Explore the field of tokenized securities and leading projects

Reprinted from jinse

06/04/2025·13DOriginal title: Tokenized securities-the integration and reshaping of digital finance

Author: 0xEdwardyw; Source: tokeninsight

This article will explore the definition and operating mechanism of tokenized securities in depth, introduce leading projects in this field, and analyze the key risks and regulatory challenges they face.

1. What are tokenized securities and their operating principles?

Tokenized securities are essentially digital tokens representing the ownership of traditional financial assets (such as stocks, bonds) on the blockchain . In short, tokenization is the conversion of real-world assets into digital tokens that can be traded on the blockchain. For example, investors no longer hold paper stock certificates or records in brokerage databases, but hold crypto tokens representing the company's shares. These tokens are backed by actual assets and granted the same property rights, they are just a new digital encapsulation of assets.

To summarize, tokenized securities operate by binding real assets to blockchain-based tokens. Its typical support, issuance and transaction processes are as follows:

- Underlying assets and custody:

1. Trusted entities, such as financial companies, keep real-world assets that will be tokenized. If it is a stock, it means purchasing and escrowing the actual company shares.

2. Tokens are usually **fully collateralized 1:1** by the underlying assets, that is, each token corresponds to one (or part) of the custodian shares.

3. Licensed custodians (usually banks or regulated companies) hold actual stocks or other assets in the trust, ensuring that the token has real value support.

2. Token issuance on blockchain:

1. Issuers create digital tokens on the blockchain platform to represent these assets. This usually involves **smart contracts** —self-executed code on the blockchain, used to manage attributes of tokens (such as total supply and redeemability).

2. The issuance of tokens is subject to applicable laws and regulations (for example, some platforms comply with the Swiss Distributed Ledger Technology Act).

3. The final crypto token (usually following standards such as Ethereum ERC-20) corresponds to the real assets custodial in legal or contract.

3. Token trading:

1. Once issued, these securities tokens can be traded like cryptocurrencies, both on **specialized exchanges** and sometimes on **decentralized finance (DeFi) platforms** .

2. Holders can **buy and sell tokenized stocks 24/7** on supported exchanges or via peer-to-peer approach, without the need for traditional stock brokers.

3. Token prices are designed to closely track the prices of underlying assets.

Overall, the system relies on trust in the issuer/manager. Blockchain records token ownership and makes transfers transparent and quick. At the same time, the custodian ensures that each token in circulation corresponds to the real assets in the reserve.

**2. Stablecoins and tokenized securities: Opening the door to the US

market globally**

For many investors outside the United States, access to exposure to U.S. stocks has long been difficult. High fees, regulatory restrictions, limited access to brokerage accounts, and inconvenient trading hours have caused huge friction, especially retail investors in emerging markets. Although U.S. stocks remain one of the most popular assets in the world, there are few seamless and inclusive pathways that traditional financial systems offer international players.

This is the area where blockchain innovation begins to fill this gap. The combination of tokenized securities and stablecoins provides access and infrastructure:

-

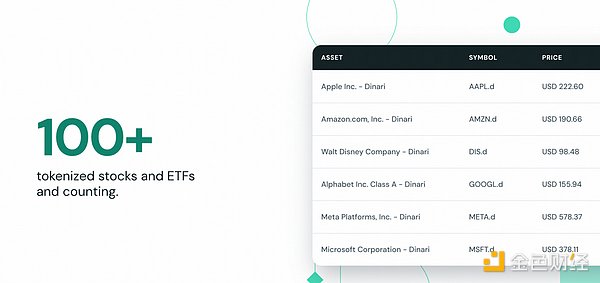

Tokenized stocks , such as Apple or Tesla stocks issued by platforms such as Backed Finance and Securities, allow investors to gain exposure to real U.S. stocks on the chain, usually in fractions , without the need for traditional brokerage services.

-

Stable coins (such as USDC or USDT) serve as borderless media to enable near-instant, low-cost cross-time zone and cross-jurisdiction settlement of these securities.

