From DeepSeek to Peer-to-Peer Tariffs, Web3 won't end

Reprinted from panewslab

02/17/2025·2MAuthor: Zuo Ye

Let the little whale fly and fly out $TRUMP

The golden cup is shared by you, and the sword is not free. Everyone regards Trump and Mile as international right-wing alliances, but the way they issued coins makes this convertible alliance look quite "not like a king" Abstract feeling.

Then on Valentine's Day, Sichuan Bao sent reciprocal tariffs to the whole world, but it was obviously discounted. It would take effect only in April, and the news must be released in advance, waiting for all parties to negotiate their own conditions, and directly create cards out of thin air .

Faced with Mile's international fraud, no one had expected Trump to issue coins himself. So on Mile, people forgot the lesson of a one-day trip to the President of China-Africa celebrity coins, because Mile focuses on liberalism. , there are many audiences in the currency circle, but in the end I didn’t expect that the person who loves you hurts you the most.

Back to the influence of DeepSeek, companies in China, the United States and Europe are currently connecting. The most difficult thing is that American capitalists call the US government to impose sanctions and bans. This is actually very uncapitalist, more close to industrial policy, and contrary to Tiangang.

Although no one expected DS to launch an open source + cheap technology surprise attack, because the stereotype has always been that the domestic industry is not good at open source and originality, and is only good at plagiarism and implementation, but this time it basically changed the existing impression, but instead it is Under the influence, OpenAI may re-select the open source route.

In essence, because the United States is actually deindustrialized, only the high valuation of the financial industry maintains the international purchasing power of the US dollar, resulting in all current technologies and products eventually becoming financial miracles to prove the superiority of the United States.

From DeepSeek to reciprocal tariffs, we can predict Trump's main trends in the next four years in advance. The general direction of financialization is undoubtedly, and industrialization is impossible, but then we will be brave enough to make money in the name of industry. Yes, and very large.

Because DeepSeek has been here, AI narrative went bankrupt in stages

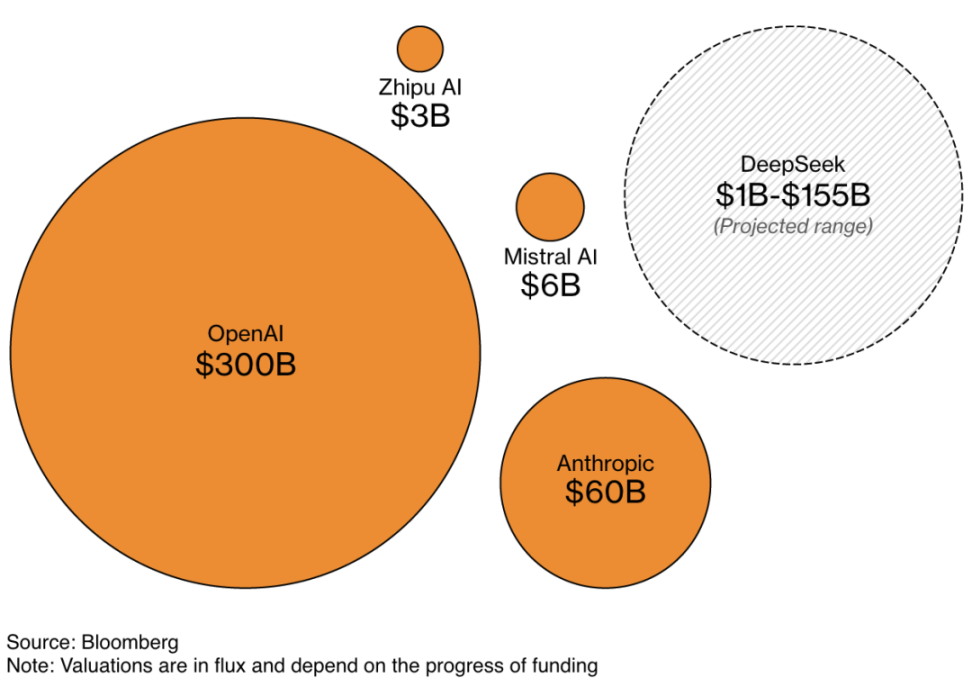

In the DeepSeek incident, Trump praised first and then banned and then praised, and performed a hat-trick acting. However, in the latest news from Bloomberg, the valuation of DeepSeek is between 1 billion and 155 billion, which is approximately the OpenAI estimate. Half of the value can become the Pente estimation system.

However, under the current situation of US funds accessing, highlighting the principle of free who doesn’t love it, DeepSeek will also seriously interfere with Trump’s thinking, because Trump’s reciprocal tariff policy is essentially a political weapon, not an economic one means.

