Is the traditional IPO "dead"? Is on-chain STO the future?

Reprinted from panewslab

02/20/2025·3MAuthor: Balaji (angel investor, former CoinbaseCTO)

Compilation and Organization: Comparison of BitpushNews

The era of technology mergers and acquisitions may be over, but the era of crypto may have just begun.

Because the combined effect of the new policy makes it more difficult for startups to exit through IPOs or mergers and acquisitions, but it has become easier to issue equity-backed securities tokens (STOs) on the Internet. Why? This article will tell you one by one:

1) IPO becomes difficult

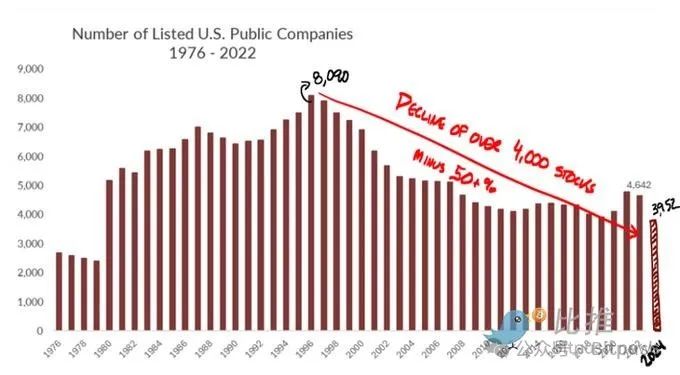

For decades, the SARbox rules of the Securities and Exchange Commission (SEC) have made it extremely cumbersome to list small companies. These rules were intended to prevent the next Enron incident, but did not work (and failed to stop the financial crisis). However, they cut the number of publicly traded U.S. companies by half from their peak in 1999:

2) Mergers and acquisitions also become difficult

Therefore, starting from the mid-2000s, the traditional view was that tech companies should remain private for a longer period of time. Due to difficulties in IPOs, mergers and acquisitions have become the main way for venture-backed technology startups to exit. This has included huge exit cases such as Instagram ($1 billion), Oculus ($2 billion) and WhatsApp ($19 billion) over the course of about 20 years.

However, since Lina Khan led the Federal Trade Commission (FTC), large mergers and acquisitions have been blocked on the grounds of "increasing competition" on the grounds that big fish are banned from eating small fish. That's the (skinny) reason behind the crackdown on Adobe's acquisition of Figma by joint EU, the US and the UK regulators, which should have been a huge exit to fund more startups:

Khan's logic is fundamentally wrong, because when big companies acquire small competitors at high prices, it is actually a surrender—and a huge capital injection into the venture capital ecosystem to create more of this competition opponent. If such exits (whether IPO or M&A) are reduced, then tech startups will not be able to obtain capital and there will be no competition.

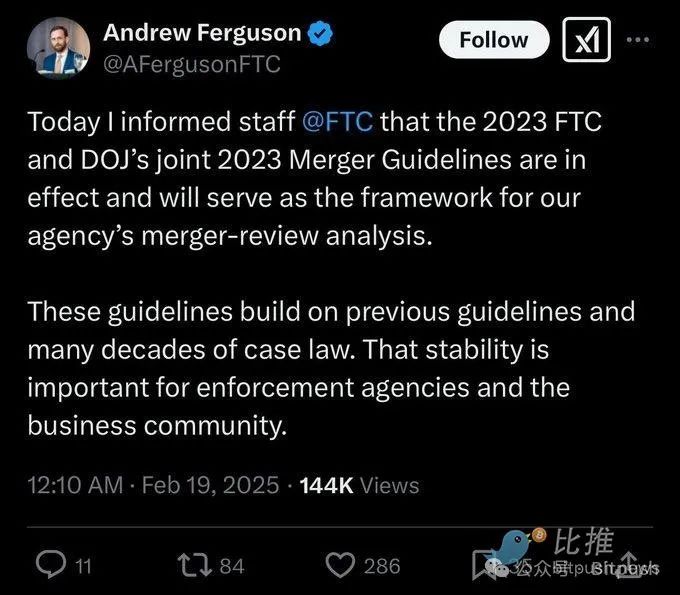

3) The new Trump administration still opposes mergers and acquisitions!

