Important information last night this morning (March 24-March 25)

Reprinted from panewslab

03/25/2025·1M

According to Binance's official announcement, an employee was found to use the non-public information obtained by his previous business expansion position in BNB Chain to buy tokens in advance through a related wallet before the project was publicly offered and cashed out partly after the announcement, forming a typical "snatch-up transaction". The employee has been suspended and Binance will cooperate with the judicial authorities to hold him accountable in accordance with the law. The platform promises to pay a reward of $100,000 to four users who report through official channels.

According to The Block, Arbitrum DAO is considering whether to withdraw the remaining funds of the "Gaming Catalyst Program (GCP)" launched in 2024. The plan originally allocated 225 million ARBs (about US$215 million at the time) to support the Web3 gaming ecosystem within three years. The proposal pointed out that the project was too optimistic at the time of approval, and there are problems such as insufficient transparency, management changes and key supporters' exits. GCP Council members responded that 25 game chain projects have been using Arbitrum technology. So far, the community has not reached a consensus on this.

Circle and SBI promote USDC into the Japanese market and will be officially launched on March 26

Circle Japan KK, a Japanese subsidiary of USDC stablecoin issuer, will cooperate with SBI Holdings Group to launch USDC stablecoin fully in Japan through SBI VC Trade on March 26. USDC has been approved by the Japanese Financial Services Agency and becomes the first global dollar stablecoin to be legally circulated in Japan. Exchanges such as Binance Japan, bitbank and bitFlyer are also planning to launch USDC in the future.

Oklahoma House of Representatives passes Strategic Bitcoin Reserves Act

The Oklahoma House of Representatives passed the HB1203 Strategic Bitcoin Reserve Act with an overwhelming majority of 77 to 15. The bill aims to support state governments holding Bitcoin as a reserve asset, allowing up to 10% of public funds to be invested in Bitcoin or digital assets with a market capitalization of more than $500 billion. Russia thus joined Texas, Arizona and Utah, becoming one of the few states to pass such legislation in the first house. The bill will be submitted to the state Senate for consideration.

Mt.Gox Cold Wallet just transferred more than $1 billion in Bitcoin

According to Arkham monitoring data, Mt.Gox cold wallet transferred a total of 11,501.58 BTC (approximately US$1.01 billion) to two addresses at 08:21 (UTC+8), of which 893 BTCs were transferred to hot wallets and 10,608 BTCs were transferred to another changed address (starting from 1DcoA). The transaction costs only about $1.98 for handling.

Dogecoin Foundation sets up official reserves and purchases 10 million DOGEs for the first time

According to The Block, the Dogecoin Foundation has established an "official Dogecoin Reserve" through its newly established commercial organization House of Doge, and has purchased 10 million DOGEs, with a market price of about US$1.8 million. The reserve is intended to serve as a validation demonstration of DOGE's efficient payment capabilities. The foundation plans to promote the application of DOGE in commercial payment scenarios, and will announce the first batch of strategic cooperation in the next few months. DOGE prices have risen 10% in the past 24 hours, but have fallen by about 40% since November 2024.

The Governor of Kentucky, the United States, officially signed the HB701 Act as a law on March 24 local time to protect residents' rights to use digital assets, self-custodial wallets and run blockchain nodes. The bill explicitly excludes such behavior from money transfer licenses and securities regulation, and restricts local governments from discriminatory management of related technical activities.

Crypto exchange Kraken plans to raise up to $1 billion in debt, paving the way for IPO

Crypto exchange Kraken is considering raising up to $1 billion in debt financing to support future growth and prepare for a possible initial public offering in the first quarter of 2026, Bloomberg reported. Kraken has partnered with Goldman Sachs and JPMorgan to advance the program and may raise some equity financing simultaneously. Previously, Kraken has spent US$1.5 billion to acquire futures platform NinjaTrader, with revenue reaching US$1.5 billion in 2024, a year-on-year increase of 128%.

US stocks close: Nasdaq rose more than 2%, Tesla rose nearly 12%

U.S. stocks closed on Monday, with the Dow Jones Industrial Average rising 1.42%, the S&P 500 gaining 1.76%, and the Nasdaq gaining 2.27%. NVDA.O rose 3%, while Tesla rose 11.9%. Among blockchain concept stocks, MARA Holdings (MARA) rose 18.01%, Strategy (MSTR.O) rose 10.43%, and Coinbase (COIN.O) rose 6.94%.

