Hyperliquid giant whale earns 5.1 million by 50 times shorting. What impact does Ming Card trading behavior have on the market?

Reprinted from panewslab

03/20/2025·2MAuthor: Glendon, Techub News

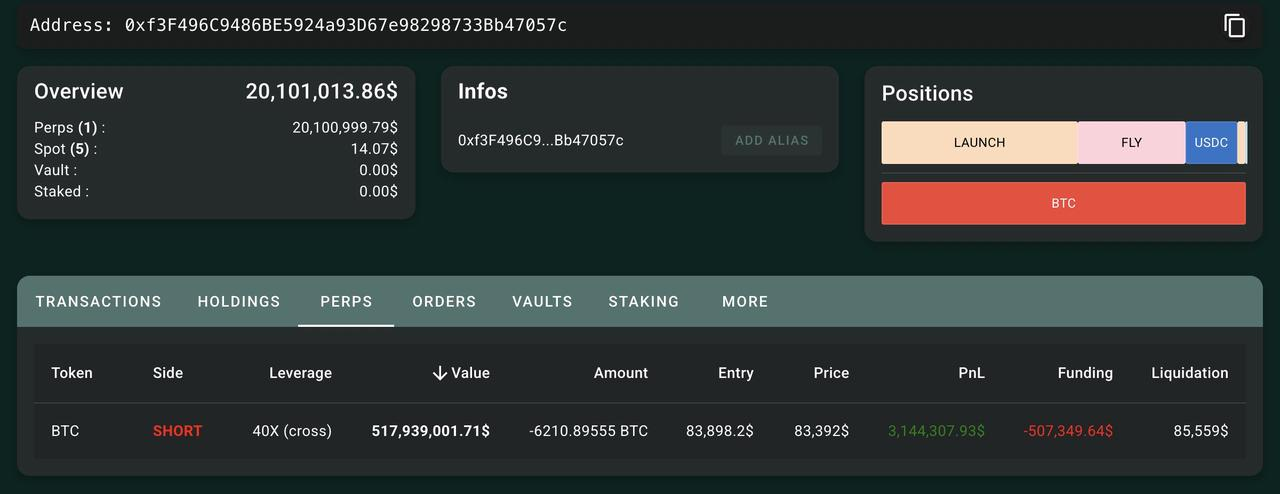

On March 18, the "Hyperliquid 50x leverage giant whale" that has caused frequent discussions in the crypto community recently shorted Bitcoin with 40x leverage, successfully making a profit of 5.101 million US dollars. According to Hypurrscan.io data, the "Giant Whale" set a record high in its holdings with 6210.89 Bitcoins, with a position value of approximately US$518 million, a cost price of US$83,898.2 and a liquidation price of US$85,559.

According to Ember Monitoring, the "Giant Whale" had transferred 16.75 million USDC to Hyperliquid as margin, which is all funds in its address, including principal and all profits in the past month.

Before this, the "Whale Hunting Team" was ready to go, claiming that "Bitcoin will break its liquidation price today", but their public sniping round ended in failure.

According to monitoring by Ai, an analyst on-chain, since March 2, the "Giant Whale" has a record of 8 wins in 9 games, with a winning rate of 88.9%, and a total profit of 16.336 million US dollars. Just two hours after it completed the previous transaction, the "Giant Whale" once again transferred 500,000 USDC margin to Hyperliquid, opening MELANIA's 5x leverage long orders. Affected by this, MELANIA rose by about 5% in a short period of time.

Seeing this, you may be curious about who this "Hyperliquid 50 times leverage whale" is, and can drive the price of tokens to rise with just one's own strength? At the same time, what's going on with the "Whale Hunting Team"? Let's learn about the whole story of this matter.

Is it a "Insider Brother" or a "operating master" in seven battles?

