East HashKey Chain, West Base: TradFi Battle under Compliance Trend

Reprinted from panewslab

04/06/2025·26DIn January 2025, Coinbase and EY-Parthenon surveyed 352 institutional decision makers and the results showed that 83% of respondents planned to expand their cryptocurrency allocation this year, and 59% planned to allocate more than 5% of their asset management scale to Crypto assets in 2025.

A very obvious signal has been passed:

As the regulatory environment becomes increasingly clear and the emergence of wider use cases, institutional confidence in crypto assets is growing. With unprecedented institutional participation, 2025 will be an important turning point in the on-chain financial outbreak.

As an important infrastructure for on-chain finance, how can blockchain better support the development of on-chain finance and carry more funds, users and complex financial play?

This is a arena for competing for hard power, and the leaders of encryption are ready to go.

Among them, there are both the implementation of the US government's crypto friendly policies and the president's active crypto actions bring popularity and traffic, and American concept crypto companies frequently stand at the forefront of public opinion. As the most representative crypto company in the United States, Coinbase is not only a guest of honor at the White House Digital Assets Summit, its high-performance L2 Base is rapidly promoting the prosperity and development of finance on the ecological chain through the path of the compliant stablecoin USDC.

In the Eastern world, which also focuses on financial innovation, a revolutionary force surrounding the tokenization of financial products has begun to brew:

As Asia's leading digital asset financial services group, HashKey 's main network of the financial and RWA's preferred public chain, HashKey Chain, launched by HashKey, is officially launched, aiming to build a secure, compliant and efficient blockchain ecosystem, and promote the deep integration of DeFi and traditional finance through the tokenization of financial products.

Under the general trend, a battle for the right to speak on-chain finance has begun. Who will take the lead in this undecided competition?

This report aims to explore the opportunities of the on-chain financial outbreak in 2025, how blockchain platforms should undertake value, and key factors in becoming an important infrastructure for on-chain finance.

**From off-chain to up-chain: The inevitable choice for financial

development**

The history of human financial development can be said to be a microcosm of the history of human civilization progress.

From the first birth of the interest concept in ancient Babylon, which was in the Mesopotamian civilization in 2400 BC, to the birth of modern banks in Italy as the center of the Renaissance in the Middle Ages, to the issue of the world's first stock in the 17th century, to the reconstruction of the world order after World War II, Wall Street, whose capital operation never stopped under the gold standard, became the world's financial barometer.

We can find that finance has been throughout our economic life since the beginning of human civilization;

Every qualitative breakthrough in finance occurs when a major change in the productive forces of human society is achieved;

Every leap forward in the financial industry is pursuing more efficient capital flow and resource allocation.

Now, in the macro situation such as the intensification of global geopolitical conflicts, the impact of the hegemony of the multi-polar monetary system on the hegemony of the US dollar, and the rise of the digital economy, facing the current financial system's accumulation of problems such as intensified inequality, decline in capital gains, and disconnection of efficiency, we are once again at an important node to witness the leap-forward development of human finance.

On-Chain Finance, built on blockchain technology, is becoming the backbone of the major changes in finance due to its huge advantages in eliminating traditional financial crises.

Decentralization is a prominent feature of on-chain finance. It not only eliminates the dependence on a single institution and lays a good foundation for inclusive finance, but also makes all transaction records open and transparent and tamper-proof, which greatly improves the transparency of the financial system.

The significant improvement in capital efficiency is the core advantage of on-chain finance. In the case where traditional finance is limited by sovereign countries, monetary systems, geographical environment and other frameworks, on-chain finance provides an effective solution for efficient capital flows around the world. At the same time, on-chain finance realizes 7 x 24-hour service through smart contracts and automated processes, bringing a financial experience of efficient and low-cost transactions anytime, anywhere, efficient and low-cost transactions.

More importantly, another major role of finance lies in leveraging to leverage greater returns. On-chain finance can provide capital gains several times higher than traditional finance by optimizing resource allocation, reducing transaction costs, shortening investment cycles, etc., thus bringing higher returns potential. Whether for traditional financial institutions or investment users, on-chain finance is more attractive.

With the continuous improvement of blockchain technology in performance, on-chain finance is expected to become the core engine of capital flow and resource allocation, promoting human society toward a more efficient, fairer and more sustainable financial future. With the opening of 2025, on-chain finance has also ushered in an important opportunity to explode under the general trend of clear supervision and institutions eager to try.

2025: The eve of the full explosion of on-chain finance

As early as 2024, the implementation of many milestones has laid a good foundation for the development of on-chain finance.