In Trump's perception, because other countries can enjoy "most-favored-nation" treatment, the United States needs to reduce tariffs on national products entering the United States, but American products entering other countries will face higher tariffs.

But in fact, this is the inevitable consequence of the United States' choice to establish a financial country and the internationalization of the US dollar. If the United States does not maintain its trade deficit status, other countries will not be able to obtain US dollars for easy trading. In view of this, combined with the latest statement of the Federal Reserve, we need to read it for a considerable time. Powell's expectation of interest rate hikes and interest rate cuts will, but in fact, like the housing prices of major Eastern countries, cannot rise or fall.

Going back to the subsequent price forecast of Web3, you need to build the following four basic cognitions, otherwise you will feel that Meme and BNB Chain are the main themes in the future, but this is not the case at all:

- The US stock market needs to find new support points. What the US stock market is talking about will be said in the currency circle. There is no independent market in the currency circle;

- Funds are now on various ETFs, and there is basically no spillover in the circle, but mainly because there is no technical narrative support. Pure Meme PVP cannot attract long-term funds to participate in the game;

- Next, look at the US stock market, ETF, DeepSeek response (new AI algorithm, new direction of embodied intelligence, new direction of biotechnology), Ondo+ BlackRock, government, traditional finance or government link

With Nvidia's market value returning to 3 trillion yuan, US stocks have basically emerged from the impact of DeepSeek, and GPT and Google have released new products, but the market response is mediocre. Although we are lucky enough to pass the test, we need to find new hot spots to save AI and computing power valuations. lever.

Overall, he is still positive about the US stock market and the currency circle. Musk is putting government information and funds on the chain. If he goes to Ethereum or solana, it will be a new super market. If he creates an alliance chain by himself, then nothing is wrong. Fun.

Web3 won't fall down because of Meme

Under the joint effect of DeepSeek impact, the Web3 AI Agent narrative has reached a temporary bankruptcy time. After the Meme PVP mechanism was pulled away by the three-combo of $TRUMP/MELANIA/LIBRA, it has now come to the boring second-hand time stage.

CZ still maintains its influence on Binance, such as TST, criticizing Binance's currency policy, but after all, it flows eastward. Under the supervision of the US Department of Justice, Binance, Labs and BNB Chain were completely separated, from The process of investing and incubating to listing coins has been broken up. I have always believed that Binance is regulated, which is the real reason for the bankruptcy of VC currency narratives, and at least it is also the starting gesture of pushing dominoes.

Binance spent several years to include all the processes of chip establishment and final distribution. The strongest liquidity led to the largest increase in currency listing, and the largest increase in currency listing caused the project party to be willing to discount the Labs and BNB holders. , This process continues to cycle, and ultimately creates the strongest Web3 Fortune Group.

But now none of these conditions exist:

- BN, BN Labs and BNB Chain are actually separated, and BNB Chain and Labs project parties cannot obtain a more reliable coin listing commitment;

- With the strong rise of DEX, BN main website and other CEXs have the risk of becoming a single way to exit tokens, and simply improving the currency listing process to treat the symptoms but not the root cause;

- The hidden worries of VC coins are the phased bankruptcy of technical narratives, and it is also difficult to maintain long-term effects on the BNB Chain, which dominates Meme/DeSci/AI Agent.

But there is no need to worry about it. There is no other benefits of Web3. Robust is indeed as tough as ever. The next real impact is that more Altcoin ETFs will gradually pass after BTC/ETH, and continue to absorb PVPs that should have entered the circle. Where the currency circle is going is a big question at a time when neither VC currency nor Meme currency can be maintained.

In other words, you can avoid VC coins with high FDV and low liquidity models, and you can also play Meme. You must be honest with Buidl, but you must have new ideas. Judging from the lessons learned from the two crises in 2017/2021, Web3 There will always be a new paradigm, but anyone with the mark of the past will be thrown away.

Under the CEX crisis represented by Binance, the opportunity for DEX has actually arrived, but Jupiter's performance and controversy, Solana is faster, but it is indeed not as stable as the ETH ecosystem. Before February, FUD ETH's sentiment reached its peak , Everything will turn back when extremes are extremes. The currency circle changes too quickly, which makes people overly anxious, but it is really unnecessary.

Conclusion

The way of exposing the old and accepting the new is natural. At a time when macroeconomic policies are full of uncertainty, the continuous DEX construction has proved as we have once believed that CEX is necessary and irreplaceable evil, and it can really be challenged, but this time it is not The technology-led innovation like ETH ZK L2 is more about innovation in combination of product ideas and existing technologies, but the success of DeepSeek has proved that engineering progress is a necessary path for the large-scale spread of technology.

In the old days, the king thanked BTC and flew into the homes of ordinary people.

chaincatcher

chaincatcher