Interview with Huma Finance Richard: Serving real payment and financing needs, user education is the biggest challenge at present

Reprinted from panewslab

04/30/2025·1MAuthor: Nancy, PANews

Huma is a legendary divine bird that appears in Middle Eastern and Persian mythology, symbolizing hope, sacredness and luck. According to legend, Huma will never fall to the ground. Anyone who is lucky enough to be passed by its shadow will get the king's life. This is also the inspiration behind the naming of Huma Finance.

As one of the currently popular PayFi protocols, recent discussions on Huma Finance's product mechanism and development path are continuing to heat up, including affirmation of its innovation model and doubts about its transparency and profit mechanism.

Recently, PANews interviewed Richard Liu, co-founder of Huma Finance, to help everyone understand Huma's operating logic, current development status, and their views and judgments on the future of the entire PayFi track.

Breaking financial barriers with on-chain technology, supported by the

Solana Foundation

Richard is a compound entrepreneur spanning entrepreneurship, venture capital and top technology companies, with deep technical background and insights in the financial industry.

During her nearly eight years at Google, Richard has led several innovative projects "from 0 to 1", including Google Fi, which many cross-border users use. In 2016, he left Google and devoted himself to the entrepreneurial wave, co-founded the intelligent career development platform Leap.ai and served as CEO. He accurately matched tens of thousands of job seekers through AI technology. The project was later acquired by Facebook (Meta).

Richard later joined fintech company EarnIn as CTO, a platform that helps users "advance their wages." It was this experience that planted the key seeds for his future founding of Huma Finance.

"Chinese people like to save, but many Americans are moonlight. If their children are going to celebrate their birthdays or an emergency occurs, they may not be able to get that money. When they can withdraw their salary in advance through an app, that kind of gratitude and happiness is the motivation we can feel every day." Richard recalled in an interview.

EarnIn's annual borrowing scale is as high as $10 billion, but even a company that is so large and healthy and profitable is facing the traditional financial system's exclusion from emerging Fintech corporate financing. "You can't get money from the bank, you can only find PE (private equity funds), but when they find that you only have one or two loan channels, they will 'choke you'. The terms are harsh and there is little room."

This experience made Richard realize a serious imbalance: high-quality financial assets are often only in the hands of a few people such as PE, funds, Family Office, and ordinary users cannot participate. At the same time, these assets could have provided more liquidity to the market and created benefits for the public.

Richard also began to think about whether these assets can be chained through blockchain? On the one hand, it provides enterprises with a wider range of financing channels, and on the other hand, it also allows ordinary people to access high-quality investment opportunities that were originally excluded. But he also realized that not all assets are suitable for blockchain. "Many crypto users are acceptable for the risk of cryptocurrency fluctuations, but they have almost zero tolerance for credit risks." Therefore, he chose to focus on the payment financing field with extremely low credit risks and extremely short cycles.

In April 2022, Richard officially co-founded Huma Finance. The project initially took the DeFi lending agreement as a starting point, trying to introduce huge real-world financial needs into the chain and use financial technology companies as the main service group. In the continuous exploration, the team has gradually focused on payment financing, and the core consideration is that its credit risk is extremely low and its cycle is clear.

In 2024, when the Solana Foundation listed PayFi as a strategic focus, during a meeting with Lily Liu, the foundation chairman, Lily made it clear, "You understand the underlying logic of payment financing, which is perfectly in line with Solana's strategy. You should come to Solana to build, and we fully support it."

"We are a multi-chain architecture platform, but Solana is currently the main battlefield." Richard also emphasized in the interview that Solana provides an ideal environment for Huma Finance's high-frequency PayFi clearing business. What really surprised the team was the positive response and substantial support of the Solana Foundation during the cooperation process. For example, when Huma Finance just connected to the Solana ecosystem and the technology was not yet familiar, Solana arranged an excellent team of engineers to assist in the development. At the same time, in the early stage of on-chain financing, Solana introduced many early LPs (liquidity providers), and the introduction of large institutions has built trust in on-chain financing. In addition, Huma Finance and Solana Foundation plan to jointly organize five PayFi eco-conferences to promote the industry's progress.

"Solana has done it, whether it is technical issues or institutional resource docking, and many things even exceeded our expectations," Richard admitted. Today, Huma Finance has become a banner of PayFi in the Solana ecosystem.

