EOS "departs" in a frustrated manner: renamed Vaulta to transform into "Web3 Bank" to make wedding dresses for the ecological project exSat

Reprinted from panewslab

03/20/2025·2MAuthor: Frank, PANews

EOS, once known as the "Ethereum Killer", officially announced its brand upgrade to Vaulta, starting a strategic transformation with Web3 Bank as the core. From public chain infrastructure to institutional-level banking business narrative, the EOS Foundation has found inspiration through exSat reconstructing the Bitcoin ecosystem, which is also an opportunity to completely cut off the historical burden.

Behind this transformation is the helplessness of the failure of competition in the public chain track, or the ambition to bet on Web3 financial compliance? When Vaulta tokens replace EOS, RAM scarcity surpasses native tokens, and exSat independent ecosystems mainly turn around, a backdoor-style ecological transformation has quietly begun.

Can Canadian asset custodians complete the transformation of Web3

banking?

EOS has several key points in its latest brand upgrade plan. One is about the next Web3 banking brand narrative, and the other is about how to implement this narrative path. The third is about some potential changes in token economics.

First of all, the reason why Web3 banking business is needed in the direction of brand upgrades was emphasized in the announcement. One is that the adoption rate of cryptocurrencies worldwide continues to increase. Second, the market value of stablecoins continues to rise. The third is the market potential of RWA. Judging from these starting points, EOS's next new goal seems to be to become another XRP, and this transformation seems to be related to the external environment of the crypto market.

In addition, Vaulta has also announced the launch of a banking advisory committee. The current position and specific role of this banking advisory committee in ecological governance has not been mentioned.

Judging from the background of these bank information committee members, these institutions are actually not traditional banks, but are mainly asset custodians. And it is highly regional, all from Alberta, Canada. Among them, ATB Financial is the largest financial institution in Alberta. It was established in 1938 with assets of US$65.5 billion and serving more than 830,000 customers. The other companies are digital asset custody companies that were created within a few years, and the specific scale of managed assets has not been disclosed.

However, overall, although cooperative financial institutions hold Canadian compliance licenses, they still need to be questioned whether their regional attributes match Vaulta's global Web3 banking vision.

The upgrade called EOS is actually a wedding dress for exSat

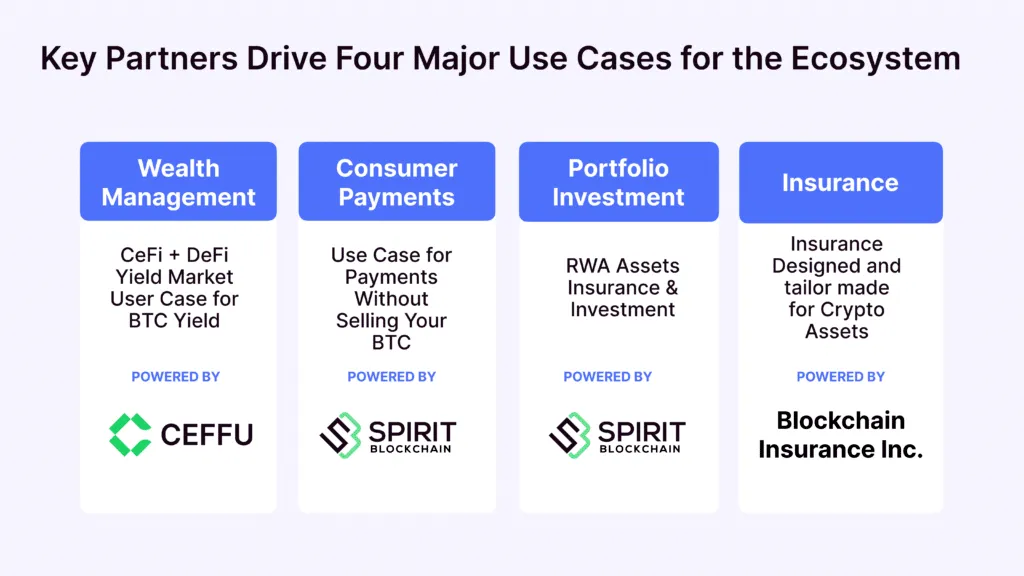

In the new announcement, Vaulta mentioned four major business directions as its core pillar. These are wealth management, consumer payment, securities investment, and insurance. Among these four businesses, the focus can be on the exSat business launched to institutions in wealth management.