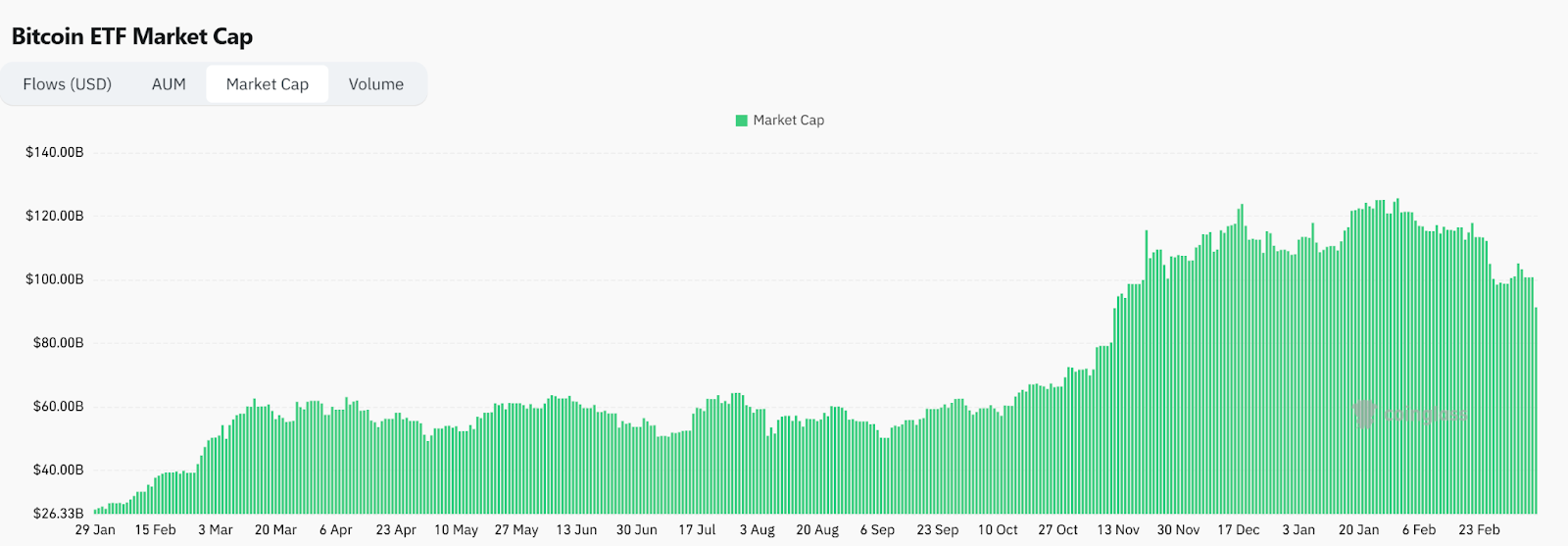

We witnessed the passage of Bitcoin ETFs in January 2024 , a historic moment that eliminated the complexity and technical barriers of direct purchase, storage and management of Bitcoin, opened the door to mainstream participation and attracted a large amount of institutional funding:

According to Coinglass data, the total net asset value of Bitcoin spot ETFs is currently about US$100 billion, of which: IBIT (BlackRock) holds about US$46.3 billion; Fujida (FBTC) holds about US$16.2 billion; GBTC (Grayscale) holds about US$15.8 billion.

Ethereum ETF followed closely behind. Although its size is far less than Bitcoin, it also achieved good results: According to SoSoValue data, the total funding scale of Ethereum spot ETF is about US$6 billion, of which: ETHE (Grayscale) holds about US$2.5 billion; ETHA (BlackRock) holds about US$2.4 billion.

In addition to ETFs, multiple tracks closely related to on-chain finance have ushered in explosive growth, building an important bridge for the integration of on-chain finance and traditional finance.

In 2024, RWA ushered in explosive growth, with a total value exceeding US$19 billion (excluding stablecoins), an annual growth of more than 85%. Tokenized credit, tokenized treasury bonds, and tokenized real estate have become the main driving forces.