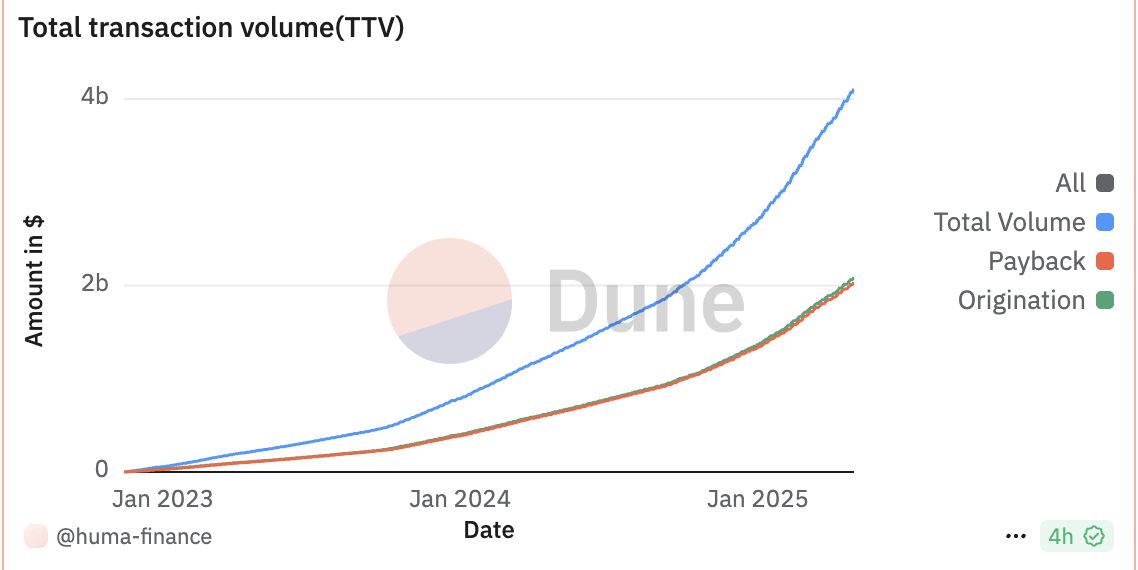

For Richard, Huma Finance is not only a continuation of his mission from the EarnIn era, but also a natural extension of his many years of cross-border experience in technology and finance. So far, Huma Finance has publicly received more than US$46 million in financing, and the on-chain transaction volume has exceeded US$4 billion.

Focus on cross-border payment advancement and credit card business, and

create a strategic closed loop of platform + application

In the interview, Richard introduced that Huma is the first PayFi network, mainly with a strong PayFi infrastructure, especially in the financing layer, and a series of self-operated and third-party applications. The core application scenarios of the PayFi ecosystem can be divided into three major sectors: cross-border payment advancement, credit card and trade financing. Currently, Huma Finance mainly focuses on cross-border payment advances and credit cards.

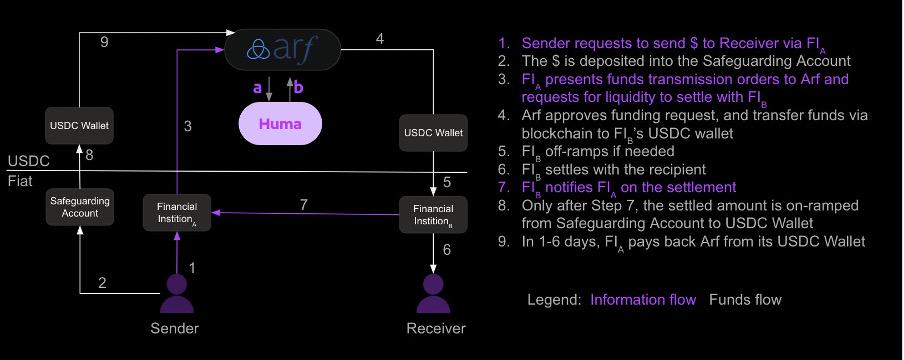

In response to the outside world's doubts about Huma's profit mechanism, Richard pointed out that in terms of cross-border payment advances, Huma Finance focuses on providing short-term advances for payment companies through its subsidiary Arf. The accounting period of such businesses is usually only a few days, with higher funding efficiency and more controllable risk characteristics. Richard pointed out in the interview that the industry itself has formed a stable price structure: the single fee is usually 20 to 60 yuan for remittances through SWIFT; while the processing fee is between 2% and 5% for remittances using payment company channels. The daily lending rate between payment institutions is about 10 basis points per day.

