Arbitrage or "theft"? Is the lawyer's letter useful? ......Inventory of the 5 Popular Questions in the Bitget VOXEL Event

Reprinted from panewslab

04/30/2025·1MI wonder if you have been eating hot currency circles recently. Lawyer Mankun is willing to call it the "Bitget VOXEL contract incident".

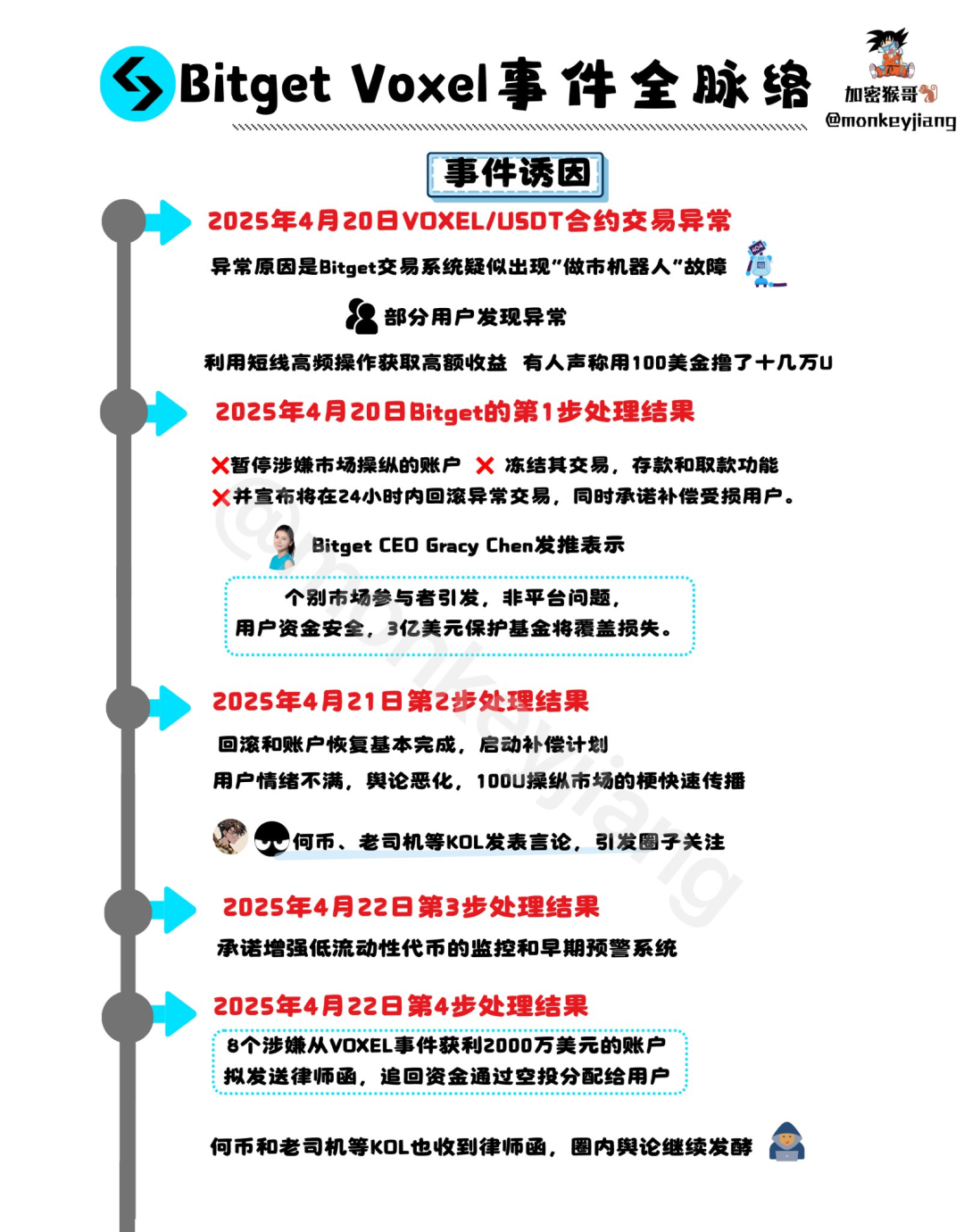

Here I borrow the timeline of X platform user encryption Monkeyjiang (@monkeyjiang) (the picture is done well).

