETF, there was a major survival risk that had been lingering in my mind: What if the government bans Bitcoin?

US Strategy Bitcoin Reserves

This is the question I always mention every time someone asks me at a meeting, “What makes you sleepless?”.

I have been thinking that the United States confiscated privately held gold in 1933 in order to enrich the treasury, which is well known. Then why would it allow Bitcoin to grow to a scale that is enough to threaten the dollar's status?

To be honest, I didn't know the answer at the time.

When asked on stage, I always remind people that the US government "buyed" gold from the people in 1933: I would say that if Bitcoin developed enough to challenge the US dollar, then your investment may have made a lot of money.

That's the best answer I can give.

But just earlier this month, President Trump signed an executive order to set up the U.S. strategic bitcoin reserve. In this way, the last major survival risk faced by Bitcoin disappeared before my eyes.

Many people are wondering why the United States does this. "If cryptocurrencies are a long-time viable competitor to the dollar, why exactly should we push this rival directly against our position as the world's reserve currency," Cliff Asness, founder of hedge fund AQR Capital, wrote immediately after Trump signed the executive order.

The answer is of course that Bitcoin is better than other alternatives. The best situation for the United States is that the US dollar continues to maintain its position as a world reserve currency. But if it is the day when the US dollar is at risk, it is better to choose Bitcoin as an alternative than to choose a currency such as RMB.

This is what I didn't expect at the beginning: Of course the United States will accept Bitcoin. It is the best backup solution on the market.

What does this mean for investors

From the actual situation, in Bitwise, we have begun to see the impact of this risk reduction. Two years ago, Bitwise customers would normally allocate about 1% of their portfolio funds to Bitcoin and other crypto assets, a ratio they wouldn't care too much even if they lost it. Such a configuration is reasonable considering that Bitcoin is banned or faces other failures. But in today's environment, the situation is different. We more often see customers allocating 3% of their funds to Bitcoin. As more people in the world realize that the risk of Bitcoin has been greatly reduced, I think this ratio will rise to 5% or even higher.

Note 1: I created this image based on the original website's graphics and terms of service, which you can view here (https://web.archive.org/web/20100301174241/http://newlibertystandard.wetpaint.com/page/Exchange+Rate).

chaincatcher

chaincatcher

panewslab

panewslab