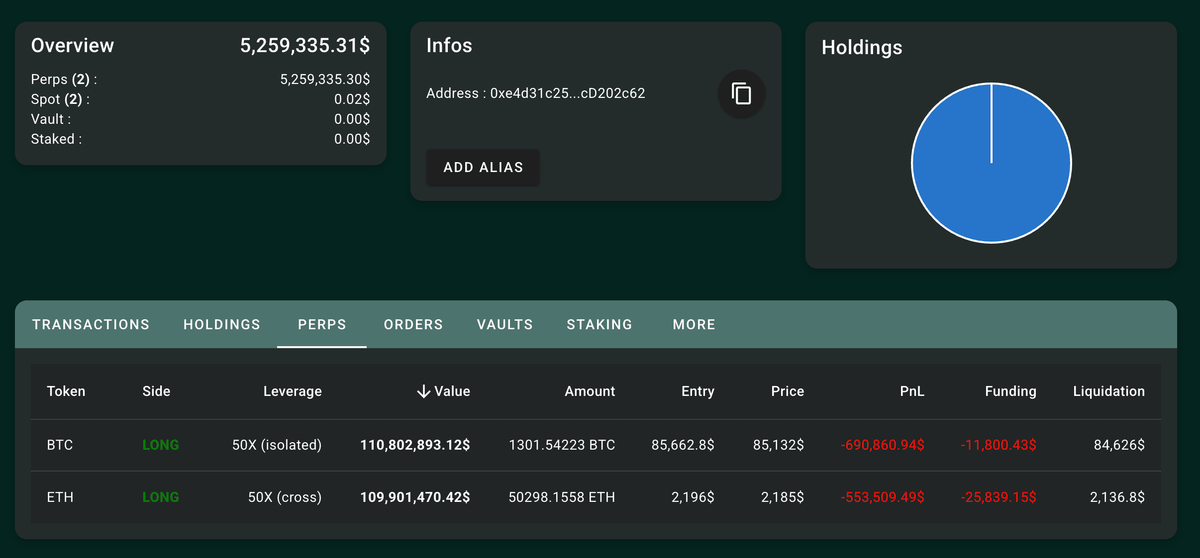

As early as March 2, the "Giant Whale" went long with 50 times leverage on Hyperliquid through an address starting at 0xe4d, which began to attract the attention of some cryptocurrency KOLs.

Hyperliquid is a decentralized perpetual contract trading platform that has become a paradise for high-risk traders with efficient on-chain order books, zero Gas fees and up to 50 times leverage. At that time, the "Giant Whale" opened a long position of more than US$200 million with a principal of US$6 million on this platform.

-

Bitcoin: 1260 pieces, opening price is US$85,671, liquidation price is US$84,629;

-

Ethereum: 49,384 pieces, opening price is US$2,196, and liquidation price is US$2,133.9.

Since the liquidation space for these two short positions is only US$1,042 and US$62.1, the decline will only reach 2.8% and the position will be over. Therefore, at first, the "giant whale" was once considered the "ultimate gambling dog". Subsequently, the long position of the address increased its position by 914 ETH and 41 BTC, and its floating loss at that time had exceeded US$900,000.

However, the market is always full of variables. At around 23:00 that night, as Trump issued a statement saying that the presidential working group would promote strategic reserves of cryptocurrencies including XRP, SOL, ADA, BTC and ETH, the crypto market immediately ushered in a wave of rises, and the address quickly turned losses into profits, and eventually successfully made a profit of US$6.83 million.

However, because the timing and clearance points of the order were too extreme, there were endless speculations in the community that "may be an insider close to Trump". Some even believed that the "big whale" might be Trump's second son Eric Trump. So, the "Giant Whale" was praised as the "Insider Brother".

On March 3, the "Giant Whale" once again issued a BTC short order of $13.45 million, only 20 minutes before the opening of the US stock market. It was also a familiar 50 times and a sensitive time point. At that time, the difference between the opening price (93117.5 US dollars) and the liquidation price (94083 US dollars) was only US$965.5, while the floating loss reached US$60,000. But similar to the previous situation, the address quickly reversed its losses and eventually retired with a profit of nearly $300,000.

