Golden Web3.0 Daily | Federal Reserve takes a neutral stance on encryption

Reprinted from jinse

02/19/2025·3MDeFi data

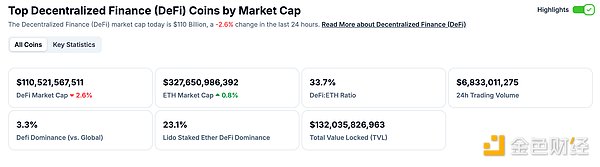

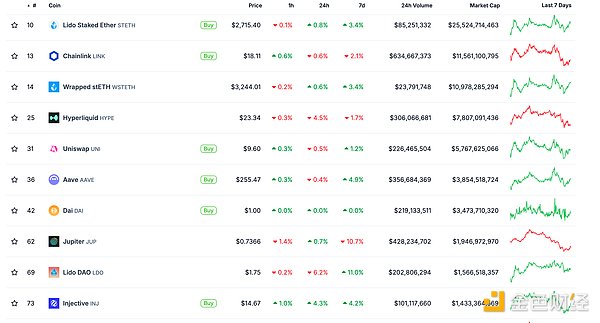

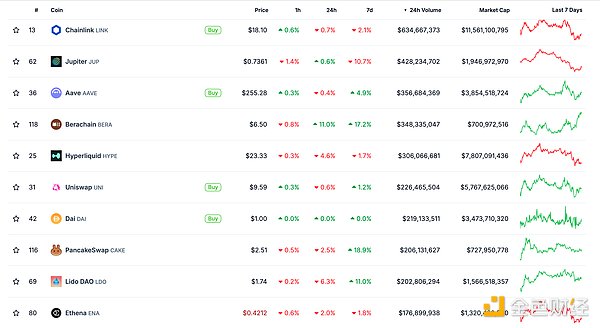

1. Total market value of DeFi tokens: US$110.521 billion

DeFi total market value data source: coingecko

2. The trading volume of decentralized exchanges in the past 24 hours was US$6.833 billion

Source of transaction volume data from decentralized exchanges in the past 24 hours: coingecko

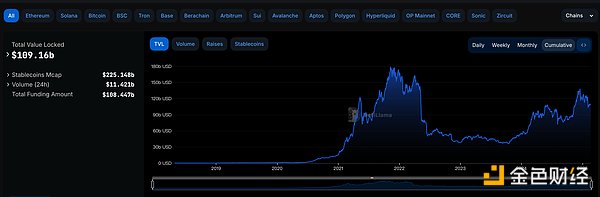

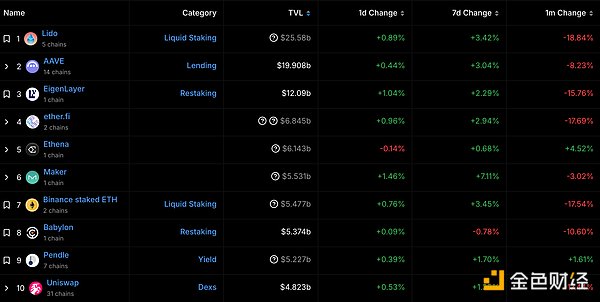

3. Locked assets in DeFi: US$109.16 billion

DeFi project locked assets ranking and locked positions data source: defilama

NFT data

1.NFT total market value: US$23.147 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

2.24-hour NFT trading volume: US$ 2.187 billion

The top ten NFT projects ranked in total market value and market value data source: Coinmarketcap

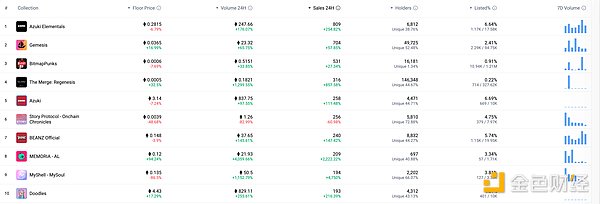

Top NFTs within 3.24 hours

NFTs with the top ten sales gains within 24 hours Source: NFTGO

Headlines

Fed Vice Chairman of Regulation: Fed takes a neutral stance on cryptocurrency

FOX Business reporter Eleanor Terrett disclosed that the outgoing Federal Reserve Michael Barr spoke on bank decentralization and crypto-regulation at the New York Foreign Relations Commission this afternoon. Barr said the Fed is trying to take a "neutral" stance on the above issues. The Fed expects that they operate in a safe and sound manner and comply with consumer laws, anti- money laundering laws and anti-terrorism financing laws. If they do, we have no objection. “The Fed has a novel regulatory program designed to oversee institutions in the field to ensure we have the expertise to properly execute the field. Some institutions are doing this, while others are doing it wrong and getting stuck, either because of anti-money laundering , bank confidentiality law issues, either because they can’t meet the liquidity needs of their customers, and then they go bankrupt. So, at least for me, it’s just direct middle-level risk management and banking. If you do it right, you It can be done. If you do it wrong, then you shouldn't do it." Barr also said he has never seen evidence that a client was cancelled from a bank account due to a political view.