"In Huma, users usually pay a capital cost of 6 to 10 basis points per day, which is a very conventional price in the current industry. In addition to the reasonable price advantage, we also use stablecoins as the underlying clearing, combining the natural advantages of blockchain and stablecoins into the system to build an efficient and secure clearing system, which is also a technical innovation to the existing order." Richard bluntly stated that cross-border payment advances are a supermarket with a volume of up to 4 trillion US dollars. Because of the extremely large market base, and the scale of advance payment business currently handled by Huma Finance is still small, it will not have a significant impact on the overall price level of the industry for the time being. Only in the future, as the platform transaction volume increases to tens of billions or even hundreds of billions, may drive changes in the industry cost curve. Of course, in addition to Huma Finance, other competitors will gradually leverage more low-cost funds sources by enhancing brand trust and optimizing the capital cost structure, causing changes in the market structure.

In addition to cross-border payment advances, Richard believes another greater opportunity exists in the field of credit card advances—a huge market with a scale of up to $16 trillion. Taking the United States as an example, after consumers swipe their cards, the issuing bank needs to settle the money to the merchant account through the payment network within 2-3 days. Some emerging markets such as Brazil even delayed for up to 30 days. Before the user actually repays the loan, the bank actually assumes the responsibility for advance payment during this period. At the same time, there is also a waiting period for funds on the merchant side. But many merchants are actually willing to pay a sum of funds to get the funds immediately.

Richard said that he and Lianchuang Erbil have experience in issuing cards. Whether it is cooperation in the Google Pay system or leading the issuing business in EarnIn, he has deeply participated in the design and execution of the credit card payment chain. In other words, the team is not only capable of understanding the complexity of this industry, but also has experience in polishing products and models from the bottom layer.

Regarding Trade Finance, Richard pointed out in an interview that although Huma Finance's system has the ability to support trade finance technically, due to the generally long accounting period and slow capital turnover, it does not comply with Huma Finance's current "high frequency and short cycle" strategy, so it is not directly involved.

In terms of access to the capital side, Huma Finance was mainly aimed at professional investors or institutions before Huma 2.0. Recently, Huma 2.0 was launched, and it opened up to participate in retail investors under the premise of compliance. Users can choose Classic mode or Maxi mode. Richard believes that this is not only an expansion at the product level, but also a deep fit with the core concept of its community ownership.

At the same time, considering that users generally do not want funds to be forced to lock their positions, Huma also made a design balance: although B-side assets usually have a fixed account period (such as three months) and cannot be withdrawn at any time, in addition to using about 80% of the funds for payment of transaction financing, the platform will allocate about 20% of the assets as high-liquid assets to meet users' needs for redemption at any time.

"We will not force users to lock their positions. This is their explicit feedback to us. In order to ensure smooth redemption, we will reserve a certain proportion of liquid assets, and the redemption process can usually be completed in 1 to 2 days." Richard emphasized.

In addition, regarding Huma Finance's choice to actively embrace the DeFi mechanism in the early financing stage rather than just dealing with traditional financial institutions, Richard explained that unlike traditional financial institutions, DeFi provides a highly transparent and high-speed financing path. "Anyone who does financial asset allocation understands that it is not easy to increase the scale of assets, especially in the early stages. Traditional financial institutions have slow processes and complex docking, and snowball rolling is often slow. There are a large number of funds willing to support high-quality assets in the market, but under the traditional system, there is a lack of transparent and convenient channels for participation. We are willing to display asset data completely transparently on the chain, so as to gain the trust and financial support of the DeFi community, which is of great help to our development speed."

In addition to efficiency and transparency, Richard also emphasizes the value of community co-building. He said that Huma Finance highly recognizes the power of the community, especially under the premise of compliance, empowers retail investors to participate in high-quality asset opportunities. "What attracted me the most about Web3 is that it can realize real community co-construction and sharing. In a traditional financial system, such a mechanism is almost impossible to exist," Richard added.

"Google currently uses Android platform, as well as core applications such as Gmail, YouTube, and Search as ecological anchors, supporting the platform's growth and user stickiness. Similarly, we hope that the PayFi platform can provide both the underlying capabilities and scalability, and core products can be used to drive real needs and capital flows." Richard also emphasized in the interview that Huma Finance is not just about building a single product, but a PayFi infrastructure platform, which can run various products and applications, and its value is much higher than any independent application.

