Market macro research report: The wave of entry of crypto ETF institutions is coming, and the industry may hit another high in 2025

Reprinted from panewslab

02/20/2025·3Msummary

Since 2024, the successful approval of Bitcoin spot ETFs marks a new stage of development in the crypto asset market. With the continuous inflow of institutional funds, market liquidity has increased significantly, driving the prices of Bitcoin and other crypto assets to hit new highs. Looking ahead to 2025, with the potential Fed rate cut, the increase in the allocation ratio of institutional investors, and the continued improvement of Web3 infrastructure, the crypto industry is expected to usher in a new round of large-scale bull market. This article will conduct in-depth analysis of the far-reaching impact of encrypted ETFs on the market and explore the core driving force that may trigger further market growth.

1. The impact of crypto ETFs on the market

The successful implementation of Bitcoin spot ETFs is regarded as an important milestone for the crypto market to move towards mainstream finance. This not only provides institutional investors with a compliant and safe investment channel, but also has a profound impact on market liquidity, price discovery mechanism, volatility and market confidence. This section will conduct in-depth analysis on the following aspects:

**1. The implementation of Bitcoin spot ETFs: Opening a new era of

institutional investment**

(1) Background and approval process of ETF

Institutional investors' interest in Bitcoin has gradually increased in the past decade, but due to regulatory restrictions, custody difficulties and market opacity, many traditional financial institutions have difficulty directly investing in crypto assets. The launch of Bitcoin ETFs provides these institutions with a low-threshold and compliant investment method. The approval of Bitcoin ETF not only marks the loosening of the SEC's regulatory framework for the Bitcoin market, but also paves the way for other crypto asset ETFs in the future, such as Ethereum ETFs.

(2) ETF trading model and its attraction to institutions

Compared to buying Bitcoin directly, ETFs have the following advantages to make them more in line with the needs of institutional investors:

Compliance: ETFs are regulated by SEC, and investors do not need to worry about compliance risks.

Security: Institutions do not need to host Bitcoin by themselves to avoid losses from private keys or hacking.

Liquidity: ETFs can be traded freely on exchanges to improve the liquidity of assets.

Tax Advantages: Investment in ETFs in some regions has more advantages in tax processing than holding Bitcoin directly.

This series of advantages makes Bitcoin ETF the first choice for institutional investors to allocate crypto assets.

2. ETF capital inflows and its impact on the market

Since its launch, Bitcoin spot ETF has continued to attract a large amount of capital inflows, which has had a profound impact on market prices and structure.

(1) ETF capital inflow data

According to The Block and Cryptoslate, as of Q4 2024, institutional investors' interest in spot Ethereum ETFs increased significantly, with institutional holdings of Ethereum ETFs jumping from 4.8% to 14.5%; at the same time, spot held by institutional investors Bitcoin ETFs managed assets (AUM) totaled $26.8 billion, with holdings of these institutions increased by 113% in Q3 to Q4 2024, and total assets managed jumped 69% to $78.8 billion. Especially as more sovereign countries/enterprises begin to include Bitcoin in their strategic reserves, and expectations of staking on Ethereum ETFs continue to increase, the market size of these ETFs will be further expanded.

(2) The driving effect on Bitcoin price

After the launch of ETFs, institutional investors gradually increased their holdings in Bitcoin, causing major changes in the supply and demand relationship of Bitcoin. In December 2024, the price of Bitcoin once exceeded the psychological mark of $100,000, setting a record high, and broke through the $109,000 mark on the eve of Trump's takeover in January 2025, breaking through the historical high again.

More importantly, the inflow of funds of ETFs belongs to long-term holding funds (HODLer), which is different from retail investors' short-term trading behavior. This capital flow model reduces Bitcoin’s selling pressure and forms continuous buying support. If the inflow trend of ETFs continues, Bitcoin may usher in a larger increase in 2025.

3. How do ETFs change the market structure?

The successful implementation of Bitcoin ETFs is not only a catalyst for price increases, but also profoundly changes the overall structure of the crypto market.

