Interpreting the weekly DeFi news: Old DeFi has new actions, Ethena releases new public chains

Reprinted from panewslab

04/23/2025·24DDiscussion on Ethereum engine reconstruction;

Ethena selects Arbitrum camp for the launch chain;

Unichain and MakerDAO old DeFi are all moving;

Thoughts on DeFi in the past week.

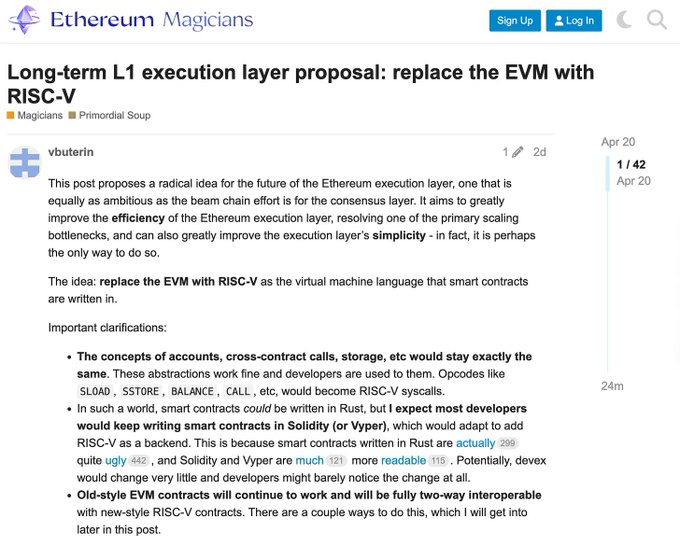

**1/ Let’s talk about ETH-related first. V God proposes to replace EVM

with RISC-V as the long-term execution layer.**

Try to interpret it in a simple and easy way:

(1) It can be understood briefly as changing the engine, with the goal of improving efficiency

(2) Coping with the huge amount of computational consumption that may be faced in the future

(3) Break through the insurmountable performance ceiling under the EVM framework

(4) This change only occurs in the underlying execution engine

(5) Will not change Ethereum's account model, contract call method, etc.

(6) When users and developers use Ethereum, they do not need to change the way they interact with smart contracts.

In summary, Vitalik believes that in the long run, the bottleneck of the Ethereum execution layer will eventually face the problem that the execution layer itself is difficult to verify or requires special hardware to run (huge computing resource consumption), and the expansion will be limited. Using RISC-V is the solution to this problem. As for why RISC-V is better, a brief understanding is that RISC-V represents a general and efficient computing model, and its hardware and software ecosystem is more mature. It is still the stage of discussion. The change will not be small, and the cycle will probably happen in a few years.

2/ Ethena send chain

I was surprised by Converge's choice of Arbitrum camp, because there are many good players such as Unichain and Base on OP Superchain. Arbitrum is obviously weak in the camp. Although Arbitrum Orbit and OP Superchain are both based on L2 expansion solutions, there are still some differences in design:

(1) Orbit allows developers to create dedicated Rollup or AnyTrust chains: they can be anchored directly to Ethereum as L2, or to Arbitrum as L3.

(2) OP Superchain’s vision is a network of multiple parallel L2s. These L2s (called OP Chains) are built on a shared OP Stack standard code base.

To put it seriously: Orbit is vertical expansion, Superchain is horizontal expansion, and the two views are different. Orbit advocates openness. For example, the DA of the Orbit chain can choose to directly publish data in Ethereum (Rollup method), maintain data by the Data Availability Committee (DAC) (AnyTrust method), and can also be integrated into external data availability networks such as Celestia. Superchain focuses on providing an EVM execution environment equivalent to Ethereum. It emphasizes consistency with Ethereum and multi-chain standardization, and modular changes need to be carried out with caution.

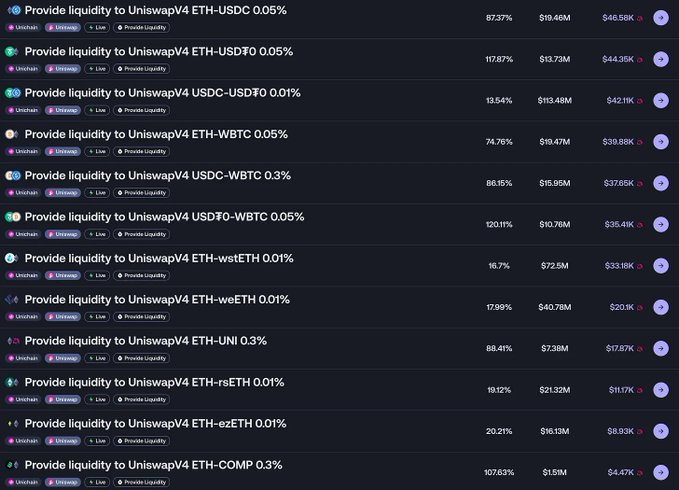

3/ Unichain Liquidity Mining Situation

The income is quite considerable, but you need to control the range by yourself. There is no sense of existence in the mining of the entire range (the APR on Merkl is inaccurate, and you need to calculate it by yourself based on the amount of funds and range). Compared with the liquidity mining in the previous version, the threshold and difficulty are high. Newcomers are not very popular with this, and people who play memes will not play. The current audience is still old miners. In fact, it is also very pleasant for old miners to grab the income without newcomers. They are very honest in their words and their bodies. It is a bit difficult to make DeFi appear on the circle.