With the progress of U.S. stablecoin regulation (which is highlighted by the Senate’s recent GENIUS Act), the market is generally optimistic that a clear legal framework may accelerate the convergence of tokenized finance. As compliant stablecoins promote frictionless global payments, and tokenized securities provide transparent access to U.S. assets, a liquidity cycle may eventually emerge—capital can be liquidated, invested and settled entirely on-chain, cross-border and without traditional gatekeepers.

3. Industry-leading projects

In recent years, tokenized securities have moved from theory to practice, and some well-known projects are leading the way in this field.

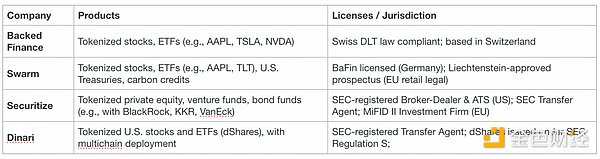

- Backed Finance

-

Background: Swiss fintech companies focused on tokenizing real-world assets (stocks, bonds, indexes, etc.) into freely tradeable tokens.

-

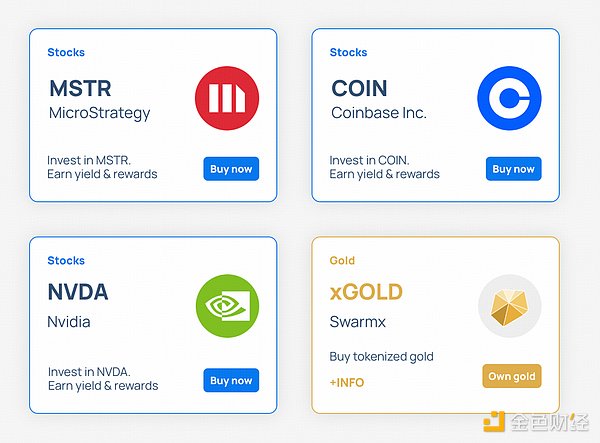

Cooperation Example: In May 2025, cryptocurrency exchange Kraken announced a partnership with Backed Finance to provide more than 50 tokenized U.S. stocks and ETFs (such as AAPL, TSLA, NVDA) to customers outside the United States.

-

Features:

-

Each Backed token (such as “APPLx” representing Apple or “TSLAx”) is fully collateralized by the underlying stock held by the licensed custodian.

-

The issuing xStocks is a freely transferable token that is not locked on a single platform and users can save it in a self-hosted wallet.

-

In addition to basic trading on centralized exchanges, xStocks can also be used in decentralized exchanges (DEXs) and integrated into lending protocols.

-

-

Regulation and transparency:

-

Operate under the Swiss DLT Act to ensure that all tokenized assets meet regulatory standards.

-

Use the licensed custodian to hold underlying assets and integrate Chainlink's Proof of Reserve to provide transparent verification of asset-backed.

-

- Swarm

-

Background: European blockchain platform, dedicated to connecting traditional finance with decentralized finance (DeFi).

-

Core features: Allow real-world assets to be converted into digital tokens and traded 24/7 on decentralized exchanges while fully complying with financial regulations.

-

Tokenable assets: a wide range of niche assets including publicly traded stocks, bonds, real estate, and even carbon credit.

-

Practical case: Tokenized versions of popular technology stocks (such as Apple, Tesla, Intel) have been launched, as well as short-term US Treasury funds (through iShares ETF products).

-

Regulatory compliance:

-

Headquartered in Germany, it operates under the supervision of the German Financial Supervisory Authority BaFin .

-

Its tokenized securities have approved prospectuses in Liechtenstein, enabling it to provide these digital assets to retail investors in the EU without a minimum investment limit .

-

- Dinari

-

Background: American fintech companies aim to achieve democratized access to U.S. stocks through blockchain technology.

