Is the Bitcoin super cycle coming soon? Will BTC reach $150,000?

Reprinted from jinse

05/19/2025·20DSource: Bitcoin Magazine; Translated by: Deng Tong, Golden Finance

Bitcoin will soar in 2025, sparking speculation about the historic Bitcoin supercycle. After turmoil at the beginning of the year, new momentum, recovery of market sentiment and bullish indicators have made analysts wonder: Are we about to repeat the Bitcoin bull market in 2017? This Bitcoin price analysis explores cycle comparisons, investor behavior and long-term holder trends to assess the possibility of explosive phases in this round of cryptocurrency market cycle.

Comparison between Bitcoin Cycle in 2025 and previous bull markets

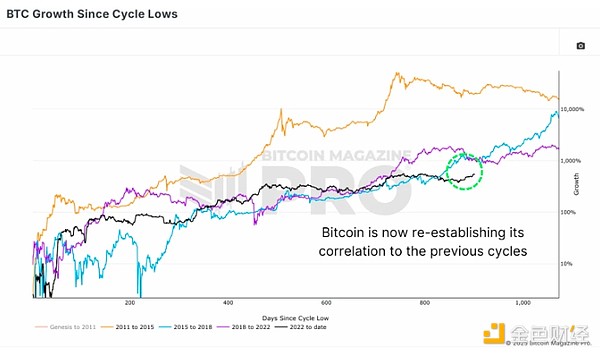

The recent surge in Bitcoin prices has refreshed expectations. According to the “Growth of Bitcoin Since Cyclic Lows” chart, despite macro challenges and pullbacks, Bitcoin’s trend is highly consistent with the cyclical trends from 2016-2017 and 2020-2021.

Figure 1: Bitcoin’s bull market price trend in 2025 is similar to the previous cycle trend.

Historically, the peak of the Bitcoin market cycle usually occurs about 1,100 days after the lows. The current cycle has lasted for about 900 days, and the price of Bitcoin may still have hundreds of days of potential explosive growth. But can investor behavior and market mechanisms support the arrival of the Bitcoin super cycle in 2025?

Bitcoin Investor Behavior: The Echo of the Bull Market in 2017

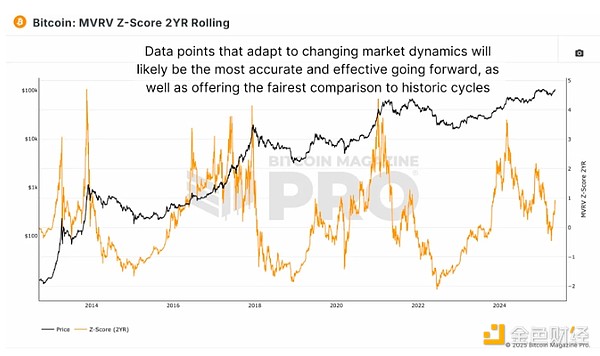

To measure the psychology of cryptocurrency investors, the two-year rolling MVRV-Z score provides key insights. This advanced metric considers lost tokens, under-liquidity supply, growing ETF and institutional holdings, and changes in long-term Bitcoin holders’ behavior.

Last year, when Bitcoin price reached about $73,000, the MVRV-Z scored 3.39—a high level, but not unprecedented. A callback followed, exactly the same as the mid-term consolidation that occurred in 2017. It is worth noting that several high score peaks appeared before the last parabolic rebound of the Bitcoin cycle in 2017.

Figure 2: The MVRV-Z score is similar to the Bitcoin bull market in 2017.

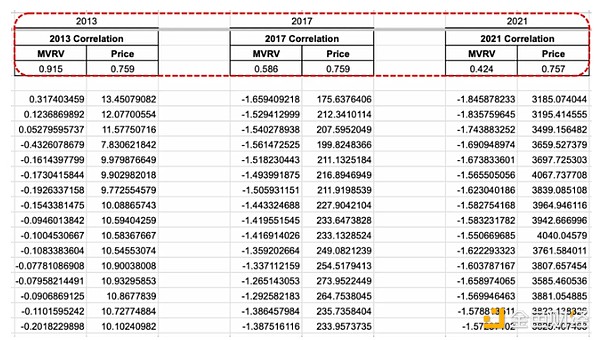

Cross-cycle Bitcoin analysis was performed using the Bitcoin Magazine Pro API and found that it was correlated with the behavior of the bimodal cycle in 2013 by up to 91.5%. There have been two major highs now – one before the halving ($74,000), one after the halving ($100,000 or above), and the third record high may mark the first three-peak bull market in Bitcoin, which may be a sign of the Bitcoin supercycle.

Figure 3: Cross-cycle behavior correlation using rolling MVRV-Z scores and price behaviors.

The 2017 cycle showed a behavioral correlation of 58.6%, while the investor behavioral similarity in 2021 was low, but its Bitcoin price trend was about 75%.

Long-term Bitcoin holders are in a strong sense

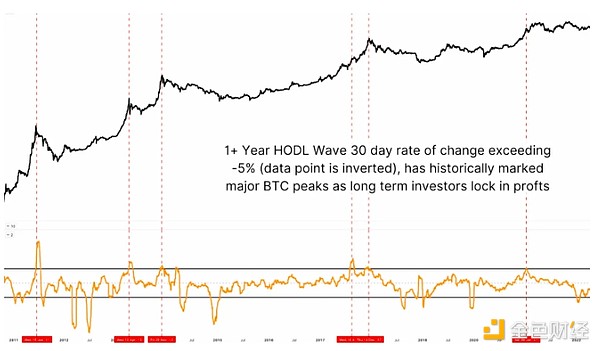

The wave of holding coins for more than one year shows that even if the price rises, the proportion of Bitcoin that has not moved for more than one year is still rising - this is rare in a bull market and reflects the firm confidence of long-term holders.

Figure 4: The change rate of the wait-and-see wave of holding coins for more than one year shows that the market is full of confidence in the future Bitcoin price.

Historically, the sharp rise in the rate of change in the coin holding tide predicts an important bottom, while the sharp decline marks the top. Currently, the indicator is at a neutral turning point and is far from reaching its peak distribution, indicating that long-term Bitcoin investors expect a sharp rise in prices.

Is Bitcoin super cycle or further consolidation?

Can Bitcoin replicate the gratifying parabolic rise in 2017? This is possible, but this cycle could open up a unique path to blend historical patterns with modern cryptocurrency market dynamics.

Figure 5: Repeating the exponential growth of Bitcoin prices in 2017 may be ambitious.

We may be approaching the third major peak in this cycle – for the first time in Bitcoin history. Whether this will trigger a full-scale meltdown in Bitcoin’s supercycle remains uncertain, but key indicators suggest that BTC is far from reaching its peak. Supply tight, long-term holders remain firm, and demand is also rising, mainly due to the growth of stablecoins, institutional Bitcoin investments and ETF liquidity.

Conclusion: Can Bitcoin usher in a rebound of $150,000?

It is tempting to compare Bitcoin directly with the situation in 2017 or 2013, but Bitcoin is no longer a fringe asset. As an increasingly mature and institutionalized market, its behavior is evolving, but the potential for explosive growth of Bitcoin remains.

Bitcoin’s historical cycle correlation is still high, investors’ behavior is healthy, and technical indicators indicate upside potential. With no obvious signs of surrender, profit-taking or macroeconomic weakness, the continued rise of Bitcoin price is ready to go. Regardless of whether this can bring a rebound of $150,000 or more, the 2025 Bitcoin bull market could go down in history.

chaincatcher

chaincatcher