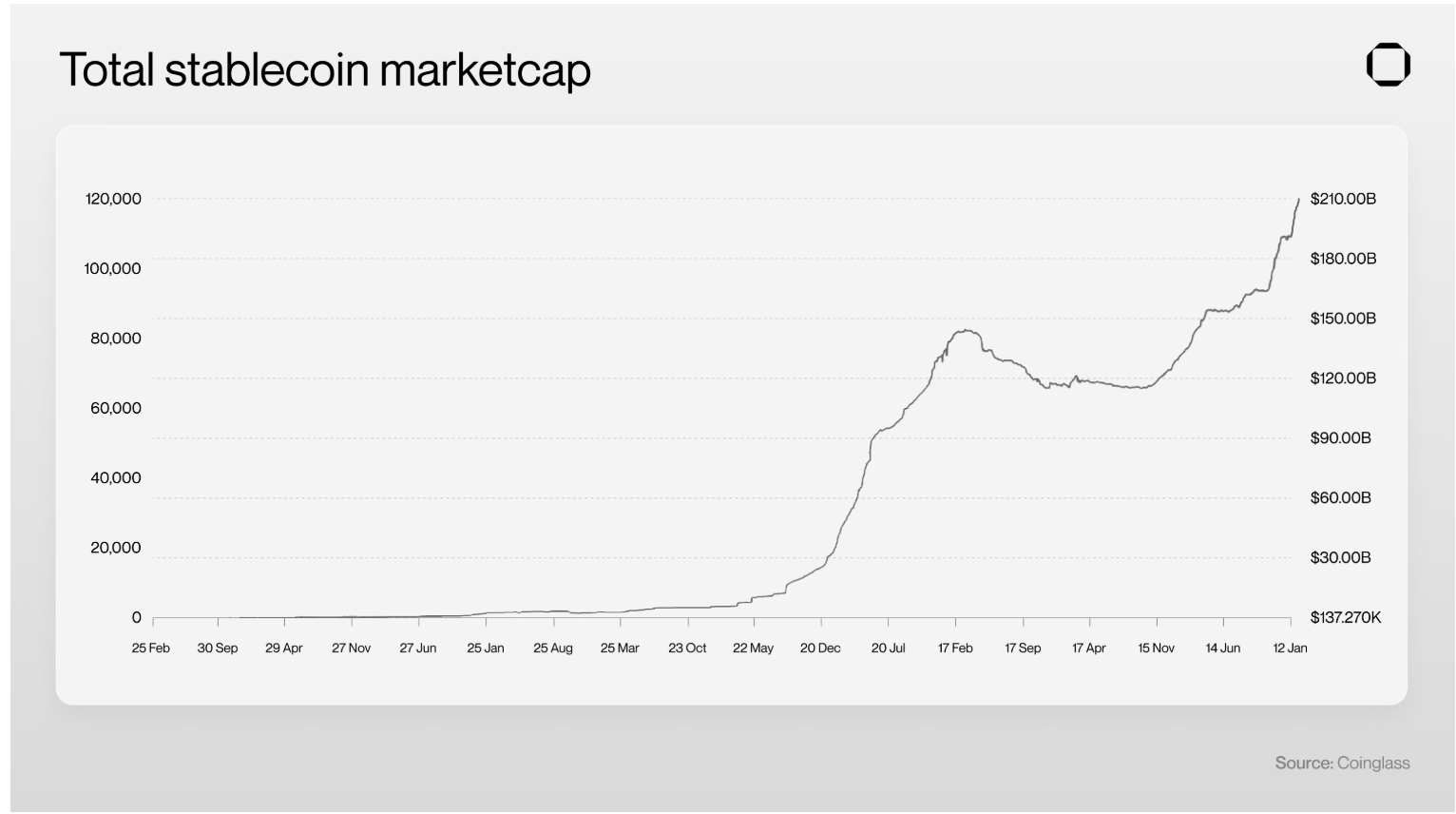

In addition, according to Coinglass data, the annual trading volume of stablecoins in 2024 exceeded US$8.3 trillion, with a total market value of more than US$210 billion. At the same time, traditional giants including Stripe, PayPal, SpaceX, etc. have made some arrangements in the stablecoin track.

Meanwhile, in November 2024, Trump 's victory in the U.S. election brought more positive expectations of an on-chain financial outbreak.

This US president, who always unexpectedly, spared no effort to practice crypto-friendly attitude before taking office: not only attended the Bitcoin 2024 conference held in Nashville in a massive manner, but also demonstrated its huge influence in the field of crypto.

After taking office, just two months after taking office, the Trump administration has implemented more than a dozen encryption policies, including signing the executive order of "Strengthening the U.S. Leadership in the Field of Digital Financial Technology", the SEC established an encryption task force and withdrawing lawsuits against multiple crypto companies, overturning the IRS's DeFi broker rules, and announcing five major encryption strategic reserves including BTC, ETH, XRP, SOL, and ADA.

Under the slogan of "Make America Great Again", Crypto has clearly become an important tool for the United States to consolidate its important position as the "global financial heart".

In fact, the influence of this crypto-friendly trend in the United States is not limited to the United States.

On-chain finance has blossomed at multiple points around the world and many countries have to face up to the crypto supervision, the implementation of many regulatory policies in the United States has provided a good demonstration role, and will also trigger the followers of other countries/regions, thereby promoting the establishment of a clearer crypto supervision framework. For example, the EU's Crypto Asset Market Supervision Act (MiCA) officially came into effect in early 2025 further brought an "with courtesy" crypto development environment to European countries.

Compared with the Western world led by the United States, the competition among Eastern countries and regions is even more fierce in promoting clear supervision and grabbing the financial chain. Previously, countries including Hong Kong, South Korea, Japan, Singapore, Thailand, India, Dubai and other countries have issued relevant policies to regulate crypto-economic development.