-

Core Products: dShares, is an ERC-20 token that represents part of the ownership of real-world assets such as U.S. stocks and ETFs.

-

Mechanism: Each dShare is fully collateralized, maintaining 1:1 support with the corresponding underlying assets. The issuance and redemption of dShares is managed through automated smart contracts and cooperation with clearing services.

-

Regulatory compliance:

-

Register as a Transfer Agent with the U.S. Securities and Exchange Commission (SEC) to ensure that its operations comply with established financial regulations.

-

dShares is issued under SEC Regulation S to meet the needs of non-U.S. investors while complying with U.S. securities laws.

-

-

Enterprise Solutions: Support enterprises to integrate tokenized assets into their platforms through their comprehensive APIs and developer tools.

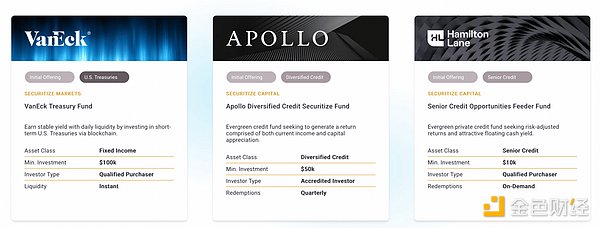

- Securitize

-

Background: American fintech companies, one of the leading platforms in the field of tokenized securities.

-

Core Services: Provide a fully digital, regulated platform for issuing and trading digital asset securities – converting traditional financial assets (such as stocks, bonds, investment fund shares) into blockchain tokens that can be easily bought and sold.

-

Cooperation case: Cooperation with major asset management companies such as BlackRock, Hamilton Lane and KKR to launch tokenized investment funds on the blockchain. These tokens allow investors to partially acquire private equity funds, venture capital funds or stock/bond portfolios in a more convenient form.

-

Multiple regulatory licenses:

-

In the United States, Securities Markets LLC is registered as a broker-dealer under the SEC and operates an alternative trading system (ATS) regulated by the SEC for secondary trading of tokenized securities (under FINRA/SEC supervision).

-

In the EU, Securities has been authorized by MiFID II to become a regulated brokerage proprietor in Spain (granted by the Spanish National Securities and Markets Commission CNMV), meeting the EU's strict requirements for tokenized asset trading platforms.

-

4. Risks and Challenges

As an emerging field, tokenized securities also face a series of key risks and regulatory challenges.

- Custody and counterparty risks:

1. Purchasing tokenized securities means trusting the issuer to indeed hold underlying assets and act in good faith.

2. This involves dependence on custodians and issuers, unlike purely decentralized assets such as Bitcoin.

3. If a company that represents you holding real stock goes bankrupt, is hacked or even cheated, your tokens can become worthless due to loss of support. Essentially, you trust not only the code, but also a company that can safely keep assets.

2. Technology and smart contract risks:

1. Tokenized securities run on blockchain networks and rely on smart contracts, thus inheriting typical crypto-tech risks.

2. Smart contracts may have vulnerabilities and are exploited by hackers. There have been cases of losses or thefts caused by defects in token contracts or agreements in the DeFi field.

3. If the token contract is written improperly, fake tokens may be maliciously minted.

4. The blockchain platform itself can also pose risks, for example, if the token is located on a chain with less security or decentralization, there may be a risk of cyberattacks or downtime.

3. Regulatory uncertainty:

1. Tokenized stocks are essentially securities and are governed by complex securities laws.

2. Different countries have different regulations and many regulators have not yet fully clarified how to deal with blockchain-based securities.

3. For example, in the United States, the SEC has strict requirements on the public offering of securities, and so far, **no tokenized stock products have been approved by retail investors in the United States** .

4. Platforms typically restrict tokenized securities to only target non-U.S. residents to avoid violating U.S. laws.

5. The lack of clear global standards means uncertainty: projects may be launched in the gray zone and then face legal obstacles, or regulators may take action if their issuance circumvents investor protection.

chaincatcher

chaincatcher