(1) Enhancement of market liquidity

Bitcoin ETFs provide a standardized investment tool that enables more traditional financial institutions to quickly enter the market. As ETF trading volume increases, market liquidity improves significantly, which means:

Less price manipulation: After liquidity increases, the impact of large-scale sell-offs or buys on the market will be reduced, reducing the room for manipulation.

Price spread narrowed: In the past, the trading depth of the crypto market was limited, resulting in large differences in the price of Bitcoin between different exchanges. The introduction of ETFs can promote the unification of prices.

(2) The decline in Bitcoin volatility

Bitcoin has long been considered a high volatility asset, but the launch of ETFs may reduce short-term volatility in the market:

Institutional positions are usually long-term investments and will not buy and sell as frequently as retail investors, reducing the possibility of severe market fluctuations.

The arbitrage mechanism of ETFs can make the price of Bitcoin more stable. For example, when the ETF has a high premium, arbitrage traders will sell the ETF and buy Bitcoin, thereby suppressing price fluctuations.

Data shows that since the launch of the ETF, Bitcoin's 30-day historical volatility has dropped from 65% to around 50%, showing a downward trend.

(3) Influence of derivatives market

The success of Bitcoin ETFs has also prompted the further maturity of the derivatives market. As institutional investors use ETFs for hedging, the following trends may gradually emerge:

The liquidity of the Bitcoin options market has increased, providing more efficient risk management tools, increasing the linkage between the spot market and the derivatives market, reducing market irrational fluctuations and ETF holdings will become an important weather vane of market sentiment and affecting investor expectations.

4. Will the success of the ETF be copied to other crypto assets?

The success of Bitcoin ETF has attracted high attention from the market for other crypto asset ETFs (especially pledged Ethereum ETFs and counterfeit ETFs such as LTC, SOL, and DOGE).

(1) Expectation of pledgeable Ethereum spot ETF

At present, some Ethereum ETF issuers have submitted applications to the SEC for pledgeable Ethereum spot ETFs, and the US SEC confirmed that it had received a proposal by 21 Shares to pledge Ethereum ETFs. The market generally expects that the pledged Ethereum ETF will be approved in 2025.

Once a pledged Ethereum ETF is approved, its market impact may include:

- Institutional funds accelerated their entry into the ETH market, driving ETH prices to rise.

- Accelerate the development of the ETH ecosystem and increase the activity of tracks such as DeFi and NFT.

- Promote the demand for ETH 2.0 and reduce market selling pressure.

(2) ETF products that may be launched in the future

If the pledged Ethereum ETF is successfully implemented, the crypto asset ETFs that may be approved in the future include:

- Multi-asset encryption ETF (BTC + ETH + other mainstream assets)

- Public chain ETFs such as Solana, Avalanche, Polkadot, Litecoin, Dogecoin, Ripple, etc.

- DeFi blue chip ETF (UNI, AAVE, LDO, etc.)

- RWA (Real World Asset) Tokenized ETF

The launch of these products will further expand the coverage of institutional funds and promote the long-term development of the crypto market.

2. Key growth factors of the crypto market in 2025

In 2024, with the implementation of Bitcoin spot ETFs, institutional investors began to enter the crypto market on a large scale, bringing new capital inflows and stability to the market. However, the growth of the crypto market in 2025 is not only ETFs, but is also driven by multiple factors. Here are the key growth factors that could drive the crypto market to a new high in 2025:

**1. Macroeconomic environment: liquidity turning point and global

monetary policy**

(1) Federal Reserve monetary policy: market dividends brought by the expectation of interest rate cuts

The Federal Reserve's monetary policy is an important variable that affects liquidity in global capital markets. Currently, the market generally expects that the Federal Reserve will continue to cut interest rates in mid-to-late 2025. This policy shift will have the following implications for the crypto market:

Reduce capital costs and promote risky assets to rise: During the interest rate cut cycle, bond yields in traditional markets have declined, and institutional investors are more willing to allocate high-growth assets, such as technology stocks and crypto assets.

