Hayes: When will the $250,000 copycat season start this year

Reprinted from jinse

05/19/2025·20DSource: [Fortune](https://fortune.com/crypto/2025/05/18/arthur-hayes-on- bitcoins-route-to-200000-holding-gold-and-why-hated-ethereum-is-due-for-a- comeback/) ; Translated by: AIMan@Golden Finance

Arthur Hayes, an early-stage figure in Bitcoin, co-founded the offshore exchange BitMEX with others in 2014, but then clashed with U.S. regulators. Hayes recently admitted to failing to implement adequate money laundering controls and accepted a sentence of probation and fines, but earlier this year he received a full pardon from President Donald Trump. Today, his focus is on managing family fund Maelstrom, but Hayes remains a far-reaching figure in the digital asset space.

Fortune freelance writer Anna Tutova interviewed him on the sidelines of the Token 2049 event in Dubai, where he shared his views on current market trends, including forecasting that Bitcoin prices could reach $200,000 in the near future and $1 million by 2028.

During the Q&A session, Hayes also conducted in-depth analysis of Ethereum and other altcoin markets and explained why he unexpectedly allocated 20% of his assets to gold. He also issued some horrible warnings about the ever-inflated U.S. debt. (The interview content has been edited and concise and clear.)

Q1: You describe the U.S. Treasury’s recent lending strategy as a trick.

Why?

Hayes: The Ministry of Finance has been exhausting its "checking account" (i.e. Treasury ordinary account, TGA for short) and using "extraordinary measures" (underfunded projects) to bypass the borrowing limit, causing TGA to drop from $750 billion to $450 billion this quarter. He noted that this amounted to $300 billion spent without additional debt, which means the actual borrowing is far more than official data.

“It’s confusing,” he said. “Because we’re at the debt ceiling. So the U.S. government can’t borrow more money in net. They have all kinds of ways to spend money while staying below the debt ceiling. From January to March 2025, the Treasury Department’s borrowings increased by 22% from the same period last year. So the deficit is higher .”

Q2: What impact does this have on Bitcoin?

Hayes: “I think the U.S. government needs to borrow more money than we think so Treasury Secretary Becent is going to have to issue more debt, so he needs to find a way to get as much leverage as these people can through the banking system, and ultimately that means more dollars in circulation in the world because the U.S. government spends more money on material things.

That's the point about the buyback and how I think it's positive for market liquidity, which is why I think Bitcoin bottomed out on April 9 and Bitcoin will continue to move higher as the government continues to borrow money, and Bessent takes the necessary steps to ensure funding is available at affordable rates. ”

Q3: So, which point should Bitcoin reach to start the altcoin season? What

are the factors that open the altcoin season?

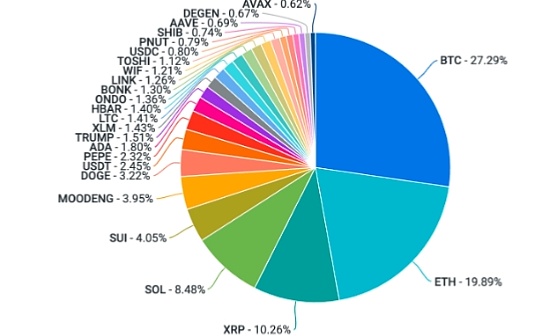

Hayes: I think Bitcoin needs to exceed $110,000, and the transaction volume also needs to reach the corresponding $150,000 to $200,000. I think that sometimes happens in the summer or early in the third quarter, and then the market starts rotating towards various altcoins.

Q4: Do you think this will be like a slight increase in altcoins? Or will

it be like the crazy altcoin season super cycle we see in 2021?

Hayes: I don’t think there will be any more situations in 2021, and all currencies will rise 100 times. We will have a new saying that people will try to trade and the prices will rise to crazy levels, but those old currencies in your portfolio that are not moving may not move for some reason. I think many of these currencies have high FDV, low circulation, no customers, no revenue, only some are listed on centralized exchanges (CEX), and these currencies fell by 95%. I really can't see any good performance they will perform in the next cycle.

Q5: So in this market, what is a good return for you, what price targets

do you usually aim for?

Hayes: "They need to outperform the returns of Bitcoin. So if we are going to deploy capital, it needs to outperform Bitcoin."

Q6: What are your expectations for Trump’s policy?

Hayes: I think they will do something that is good for cryptocurrency. But that doesn't mean that your specific project will appreciate. It doesn't mean they will do it on a reasonable schedule for you.

I think people have very high expectations and they think cryptocurrencies are the top priority Trump needs to pay attention to. You know, Trump is a politician, he has a lot of things to pay attention to, so I think people need to be patient.

Q7: In addition, during the market turmoil, we have seen gold prices rise

a lot. So are you investing in gold or simply investing in cryptocurrencies?

Hayes: I have held gold for a long time, so there is physical gold in my vault. I hold a lot of gold mine stocks, and considering the sharp rise in gold prices, I think these stocks are still undervalued. I think gold prices may rise sharply in the future as central banks are buying gold.

I still believe that the United States will significantly increase its gold holdings, thereby lowering the dollar-to-gold exchange rate. So, I think that by the end of this round of rebound, gold may reach $10,000 to $20,000.

Q8: So what is the proportion of gold in your portfolio?

Hayes: "It's about 20%.

Q9: There are really a lot! There are also many discussions about Ethereum

and Solana. Which one will perform better?

Hayes: I think Ethereum will have a better outlook, mainly because it is very hateful. Everyone thinks Ethereum does nothing and does nothing right, but it still has the highest total lock value (TVL), still has the largest number of developers, and is still the safest Proof of Stake (PoS) blockchain. Yes, it hasn't performed very well from 2020 until now.

Solana rose from $7 to $172, obviously doing well. But if I were to invest new fiat capital into the system, I think Ethereum might outperform Solana in the next 18-24 months of bull market.

Q10: You previously predicted that the Bitcoin trading price will reach $1

million. When will it be realized?

Hayes: “I think by the end of Trump’s presidency, that is, by the end of 2028, the price of Bitcoin will reach around $1 million .

Q11: What is the next trend of cryptocurrencies this year?

Hayes: So I think Bitcoin’s dominance will continue to rise. I think Bitcoin may be close to $200,000 in the next slight gain. Then the altcoin season arrives and we 'll see something interesting. By the end of this year, the price target for Bitcoin is around $250,000 .

chaincatcher

chaincatcher