How can HUSD break the monopoly of stablecoin and feed back to the Hyper ecosystem?

Reprinted from chaincatcher

05/19/2025·21DOriginal title: "What does it mean to be a Hyperliquid-aligned fiat stable?"

Author: husd_fiat

Compiled: zhouzhou, BlockBeats

Editor's note: HUSD is a public stablecoin project launched by Hyperliquid. It reverts stablecoin interest to the ecosystem to repurchase HYPE, subsidizes interface rates, and supports the Builder Code model to promote ecological growth. It breaks the USDC/Tether model and allows funds to no longer flow to centralized institutions, but to feed back to the community and product development.

The following is the original content (to facilitate reading comprehension, the original content has been compiled):

What the ecosystem really needs

The story of HUSD is about how to disrupt a multi-billion dollar stablecoin market. Hyperliquid was originally featured as a leading perpetual contract decentralized exchange (perp DEX), outperforming old players such as DYDX and GMX. As products continue to attract new users and gradually introduce them to the spot market, Hyperliquid gradually evolved into a Binance/Coinbase competitor. Next, the target that the ecosystem will challenge is the duopoly of fiat currency stablecoins - Circle and Tether.

Currently, approximately $2.5 billion of cross-chain USDC is locked in HyperCore's order book and receives an interest income of approximately 4.3%. These earnings can bring about $107.5 million in revenue to Circle Internet Financial every year, flowing into its private balance sheet. Each USDC newly deposited in Hyperliquid is further expanding Circle's cash flow. But what if these values were not flowing to Circle, but were used in turn to strengthen the Hyperliquid ecosystem? Why are we still bound by the outdated traditional stablecoin model of USDC when we have the opportunity to break through the existing framework?

Opportunity Cost of Choosing to Use Old Stable Coins

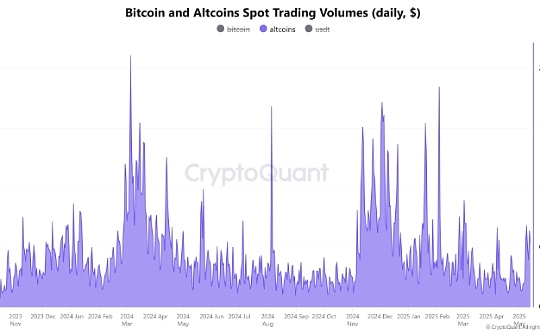

As Hyperliquid's influence in on-chain trading continues to expand, net deposits of fiat stablecoins have also grown, providing liquidity for the perpetual contract market and spot market. In a future where Hyperliquid grows by 10 times, 100 times, or even 1000 times, the opportunity cost of continuing to use traditional stablecoins will also be higher and higher. These values from the stablecoin layer either continue to flow to Circle and Tether's balance sheets or return to Hyperliquid's own ecosystem.

New stablecoin model tailored for Hyperliquid

The Assistance Fund has proved through automatic repurchase of HYPE: the cash flow generated by the agreement is perfect and should be directly given to the community. In just the past 30 days, the aid fund has recovered millions of dollars of HYPE from the market.

HUSD continues this strategy, but it is developing at the stablecoin level: at the beginning, a large part of the interest income brought by HUSD will be used to purchase HYPE, and then deploy these HYPEs to various growth directions of the Hyperliquid ecosystem. In other words, every time you use HUSD, you will increase buying pressure for HYPE and reinvest the value into Hyperliquid's development.

How will the repurchased HYPE be used?

HUSD: Fueling for the future of Builder Code

HUSD plays a key role in promoting the outbreak of the "Builder Code" business model. Builder Code is a native feature of Hyperliquid, allowing an interface operator to charge a certain fee in spot or contract transactions submitted on behalf of users. Its goal is to provide monetization methods for Hyperliquid's "last mile distribution" - that is, anyone who can effectively attract and retain users can establish a trading business through Builder Code that is not subject to technical or liquidity restrictions.

The unit economic benefits of such businesses may be very considerable, but in this early stage, new brands are still facing the problem of "cold start", and the moat between different interfaces is not obvious. The emergence of HUSD can help these "Hyperliquid hybrids" be launched, and at the same time provide a way to differentiate between them.

With HUSD subsidies for Builder Code, the interface can charge users higher fees than they originally did without increasing user costs. The interface can earn revenue in real time and further use these funds for growth strategies.

For example: Suppose Interface XYZ gets a rebate budget of 100 HUSD. All contract transactions with their Builder Code will be counted by the system, and the rebate balance of corresponding users will continue to grow. The interface can handle at least about $100,000 of contract transaction volume (i.e., 100 HUSD divided by 0.1% handling rate) before the user actually starts to bear the fees. At the same time, interface operators can also invest the revenue brought by Builder Code to attract new products or retention of users.

This is how HUSD powers the Hyperliquid ecosystem “real-time growth”.

Summarize

HUSD combines two core insights: the denominated assets (stable coins) used in transactions and the cash flow generated by them are unified into the trading platform system. The final result is a stablecoin with the nature of "public products", which converts the originally static reserve interest into active and compound interest growth of the Hyperliquid ecosystem.

HUSD is a public product project run by Felix and supported by community members, which will be available online through the Felix Points system. This deployment is also based on the foundation laid by @m0foundation. It is its vision for the "global stablecoin platform" that makes HUSD possible.

Hyperliquid has overturned the centralized exchange landscape, and HUSD is preparing to do the same with traditional fiat stablecoins.

jinse

jinse