Earning 22 million US dollars is like taking a picture, 50x "Insider Brother"'s HyperLiquid chain operation records

Reprinted from panewslab

03/19/2025·2MAuthor: Luke, Mars Finance

Recently, the "50x Leverage Whale" on the Hyperliquid platform (the address starts with 0xf3 and is nicknamed "Insider Brother" by the community) shocked the crypto market with high-profile operations and amazing returns. With his high leverage, precise timing and multi-platform strategy, he made a net profit of about $22 million in several months, including $2 million plundered from Hyperliquid Treasury HLP (Hyperliquidity Provider) through "cutting the warehouse" operation, which sparked heated discussion. This article will use the timeline as a clue, describe its trading trajectory in detail, analyze the operation methods in depth, recalculate the profit and loss based on clear profit and loss of closing positions and falling into pockets, and present the accumulated profit and loss in the form of a table, and finally reveal the reactions between the market and the platform, and outline a unique crypto game.

Timeline and operational interpretation

March 2-3: BTC and ETH make a big profit start

The legend of Brother Insider started in early March. According to Lookonchain monitoring, he went long with 50 times leverage in Hyperliquid, catching up with the soaring price caused by Trump's crypto reserve announcement, closing most of his long positions in just one day, making a profit of more than $6.8 million. This precise operation laid the foundation for his huge profits, and the market began to pay attention to this mysterious trader.