Because of this, Huma acquired its largest customer Arf, thus forming a closed-loop ecosystem of "platform + App". Richard believes that the value of the platform itself is much higher than a specific application, and it can connect the capital side and the asset side to support financial innovation in more scenarios.

It is worth mentioning that Richard also mentioned Huma Finace's phased goals and implementation paths. Not long ago, Richard said that the platform's phased goal in 2025 is to achieve a cumulative transaction volume of more than US$10 billion. He further stated, "At present, our main transaction increment comes from Arf's core customers. Although the platform has established a strong potential customer cooperation line, the implementation and launch of each customer requires a certain period of time, including the on-chain process, which often takes several months, involving the opening of bank accounts and the approval of local supervision. The process varies from place to place. Our current focus is how to accelerate this process. The team is also exploring a more efficient support system to accelerate the customer access process."

On the capital side, Huma is also constantly optimizing user experience and attractiveness. "After we launched Huma 2.0 version, the market feedback was very positive." Richard said that under the premise that the amount of funds deposited was controlled, the platform was filled with the pool in a short period of time. The number of participating users and Maxi mode participation exceeded expectations. The current activity and user interest on the capital side are very high. Once the quota is liberalized and more large investors are introduced to participate, there is plenty of room for growth. Next, the team's main focus will be on accelerating the transactions of Arf customers and promoting on-chain deployment of credit card financing scenarios.

Introduce traditional financial risk control logic and create multiple

lines of asset security

Huma Finance has sparked heated market discussions due to its PayFi model, and some investors are worried that it may face a risk of default or storm.

Regarding the market's doubts about asset security, Richard introduced that Huma Finance borrowed the classic risk control logic of traditional structured finance, introduced First-Loss Cover (first loss mechanism) and priority/underminer structure, supplemented by multiple guarantee mechanisms. The goal is to build a DeFi product system with institutional-level risk control level, especially in the cross-border payment advance business of its core asset Arf.

Specifically, for the selection of service objects, Huma Finance's Arf business only serves licensed financial institutions in developed countries (such as the United States, the United Kingdom, France, and Singapore), avoiding areas with complex foreign exchange controls. These institutions need to meet strict compliance requirements and have low credit risks, providing Arf with a basic level of risk barrier and reducing counterparty risks. At the same time, Huma Finance has formulated a strict internal risk control rating system for all cooperative institutions, and classifies them (including level one, second and third) based on factors such as their financial status, remittance path stability, counterparty risk, etc. It currently only serves customers with ratings of level one and second level; during the operation process, the advance fund must receive remittances from the customer in advance, and the funds will be deposited into a special account for funds. This account is regulated by the bank and is only used for cross-border transactions. Huma Finance will only release funds for payment after verifying that the funds are indeed due and comply with the previous risk model assessment; in terms of legal structural isolation, the assets involved in Arf are managed by independent SPV (special purpose carrier) and are completely isolated from the assets of Huma Finance or Arf's main company. Even if Arf has an extreme bankruptcy incident, user assets are still protected by law; in terms of the account period response mechanism, Huma Finance's account period design is extremely short, and advance payment and recycling are usually completed within a few days. Once an institution has signals such as delayed payments, credit changes, etc., the system can quickly adjust its credit limit or even suspend its limit to ensure that risks are identified and controlled in the early stage. Historical data shows that the bad debt rate of the financial system in the past 20 years was only 0.25%, while Huma Finace chose to provide short-term loan business to developed countries, which means the bad debt rate is lower.

Even in the face of possible large-scale redemption or systemic risk events, Richard pointed out in the interview that Huma Finance has also designed several emergency mechanisms: for example, Arf has clearly established a 2% margin to cover several times the conventional bad debt rate, which is gradually established by the platform's profit precipitation, and is given priority to cover possible bad debt risks; regardless of whether the user's funds are locked in positions, they will be "fairly liquidated" in extreme scenarios to avoid structural unfairness caused by "the first runner makes a profit". If a cooperative institution defaults or goes bankrupt, since the customer's funds are always in quarantine accounts and are circulated in the regulatory system, Huma Finance has the ability to recover most or even all of the funds through legal means. This mechanism has not been triggered in history, but from the perspective of legal structure and process, it is realistic and feasible.