4/ Ripple stablecoin RLUSD has entered the mainstream DeFi protocol

(1) Aave has added RLUSD to V3

(2) Curve Pool has deployed 53M liquidity

Stablecoins are really popular this year, and it seems that this track has a place every cycle. You can always find the angle. When the algorithm is not compliant, the algorithm is stablecoin performance, and when the compliance environment is good, the big guys also end up one after another.

**5/Optimism launches SuperStacks campaign to prepare for the upcoming

Superchain interoperability feature**

(1) April 16 to June 30, 2025

(2) Encourage users to participate in DeFi on Superchain and earn XP

(3) The agreement can also superimpose its own incentives

(4) OP official said that there will be no airdrops, it is just a social experiment

If you follow Superchain, you can participate. For example, you can also get XP when mining in Unichain. It is not recommended to deliberately brush it. Superchain's interoperability has always been something I am paying attention to. What changes will be brought about after it is officially launched.

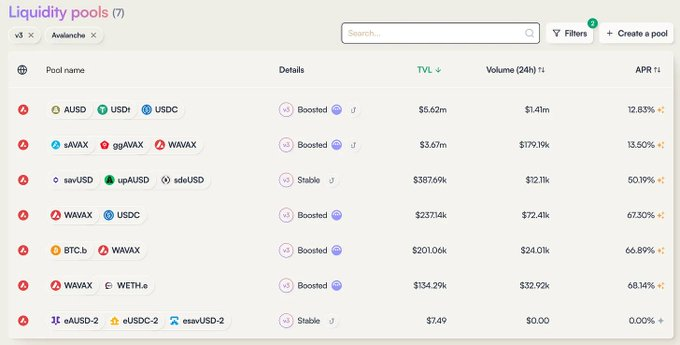

6/BalancerV3 launches Avalanche, accompanied by $AVAX incentives

The reward is pretty good, but the capacity is average. BAL was removed from the shelves by Binance before, but the agreement is still actively working, including cooperation with the ecosystem and updates and iterations. This old DeFi did not lead like Uniswap and Aave, and did not have the bonus of issuing coins from the new DeFi, so it was difficult to survive. I can only hope for a big explosion on the chain.

7/ Circle launches CPN network, targeting global payment market

A compliant, seamless and programmable framework that brings financial institutions together to coordinate global payments through fiat currency, USDC and other payment stablecoins. The network is designed to overcome infrastructure barriers that stablecoins face in mainstream payments, such as unclear compliance requirements, technical complexity, and secure storage of digital cash.

The first thing to solve is the cross-border payment problem, replacing the traditional slow and expensive payment environment. This track seems to have known Ripple before, but it is not very familiar with it. It also provides programmability. In short, it is a good thing, which drives the popularity of blockchain. If every country has on-chain stablecoins, the situation will be different again, and it is actually promoting more countries to issue compliant stablecoins.

8/ "Bridge" war

(1) GMX selects LayerZero as the information transmission bridge for multi-chain expansion plans

(2) a16z crypto purchased a 55M LayerZero token worth , locked for three years

(3) Wormhole releases future planning roadmap

Some thoughts:

This track is very demanding, but it is also very crowded. From the perspective of making money, it depends on handling fees, and it will become more and more cramming at this point, which is a good thing for users, because the fees will be cheaper, and from the perspective of protocol integration, stability and security need to be considered.

These giants are all super high-valuation, and it is difficult to design from an economic model. From this perspective, this kind of business is still suitable for opening a separate chain, or imitating this mechanism token model that incorporates PoS chains.

9/ Spark (MakerDAO) deploys 50M funds to Maple

It should be noted that this is the first time that Spark has deployed funds in the non-U.S. Treasury bond field, but there is a limit of US$100 million.

Who is Maple?

Maple focuses on providing unsecured lending on-chain and off-chain connections. Its main products include the main platform Maple Finance and the derivative platform Syrup:

(1) Both Maple's clients are facing qualified investors and institutions

(2) Syrup customers use SyrupUSDC to extend user deposits on the chain

There is a key role in Maple:

Pool Delegates: Pool Delegates are usually reputable institutions or trading companies that manage loan pools. They are core managers in the Maple ecosystem, with responsibilities including:

- Conduct a credit assessment of the borrower to decide whether to approve the loan

- Set loan terms (such as interest rates, term, etc.)

- Supervise the execution and repayment of loans

- If the borrower defaults, he will be responsible for recovering assets

It is obvious that the key to the operation of the protocol depends basically on Pool Delegates.

Maple is an old project and was not likable in the last cycle, mainly because its business model is to absorb on-chain deposits and then lend to off-chain customers without collateral through a centralized method. This concept was not easy to be accepted in the past. However, this cycle has gradually been accepted due to changes in compliance environment and user thinking, but I personally feel that USDS's choice of Maple to deploy funds is still a higher risk action.

chaincatcher

chaincatcher

jinse

jinse