How much does it cost to mine 1BTC after Bitcoin is cut in half?

Reprinted from jinse

04/23/2025·25DSource: Blockworks; Translated by: Tao Zhu, Golden Finance

We all know that halving doubles production costs, and the media portrays this fact every four years as an existential threat to Bitcoin.

Miners seeking profits must also deal with fluctuating mining difficulties and energy costs. But if the price goes up, at least every bitcoin they mine will get more money.

As BTC prices rise, high prices attract more miners, which brings Bitcoin’s total hash rate and difficulty to an all-time high.

In fact, although mining revenue is basically the same as the five-year average, the current mining difficulty is five times that of April 2021, 40% higher than before the last halving.

Therefore, mining Bitcoin is more difficult than ever. But how much does it cost to mine 1 BTC now? It's always hard to say that the answer depends largely on electricity and other indirect costs, with Cambridge currently estimated cost per BTC at $48,671.

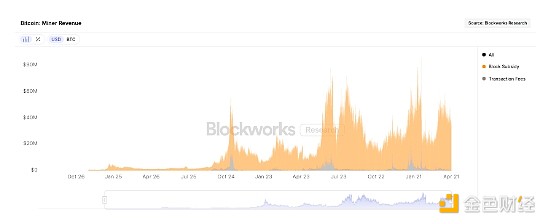

Strong Bitcoin prices have kept miners’ incomes almost on par with the peaks of the 2021 and 2024 bull markets (Source: Blockworks Research).

Let’s take Marathon as an example, the $4 billion mining giant accounts for about 7% of the total hash rate of Bitcoin.

According to Marathon's filing with the U.S. Securities and Exchange Commission, its mining revenue cost was $224.95 million in the three quarters before the latest halving.

Marathon mined a total of 10,542 BTC during the same period, meaning that the production cost per bitcoin is estimated to be slightly less than $21,500. At that time, the average transaction price of Bitcoin was $39,300, which meant a potential profit of $17,800 per Bitcoin.

In the third and fourth quarters of last year, Marathon estimated production costs $43,270 using the same method — doubled since the halving, consistent with Cambridge’s estimates — while the average transaction price was $72,250. This means the potential profit is close to $29,000, even higher than before the halving.

(Marathon CEO Fred Thiel said in February that Marathon's direct energy costs totaled $28,801 per bitcoin last year, although that included some of the costs before doubled production costs. Marathon's profit in the fourth quarter of 2024 exceeded $500 million.)

A year after the halving, Bitcoin block subsidies are still generous enough, at least for the most capitalized operations, at current prices, according to Marathon. Other miners can sometimes lose money, according to Luxor’s Hashrate Index, which shows profitability is at its lowest level on record. This is understandable because five halvings have been experienced.

Regardless, Bitcoin has three years to double its price to offset the next price increase. Have plenty of time.

Satoshi Nakamoto's Prophecy

“I’m sure that 20 years later, the volume will either be very large or there will be no volume.”

Satoshi Nakamoto said this on Valentine's Day 2010 - it's been more than 15 years since then.

Here is an appendix to the comment on the necessity of transaction fees in systems where block rewards gradually drop to zero over time. “In decades, when the reward becomes too small, the transaction fee will become the main compensation for the node.”

So, less than five years from Satoshi Nakamoto’s assumption, how close is he to the truth?

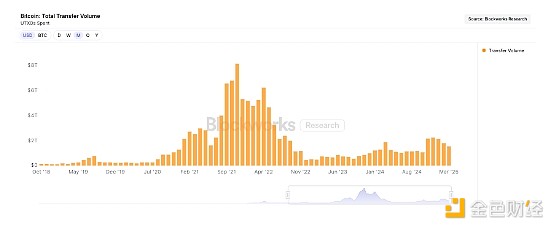

Monthly transfers have declined in recent months, but will continue to grow significantly by 2023 (Source: Blockworks Research).

Bitcoin processes more than 11.5 million transactions per month, up from less than 8 million transactions at the beginning of 2022, converting an average of $1.8 trillion in BTC transaction volume.

On the one hand, this may be as “very large” as Satoshi Nakamoto predicted, but more than 98% of miners’ income still comes from block subsidies.

With a few more halvings, the current dynamics may no longer be tenable, so the debate over the structure of the Bitcoin fee market is expected to intensify over time.

panewslab

panewslab