In 2025, when on-chain finance has become a consensus between the East and the West, the exploration of crypto-regulation among the Eastern countries and regions has become more open and active. Taking the international financial port of Hong Kong as an example, the Hong Kong Securities Regulatory Commission (SFC) recently released a roadmap for the "A-S-P-I-Re" in Hong Kong's virtual asset market, aiming to further focus on the participation of institutional investors.

If the efficient capital efficiency of on-chain finance is the original driving force that prompts traditional finance to accelerate the on-chain opening, then a clearer, open and inclusive regulatory environment further eliminates the worries of traditional finance opening and promotes institutions to adopt more active on-chain opening strategies.

In fact, this trend has emerged:

In the Western world, well-known institutions such as Sony, Samsung, HSBC, etc., have taken specific actions in the Eastern world.

Another very obvious phenomenon is reflected in the ETF application boom. At present, multiple institutions have submitted ETF applications to the SEC, including Ripple (XRP), Solana (SOL), Litecoin (LTC), Cardano (ADA), Hedera (HBAR), Polkadot (DOT) and DogeCoin (DOGE), etc.

As institutions are carrying more funds and users influx, 2025 will become an important turning point in the on-chain financial outbreak.

In the face of trends, how can we become the main competitor at the on-chain financial table? The focus is on both internal and external cultivation:

Embrace compliance externally: Compliance will become the core measurement standard for institutions to participate in on-chain finance. Actively embracing supervision will further eliminate institutions’ concerns about supervision and bring a healthy and stable environment for the development of on-chain finance.

Cultivate yourself internally: Continuously optimize transaction speed, transaction costs, user experience and security guarantees, continuously improve the service capabilities of blockchain as an infrastructure, and undertake large-scale funding users.

And how do the main competitors perform in the face of these two paths?

**The two heroes of East and West compliance: White House Guest and Hong

Kong Government Regulatory Pioneer**

Coinbase in the West, HashKey in the East.

This sentence, which is widely circulated in the community, not only comes from the fact that both have a wide range of crypto empires, but also from the firm determination and similar paths shown by both parties in compliance.

As the largest cryptocurrency exchange in the United States and the first cryptocurrency company listed in the United States, Coinbase 's compliance journey has gone through tortuous ways, but after the Trump-centered crypto-friendly government came to power, it gradually "keep the clouds clear and the moon bright":

In June 2023, the SEC announced a lawsuit against Coinbase and asked Coinbase to "permanently prohibit" related businesses, but in February 2025, the SEC revoked the lawsuit against Coinbase.

At the same time, Coinbase has been committed to compliant operations in the past few years, not only having fund transfer licenses in the United States, but also obtaining compliant operation licenses in countries including the United Kingdom, the European Union, Singapore, Japan and other countries.

As a guest of honor at the first White House Digital Assets Summit, Coinbase CEO Brian Armstrong sat fourth from Trump's left. He also publicly stated in a media interview that he was willing to serve as the government's crypto assets custodian in the context of national reserves. Coinbase has cooperated with multiple government departments in crypto asset custodian and transactions.

In addition, Coinbase also revealed that it will actively promote Congress to quickly implement stablecoin legislation and market structure bills.

As a representative of the East, HashKey, which is rooted in Hong Kong, is a well-deserved compliance pioneer in the eyes of many community members:

Not only does Hong Kong have a superior geographical location, it can link mainland China, Singapore, Japan, South Korea, Southeast Asia and other sectors to play an important financial hub role in the Asia-Pacific region, but also, as the four Asian dragons, Hong Kong has a perfect financial foundation, an active financial innovation atmosphere, and a large number of professional talents in the financial, technological and legal fields that have been accumulated over a long period of time are incomparable to other cities.

Previously, Hong Kong's fertile financial soil has successfully nurtured many leading institutions in the crypto industry such as Amber group, Crypto.Com, BitMEX. According to the Hong Kong Fintech Ecosystem Report released by the Hong Kong Investment and Promotion Agency, there are more than 1,100 fintech companies in Hong Kong, including 175 blockchain application or software companies and 111 digital asset and cryptocurrency companies.

In 2023, Hong Kong further clarified the direction of "making blockchain a key development field", and officially launched the VASP license application system. With the introduction of a series of policies such as ETFs and virtual asset funds gradually opening up to ordinary investors, Hong Kong is attracting attention from the world as a "on-chain financial innovation center".

As the first batch of crypto companies to apply for Hong Kong licenses, HashKey is also the first batch of important forces to support Hong Kong's vigorous development of the blockchain economy and actively embrace compliance. At present, HashKey has officially obtained Class 1, Class 4 and Class 9 licenses issued by the Hong Kong Securities and Futures Commission (SFC), expanding its business scope and capabilities under the supervision of the Hong Kong Securities and Futures Commission in many aspects.

