a16z led a $4 million investment. Can Glider reshape the new paradigm of DeFi financial management?

Reprinted from panewslab

04/23/2025·25D- Complex on-chain activities are being simplified and technical infrastructure is already mature;

- Everything that is old faces historical opportunities to be reshaped, and new opportunities have emerged;

- Intent, TG/Onchain Bot, and AI Agent all need to solve the authorization problem.

On April 16, Glider completed a US$4 million financing led by a16z CSX (Entrepreneurship Accelerator). It can be ranked in the on-chain investment field that looks simple and complex, thanks to the favor of technical trends such as Intent and LLM. However, DeFi does need to be recombined as a whole to simplify the investment threshold.

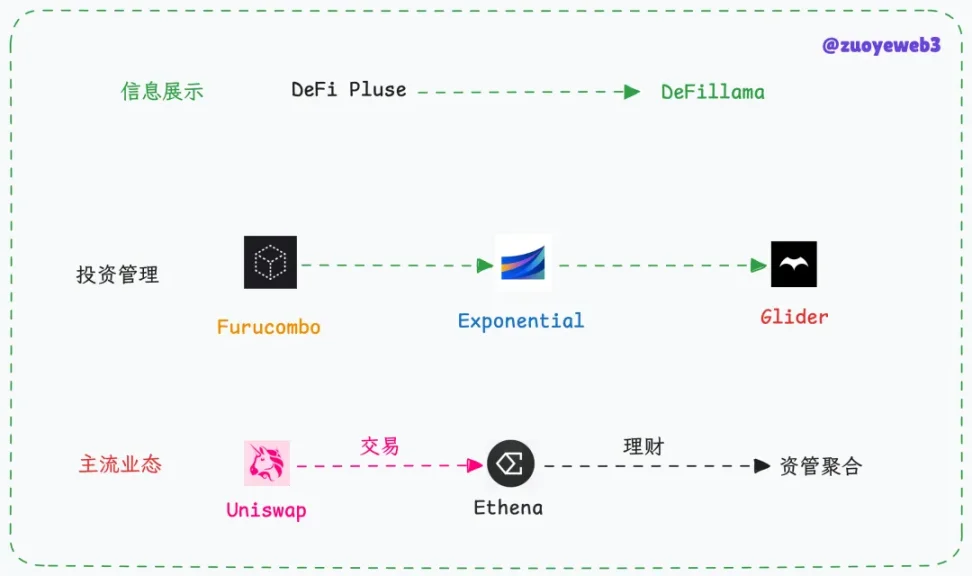

Image description: History of the development of DeFi tools, source: @zuoyeweb3

The era of DeFi is no longer the era of security-coupled financial management is coming.

Past: Furucombo Died before he succeeded

Glider started Anagram’s internal entrepreneurship at the end of 2023. The form at that time was Onchain Bots, which means combining different operating steps to facilitate users’ investment and use.

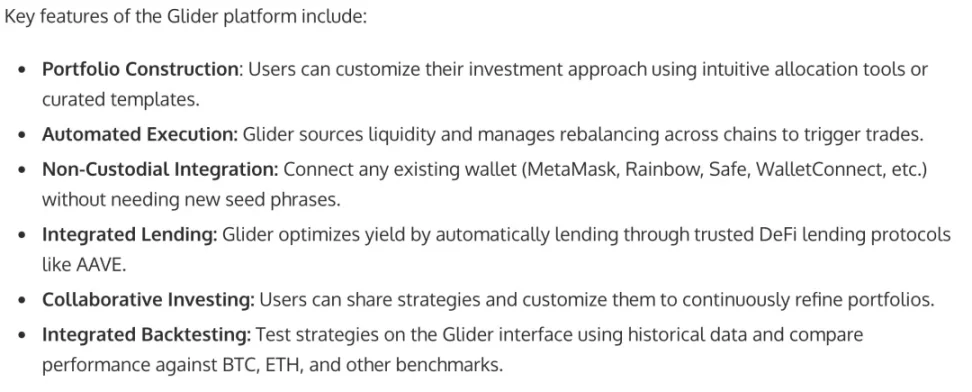

Image description: Glider function preview, image source: businesswire

But this is not a new business model. Helping users manage their finances is a long-term business. This is true for TradFi and DeFi Summer. Glider is still in the internal R&D stage. Only the content of the PR draft can describe its general ideas:

- Link existing DeFi tools, including leaders in various tracks, and emerging protocols, and build B2B2C customer acquisition logic through API access;

- Allow users to build investment strategies and support sharing to facilitate follow-up investment, copy transactions or collective investment in exchange for higher returns.

With the cooperation of AI Agent, LLM, intention and chain abstraction, building such a stack is not difficult from a technical perspective. What is really difficult is traffic operation and trust mechanism.

The flow of users' funds is always sensitive, which is also the most important reason why on-chain products have not yet defeated CEX. Most users can accept the security of decentralization and exchange of funds, but basically do not accept the increased security risks of decentralization.

In 2020, Furucombo received institutional investments such as 1kx, focusing on helping users reduce panic when facing DeFi strategies. If you want to force analogies, it is most similar to today's Meme Coin tools such as GMGN. However, the DeFi era is a combination return strategy, and GMGN is a discovery of high potential and low value Memes.

However, most people do not stay in Furucombo. The on-chain income strategy is an open market. Retail investors cannot compete with Giant Whale in terms of servers and capital, that is, most profit opportunities cannot be captured by retail investors.

Compared with the unsustainability of returns, security issues and strategy optimization are second, and there is no room for stable financial management in the era of high returns.

Now: the civilian era of asset management

ETFs for the rich and ETS for retail investors.

