Bitwise: What happens if you configure 10% of Bitcoin

Reprinted from jinse

06/04/2025·13DAuthor: Matt Hougan, Chief Investment Officer of Bitwise; Translated by:

AIMan@Golden Finance

Bitcoin is a highly volatile asset. By the most common volatility measures, the volatility is about three to four times that of the S&P 500.

However, this does not mean that adding bitcoin to the portfolio will significantly increase the volatility of the portfolio. As Bitcoin proponents like me like to point out: Since Bitcoin is low in correlation with stocks and bonds, historically adding it to a portfolio can improve returns without significantly increasing risk.

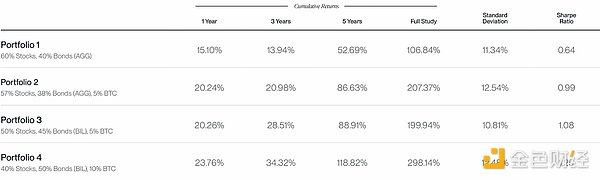

The typical way researchers prove this is to take a traditional 60/40 portfolio (60% stock, 40% bond) and gradually transfer a small portion of the funds into Bitcoin. The following table compares the risk and return indicators of portfolios with Bitcoin allocation ratios of 0%, 1%, 2.5% and 5% from January 1, 2017 to December 31, 2024, respectively. I used the calculations with the free portfolio simulation tool available in the Bitwise Expert Portal.

Portfolio performance indicators allocated by Bitcoin

Source: Bitwise Asset Management, data from Bloomberg. The data range is from 1 January 2017 to 31 December 2024. "Stocks" are represented by SPDR S&P 500 ETF Trust (SPY). The “bond” is represented by the iShares Core US Aggregate Bond ETF (AGG). Bitcoin is represented by the spot price of Bitcoin. Taxes or transaction costs are not considered. Past performance cannot be predicted or guaranteed future results. Nothing contained in this article is intended to predict the performance of any investment. The historical performance of the sample portfolio is generated and maximized based on hindsight results. Earnings do not represent the earnings of the actual account, nor do they include expenses and expenses associated with the purchase, sale and holding of funds or crypto assets. Performance information is for reference only.

For example, note that by allocating 5% of your funds to Bitcoin, your total return rate increases from 107% to 207% (up by 100 percentage points)! And the standard deviation of your portfolio (measure its volatility) has only slightly increased, from 11.3% to 12.5%.

I think this kind of research is very convincing. It is consistent with the idea that most investors allocate Bitcoin. But lately I have been wondering if there is a better way.

Can you get more rewards and reduce risks?

There is a secret for people working in the cryptocurrency industry: their personal portfolios are usually different from what I listed above. In my experience, the investment portfolios of cryptocurrency enthusiasts are often leveraged - cryptocurrencies account for a large proportion, cash (or money market funds) also account for a large proportion, and there is very little allocation in the middle. (My portfolio is roughly half of cryptocurrency, stocks and cash each, and I'm not crazy enough to suggest others do the same. But hey, let's get it public.)

Reflecting on this made me think: Does it make sense to compensate by managing risks elsewhere in the portfolio when you add Bitcoin to your portfolio?

In the example above, we made room for 5% of Bitcoin exposure by reducing the stock/bond portfolio by 60/40 proportionally, taking 3% from the stock and 2% from the bond.

If we can all do the following:

Investing 5% of the funds in Bitcoin and increasing bond allocation by 5% can theoretically reduce stock risks;

Rotary exposure from broad bonds to short-term government bonds can theoretically reduce bond risks?

Portfolio 3 shows results:

Source: Bitwise Asset Management, data from Bloomberg. The data range is from 1 January 2017 to 31 December 2024. "Stocks" are represented by SPDR S&P 500 ETF Trust (SPY). The “bond” is represented by the iShares Core US Aggregate Bond ETF (AGG). Bitcoin is represented by the spot price of Bitcoin. Taxes or transaction costs are not considered. Past performance cannot be predicted or guaranteed future results. Nothing contained in this article is intended to predict the performance of any investment. The historical performance of the sample portfolio is generated and maximized based on hindsight results. Earnings do not represent the earnings of the actual account, nor do they include expenses and expenses associated with the purchase, sale and holding of funds or crypto assets. Performance information is for reference only.

Very interesting, right? Portfolio 3 has a higher return than Portfolio 1, roughly the same return as Portfolio 2, and has a lower risk than both.

This makes you wonder: What if you push further?

The following table adds a fourth portfolio, cutting stock exposure to 40%, increasing bond portfolio to 50%, and increasing to 10% of Bitcoin.

Source: Bitwise Asset Management, data from Bloomberg. The data range is from 1 January 2017 to 31 December 2024. "Stocks" are represented by SPDR S&P 500 ETF Trust (SPY). "Broad Bond" is represented by the iShares Core US Aggregate Bond ETF (AGG). "Short-term Treasury Bonds" are represented by the SPDR Bloomberg 1-3 Month Treasury Bonds ETF (BIL). Bitcoin is represented by the spot price of Bitcoin.

Compared to Portfolio 2, you can get more returns and less risk.

Of course, no one can guarantee that this will continue in the future—Bitcoin’s early returns are excellent, and future returns may not match the returns during this study period.

But the data emphasizes one thing: Don't do it in isolation when you think about adding bitcoin to your portfolio. Consider it in combination with your overall risk budget. You may be surprised by the results