LIBRA Event Reflection: A new round of disenchantment has begun?

Reprinted from chaincatcher

02/18/2025·2MAuthor: Scof, ChainCatcher

Who is manipulating LIBRA?

"Scythe" has shifted from retail investors to well-funded KOLs and institutions.

On February 15, a crypto market earthquake triggered by politicians broke out from Argentina. At 6 a.m. that day, Argentine President Javier Milei announced the launch of the Meme coin called LIBRA through his official X account and announced the contract address. As soon as the news came out, the price of LIBRA instantly soared to US$4.61, with a market value exceeding US$4 billion, and the trading volume reached US$1.2 billion in 4 hours. But the carnival lasted only a few hours before taking a sharp turn.

At 11:30 a.m., Mile suddenly deleted the tweet and said he was unaware of the details of the token, and angrily criticized someone for trying to use his name to manipulate the market. LIBRA price plummeted by more than 85%, and its market value shrank to US$418 million. On-chain data shows that the eight wallets associated with the LIBRA team have cashed out US$107 million by removing liquidity, with a maximum single loss of US$5.17 million. Nearly 100 investors lost more than $500,000, and American law firm Burwick Law immediately announced that it would intervene in the pursuit.

The core of the incident gradually points to the issuer of LIBRA, the blockchain project KIP Protocol and its partner Kelsier Ventures. Although KIP Junchuang Julian Peh insists that Milai did not participate in the development, public information shows that the KIP team met with the president as early as October 2024 to discuss a blockchain financing plan called "Long Live Freedom". In January 2025, Hayden Davis, head of Kelsier Ventures, entered the Presidential Palace as a technical consultant for negotiations.

Blockchain analysis platform Bubblemaps revealed that LIBRA shares behind the scenes team with MELANIA tokens linked to another politician Melania Trump. Through cross-chain tracking, a wallet marked 0xcEA profited more than $2.4 million from LIBRA, and the address is the trader of MELANIA and involved multiple high-shipment scams. Solayer developers further revealed that LIBRA market makers are related to Indian serial divestment scammer Arunkumar Sugadevan, who had cleaned up more than $15 million in funds.

On February 16, the Argentine Presidential Office announced that Mile had asked the Anti-corruption Office to thoroughly investigate the companies and individuals involved in the case and set up a special investigation team to track the flow of funds. The opposition party threatened to impeach the president on the grounds that "rug pull caused the evaporation of national wealth." Under pressure, Kelsier Ventures promised to use $100 million in treasury funds to repurchase and destroy LIBRA, but was questioned as crisis PR.

As a Solana ecological head aggregator, Jupiter was accused of learning about the inside story of LIBRA's release two weeks in advance. Its team clarified that the tokens were verified only because of the president's tweet and did not participate in any distribution of benefits. Meteora Ben Chow also denied receiving tokens, saying it only provides technical support. However, YouTube reporter Coffeezilla revealed that the LIBRA team admitted that the internal rush to trade was hit by the industry again.

As of February 17, this farce has evolved into a multiple game between politics, law and encryption technology.

Series of controversies expose real anxiety in the market

Now, the community is still paying attention to the development of the incident, and KOLs have also said that bigger melons may break out in the future. In fact, no matter what the ending is? What the industry should do most now is reflection. Although many stories of young P players getting rich have been born in this mode, their essence is still a fast-moving game.

The LIBRA incident exposed the deep-seated contradictions and trust crisis in the cryptocurrency industry.

It can be seen that users' anger has never been simply because of losing money

- in fact, everyone has long been used to the surge in the currency circle, but when the president personally stands on the stage, the credit endorsement that breaks the bottom line becomes a tool for harvesting, even the last layer of value consensus The fig leaf was torn apart.

In addition, Solana, who has gained widespread recognition in this cycle, has also begun to lose her mind and is plagued by FUD.

For SOL holders, the rise of memes on the chain has brought new development opportunities to SOL, attracted more people to pay attention and hold SOL, and promoted the development of the Solana ecosystem. However, this incident brought all this back to question. The sharp decline in SOL currency price has not only greatly reduced the assets of holders, but also cast a shadow on the development prospects of the entire Solana ecosystem.

More importantly, the LIBRA incident is undoubtedly a heavy blow to the real builders of the cryptocurrency community. Manipulation, fraud and systematic harvest? People are beginning to question: Is this industry moving towards decentralization and transparency, or is it repeating the drawbacks of the traditional financial system? Some crypto KOLs even said bluntly: "Pump is destroying the industry."

Perhaps this is the real anxiety in the market.

Because of anxiety, so

"Retail investors don't need to really create a wealth effect, they just need to look like there is a wealth effect."

In the past month, the market has been deeply trapped in the vortex of "hot spot harvesting". Every hot topic is repeating the same script - traffic entry, price surge, liquidity withdrawal, and a sigh from most users.

Although we all know that PVP will not disappear, the fast-running game will continue.

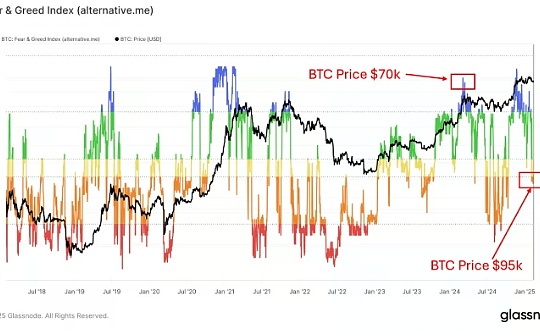

But at least at the current stage, a new round of disenchantment in the crypto market may be about to begin.

panewslab

panewslab

jinse

jinse