March 10-12: ETH/BTC long orders and "breaking positions" peak

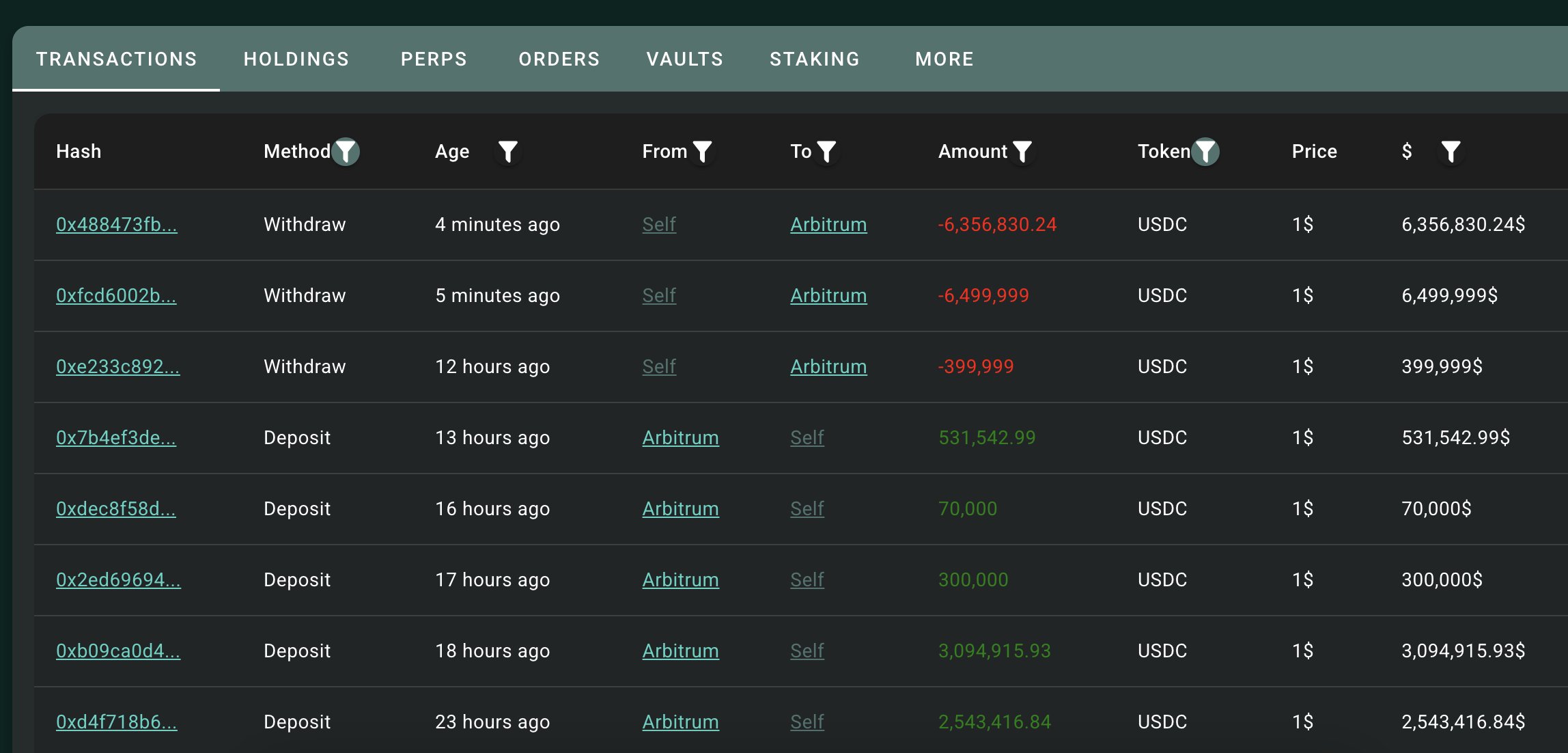

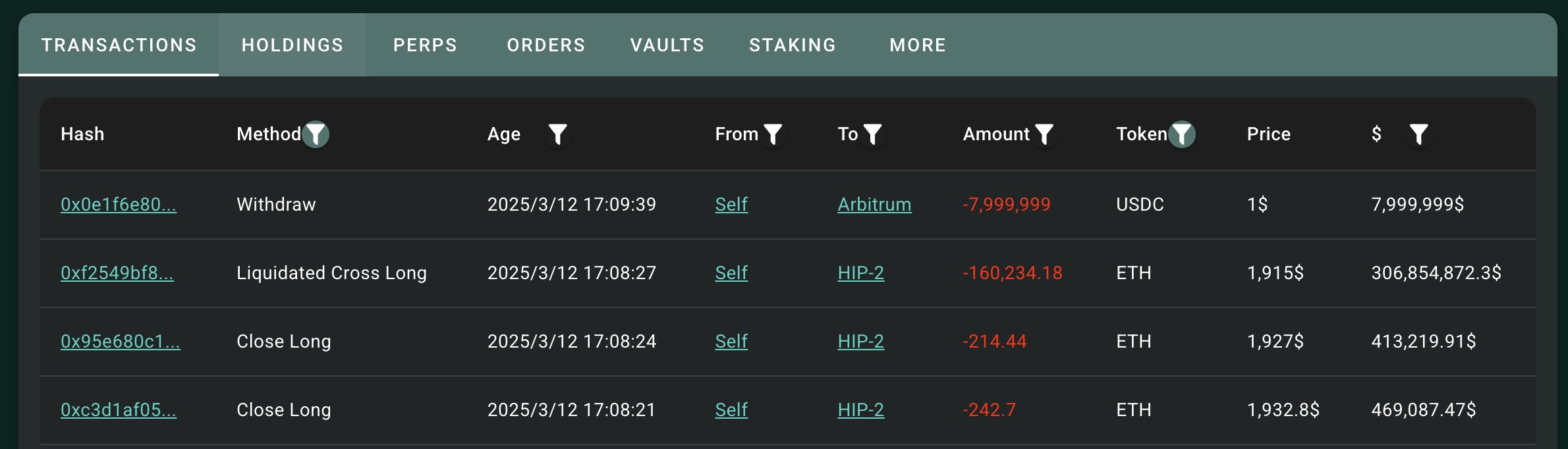

From March 10 to 12, the giant whale's operation reached its climax, while the most controversial scene was staged. On March 10, he completed two ETH ultra-short-term longs with a 100% winning rate, making a net profit of $2.2 million. On March 12, he deposited $5.22 million to Hyperliquid, opening long ETH and BTC with 50x leverages of $1,884.4 (liquidation price $1,838.2) and $82,003.9 (liquidation price $61,182). Subsequently, he converted his BTC position into ETH long position, added 10 million USDC margin, and his position increased to 140,000 ETH (approximately US$270 million), accounting for 24.65% of the platform's total ETH position, and a floating profit of US$3.1 million.