Taking Hong Kong as the starting point, HashKey has achieved rapid progress in compliance with many countries around the world over the past year, and has successively obtained the major payment institution license issued by the Monetary Authority of Singapore (MAS), the Japanese crypto exchange operating license, the Class F license issued by the Bermuda Financial Authority (BMA), and the principled approval (IPA) of its Virtual Assets Supervision and Administration (VARA) for its Virtual Asset Service Provider (VASP) license application.

At the same time, HashKey Group also stated that it will continue to promote the global license matrix in the next five years, explore markets including the Middle East, Europe, etc., and gradually expand its on-chain financial service capabilities to the world.

As a chain built specifically for on-chain finance and RWA, HashKey Chain will continue HashKey's compliance advantages, and is committed to building a compliance-oriented on-chain financial infrastructure and creating a full-stack solution for China Unicom Web2 and Web3.

The potential energy brought by compliance to HashKey is also reflected in the growth at the specific business level, especially in institutional cooperation:

In 2025, HashKey Chain not only successfully launched the Bose HashKey BTC ETF and the Bose HashKey ETH ETF, but also established in-depth cooperation with a number of well-known institutions such as Futu Securities, Tiger Securities, Cinda International Asset Management, and Zhongan Bank.

At the same time, the HashKey exchange attracted more than HK$10 billion in capital, and the cumulative trading volume exceeded HK$600 billion.

In addition to similar compliance paths, blockchain is the infrastructure that carries on-chain finance. As crypto asset management groups that both launched their L2, we can easily focus on Base and HashKey Chain.

**On-chain financial foundation: The game between compliant stablecoins

and tokenization of financial products**

We can find many commonalities between Base and HashKey Chain.

As infrastructure, both aim to become the new generation of on-chain financial technology bases, and they both put in a lot of effort to optimize performance to better carry large-scale funds and users.

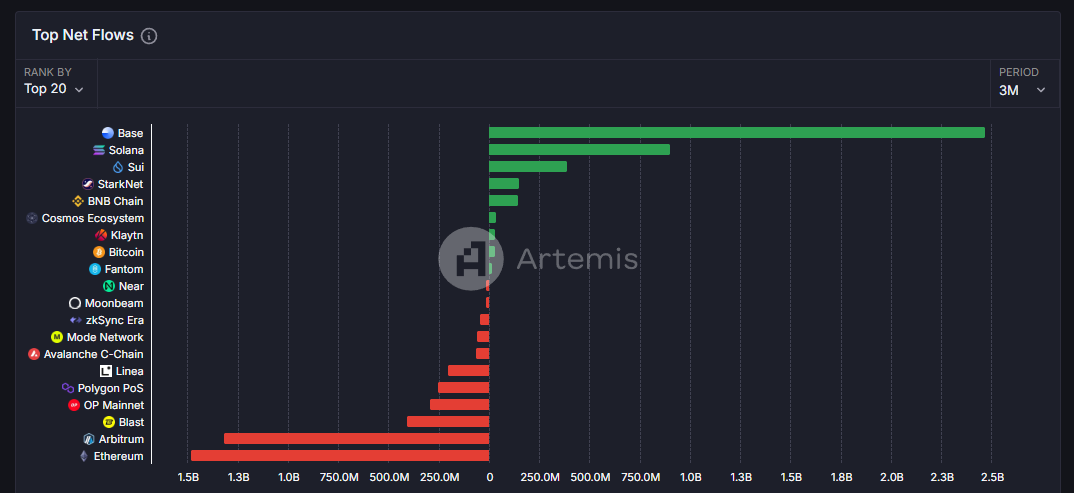

The Base mainnet was officially launched in 2023 and has become one of the hottest L2s in less than two years. According to Artemis data, Base's net inflow of funds exceeded US$2.5 billion in the fourth quarter of 2024, with about 11.1 million daily transactions. In the 2024 AI Agent and Meme boom, Base showed strong money-making ability and carrying capacity for frequent on-chain interactions for large-scale users.

In contrast, HashKey Chain, although it has only been more than two months since its launch, whether from the rapidly growing on-chain data or the series of features designed for institutional-level adoption, we can feel HashKey Chain's ambition to build the preferred blockchain for finance and RWA.