Trump Media to launch a "Made in the United States" themed ETF in partnership with Crypto.com

According to The Block, Trump Media & Technology Group (TMTG) announced a preliminary agreement with Crypto.com to launch a series of digital asset and stock ETFs and ETPs with the theme of "Made in the United States" through its fintech brand Truth.Fi. This series of funds plans cover a variety of crypto assets such as Bitcoin and Cronos, and focus on local innovative companies and industries in the United States. Crypto.com will provide backend technology, custody services and token supply. These products are expected to be launched in 2025 and require regulatory approval and will be launched in many places in the United States, Europe and Asia through platforms such as Foris Capital US.

Binance Wallet will launch Particle Network (PARTI) exclusive TGE, with subscription limit of 3 BNB

According to the official announcement, Binance Wallet will launch Particle Network (PARTI) exclusive TGE, with subscription time from 18:00 to 19:00 (UTC+8) on March 25. The total amount raised is US$1.25 million (in BNB); 5 billion tokens available (5% of the total supply); price per token: US$0.025 (in BNB); subscription limit for each wallet user is 3 BNB.

Binance HODLer airdrop launches Particle Network (PARTI)

According to the official announcement, Binance HODLer airdrop has now launched the 13th phase project ParticleNetwork (PARTI). From 08:00 on March 7 to 07:59 on March 11 (East Eighth District time), users who use BNB to subscribe for currency earning platform products will receive PARTI airdrop rewards. HODLer airdrop information is expected to be launched within 12 hours, and the new tokens will be distributed to the user's spot wallet at least 1 hour before the transaction begins. Binance will launch PARTI at 21:00 on March 25 (East Eighth District time), and open PARTI/USDT, PARTI/USDC, PARTI/BNB, PARTI/FDUSD and PARTI/TRY trading pairs.

Garantex, a sanctioned Russian crypto exchange, is suspected to be renamed Grinex

According to Coindesk, the latest report by Swiss blockchain analytics firm Global Ledger shows that the sanctioned Russian cryptocurrency exchange Garantex has been renamed Grinex. A large amount of on-chain and off-chain data indicates that Grinex is the direct successor to Garantex. Some of Garantex's liquidity, including the entirety of the ruble-backed stablecoin A7A5 held by Garantex, has been transferred to a Grinex-controlled wallet.

Solana Eco-Replenishment Agreement Fragmetric completed a $5 million financing, led by RockawayX

Solana's ecological re-staking agreement Fragmetric completed a US$5 million financing, led by RockawayX, and participated by Robot Ventures, Amber Group, Hypersphere, and BitGo. Fragmetric has received a total of US$12 million in financing. Previous news, Solana's re-staking agreement Fragmetric completed a $7 million seed round of financing, led by Finality Capital Partners and Hashed.

Market News: World Network is negotiating with Visa on stablecoin payment wallet

According to CoinDesk, World Network, a digital identity project supported by Sam Altman, is negotiating with Visa about stablecoin payment wallets. The goal is to bring the Visa card functionality into the World Network wallet, providing a range of fintech and forex applications, fiat currency entry and exit, and allowing stablecoin-based payments to thousands of merchants around the world in the Visa network. Tools for Humanity is a company co-founded by Open AI CEO Sam Altman, which manages Worldcoin and World Network, which sends requests in product form to credit card issuers. Earlier this month, World Network announced the launch of a World Chat app that supports transfers between users in the form of crypto transactions on the Internet.

Bernstein analyst: Cryptocurrency is moving towards a "one-stop" multi-asset investment platform