Strengthen the "digital gold" attributes of Bitcoin: When real interest rates drop or even turn negative, the attractiveness of anti-inflation assets such as Bitcoin will increase, which may attract more safe-haven funds to enter the market.

Increased leveraged trading activity in the crypto market: After interest rates drop, traders' financing costs are reduced, which may drive increased leverage demand in the crypto market and increase overall trading volume.

In addition, major global central banks (such as the European Central Bank and the Bank of Japan) may also enter a loose cycle simultaneously in 2025, further releasing market liquidity and creating favorable conditions for the crypto market.

(2) Geopolitics and global capital flows

In recent years, the global geopolitical situation has become increasingly tense, such as the Russian-Ukrainian conflict and the challenge of the dollar's hegemony. These factors are accelerating the global reconfiguration of funds. Against this background, crypto assets are becoming an important carrier for safe-haven funds and capital flows in emerging markets.

Emerging market investors have increased demand for Bitcoin: For example, high-inflation countries such as Argentina and Turkey, people are more inclined to hold crypto assets such as Bitcoin to avoid the risk of depreciation of their own currency.

Institutional recognition of Bitcoin as a non-sovereign asset has increased: sovereign debt problems have intensified, which may lead more institutions to include Bitcoin in their portfolios to hedge risks in traditional financial systems.

Web3 enterprise financing and investment demand grows: As global capital flows to crypto markets, Web3 projects and innovative companies may usher in a new financing boom.

2. Institutional configuration wave

According to the latest data on Bitcoin and Ethereum ETFs disclosed by the SEC, the Bitcoin/Ethereum spot ETFs held by 15 institutions in 2024, covering investment institutions, hedge funds, banks and pension funds. The cumulative holdings of these institutions exceed US$13.98 billion, of which the holdings of Goldman Sachs, Millennium, SIG and Brevan Howard all reached billions of dollars, compared with the previously counted Bitcoin spot ETF holdings of mainstream institutions in multiple quarters of 2024. From the perspective of this, the allocation of these institutions has been significantly improved. From the perspective of holding strategies, each company has different market expectations and asset allocation directions. Many institutions have large-scale increase in holdings in the fourth quarter of 2024, especially BlackRock's IBIT is the most money-making. In terms of position structure, most institutions mainly focus on Bitcoin spot ETF products. However, since Q4, many institutions have increased their investment in Ethereum ETFs, mainly BlackRock's ETHA, FETH and Grayscale Mini Trust ETH is the main one.

3. The dual effect of ETF+ halving

Unlike the previous halving cycles, this time the market ushered in institutional capital inflows from Bitcoin spot ETFs, which means that the supply and demand relationship will become more tilted:

ETF institutions’ daily buying demand is greater than miners’ new daily issuance of Bitcoin, which may lead to supply tightening, which in turn drives up prices.

Assuming that ETFs buy 1,000 bitcoins a day, while miners produce only 450 pieces a day, this supply and demand imbalance could lead to a sharp decline in the supply of liquid bitcoins in the market, thereby accelerating price increases.

Overall, the market structure of Bitcoin will undergo major changes in 2025, and the halving + ETF capital inflows may jointly drive the price to a record high.

4. Ethereum Petra upgrade

According to the latest news from the Ethereum Foundation, the Prague/Electra (Pectra) upgrade is scheduled to be held in early April 2025. Its most notable planned changes include: Variable Verifier Valid Staking up to 2048 ETH, which will significantly change the staking distribution, validator schedule, and simplify management improvements for large staking providers by integrating smaller staking The interaction between the execution layer and the consensus layer simplifies the data exchange between the Eth1 execution block and the beacon chain block. This will greatly simplify deposits, activations, withdrawals and exits, speeding up these processes, laying the foundation for further interaction between the consensus layer and the execution layer in smart contracts to support cheaper directly through the new "pair-friendly" BLS12-381 precompilation BLS signatures and zkSNARK verification encourage Rollups to adopt blob transactions by increasing blob transaction thresholds and increasing calldata costs. Using blob transactions enables EOA to act as a programmable account, giving it multiple calls, sponsorships, and other advanced features As you can see, Pectra will stake and consensus on stakes and consensus. The end user experience of the layer, as well as the execution layer, has a significant impact.