In addition, in terms of transparency, Richard revealed that all funds in Huma Finance are entrusted to Fireblocks wallets, flowing to predefined compliance paths, and require multiple signings to ensure that funds are not misappropriated. Not only that, the flow of funds can be traced in real time through blockchain. Huma Finance has disclosed some information on Dune Dashboard. In the future, it will gradually improve the dashboard to display more detailed funding dynamics. In addition, Huma Finance releases monthly fund flow reports to disclose the allocation and use of funds in the pool. It also plans to write them into smart contracts in the future to further improve transparency and auditability through decentralized methods.

It can be seen that Huma Finance's core logic does not rely on market sentiment or Ponzi cycle to support its liquidity, but establishes a DeFi financial ecosystem with high resilience and accountability through multiple risk control layers, legal structures and own fund buffers. Although extreme risks are never completely avoided, their systematic buffering mechanism and liquidation principles aim to build multiple lines of defense for the safety of user assets.

Strengthening community construction, user education is the biggest

challenge at present

"Disrespect for the community and users is the absolute red line of Huma Finance. Sincerity is a weapon to penetrate all noise." After a recent community controversy arose due to the communication methods of team members, Richard immediately issued an open letter to respond, and further elaborated on the team's reflection on community construction and future improvement directions in the interview.

On the one hand, Richard admitted that due to mismatch between people and positions, communication problems occurred. "Our colleague is very hardworking and creative, but I put her in an inappropriate position - responsible for communication with the outside community. This is not her strength, I should have realized it earlier." To this end, Richard has readjusted the external communication responsibilities. Richard himself will be responsible for communication in the Chinese-speaking community, and the English-speaking community will be handed over to another co-founder Erbil Karaman.

"We believe that community communication is one of the most critical tasks of Crypto. Lianchuang best represents the company's mission and values. They must be at the forefront of community communication." This adjustment is also Huma Finance's direct response and structural repair to past problems.

Not only that, Richard also emphasized that the team has formed an internal consensus: every feedback from the community, regardless of the wording, is worthy of being listened to and reflected on carefully. "For community accusations, we need to maintain a healthy mindset and try to understand the issues they are really worried about. We either explain clearly or admit that we are not doing well enough and actively improve. For example, when it comes to transparency, we did not prioritize transparency in the past. In the future, we will improve this aspect to ensure that information disclosure is clearer and more systematic."

At the end of the interview, Richard also shared his overall view of the PayFi track, especially the core key to breaking the gap between traditional finance and DeFi, as well as the challenges and solutions faced in the process of user education and adoption.

"The core of PayFi is to use blockchain technology to serve real-world payment and financing needs." Richard pointed out that although many financial institutions and payment companies are very interested in this model, the real implementation is often stuck in the most traditional links - compliance and bank account systems.

He further pointed out that the path of compliance and capital entry and exit from the chain are the most critical middleware in the entire ecosystem. If Hong Kong can introduce clearer relevant legislation to allow local payment companies to legally and conveniently access on-chain services, this will not only be a breakthrough for Hong Kong locally, but will also be a great boost to the development of the entire PayFi ecosystem.

In addition to opening up interfaces to traditional finance, Richard also said, "We not only hope that users will invest their money on the Huma Finance platform, but more importantly, whether these PayFi assets can 'go global' in the DeFi ecosystem and become the core component assets in the entire DeFi world."

But between ideals and reality, there is another most difficult threshold to overcome - user education. "This is actually the biggest challenge we are facing at the moment." Richard admitted that for DeFi users, they are used to the "coin issuance logic" of high APY and are unfamiliar with PayFi's income structure based on real lending and no coin issuance subsidies. "Even if I tell them that this place can actually generate 12.5% returns, which is higher than many on-chain protocols, their first reaction is often: Are you doing Ponzi? Is it fake?" For traditional financial practitioners, they are full of doubts about the entire DeFi technology path. "Many people will ask me directly why I can't use fiat currency accounts to complete operations directly? Why do I have to use stablecoins?" Once stablecoins or on-chain liquidation are involved, they will hesitate because of unclear supervision.

Richard pointed out that this "cognitive misalignment" stems from the unfamiliarity between the two circles of each other's language and logic. "This also means that our team needs to speak two 'languages' at the same time, which can not only use the professional terms of DeFi, but also know how to use the traditional finance language. PayFi has a long way to go. We need to work with the community to generate more content so that more people can better understand PayFi, jointly build this track, and develop PayFi into the most successful application of Crypto in real life as soon as possible."

chaincatcher

chaincatcher