According to Theblock, Bernstein analysts said that as exchange and broker/dealer models begin to merge, the crypto industry is moving towards a more integrated "one-stop" multi-asset investment platform. Coinbase is in deep negotiations on the acquisition of Deribit, Kraken is about to acquire NinjaTrader, and Robinhood is integrating Bitstamp. "As the regulatory environment relaxes, crypto exchanges and brokers/dealers are undergoing strong M&A actions," analysts led by Gautam Chhugani wrote in a report to clients, as traditional brokers seek to offer crypto tokens, while crypto exchanges plan to integrate traditional stocks and derivatives. Analysts believe that the U.S. crypto derivatives market has huge growth potential, as offshore markets such as perpetual futures are three to four times larger than spot markets. They said that Bitcoin and Ethereum futures trading outside the United States was $31 trillion last year, while the Chicago Mercantile Exchange annually traded at about $2.5 trillion. Meanwhile, the U.S. crypto options market is still in its early stages, mainly limited to Bitcoin futures options on the Chicago Mercantile Exchange. However, as the US SEC and CFTC support for encryption increases, analysts expect the market for spot and derivative crypto products in the United States to expand. They noted that this could lead to crypto platforms providing traditional assets and vice versa, allowing broker platforms to provide a wider range of assets.

Nillion Alpha mainnet is online

Blind computer network Nillion tweeted that the Nillion Alpha mainnet and NIL tokens have been launched.

According to the official announcement, Binance Financial Management, one-click buying of coins, flash exchange, leverage, and contracts will be launched on Nillion (NIL). NIL's guaranteed and earned currency current products will be launched on the Binance guaranteed and earned currency platform at 21:00 on March 24 (East Eighth District Time) and will be open for subscription. On March 24, 21:00 (East Eighth District Time) NIL 1-75 times U standard perpetual contract will be launched.

Data: Last week, five companies increased their holdings of 7,349 Bitcoins

According to HODL15Capital, among the top 70 companies holding Bitcoin, five companies increased their holdings last week, with an increase of 7,349. The top 70 companies hold a total of 670,153 Bitcoins.

According to Fortune, Rain, a company that issued debit and credit card issuing, completed a $24.5 million financing, led by Norwest Venture Partners, and participated in the investment. Rain's valuation in this round of financing has not been disclosed. Rain is a company that issues debit and credit cards that allows customers to settle payments in stablecoins. Rain will use the funds raised in this round to expand its team, develop new technologies and apply for additional regulatory licensing.

According to market news, Strategy increased its holdings of 6,911 bitcoins from March 17 to March 23, with an average purchase price of US$84,529 and a total value of US$584.1 million. . Currently, it holds 506,137 BTC, with a total value of approximately US$33.7 billion, with an average of US$66,608 per Bitcoin.

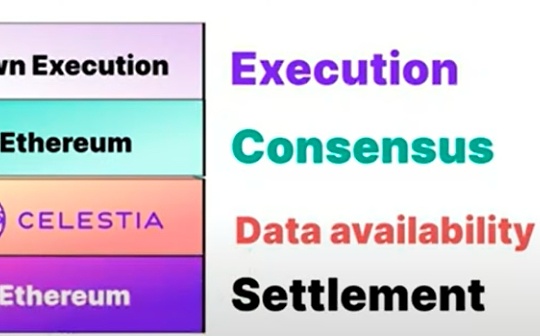

DefiLlama tweeted that the community-transmitted "BNB Chain's 7-day DEX transaction volume exceeds Ethereum". In the graph, there is a fault in the Base data and is currently being repaired. Everything else in the screenshot is correct.

Binance platform’s Bitcoin open interest increases by about $600 million

According to CoinDesk, Binance's open interest increased by about 7,000 BTC ($614.6 million) since trading in early Asian trading, according to data tracked by Coinglass and Velo Data. An open position is the number of contracts that are active or open for a specific time. In addition, Binance's capital rates have remained positive, indicating that investors are biased towards leveraged bullish (long) bets. The upward trend is confirmed by the increase in open positions and the rise in prices.

According to CoinShares' latest weekly report, digital asset investment products reversed last week, breaking the five consecutive weeks of capital outflow trend, with a total inflow of US$644 million. Bitcoin attracted $724 million inflows, ending a total of $5.4 billion inflows for five consecutive weeks. Ethereum suffered the worst outflow, with outflows of $86 million, while Solana's inflows of $6.4 million. Most of the capital flows came from the United States, with inflows reaching $632 million. However, optimism is widespread, with Switzerland, Germany and Hong Kong also recording inflows of $15.9 million, $13.9 million and $1.2 million, respectively.