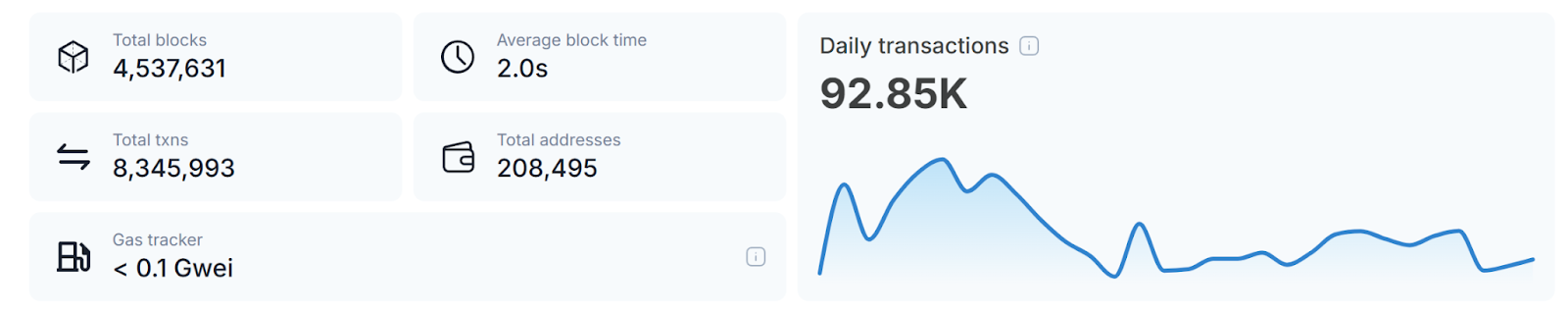

As Ethereum Layer 2 built on OP Stack, HashKey Chain has the advantages of EVM compatibility, high throughput, scalability, etc. According to public data, the average block production time of HashKey Chain is 2 seconds, the gas fee is as low as 0.1 Gwei, and the TPS can reach 400, which is committed to bringing outstanding on-chain financial interaction experience.

During the test network stage, HashKey Chain completed a total of 25.816 million transactions; more than 870,000 wallet addresses were registered; and 300,000 community members participated. According to hashkey.blockscout data, in more than two months after the main network was online, the total transaction volume of HashKey Chain exceeded 8.34 million; the total number of addresses exceeded 208,000.

At the same time, for institutions with large capital volume, security is their primary consideration for participating in on-chain finance, and HashKey Chain has also made sufficient preparations for this:

HashKey Chain's intelligent escape pod synchronizes the state Merkel tree to Layer 1 through interval fixed blocks, achieving the ultimate guarantee of asset security.

At the same time, multi-level DAO governance has enabled the DAO of the Security Council to quickly respond to possible security threats, while the technical audit DAO focuses on in-depth analysis and verification to further enhance the security factor of HashKey Chain.

In addition, through cooperation with Chainlink, Chainlink CCIP will serve as the HashKey Chain standard cross-chain infrastructure, thereby effectively avoiding common cross-chain security issues such as double-spending attacks and cross-chain reentry attacks, ensuring that HashKey Chain provides reliable and secure cross-chain services; Chainlink Data Streams will serve as the official data solution of HashKey Chain, bringing low-latency, real-time, and tamper-proof market data to HashKey Chain, opening the door to innovation in high-frequency trading and derivative trading scenarios.

Of course, in the public chain infrastructure arms race, in addition to the hard power of performance, the soft power of ecological construction has attracted more attention.

In this regard, although Base and HashKey Chain are committed to seizing the opportunities of on-chain financial development in 2025, their respective ecological entry point selections have different plans.

Base focuses on the compliant stablecoin USDC :

Stablecoins provide a stable medium of trading and are a bridge for rapid exchange and efficient flow between different crypto assets. Their importance is self-evident. Compliant stablecoins further provide a compliance path for traditional financial funds to participate in on-chain financial activities, which is of great significance in promoting the penetration of Base ecosystem in more financial scenarios such as payment and RWA and attracting institutional participation.

In 2018, Circle and Coinbase jointly launched the first stablecoin USDC, supported by a centralized exchange, with Coinbase mainly responsible for the US dollar reserves behind USDC. USDC has compliance as its main advantage. Among the two major issuers behind it, Circle has full US licenses and payment licenses between the UK and the EU, and Coinbase's compliance advantages cannot be underestimated. Last July, Circle was qualified to issue USDC and EURC under the MiCA Act.

Through the compliant stablecoin USDC, Base not only brings a better on-chain financial experience to developers and users, such as the Gas fee discounts enjoyed when users pay with USDC, but also promotes the integration and expansion of the Base ecosystem with traditional finance: At present, the Base ecosystem has emerged with multiple native stablecoin payment applications such as Peanut and LlamaPay.

HashKey continues to carry forward its advantages in institutional cooperation. HashKey Chain focuses on the tokenization of financial products and builds the preferred blockchain for finance and RWA:

Institutions manage large-scale funds and users. The participation of institutions will guide the on-chain accumulation of a large amount of funds and the influx of incremental users, which is an important symbol of the maturity and scale of on-chain finance. HashKey Chain aims to clear barriers to institutional participation by providing institutions with efficient and compliant tokenization solutions for financial products.

The tokenized US dollar money market fund "CPIC Estable MMF" initiated and managed by China Taibao Investment Management Co., Ltd. (Hong Kong) was successfully deployed based on the HashKey Chain, which is a demonstration case of HashKey Chain using the tokenization of financial products as a starting point to build the preferred platform for finance and RWA.