exSat is a project on Bitcoin scalability launched by the EOS ecosystem in 2024. As a "Docking Layer" connecting the Bitcoin main chain and layer 2 expansion solution, it uses EOS RAM to store and process Bitcoin data, enhancing Bitcoin performance and interoperability. Its main function is to achieve faster and lower-cost Bitcoin transactions and provide the Bitcoin ecosystem with space to carry out DeFi business.

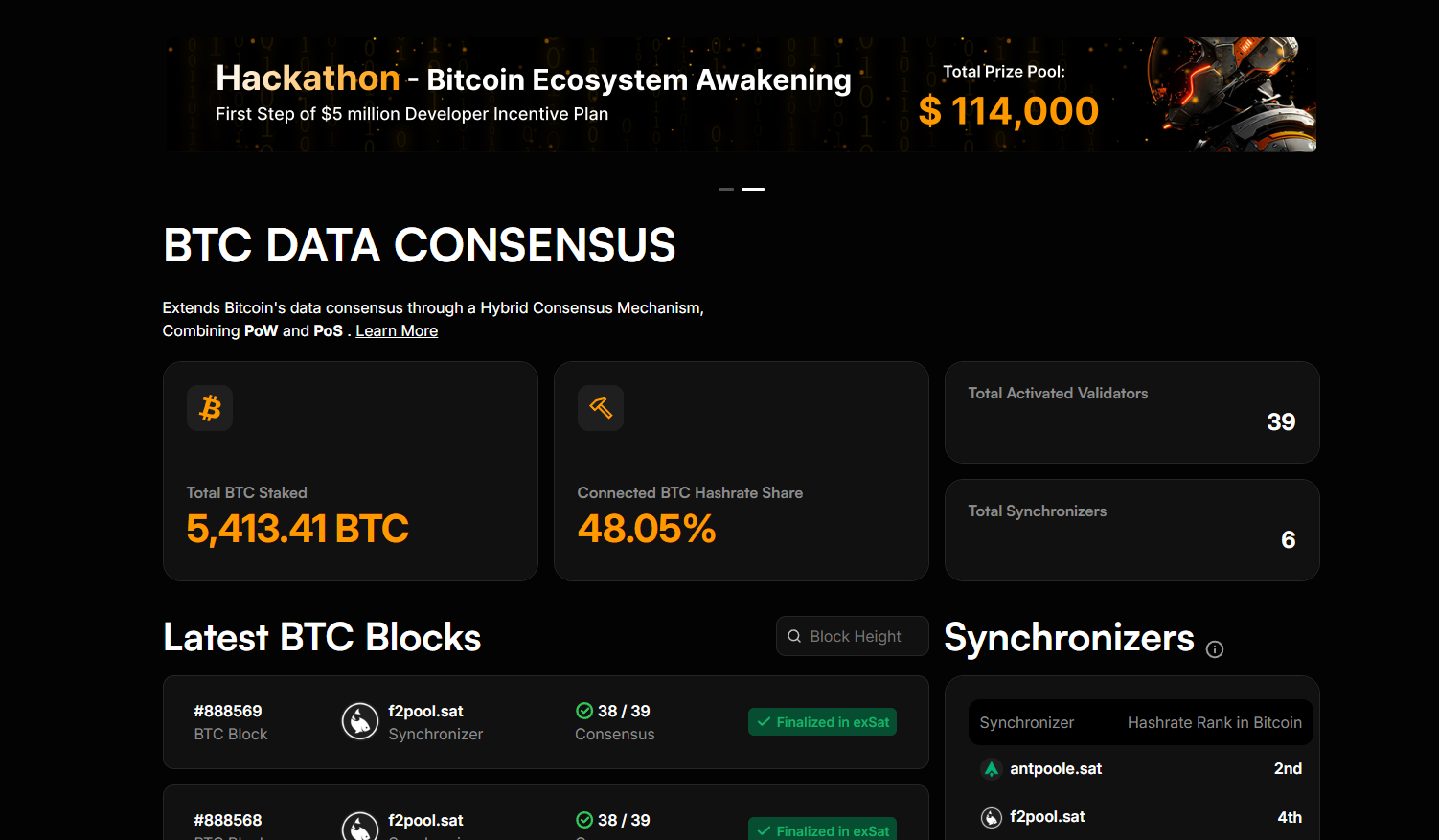

This project seems to have gained influence beyond EOS itself. As of March 20, the Bitcoin staked on exSat was 5,413 BTC, and TVL had reached US$587 million, far exceeding the US$174 million of the EOS main network.

Therefore, in the brand upgrade plan, it is not difficult to see why the focus is basically on exSat rather than EOS. In fact, exSat has an independent consensus mechanism (the combination of three consensuses: POS+POW+DPOS), and there are currently 39 validators. Among these validators, some well-known encryption institutions can be seen participating, such as Certik, Hashkey, Bitget, F2pool, OKX, Matrixpt, Tron, etc. Judging from various characteristics, exSat seems to have become another independent public chain grown from EOS, but it still uses EOS's RAM and block space.

Vaulta tokens will be launched, the tokens are weakened and RAM is more

scarce

In terms of token economics, Vaulta will also replace EOS tokens with Vaulta tokens. But it is obvious that the new Vaulta token will be greatly weakened in terms of governance functions. Just as this brand upgrade plan was not launched through voting proposals but was directly released by the EOS Foundation. The governance of the EOS network seems to be in name only.

The announcement shows that "Vaulta token holders pledge tokens and receive rewards, actively participate in governance, and vote for block producers responsible for managing network consensus and security. With the development of Vaulta, token holders of all sizes can participate in discussions and proposals." In this description, we can see that the main benefit of token holders is that they can pledge rewards. Regarding governance, it seems that only votes for block leaders. This is the consensus mechanism design of DPOS and does not fall into the scope of governance. As for when token holders can participate in substantive governance, the right to interpret is still in the hands of the foundation.

However, judging from the current EOS token price and TVL, this block reward seems to only meet the normal operation of the infrastructure. No one seems to actively promote the expansion of the EOS ecosystem, but only does a good job in infrastructure for exSat. In addition, it was proposed in this announcement that EOS tokens can be exchanged for Vaulta tokens 1:1, but it did not specify whether Vaulta tokens will be issued on the basis of EOS.

With this brand upgrade, the importance of RAM seems to be more scarce than EOS tokens. “As Vault expands its role in decentralized finance and Web3 banking, the inherent scarcity and growing demand of RAM put holders in a unique position.”

