Bitcoin is decoupling – It doesn't care about tariffs or earnings reports

Reprinted from jinse

04/23/2025·25DSource: Bitcoin Magazine; Translated by: Wuzhu, Golden Finance

As global capital pressure intensifies, the decoupling of Bitcoin from traditional markets has become increasingly obvious. Re-hit tariffs, rising interest rates and weak corporate earnings have led to volatility in stocks and credit markets. Many large-cap companies have underperformed not only by fundamentals, but also by geopolitical, trade policy and policy uncertainty.

However, the price of Bitcoin is rising.

Its movement was not abnormal. It is not out of reality. It is becoming increasingly independent—not just in terms of asset performance, but in terms of the power that drives asset performance. Bitcoin began to be no longer like a high beta stock tool, but more like a structurally differentiated asset.

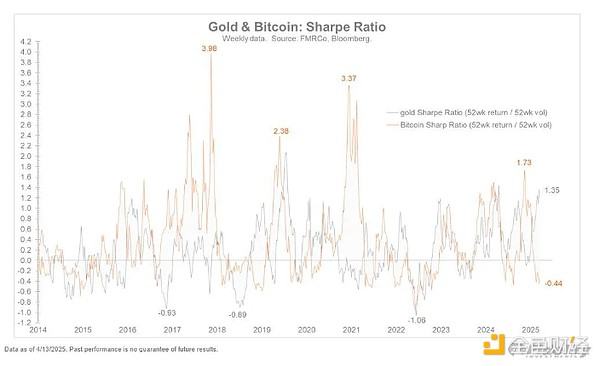

As Fidelity Global Macro Director Jurrien Timmer recently said, gold remains a stable means of store of value, and Bitcoin’s volatility provides a strong reason for holding both gold and Bitcoin, as their Sharpe ratios show:

For corporate finance leaders, the ever-changing risk/reward situation and its growing differences from traditional assets deserve serious attention.

Highly sharp, medium related outliers

Bitcoin is still unstable – but this instability has already produced results. Its Sharpe ratio currently exceeds most traditional asset classes, including U.S. stocks, global bonds and physical assets. This shows that on the basis of risk adjustment, Bitcoin will continue to perform well even after experiencing stress and recovery cycles.

Meanwhile, Bitcoin’s correlation with the S&P 500 has dropped to a moderate level. In a practical sense, this means that while it may still respond to changes in global liquidity or investor sentiment, it is increasingly affected by structurally different factors:

-

Accumulation at the sovereign level

-

Spot ETF inflow

-

Supply side compression events (e.g. halving cycle)

-

Global demand for neutral reserve assets

This shift in behavioral characteristics—from risk correlation to structural differentiation performance—emphasizes why Bitcoin may be developing into a strategic reserve asset, not just a speculative asset.

The core structure of Bitcoin is decoupled in design

Even if Bitcoin has traded synchronously with tech stocks over the past cycle, its basic characteristics are still very different. It generates no profit. Its valuation is not based on cash flow forecasts, product cycles, or regulatory guidance. It is not affected by tariffs, labor cost shocks or supply chain restrictions.

Today, despite pressure from the rise of protectionism and fragile earnings growth in the U.S. stock market, Bitcoin has not been structurally affected. Not affected by trade frictions between major powers. It does not depend on quarterly results. It is not susceptible to currency tightening, corporate taxation or industry rotation.

It is not temporary that Bitcoin is not affected by these forces. This is the result of how asset is built.

It is globally liquid, censorship-resistant, and politically neutral. These attributes make it increasingly attractive – it is not only a growth asset, but also a strategic capital reserve.

The risks of Bitcoin have nothing to do with the business operation model

This distinction is often overlooked in financial discussions. Most enterprise exposures are concentrated in the same system:

-

Income is denominated in local currency

-

Reserves held in the form of short-term sovereign debt or cash equivalents

-

Credit lines are priced at domestic interest rates

-

Stock valuations are based on business cycles and central bank guidance

These exposures form a multi-layered correlation between the company’s revenue, reserves, and capital costs—all driven by the same set of macro conditions.

Bitcoin runs outside this loop. Its volatility is real—but its risks do not stem from corporate earnings, GDP trends, or policy cycles in any country. Its value will not be damaged by negative profit surprises or decline in consumer confidence. Its performance will not be weakened by monetary expansion or politicized monetary policy.

Therefore, Bitcoin introduces a capital exposure that is orthogonal to the typical fiscal framework. That’s why it works – it’s not only an asset with asymmetric upside, but a real diversification tool in the balance sheet of a business.

Conclusion: Independence is its characteristic, not its defect

The decoupling of Bitcoin from traditional markets is not perfect and not permanent. It will still deal with major liquidity shocks and macro-stress events. But its growing independence from trade policies, profit seasons and policy expectations is structural rather than speculative.

In fact, it is a monetary tool that is not affected by many of the systemic pressures faced by listed companies.

For business leaders focusing on long-term capital strategies, this independence is not a flaw, but a feature. As capital becomes more politicized, inflation becomes more entrenched, and traditional reserves become more relevant, the differentiated characteristics of Bitcoin become not only defensible, but also strategically necessary.

panewslab

panewslab