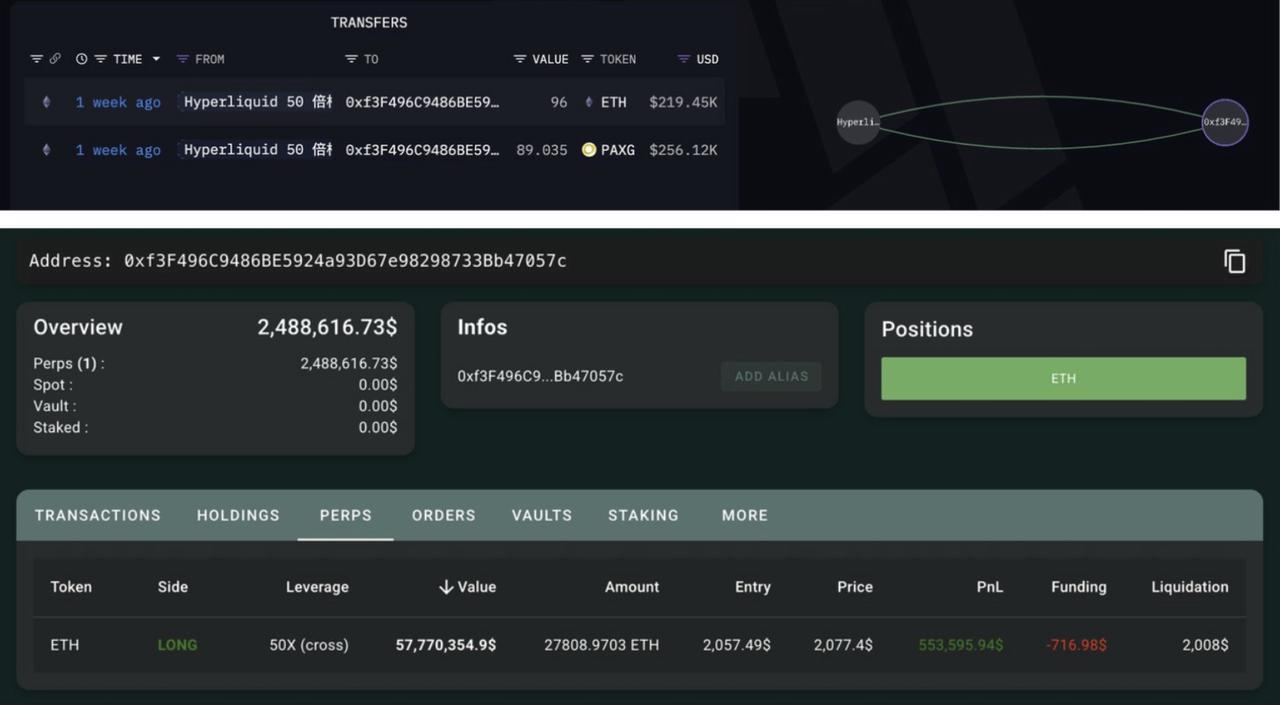

After that, the "giant whale" seemed to have stopped for nearly a week. Until March 10, according to monitoring by Aunt Ai, the "giant whale" had gained 600,000 attention, and it also began to use a small trumpet (the address starting with 0xf3f). It uses 1.95 million USDC as margin and holds 27,809 ETH (about 57.88 million US dollars), which is still 50 times the leverage, but the operation is even more extreme. The gap between the cost price and the liquidation price narrows to US$50. Once it falls below this threshold, it will trigger a explosive position.

But the result was that the address eventually made a profit of US$2.15 million in 40 minutes, achieving closing positions and taking profits. At that time, it had made a cumulative profit of US$9.28 million through three leverages. Since then, the "Giant Whale" completed four leveraged transactions from March 11 to 14, making a profit of approximately US$3.106 million. One of the transactions directly caused the Hyperliquid liquidation incident that has been hotly discussed in recent days.