People in the tech industry once believed that the new government would be more friendly to mergers and acquisitions. But surprisingly, the new government embraced Lina Khan's logic—and apparently continuing her policy:

I think this is partly due to their (understandably) tribal hostility to the media-driven censorship that big tech companies have during the 2020 elections. But unless things change, this means that technology mergers and acquisitions won't return.

In addition, the new administration continues Biden's anti-M&A policy in another aspect. Japan's Nippon Steel was blocked by Biden from acquiring US Steel, and the new administration maintained that block. However, they seem to offer a different path, namely, that Japanese iron invests in American companies but does not own it.

In any case: It is not easy to acquire American companies, either large or foreign companies. And mergers and acquisitions are already very difficult. This is like getting married now, it is a big project. If you stack some unpredictable government risks on a transaction that is already difficult to complete, many mergers and acquisitions will not even be considered.

4) But the encryption window is already open

However, when the government closes a door, a window sometimes opens. Although IPOs are still expensive, and even though mergers and acquisitions have become more difficult... The new government has actually relaxed its regulation of cryptocurrencies by introducing President Meme and pro-crypto executive orders.

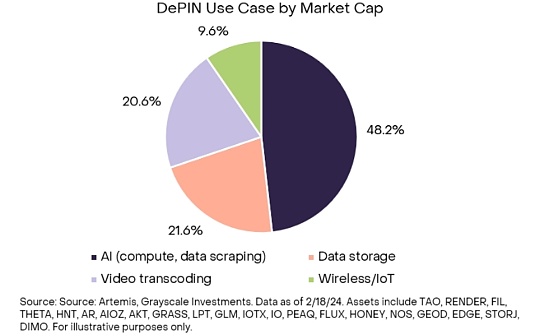

While no one knows what the new rule is, if you can issue unsupported Meme coins, then it's almost certain that you can also issue equity-backed ICOs, also known as Securities Token Issuance (STO):

In fact, the STO is actually in line with the government’s vision that “the world should invest in tokens created by the United States” and that “small entities should be able to remain independent for longer.”

Remember their idea that Japanese iron making investment in US Steel is OK, but owning it is not OK? This may be a way to solve the problem. If you don't allow large tech companies to acquire small tech companies, you need to allow the latter to raise funds in some way in order to compete with large tech companies.

So let the world invest in them on chain without owning them, just like Japanese iron investing in American Steel. Just like Masa and Saudi Arabia are investing hundreds of billions of dollars in U.S. companies without fully owning them.

This is a financial win-win, while retaining sovereignty.

In addition, in theory, small businesses (such as restaurants, etc.) can also perform STO. In theory, STO reduces the cost of listed capital from millions to zero. But you need to superimpose new decentralized regulatory mechanisms in such markets, similar to Uber/Airbnb/Amazon’s star ratings and bans on bad actors.

5) From Lanzhou to Blockchain

In any case: There are countless details to be solved in terms of raising the equity list and conducting a high-trust public offering (with lock-up period, etc.).

But that is ultimately where we want to go. California is no longer the only place to operate, Delaware is no longer the best place to register, and New York is no longer a place where the rule of law is trustworthy.

The era of Blue State is over, but blockchain is on the rise.

Because obviously, Internet companies should exist on the chain in the form of the Internet native and be able to access the Internet-scale capital market through encryption. In fact, although the number of stocks listed in New York has been declining, the number of digital assets listed on the Internet has been rising.

So, I want to say to my tech friends: Yes, the window for technology IPOs and mergers and acquisitions may have been closed, but the window for technology STO may be greatly opened.

jinse

jinse