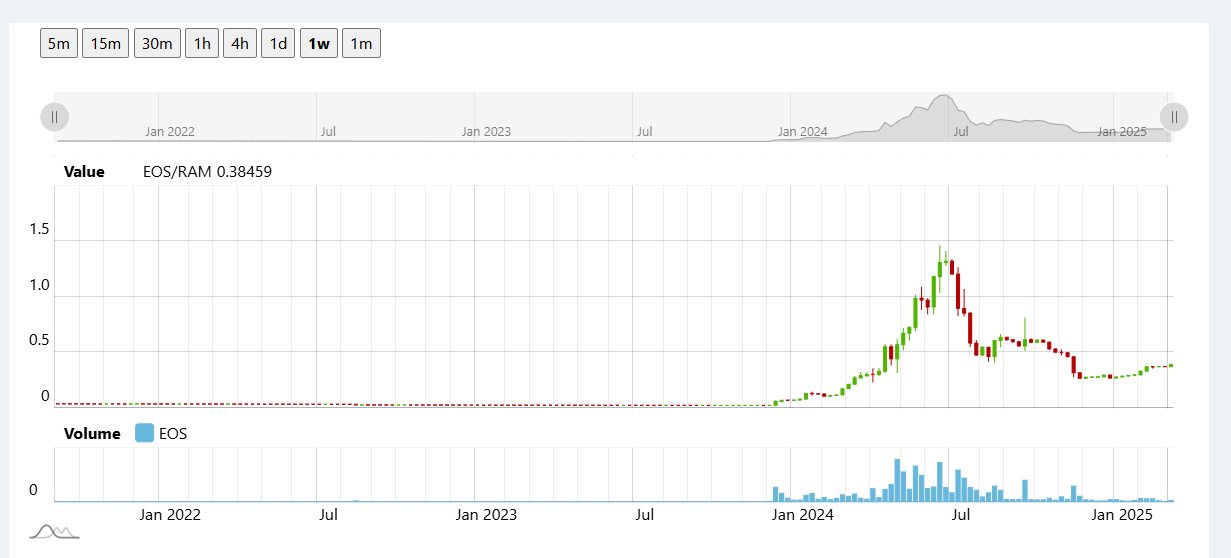

RAM is the running memory within the EOS network, and all products running on the EOS network require rental memory. exSat is no exception, as the current design of the total amount of RAM is that inflation has stopped. Therefore, as a strategic resource in the network, the practicality and value potential of RAM seem to be higher than the token itself.

Judging from the price trend, the price trend of RAM is much more stable than that of EOS tokens.

4 billion ICO financing giant, frustrated exit from the stage of history

Essentially, the biggest change in this brand upgrade seems to be that EOS's original route has been completely abandoned. Due to the failure of ecological construction in recent years, EOS has failed in the direction of land grabbing in public chain competition. Fortunately, EOS has never had any problems with performance. The new Vaulta brand seems to be integrating with EOS's existing infrastructure and the exSat network that launched the effective exSat network last year. It is still unknown whether Vaulta's Web3 bank will be successful. But what will definitely happen is that the EOS brand will completely withdraw from the stage of history.

In fact, for users who entered the encryption field earlier, the end of EOS seems to be a pity. In 2017, EOS raised US$4 billion through ICO, setting a record cryptocurrency history. At that time, the founder of Solana was still struggling to raise funds and finally received only US$3.17 million in seed support.

In 2018, the influence of EOS online was at its peak. Just like Solana's suppression of Ethereum today, there are many voices in the market that EOS will soon become the new king of public chains. Its price also rose to $15.6, with a market value of nearly $18 billion, ranking third in the market. Currently, the market value of EOS tokens is only US$870 million, and the ranking is also ranked 97th.

The biggest reason for this huge gap is the inaction of Block.one, the project that has received huge financing, has all been hit by several projects launched by the official. With founder Daniel Larimer resigning from Block.one's chief technology officer. The community's trust in EOS has also disappeared further.

Although the new EOS Network Foundation was established in the later stage and many economic model adjustments and infrastructure upgrades were made in 2024, none of them seemed to have caused a stir in the market. With the launch of exSat at the end of 2024, EOS unexpectedly achieved some success in the construction of the Bitcoin ecosystem. But what's interesting is that the EOS network has never counted the exSat data into its own ecosystem data, and it seems that it has made a purposeful difference from the beginning. Perhaps this Vault upgrade is not a temporary plan, but has been planned for a long time.

The brand effect of EOS seems to be worthless, so the EOS Foundation chose to give up almost completely to upgrade this time (although the brand name of Vault is not necessarily more intuitive and easy to remember).

Back then, a saying circulated in the EOS community: "I will never see EOS under 100 yuan again." With this brand transformation, this sentence has finally come true. But this time it has nothing to do with the market trend, but EOS will never be seen again.