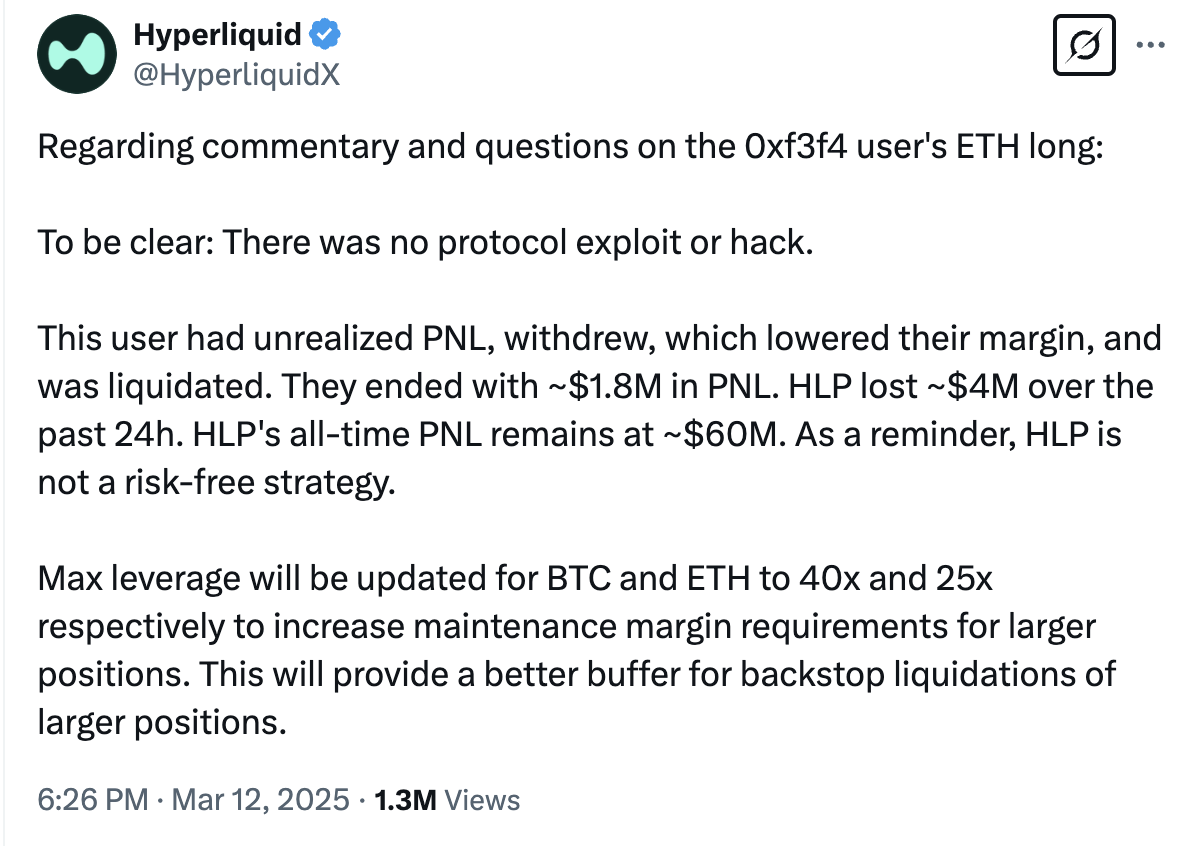

On March 12, the "Giant Whale" continued to increase its position until the long position of ETH reached 175,000, and its position value once exceeded US$340 million. Just when everyone thought it would close its position and make profits or continue to increase its positions to increase its profits, it did not expect that it chose to "detonate itself", withdrawing the principal and profits by withdrawing margin, thereby reducing the liquidation price, resulting in the long positions with remaining more than 160,000 ETH "actively liquidated". Due to its move, Hyperliquid's automatic liquidation system took over the position, and its community-driven liquidity pool "HLP Vault" was forced to take over and close the position at a high price, with Hyperliquid's losses reaching $4 million in the process.

The direct impact of this incident is the adjustment of the Hyperliquid contract rules. Hyperliquid lowered BTC maximum leverage from 50 to 40 times and ETH from 50 to 25 times respectively to limit the potential impact of large positions. In addition, the platform has also upgraded its margin system and introduced new margin rules, requiring the isolation position to maintain a margin rate of 20% after transfer, preventing liquidation through divestment.

"Hyperliquid 50x Leverage Whale" made a profit of $1.857 million in this event. As of the 14th, the "Giant Whale" has achieved seven battles and seven victories through two addresses. Since then, it has also lost $1.15 million only when opening LINK long orders.

On March 15, the "Giant Whale" once again shorted Bitcoin with a full position with 40 times leverage. Interestingly, except for some retail investors who have successfully drunk soup after orders, its multiple victories seem to have finally aroused the anger of some well-known traders, and a "whale hunting operation" targeted it began in a huge way.

The "Whale Hunting Team" was established. What impact will the

liquidation of the "Giant Whale" have on Hyperliquid and the market?