5. The explosion of real-world assets (RWA) tokenization

RWA (Real World Assets) tokenization is becoming the next growth point in the blockchain industry. In 2025, the following asset classes may be accelerated:

Treasury bonds, stocks, and real estate tokenization: Financial giants such as BlackRock and Fidelity have begun to deploy on-chain Treasury bond markets, which may expand to stocks and real estate in the future.

Carbon credit, artwork, luxury goods NFT: RWA's application will expand from financial assets to environmental protection, culture, collectibles and other fields.

DeFi + RWA Combination: RWA will drive the growth of the DeFi market and provide real-world asset support for decentralized finance.

3. Bull market strategy in 2025 - parallel stability and flexibility to

seize the dividends of the new cycle

In 2025, the crypto market is standing at a critical turning point, which includes both the long-term benefits brought by the institutional entry wave of Bitcoin ETFs, and the possible recovery of global liquidity caused by the Federal Reserve's interest rate cut. At the same time, the expansion and reality of the Ethereum ecosystem World Assets (RWA) tokenization, innovation in tracks such as Meme and SocialFi will also become an important driving force for market growth. In this context, investors need to use more systematic strategies to flexibly capture short-term trends on the basis of a steady layout of core assets in order to maximize returns.

1. The three core logics of the market in 2025

To understand the market in 2025, we can summarize the following three core logics:

(1) The institutionalization process is accelerating, and Bitcoin and Ethereum have become the dual pillars of "digital gold" and "on-chain finance"

The successful launch of Bitcoin ETFs has changed the market structure, with institutional investors significantly increasing acceptance of crypto assets, and the potential approval of pledged Ethereum ETFs may make ETH the second largest allocation asset for institutional funds. In 2025, the performance of BTC and ETH may be similar to the role of the dual pillars of "digital gold + on-chain finance", becoming the core assets held by investors for a long time.

(2) Encryption ecosystem innovation is accelerating, and AI Agent, RWA, and DeFAI empower a new round of growth

As the crypto market gradually matures, the market's focus is shifting from simple speculation to areas with practical application value. In 2025, the full implementation of AI Agent in the crypto industry, the on-chain of real-world assets (RWA), the deep integration of decentralized finance (DeFi) and AI may all bring new investment opportunities and further promote the total market value of the market. expansion.

(3) Liquidity-driven cycle return, Federal Reserve rate cuts and global capital return to crypto market

If the Fed starts a cycle of interest rate cuts, funds from traditional financial markets may flow into crypto markets in pursuit of higher yields. At the same time, factors such as uncertainty in the global economy and geopolitical risks may accelerate capital's need for decentralized assets. The recovery in liquidity will further stimulate the price increase of risky assets, making 2025 the peak of a new bull market.

**2. Summary of investment strategy: long-term stability + short-term

flexibility**

Faced with the market environment in 2025, the best investment strategy is to hold core assets stably for a long time and flexibly adjust the allocation to seize the short-term hot spots of the market. Specifically, the following strategies can be adopted:

(1) Long-term holding of Bitcoin (BTC) and Ethereum (ETH) as core configuration

BTC: Continue to play the role of digital gold, favored by institutional funds, and the price is expected to exceed $110,000 or even higher.

ETH: Ethereum's Layer 2 and RWA ecosystem growth may drive ETH's valuation to rise. The inflow of funds after pledge Ethereum spot ETF approval will further push up prices.

Recommended positions: 60%-70% of the investment portfolio (long-term investment)

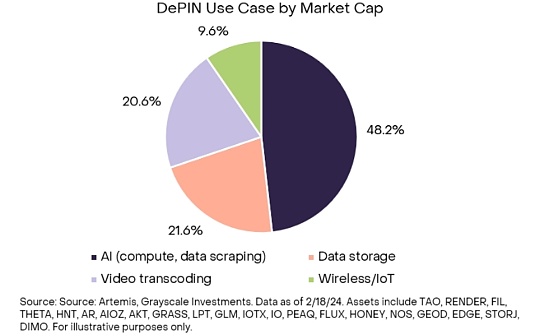

(2) Pay attention to growth tracks: DEPIN, RWA, Solana Ecology, DeFAI

DEPIN is expected to usher in a wave of AI and application implementation and expansion again.

