Golden Web3.0 Daily | Galaxy is scheduled to be launched on Nasdaq on May 16

Reprinted from jinse

04/30/2025·1MDeFi data

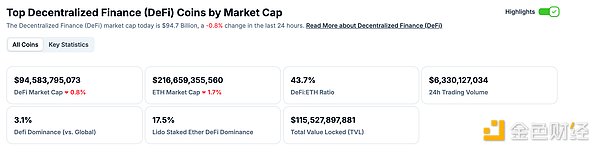

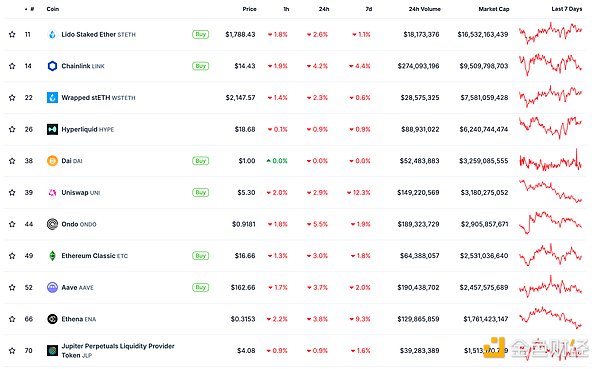

1. Total market value of DeFi tokens: US$98.835 billion

DeFi total market value data source: coingecko

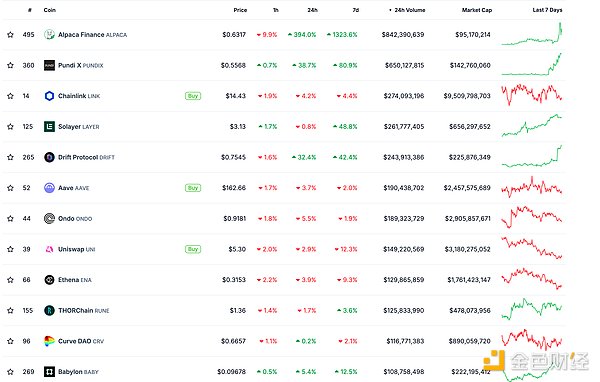

2. The trading volume of decentralized exchanges in the past 24 hours was US$5.828 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

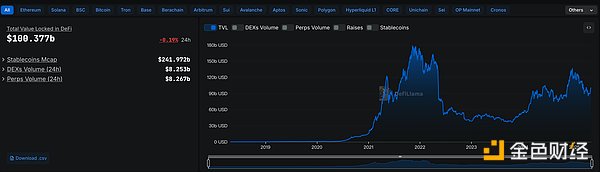

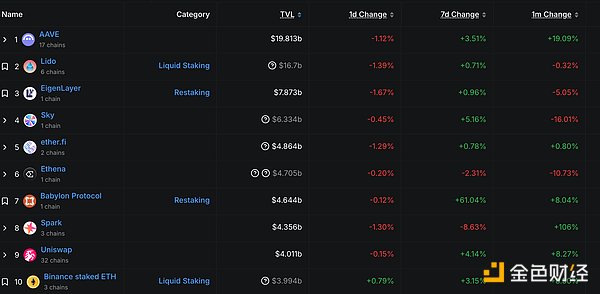

3. Locked assets in DeFi: US$101.033 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

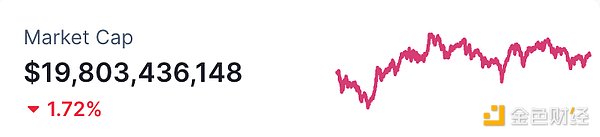

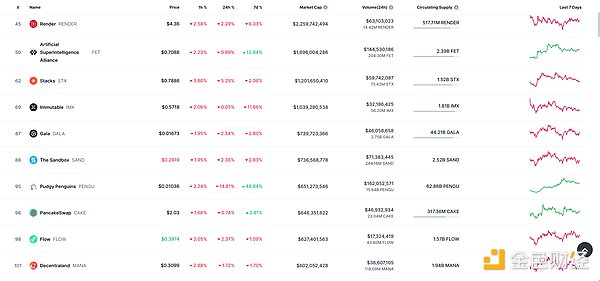

1.NFT total market value: US$19.803 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