ETF tools can not only operate in the stock market, but Binance and other exchanges have tested the waters in 2021, and the tokenization of assets from a technical perspective will eventually give birth to the RWA paradigm.

Image description: Exponential page, image source: Exponential

Going further, how to complete the on-chain ETF tools has become the focus of entrepreneurship. From the APY calculation and presentation of DeFillama to the continuous operation of Exponential, it all shows that the market has demand for it.

Strictly speaking, Exponential is a strategic sales and display market, with massive, precise calculations, and artificial and AI-assisted strategy decisions. However, on-chain transparency results in no one who can really hide efficient strategies and not be imitated and transformed, which leads to arms races and eventually flattening the yield.

Finally, there is a new round of boring game of big fish eating small fish.

But it has never been standardized and developed into projects that redefine the market like Uniswap, Hyperliquid or Polymarket.

I have been thinking recently that after the end of Meme Supercycle, the DeFi form of the old era is difficult to revive. Is the industry's peak temporary or permanent?

This is related to whether Web3 is the next step in the Internet or the FinTech 2.0 version, if it is the former, then the human information flow and capital flow operation method will be reshaped. If it is the latter, then Stripe + Futu Niu Niu is the end of everything.

From Glider's strategy, it can be decoupled that on-chain returns will be transformed into the era of civilian asset management. Just as index funds and 401(k) have jointly created a long bull market for US stocks, with an absolute amount of funds and a huge number of retail investors, the market will have a huge demand for stable income.

This is the meaning of the next DeFi. In addition to Ethereum, there is Solana. The public chain still needs to undertake the innovation of Internet 3.0, and DeFi should be FinTech 2.0.

Glider has added AI assistance, but from the information display of DeFi Pulse, to the first attempt of Furucombo, to the stable operation of Exponential, the stable on-chain revenue of about 5% will still attract basic people outside of CEX.

Future: Interest-generating assets are on the chain

With the development of currency products in today's world, only a few products have truly gained market recognition:

- Exchange

- Stable Coin

- DeFi

- Public chain

Any remaining product types, including NFT and Meme coin, are just phased asset issuance models, and they do not have continuous self-sustaining capabilities.

However, RWA has taken root and grown since 2022, especially after the FTX/UST-Luna collapse, as AC said, people do not really care about decentralization, but more about returns and stability.

Even if the Trump administration does not actively embrace Bitcoin and blockchain, RWA's productization and practicalization are accelerating. If traditional finance can embrace electronicization and informatization, there is no reason to give up blockchainization.

In this cycle, whether it is complex asset types and sources, or the dazzling on-chain DeFi strategies, they are seriously hindering CEX users from migrating to the chain. Regardless of the authenticity of Mass Adaption, at least the huge exchange liquidity can be sucked away:

- Ethena converts rate returns into on-chain returns through an interest alliance;

- Hyperliquid pumps the exchange perpetual contract to the chain through LP Token.

Both cases prove that liquidity is feasible, and RWA proves that asset is feasible. Now is a wonderful moment in the industry. ETH is considered to be unsustainable, but everyone is clearly on the chain. In a sense, Fat Agreement is not conducive to the development of Fat Applications. Perhaps this is also the last night when public chains return to infrastructure and application scenarios shine brightly, and the morning light is dim.

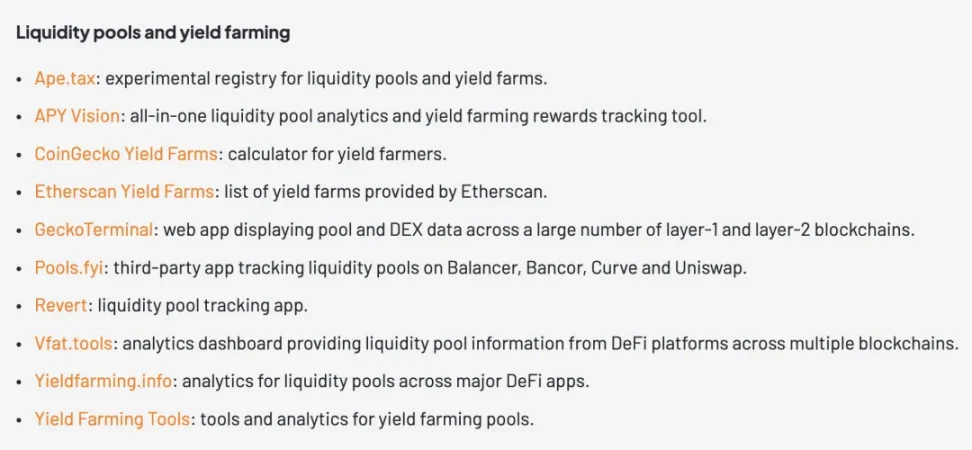

Image description: Income calculation tool, image source: @cshift_io

In addition to the above products, vfat Tools has been running as an open source APY computing tool for more than several years. De.Fi, Beefy, and RWA.xyz all have their own focus, showing the project's APY and the focus of the revenue tools. With the change of time, it has become increasingly concentrated on interest-generating assets such as YBS.

At present, if this type of tool increases trust in AI, it will face the division of responsibilities. Strengthening manual intervention will reduce the user experience and make it difficult to deal with it.

It may be a better way out to separate information flow and capital flow, build a UGC strategy community, allow project parties to intra-come and allow retail investors to benefit.

Conclusion

Glider has gained market attention because of a16z, but long-term problems in the track still exist, authorization and risk issues. The authorization here does not refer to wallets and funds, but whether AI has the ability to satisfy humans. If AI investment losses are heavy, how can responsibilities be divided?

This world is still worth exploring the unknown, and Crypto, as a public space that collapses the world, will still be endless.

jinse

jinse