For institutions, through compliance-friendly, safe and trustworthy, high performance and low cost, and a complete on-chain DeFi ecosystem, HashKey Chain significantly reduces the technical threshold and operating costs of institutional financial products on the chain, making CPIC Estable MMF an effective digital asset allocation tool, helping institutions achieve transparent, efficient and refined management of fund shares on the blockchain.

For DeFi users, by providing institutions with efficient tokenization tools for financial products, on-chain financial users will usher in more excellent assets with real returns and obtain more diverse sources of income.

For on-chain finance, as more and more institutional-level assets choose to undergo digital transformation on HashKey Chain, on-chain finance is accelerating its integration with traditional finance and playing an increasingly important role in the global financial system.

According to HashKey data, the subscription scale of CPIC Estable MMF exceeded US$100 million on the first day of its operation, further reflecting the huge market demand for tokenization of institutional financial products. As HashKey Chain continues to promote in-depth cooperation with multiple institutions, HashKey Chain will further become an ideal platform for tokenization of financial products such as bonds, funds, and stablecoins, helping the leapfrog development of on-chain finance and RWA.

Both paths have their own advantages, both carry the grand vision to promote the explosion of on-chain finance, and have achieved breakthrough achievements at their respective entry points. However, at a time when on-chain finance is still in its early stages, perhaps Base and HashKey Chain need more specific scenarios for deep integration of off-chain and on-chain finance to verify its feasibility. We need to look at it from a longer-term perspective.

And to predict the future at the moment, perhaps the 2025 roadmap released by the two can bring more long-term judgments.

**Multiple measures to go hand in hand: Welcoming the golden age of

financial development on-chain**

In the 2025 roadmap released by Base, we can clearly see the dual track parallelism of technology and ecology:

Technically, Base will focus on OnchainKit, Paymaster and L3 to enhance the experience;

In terms of ecological aspects, Base aims to open up more than 25 fiat currency channels and is committed to introducing 25 million users and 25,000 developers. At the same time, the on-chain assets scale is 100 billion US dollars this year.