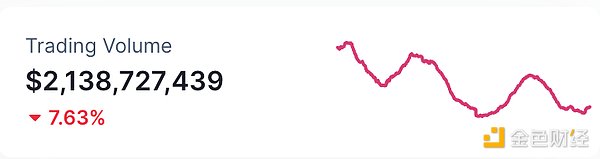

2.24-hour NFT trading volume: US$ 2.138 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

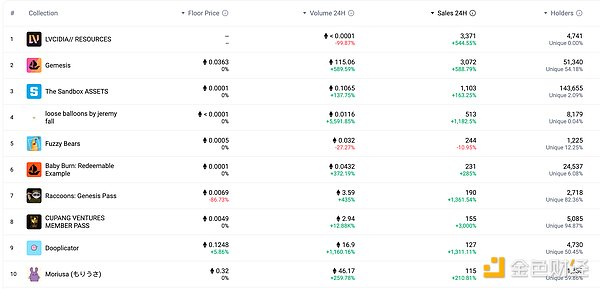

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

Galaxy is scheduled to be available on Nasdaq on May 16

According to Golden Finance, Mike Novogratz, CEO of digital asset management company Galaxy, posted on the X platform that Galaxy plans to go public on Nasdaq on May 16, awaiting shareholder approval on May 9. This listing will allow Galaxy to better serve investors in the digital asset and artificial intelligence ecosystem and start the next stage of growth.

MEME hot spots

1. MELANIA team transfers $1 million tokens

According to Arkham monitoring, the MELANIA team transferred $1 million worth of MELANIA tokens from the Meteora liquidity pool to a new wallet. Previously, the team sold MELANIA through Jupiter's DCA function and deposited the resulting SOL to the MEXC exchange. This transfer may indicate a similar operation.

DeFi hotspots

1. Securitize and Gauntlet launch leveraged DeFi earnings strategy based on Apollo tokenized credit funds

Golden Finance reported that tokenized asset issuer Securities and DeFi research and risk management company Gauntlet cooperated to launch a leveraged DeFi income strategy based on Apollo tokenized credit funds. The leveraged RWA strategy will initially be launched on Polygon and will be expanded to the Ethereum mainnet and other blockchains after the pilot phase. The strategy uses a DeFi native technology called looping to boost revenue to demonstrate the increasing use of tokenized assets in crypto-native applications.

2.OpenZK announces that it will burn 25% of the total token

On April 30, OpenZK announced that it will soon burn huge tokens, accounting for 25% of its tokens. OpenZK said that this move is to benefit the community and open up OZK's token economics for deflation, which will have a huge positive impact on its long-term network development, community building and transparency. The role of the deflation mechanism will gradually be transmitted to the currency price. It is reported that the first large-scale token destruction will take place on May 7.

3. Vitalik releases focus on 2025: Ethereum technology development and decentralization acceleration

According to Golden Finance, Ethereum co-founder Vitalik Buterin announced his focus in 2025: 1. Ethereum development, including single-slot finality, long- term virtual machines, statelessness, security, etc. in the L1 long-term roadmap, as well as full-stack security, open source and privacy protection; 2. Decentralization acceleration at the macro level involves communication tools, social levels, governance mechanism design, cryptography, infrastructure, etc.

4.Ptotos: Ethereum Foundation has not disclosed Vitalik Buterin 's voting rights

According to Ptotos, although the Ethereum Foundation issued a document emphasizing its community-centric governance, it has not announced the voting rights of co-founder Vitalik Buterin. It is reported that Laura Shin, the author of the book "The Cryptopians", has been questioning for many years whether Vitalik Buterin has three super votes or whether the voting rights of four board members are the same. Currently, there are four directors on the board of Ethereum Foundation: Vitalik Buterin, Aya Miyaguchi, Hsiao-Wei Wang and Patrick Storchenegger, but the agency has not disclosed how the voting rights are allocated so far. Protos has contacted the Ethereum Foundation for solicitation and has not received any reply so far.

5.Scroll has been upgraded to Stage 1 zk-Rollup through Euclid

According to Golden Finance, Scroll official posted on X that it has been upgraded to a Zk-Rollup that meets the Stage 1 standard through Euclid. Euclid upgrade introduces a permissionless sorter mode to ensure that the network remains active even if the sorter fails. In addition, Scroll has established a diversified security committee of 12 members (75% of the votes passed, 7 independent members) to provide security, while users can exit safely before upgrading. In the future, Scroll plans to move towards Stage2 through multi- proof systems and Zk+TEE technology.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

panewslab

panewslab

chaincatcher

chaincatcher