Simply put, this is that on April 20, the VOXEL/USDT contract transactions were abnormal, causing some users to earn a total of more than US$40 million through short-term operations, especially one of the teams, that is, 8 people who sent lawyer letters from Bitget (hereinafter referred to as BG), earning 20 million+ US$20 million (BG said it was suspected to be a professional hair-fighting team, while the other party said that they were a professional market maker, and we don’t know who is true and who is fake).

Afterwards, BG began to recover losses by rolling back transactions, freezing accounts, and sending lawyer letters. This series of actions directly pushed the incident to the forefront of public opinion.

Players in the currency circle have taken sides, and Web3 KOL, represented by He Bi (@hebi555) and veteran driver in the currency circle (@SEFATUBA3), accused BG: I make money by operating, and you will be a rogue if you lose. Do you can’t afford to play? Another small number of KOLs believe that BG is doing the right thing, and it is wrong to make profits by taking advantage of bugs; and BG also said that the $20 million it recovered was airdropped to users, which is very good.

Passers-by, such as lawyer Mankun, have been surfing the limit these days, silently eating melons.

However, while eating the melon, lawyer Mankun also saw the popular doubts on social media. Today I will talk to you about the five most popular and controversial issues from the perspective of Chinese legality.

Q1: User arbitrage, Bitget said it was "theft". Is this statement valid?

Judging from the lawyer's letter issued by BG, the platform or lawyer's caliber is: the user has used the system bug arbitrage and is suspected of stealing, so he sent a lawyer's letter to warn him.

Then the question is, is exploiting system vulnerabilities arbitrage a theft?

First of all, in the Criminal Law, theft is interpreted as "a act of secretly stealing public and private property for the purpose of illegal possession, and a large amount", and a simple understanding is to secretly get rid of other people's money on their backs.

As for arbitrage, in the open market, you see that the price is misaligned and the spread is essentially a market behavior, not someone behind the back, but rather a trade openly. It's far from theft.

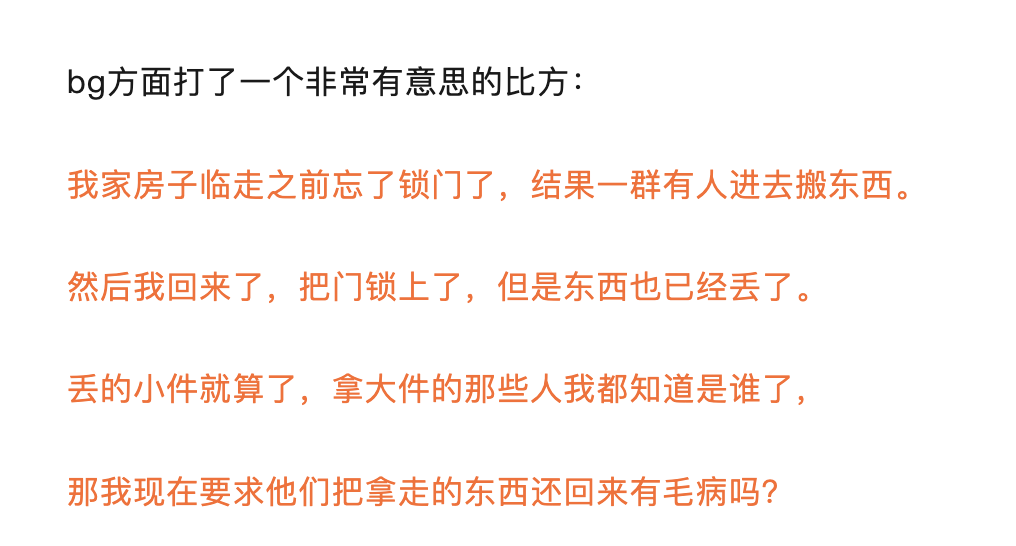

However, pay attention to this. If you know that there is a problem with the other party’s system and use the bug to arbitrage, it is not as simple as arbitrage. The content of the official account of Juzuozu - bg made this metaphor:

In fact, when our lawyers handle traditional criminal cases, they often encounter the Web2 industry being fucked by external personnel using system bugs, and the court ends up stealing or even fraud; when internal personnel use system loopholes to make profits, they are considered to be embezzled.

So we have to look at the evidence for this behavior, that is, whether these people knew and used the system bug, and caused property losses to the BG.