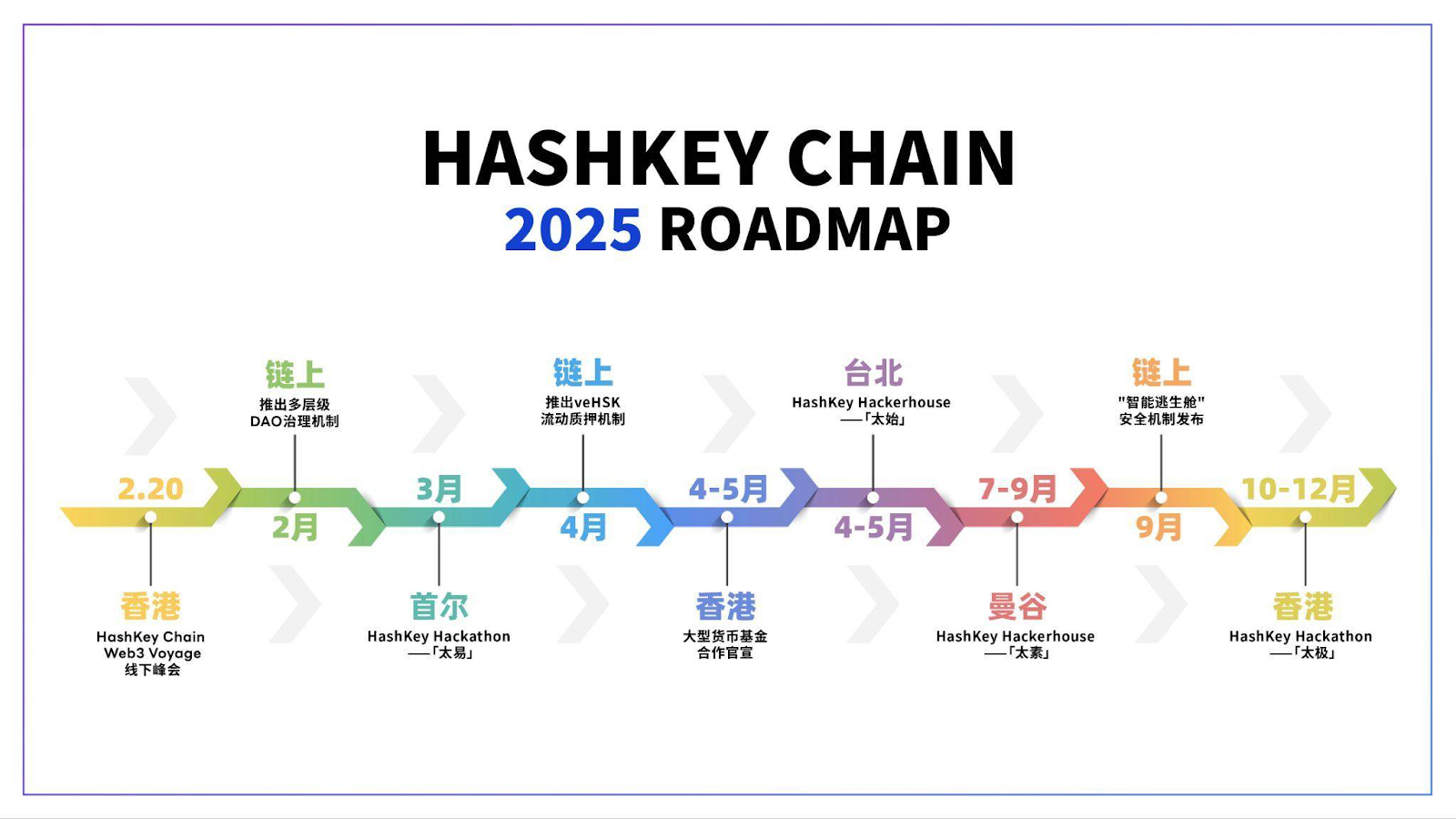

Compared with Base's data macro, HashKey Chain's 2025 roadmap takes BTCFi, PayFi, RWA and stablecoins as the main line, and introduces more specific measures in focusing on chain finance, expanding developer scale, attracting large-scale funds to be launched on the chain, and building a compliance-oriented on-chain financial infrastructure.

On the one hand, the Wrapped BTC asset HashKey BTC (HBTC) issued by HashKey Chain is coming soon:

This product aims to focus on the trillion-dollar BTCFi market and bring users compliant and stable on-chain income, including lending income, liquidity mining income, re-pled income and HashKey points.

On the other hand, with the vision of "finance and RWA first blockchain", HashKey Chain will continue to focus on the RWA track and continuously improve the tokenization services of institutional-level financial products:

Previously, HashKey Group launched the first STBL project issued by Hong Kong financial institutions in cooperation with Cinda International Asset Management. STBL's related assets are AAA-grade Money Market Funds (MMFs) investment portfolios. Each STBL has a face value of USD 1 and can be transferred 24/7. It will automatically allocate daily accumulated interest to professional investors' wallets in the form of a new token on the monthly dividend payment date. In the near future, the issuance of STBL will be expanded to HashKey Chain.

At the same time, HashKey Chain will also promote tokenization of traditional asset areas such as real estate, commodities and art, promoting asset liquidity and market transparency.

More importantly, based on in-depth partnerships with multiple institutions, HashKey Chain 's Hong Kong dollar stablecoin is brewing:

Previously, HashKey Exchange has reached cooperation with companies such as Yuanbi Technology and Allinpay international. The Hong Kong dollar stablecoin issued by HashKey Chain will meet you soon. The stablecoin ecosystem based on HashKey Chain will further promote the prosperity and development of cross-border payments and decentralized financial solutions on HashKey Chain, and accelerate the on-chain transformation of global finance.

At the developer level, a number of developers’ incentive policies also reflect HashKey Chain’s determination to build on-chain finance:

As the HashKey Chain mainnet is officially launched, the total prize pool of up to $50 million is planned. The program aims to deeply explore high-quality projects in the Web3 field and provide comprehensive empowerment to help exponential growth of HashKey Chain application layer and on-chain users. The first phase of Atlas Grant ended on January 20, 2025, and the second, third, fourth and fifth phases will be launched in Q2, Q3 and Q4 in 2025.

In addition, the series of HashKey Hacker House and Hackathon events will be held in many cities around the world, including South Korea, Taiwan, Japan and Thailand, providing developers with a platform to communicate and directly communicate with HashKey Chain core team members and obtain support.

From embracing compliance to using BTCFi, RWA, stablecoins and other tracks as a starting point to build a safe, efficient, institutionally friendly and diversified on-chain financial ecosystem, HashKey is becoming an important force in promoting the deep integration of on-chain finance and traditional finance.

Whether it is the Western Coinbase and its high-performance Layer 2 Base, or the Eastern HashKey, its preferred public chain HashKey Chain, which is the HashKey Chain, the first choice for finance and RWA, they are promoting the prosperity and development of on-chain finance in their respective ways. This parallel pattern of East and West not only shows the diversification path of on-chain finance, but also reveals the profound trend of global financial system change.

As the community said:

Coinbase in the West, HashKey in the East

The West Base, the East HashKey Chain

Perhaps under the almost irreversible trend of clear supervision and continuous institutional entry, the two are better at co-construction than talking about competition.

In San Francisco, where Coinbase is located and Hong Kong where HashKey is located, and tokenization of institutional financial products of Base's compliant stablecoins and HashKey Chain as two major tools, facing the golden age of on-chain finance, perhaps we can even look forward to that in the future, both Base and HashKey Chain will promote the construction of the East and West financial order in a win-win situation, and at the same time accelerate the arrival of global on-chain financial reform earlier.

chaincatcher

chaincatcher