Interest-eating stablecoins are booming, how can they earn profits from them?

Reprinted from panewslab

03/29/2025·1MAuthor: The DeFi Investor

Compiled by: Deep Tide TechFlow

A few months ago, discussions in the cryptocurrency community also focused on Memecoins and Celebrity coins, with many keen to guess which one should be invested in next. However, the focus has quietly shifted today. Stablecoins and real world assets (RWA, Real World Assets) have become the core issues of industry discussion.

Source: Kaito

Stablecoins are showing huge development potential and are expected to become a trillion-dollar market in the future. In this article, I will share why I am optimistic about the stablecoin field and explore how to seize the growth opportunities in this market.

Why are you optimistic about stablecoins?

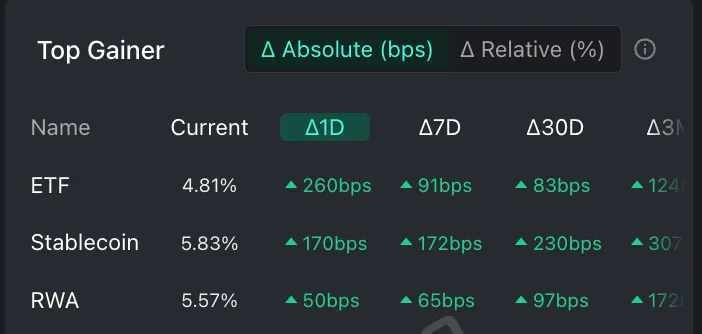

Currently, the stablecoin field is ushering in a series of positive factors:

More friendly regulatory environment

The Trump administration plans to pass stablecoin-related legislation by August and hopes to further consolidate the dollar's dominance in the world. This will pave the way for the legalization and popularity of stablecoins.

Traditional financial giants enter

Fidelity, which has a global asset management scale of $6 trillion, announced this week that it will launch its own stablecoin. This marks a significant recognition of traditional financial institutions in this field and injects confidence into the stablecoin market.

High-yield stablecoin products

Some interest-bearing stablecoins provide attractive annualized yields through decentralized applications (dApps), which can even reach 20%-30%. These products have attracted not only crypto investors, but also began to attract attention from the traditional financial field.

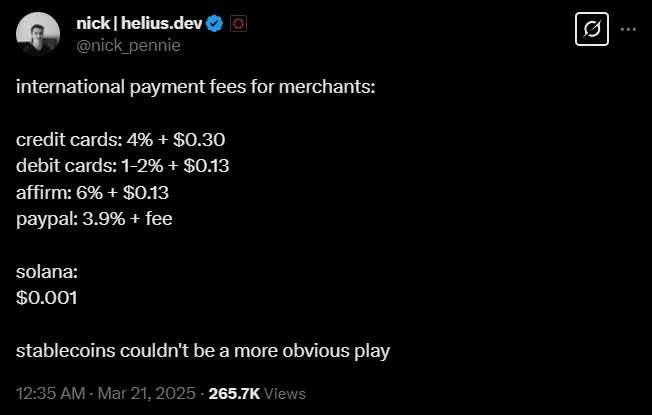

In addition, stablecoins have particularly significant advantages in the field of cross-border payments. The international transfer fees of traditional payment companies remain high, and when paid with stablecoins, these fees are almost negligible. With the gradual implementation of US legislation on stablecoin-friendly, its penetration rate is expected to rise rapidly in the next few years.

How to seize the growth opportunities of the stablecoin market?

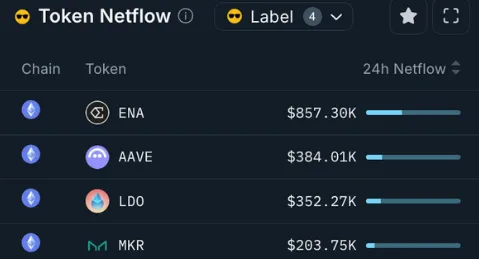

Invest in stablecoins related protocol tokens

Although mainstream stablecoin issuers such as Circle and Tether have not yet provided direct investment channels to average investors, protocol tokens related to stablecoins are still worthy of attention, such as Ethena ($ENA) and MakerDAO/Sky ($MKR). These protocols have attracted billions of dollars in total lockouts (TVL) and are expected to benefit from the expansion of the stablecoin market. However, it should be noted that these two tokens also have their own problems. $ENA Currently, only 34% of tokens are in circulation, and a high inflation rate is expected in the future. And MKR has basically stagnated in TVL growth in the past few years and has not benefited from the rapid growth of the stablecoin market. Nevertheless, on-chain data shows that "smart money" with market insight is increasing its holdings in ENA and MKR, indicating that these tokens may perform better in the future.