Judging from the current public opinion, most retail investors think that you have made so much money normally, but now there is a problem with the system, why can't the pattern be opened? (You can't learn from a well-known overseas e-commerce platform. The price is wrong and someone bought it, even if the customer benefits are benefited). The platform sometimes caused the BOT problem by the other party, and sometimes said that it was using the BUG limit to pick hair.

Lawyer Mankun suggested that if there is insufficient evidence, everyone should wait first. Didn’t BG say that the incident report will be released soon?

Q2: Bitget is an overseas entity. Can it send lawyer letters and sue

Chinese users?

Many people are questioning that BG is an overseas entity, so why did this time suddenly send a lawyer letter to Chinese users, saying that they would be held accountable?

Lawyer Mankun saw some legal analysis and said it was OK because BG has overseas entities, and theoretically overseas companies can hold domestic individuals accountable. Article 265 of China's Civil Procedure Law also stipulates that if a foreign-related contract dispute, the place where the dispute occurs or the place where the defendant's property is located is in China, the court can manage it.

There is nothing wrong with this theory. In the early years, Microsoft sent letters to domestic pirated users, but in the currency circle, we have to consider the attitude of the domestic regulatory side towards cryptocurrency trading - virtual currency transactions are classified as illegal financial activities.

This is the point that everyone discusses the most. In this context, BG sends a lawyer letter to users, wanting to seek Chinese legal protection?

In fact, the lawyer's letter is just a right of entrustment. It is essentially to inform the recipient that "I entrust this lawyer to speak for me." It is neither a notice of filing or a court judgment. Even the suspect can entrust a lawyer to send a lawyer's letter.

As for whether we can really prosecute and whether we can really win, it is the judicial process that follows.

So, starting from this fact, the current lawyer's letter may be more of a psychological warfare. Will it in the end cause splashes? What kind of splashes? Let's continue to see.

Q3: Rumor has Bitget frozen user Binance accounts, how did it do it?

This wave of melons is even bigger. It is said that BG has frozen the Binance account of arbitrage users through the police and started directly across exchanges.

Can you still operate like this?

Generally speaking, if the public security freezes the account, it means that the case has begun to be investigated, and you are suspected of being a criminal offense, and then issue a formal document to notify the relevant platform to cooperate with the action. However, this step must be approved by the case-handling unit before it can be implemented.

So, based on the first and second questions, lawyer Mankun boldly speculated that BG's lawyer's letter and the public security freeze were actually to cooperate, with the purpose of pushing the matter in a criminal direction, locking the other party's funds, and increasing negotiation chips.

Judging from the feedback from X platform, some accounts have indeed been frozen, but the specific details are not disclosed, so we can only be cautious and wait for the follow-up.

Q4: Bitget rollback transactions, is this operation reasonable and legal?

It should be said that what caused user dissatisfaction at the beginning was that after the incident, BG freezes the withdrawal and recovers part of the losses through rollback.

Originally, users fought in the contract market and were rarely lenient, but the platform directly used a big move: "Sorry, the system is abnormal, this order does not count, it rolled back." Moreover, not only did they roll back, but they also wiped out all the handling fees and slippages. Some users even had their account balances negative

Therefore, many users scold on social media: You open a casino yourself and bet against users, can’t afford to lose, right?

But the question is, is it legal to roll back this matter?