According to Bloomberg, U.S. exchange-traded funds that invest directly in ETH suffered the longest outflow record since their launch in July 2024. Nine ETFs have been net outflows for 13 consecutive days, with a total outflow of approximately US$415 million. By contrast, the U.S. Bitcoin ETF has rebounded from a period of weakening investor demand, achieving net inflows for six consecutive days as of March 21. Standard Chartered cut its year-end price target of ETH by 60% to $4,000 in a report last week, citing concerns about Ethereum’s scalability. In a report, the bank said Ethereum was “largely commodified within its own L2 framework”, which created doubts about its long-term competitive advantage.

OKX will launch PARTI (Particle Network) spot trading

According to the official announcement, OKX will launch PARTI (Particle Network) spot trading. The transaction is open at 9:00 pm on March 25 (UTC+8).

Curve Finance founder sold 468,769 CRVs about 9 hours ago, with an estimated loss of $745,000

According to Spot On Chain monitoring, Curve Finance founder Michael Egorov sold 468,769 CRVs for $0.508 about 9 hours ago, earning 238,171 USDC. On December 17 and 18, Michael Egorov purchased 1.226 million CRVs for an average of $1,114 ($1.37 million). The investment is now losing $745,000 (-54.6%).

According to market news, the WLFI project is suspected to issue stablecoin USD1 on Ethereum and BNB Chain, and is undergoing multiple functional tests, and Wintermute has participated.

The dYdX community launches its first DYDX token repurchase program, with 25% of the agreement's net revenue going to the repurchase program. While the initial allocation uses 25% of net agreement revenue to repurchase, the community is discussing the possibility of increasing this to 100%. Affected by this news, DYDX rose by more than 10% in a short period of time.

Aptos ecological liquidity staking protocol Amnis Finance launched its governance token AMI with a total volume of 1 billion. Token allocation plans include: community rewards 20%, team rewards 20%, marketing 15%, ecological development 16%, investors 16%, liquidity 5%, and airdrop 8%. Previously, Aptos' on-chain liquidity staking agreement Amnis Finance completed a $2 million financing round. This round was led by Borderless Capital and OKX Ventures, with Aptos Labs, Arkgrow Pte Ltd, Ambush Capital, Gate Ventures, Sky Vision Capital, Old Fashion Research, Chorus One Venture, Re7 and Flowdesk participating.

The CEX platform ETH holdings reached 8.97 million, hitting a new low in nine years

According to CoinDesk, the amount of Ethereum (ETH) held in wallets pegged to centralized exchanges has dropped to its lowest point in nine years at 8.97 million, according to data tracked by CryptoRank and Santiment. This is the lowest record since November 2015. Continuous outflow of tokens from centralized trading platforms may lead to a decrease in the supply of tokens in the market, causing a surge in prices. BTC also showed a similar trend, with prices soaring after exchange holdings hit their lowest levels in seven years.

Singapore's crypto investment institution QCP Capital stated that the crypto market rebounded moderately last weekend, with BTC and ETH breaking through US$85,000 and US$2,000 respectively. The recovery appears to be led by the stock market, with stock futures showing a strong rebound. While concerns about the recession continue, Powell’s speech at the FOMC meeting last week, while cautious, helped ease investor tensions. The Crypto Fear and Greed Index has risen from 32% last week to 45% this week (49% neutral), reflecting a general relief from risk aversion. The highlight of note is the inflow of spot BTC ETFs, which purchased 8,775 BTC (equivalent to $744 million) last week, a significant increase. This marks a sharp reversal after several consecutive weeks of net outflows and sends early signs of liquidity reflux in crypto markets. As perpetual positions remain in a downturn and capital rates remain flat, the rebound appears to be driven by real spot demand rather than leverage, a key difference, as leverage-driven trends tend to suddenly close positions at liquidation. However, despite the resurgence of ETF momentum and a subsequent rebound today, it is still cautious about the prospect of continuing to break through and rise. The upcoming tariff escalation to be implemented on April 2 could put pressure on risky assets again. Meanwhile, the options market reflects a more neutral wait-and-see attitude, implicit volatility tends to decline, and risk reversals for all periods flattening, in sharp contrast to the more bearish trend observed a week ago. It is important to keep a close eye on whether this week’s recovery will be exactly the same as last Monday’s price trend, when cryptocurrencies rose on Sunday but pulled sharply in 48 hours.

jinse

jinse