Source: Nansen

In addition, projects such as DeFi projects AAVE and decentralized application Pendle may also benefit from the expansion of the stablecoin market. A large part of its TVL comes from stablecoins. If the supply of stablecoins continues to grow, the TVL, revenue and transaction fees of these protocols are expected to increase simultaneously.

**Participate in airdrop of stablecoin agreements that have not yet

issued coins**

Many emerging stablecoin protocols have launched points reward programs that provide rich returns for early users. Here are a few protocols and strategies worth paying attention to:

Resolv: A neutral risk stablecoin using a dual token model.

Resolv's stablecoin USR and vault token RLP form its dual token system. As USR's insurance token, RLP provides risk protection while providing users with higher rewards.

Users can redeem USDC to USR through the Resolv application and deposit it into the HyperUSD vault. HyperUSD is a new vault that automatically optimizes the liquidity deployment of Hyperliquid DeFi. By depositing funds into the HyperUSD vault, users receive 30x points rewards and additional points from the Hyperliquid ecosystem.

Level Finance: An interest-generating stablecoin that supports DeFi native income.

Level Finance's stablecoin lvlUSD is backed by USDC and USDT, and these funds are automatically deposited into DeFi protocols such as AAVE to generate income. After the user pledges lvlUSD to slvlUSD, he can start earning profits. For example, users can earn 14% annualized rate of return (APY) and 20 times Level points by providing stablecoins to Pendle's slvlUSD liquidity pool.

Behind Level Finance is supported by two well-known crypto venture capitalists, Dragonfly and Polychain, and the possibility of issuing tokens in the future is high.

Coinshift: Provides on-chain fiscal management solutions with institutional-level revenue.

Its income stablecoin csUSDL generates income through U.S. Treasury bonds and cash equivalents. In just 4 months of listing, the supply of csUSDL increased from 0 to 35 million. Recently, Gearbox launched the leveraged csUSDL cycle mining function. By cycling csUSDL up to 6 times, you can earn an annualized rate of return of up to 46%, and at the same time you get 6 times SHIFT points.

However, when using Gearbox, you need to pay attention to risk management to avoid excessive leverage and liquidation.

OpenEden: A platform focusing on real-world assets (RWA) tokenization

OpenEden recently released the interest-generating stablecoin USDO, providing real income through tokenized U.S. Treasury bonds. Its points plan has also been launched. The user first redeems USDC or USDT to cUSDO on ParaSwap, and then provides cUSDO to Spectra's liquidity pool (Spectra is a Pendle-like income trading protocol). In this way, users can earn 18% annualized rate of return and 5 times OpenEden bill points. To participate in this point program, users need to sign a message on OpenEden’s Points Program page to start accumulating points.

Pay daily expenses with stablecoins

The purpose of stablecoins is no longer limited to earning profits. Today, there are a variety of solutions that allow users to use stablecoins to pay for their daily consumption without redeeming fiat currency.

Compared with traditional bank cards, the advantages of cryptocurrency cards include:

- Self-hosting: Users have complete control over their assets and do not need to rely on third-party institutions.

- Zero handling fees: To attract early users to participate, many cryptocurrency cards currently offer zero handling services, including no transaction fees, no foreign exchange fees and no withdrawal fees, which are especially suitable for overseas travel.

- Solve bank restrictions: Cryptocurrency cards provide convenient solutions for users who have difficulty cashing in crypto assets through traditional banking channels.

In the future, with the launch of more stablecoin project points plans, the penetration rate of cryptocurrency cards and stablecoins as payment methods is expected to be further improved. The stablecoin market is undergoing an unprecedented change. Whether it is the improvement of the regulatory environment, the entry of traditional financial institutions, or the attractiveness of high-yield products, the growth potential of stablecoins cannot be ignored. Interest-eating stablecoins are particularly expected to be one of the fastest growing areas in the coming years.