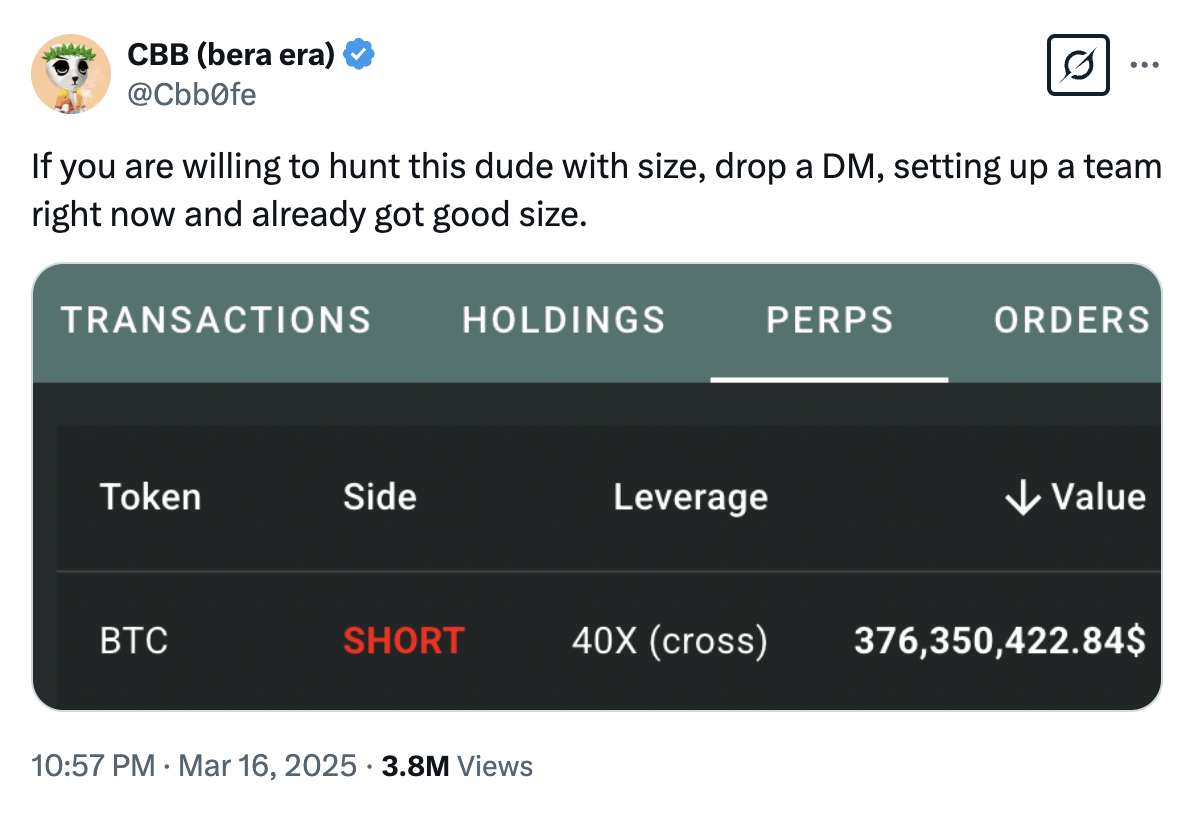

On March 16, the cryptocurrency KOL "@Cbb0fe" posted a post to collect the "Whale Hunting Team" and said, "If you are willing to have a big fight with this guy, send me a private message. We are forming a team and it has a good scale." Then, the KOL also posted a picture and said, "Justin Sun will join the action."

During this period, many netizens left messages and called on the official X account of the Securities and Exchange Commission, saying, "(Hyperliquid 50x leverage whale) looks like an organized "Pump" (referring to the operation of selling profits after artificially raising asset prices). It's time to investigate."

This "whale hunting operation" lasted for nearly two days and ended yesterday. The ending was still the "Hyperliquid 50 times leverage giant whale" that ended with the last laugh.

Cryptocurrency KOL "@Cbb0fe" said: "Shorter (shorter) closed with a profit of $9 million. We lost the war, but we haven't had such a happy time. I wish Shorter a victory!"

However, rather than hunting, this is actually a showdown between the team led by @Cbb0fe and the "Hyperliquid 50x Leverage Whale" and its followers. So the question is, if the "giant whale" is really exposed, will this prompt the Bitcoin market to rise?

Theoretically, once liquidation is carried out, the forced liquidation mechanism of short contracts will inevitably be triggered, which means that equal amounts of Bitcoin need to be purchased in the market to complete the settlement, which may drive price increases in the short term. However, the "big whale" liquidation does not represent a signal of "shorts are out", so this may not attract more bulls to enter the market, especially in the current situation of overall market sentiment and lack of confidence among investors, Bitcoin's upward momentum is insufficient, and even if there is an increase, its increase and duration may be quite limited.

From another perspective, the frequent occurrence of trading behaviors such as "Hyperliquid 50x leverage whale" is actually an inevitable part of the development and growth of the Hyperliquid platform, which can promote its discovery of its own mechanisms in the face of extreme market behavior. After all, as an emerging market, it has not yet been tested by the long-term market.

As mentioned above, in order to prevent the recurrence of previous liquidation events, Hyperliquid has taken a series of measures, including adjusting the leverage multiple of the contract and increasing the margin ratio to limit users to open too large positions. In terms of risk management, Hyperliquid uses the price oracle mechanism across multiple exchanges to achieve price update frequency every three seconds, thereby avoiding the wrong prices caused by malicious operations in a single market. At the same time, the platform allows anyone to participate in liquidation to improve the degree of decentralization and set up an independent HLP Vault to act as a liquidation vault, centrally managing and bearing the losses caused by liquidation.

It is worth mentioning that the multiple trading behaviors of the "Giant Whale" have also brought considerable trading volume and attention to Hyperliquid. As the platform's contract market becomes increasingly mature, the joining of market makers and the gradual increase in platform liquidity, the cost of price manipulation will significantly increase, and then the fairness and stability of the market will be further guaranteed.

As for whether this "Hyperliquid 50x leverage whale" is "Insider Brother" or "Operational Master", whether it can maintain the "Everything General"'s signature standing still remains to be tested by time.

chaincatcher

chaincatcher

jinse

jinse