MEME hot spots

1. 86.2% of the new share of Trump 's crypto project WLFI has been sold

According to the information on the official website, 86.2% of Trump's crypto project WLFI has been sold by 5% of its new share (5 billion tokens). Previous news, Trump's crypto project WLFI added 5% and the supply price rose to $0.05, followed by the previous round of selling price of only $0.015.

2.Definalist: The biggest event today and tomorrow may be the two unlocked MELANIA tokens

Golden Finance reported that South Korean trader Definalist posted on social media, saying, "I think the biggest event today and tomorrow may be the unlocking of MELANIA tokens, which will be carried out in two days: Today (17:26 Beijing time on the 19th), there is still a lot of time left now. 5 hours, MELANIA unlocked worth $37 million; MELANIA will be unlocked tomorrow (17:47 Beijing time on the 20th). MELANIA will be unlocked. "

3. A trader made a profit of US$109 million by sniping TRUMP coins, and the on-chain correlation caused doubts about insider trading

According to a joint investigation by blockchain data platform Bubblemaps and well-known YouTuber Coffeezilla, a trader named Naseem made a profit of $109 million in TRUMP token trading through 'sniper'. On-chain data shows that Naseem purchased tokens for $1.09 million in the first second of TRUMP online and paid a priority transaction fee of $84,000, and then spread the funds to at least 9 wallets. Bubblemaps notes that although insider trading cannot be fully confirmed, the high correlation of multiple on-chain addresses is 'not to be ignored'. Naseem denied receiving internal news that its team speculated the launch time by observing the interaction of Meteora's funding pool.

DeFi hotspots

1. Vitalik: There is no so-called "ETH 3.0" at present

According to Golden Finance, Ethereum co-founder Vitalik Buterin published an article saying that there is no so-called "ETH 3.0" at present. Although the five-year plan proposed by Justin Drake is often mistaken for ETH 3.0, the plan only involves the consensus layer, not the execution layer. Regarding the relationship between L1 and L2, Vitalik pointed out that there is a clear roadmap, including improving L1 performance (improving gas limit, introducing verkle trees, etc.), enhancing cross-L2 interoperability, and optimizing blob space. Vitalik stressed that it is imperative to strengthen L1 performance, ensure that the transactions that should occur in L1 can be smoothly carried out, while expanding the scale of blobs and maintaining the adaptability of the Ethereum community.

2. Vitalik: Ethereum L1 and L2 need to clearly define the scope of transactions

On February 19, Ethereum founder Vitalik Buterin responded to the question of "Is rollups generally good for Ethereum or blood sucking, and whether ETH really needs these L2s?", saying that Ethereum currently adopts a hybrid L1 + L2 expansion solution, but it is still The respective transaction scope of L1 and L2 layers needs to be clearly defined. Vitalik said that transferring all transactions to L2 could undermine ETH's position as a medium of exchange and store of value, and that operations across L2 still require L1. At the same time, it is also not feasible to keep all transactions at L1, as this may lead to centralization and cannot meet the unlimited growth of on-chain transaction needs. The right balance between these two extremes needs to be found to provide the best solution for users.

3. DeFi platform MANTRA obtains Dubai Virtual Asset Service Provider License

According to Golden Finance, DeFi platform MANTRA has obtained a Virtual Asset Service Provider (VASP) license issued by Dubai Virtual Assets Regulatory Authority (VARA). The license allows the platform to operate as a virtual asset exchange and provides brokerage dealer and investment management services in the region. The company said it targets global expansion for MANTRA, which focuses on the Middle East, while strengthening its focus on real-world assets (RWA) tokenization.

4. Blockchain platform DigiFT announces tokenization of Invesco 's $6.3 billion credit fund

According to Golden Finance, Singapore's blockchain platform DigiFT announced that it will tokenize an Invesco private credit fund with a scale of US$6.3 billion. Since its establishment in 2006, the fund's annualized net return rate has reached 4.5%, mainly investing in corporate priority guaranteed loans. According to a statement released by DigiFT on February 19, institutional investors can purchase tokenized shares of the fund using USD or stablecoins (USDC and USDT). DigiFT CEO Henry Zhang said the move is the latest case in the integration of traditional finance and crypto.

5.Space ID will become the digital identity provider for Story Protocol

Golden Finance reported that according to Cryptonews, Web3 domain name service provider Space ID announced on Tuesday that it would work with blockchain startup Story Protocol to provide an identity management solution. Space ID will integrate its domain name infrastructure into Story Protocol. Human- readable domain names like "jane.ip" will serve as a creative proof of blockchain verification, allowing IP owners to authenticate, license and monetize their works on Story Protocol.

Disclaimer: As a blockchain information platform, the content of the articles published by Golden Finance is for information reference only and is not used as actual investment advice. Please establish the correct investment philosophy and be sure to improve your risk awareness.

chaincatcher

chaincatcher

panewslab

panewslab