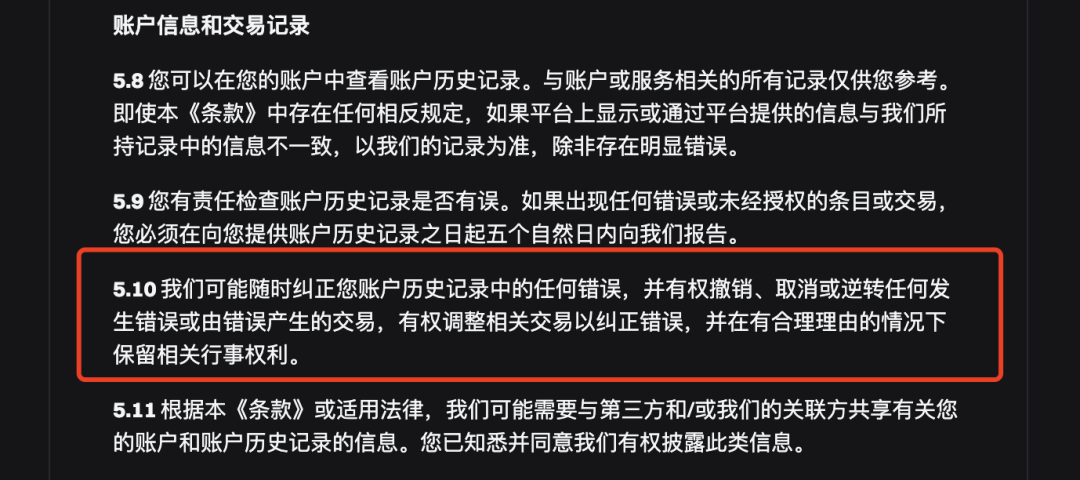

First of all, in the user agreement of a general exchange, there is usually a piece that roughly means that if there is a system failure or technical abnormality, the platform has the right to adjust or roll back.

So, if you want to use BG, you have to agree. If you agree, if something really happens, you have to follow the agreement. BG said that you can roll back.

In fact, other platforms have also had a history of rollbacks. For example, in September 2021, FTX's SOL-PERP contract plummeted due to liquidity issues, resulting in high leverage liquidation of some users, and the transactions seriously deviated from the spot price. Subsequently, FTX issued an announcement in advance, announcing some transactions to roll back. Previously, OKX had a small-scale rollback, and also issued an announcement throughout the whole process, explaining the scope and standards of the rollback, but no negative public opinion was generated.

Let’s talk about this incident, is it necessary to roll back if there is a user agreement?

Obviously, this is the same as the bugs and system retracement in some network companies. Although it is reasonable, it is inaccurate. If we learn more about the above examples, we can find that before and after the rollback, other platforms will issue announcements as soon as possible. The overall procedures are transparent, the standards are clear, and there are corresponding compensation plans.

On the other hand, this time, BG may be because it is in a hurry to cut off capital flows and prevent arbitrageurs from transferring funds, which leads to too urgent action and too rough procedures. It is precisely because of this rough operation that irreversible platform credit discounts - if there is a system problem, the platform will save itself, and this market can understand it; but first, the operation is secretly carried out, and then a set of lawyer's letters and cross-exchange freezing operations, which is really difficult for users to accept.

Q5: Can users sue Bitget to open a casino? Can the losses be recovered?

Now, social media public opinion has fermented to the point where "If you send me a lawyer's letter, then I will sue you for opening a casino."

Be good, be prepared to fall in love and kill each other, right? So, is that OK? Can this help users recover their losses?

First, let’s take a look at Article 303 of the Chinese Criminal Law: The crime of opening a casino refers to organizing gambling for the purpose of profit or providing gambling conditions.

Based on this, combined with the previous tweets of Mankun lawyer "Mankun Research | Is cryptocurrency perpetual contract trading gambling or financial derivatives? Mankun Lawyer Horizontal Comparison of the Current Status of Global Regulation" "Mankun Legal Publicity丨Virtual Currency Exchange Contract with Order Rebate, Why are you suspected of opening a casino? 》, there is indeed a court case in mainland China that it regards cryptocurrency perpetual contracts as illegal gambling. Some players with order rebates are considered to be helpful criminals in opening casinos.

Lawyer Mankun is now doing defense for several exchanges, and the defense hopes to deny the gambling determination of the exchange's perpetual contract::

1. On the one hand, in terms of global regulatory policies, the mainland is the only one who recognizes gambling when contracts are recognized as financial derivatives. This is not a matter of difference in laws, but a matter of lagging in some people's understanding of the Web3 industry.

2. On the other hand, from the perspective of social governance, investors really want to maintain the mainland's practice of contract identification gambling. Be prepared. These exchanges are investigated, the records of contract playing in the backend and withdrawal records are all there. One gambling penalty is imposed (administrative penalties).

So, if you are willing to turn over the table, you can go to the regions where the case is reported that "contracts are gambling", let them unify the referee standards, and then those who play the contract will receive an administrative penalty for participating in gambling?

Summary of Lawyer Mankun

Until now, the VOXEL contract incident is basically a public opinion war in the market. It is true or false. We are not stakeholders, and we can only eat melons. It is better to let the bullets fly for a while. Anyway, BG said that the incident report will be released soon. In addition, since the lawyer's letter and the public security freezing account have both begun, it cannot be ended with just talking.

/ END.

chaincatcher

chaincatcher