The RWA track (Tokenized Bonds, Real Estate, Carbon Credit) will gradually introduce institutional funds to open up the trillion-dollar market.

The Solana ecosystem may continue to become an important growth point for Meme, DeFi and NFT.

DeFAI: The combination of DeFi and AI may bring about a new round of capital efficiency improvement.

Recommended positions: 20%-30% of the investment portfolio (medium-term investment)

(3) Flexible grasp of short-term trends: Meme track, SocialFi, AI Agent

Meme Track: Leading assets such as DOGE, SHIB, WIF, and emerging Meme projects may continue to be driven by market sentiment.

SocialFi: Combining Web3 social and finance may become a new growth point.

AI Agent: After the current market adjustment, AI Agent will bring about a new round of technological upgrades and application waves.

Recommended positions: 10%-20% of the investment portfolio (short-term speculation)

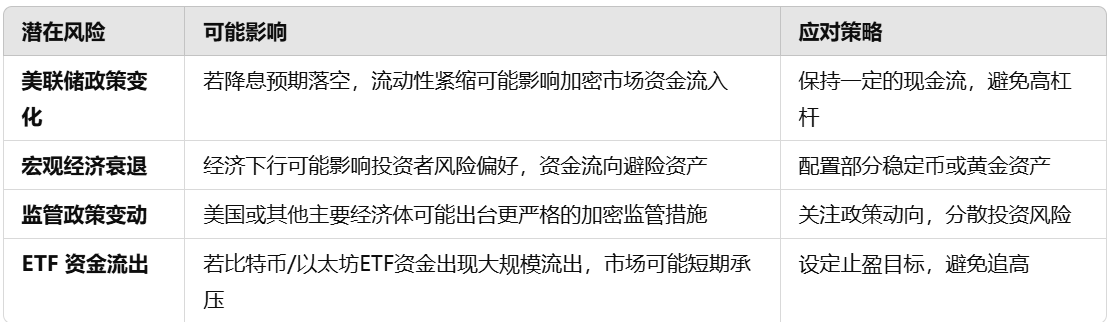

3. Potential market risks and response strategies in 2025

Although the overall trend of the crypto market is improving in 2025, we still need to be vigilant about the following potential risks and do a good job in risk management:

4. Conclusion: Market Outlook in 2025: The crypto industry is maturing,

and a new round of wealth opportunities begins

Overall, 2025 is expected to become an important milestone in the development of the crypto market, mainly manifested in:

- Institutionalization accelerates: Bitcoin ETFs and Ethereum ETFs continue to promote institutional funds, and market maturity increases.

- Technological innovation drives growth: AI Agent, DePIN, RWA, Petra upgrades and other technologies are upgraded to promote the practical development of the blockchain ecosystem.

- Liquidity recovery: The global interest rate cut process has been further expanded, providing financial support for the crypto market, and market confidence has rebounded.

- Rise of emerging tracks: Investment opportunities driven by market sentiment such as Meme, DeFAI, and AI Agent still exist.

For investors, 2025 may be the year when the crypto market truly enters the mainstream financial system. The coexistence of the market's cyclical bull market and structural growth will bring unprecedented investment opportunities. In this environment, through reasonable asset allocation and dynamic adjustment strategies, we can not only enjoy the long-term growth dividends of the market, but also flexibly seize opportunities in short-term fluctuations to achieve maximum asset appreciation.

If 2021 is the year of the outbreak of DeFi and NFT, 2025 may be a year of deep integration of institutional capital and blockchain technology. This year, the crypto market may no longer be just a game for "crypto native players", but an important part of the global capital market.

jinse

jinse

chaincatcher

chaincatcher