The dramatic twist occurred between 17:05 and 17:08. According to Hyperscan data, Giant Whale tried to withdraw cash continuously when its position was not closed. First, due to the failure of "exceeding the single transaction limit", the withdrawal of US$17 million was divided into two transactions (8 million and USDC 9 million), exceeding its USDC margin of US$15.23 million. The remaining positions were quickly liquidated, and at 17:08 points, 140,000 ETH was taken over by HLP at $1,915. As ETH price fell to $1,910 in liquidation, HLP suffered a loss of about $4 million, while the giant whale locked in $2 million in profits to leave the market. This "cutting through position" operation shocked the community. Hyperliquid immediately announced that it would lower the maximum leverage of BTC and ETH to 40 times and 25 times respectively, trying to fix the vulnerabilities.

March 13-14: Cross-platform expansion and LINK turmoil

On March 13, the giant whale extended its tentacles to GMX, opened a short position of US$45.17 million, and also went long on the ETH/BTC exchange rate on Hyperliquid, accurately seizing the opportunity of the exchange rate falling to 0.0228, making a profit of US$2.15 million. The next day, he turned to LINK, invested $14.98 million to buy 506,000 LINK (cost 13.93), and opened 10 to 23 times long orders on Hyperliquid and GMX, and closed the position and made a profit of $1.27 million after operation. However, the 20x LINK long order was liquidated at USD 13.6857, with a loss of USD 1.07 million. The market was full of discussion, and Hyperliquid quickly reduced the LINK leverage limit from 20 times to 10 times, showing alertness to giant whales.

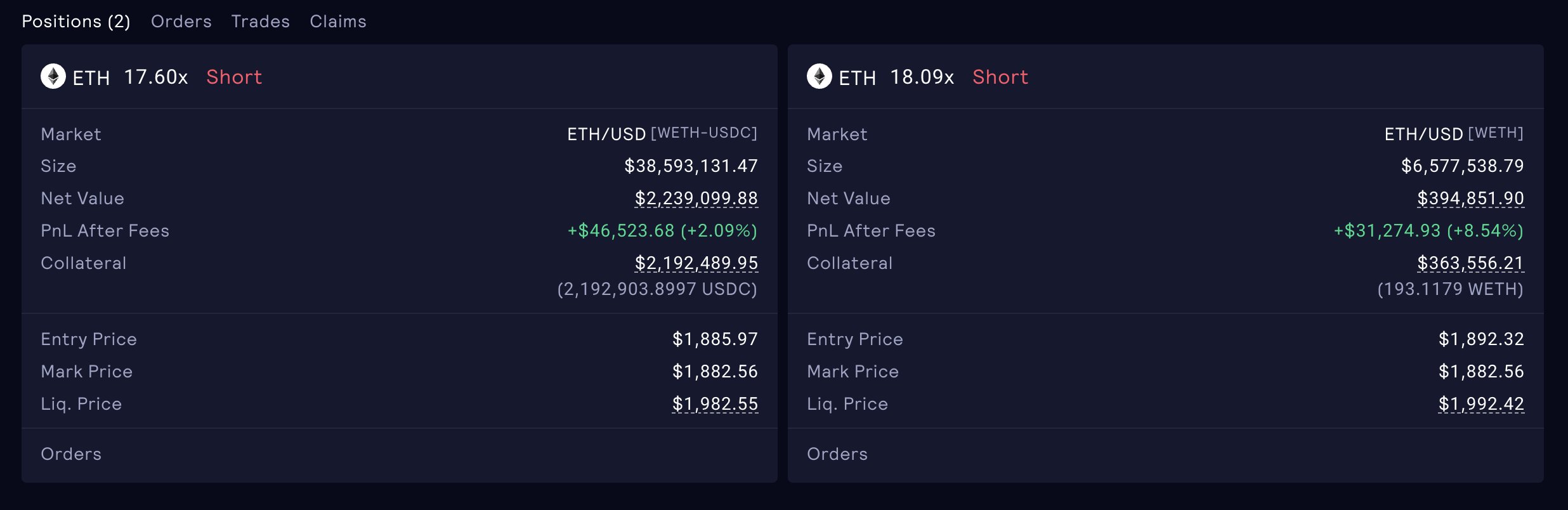

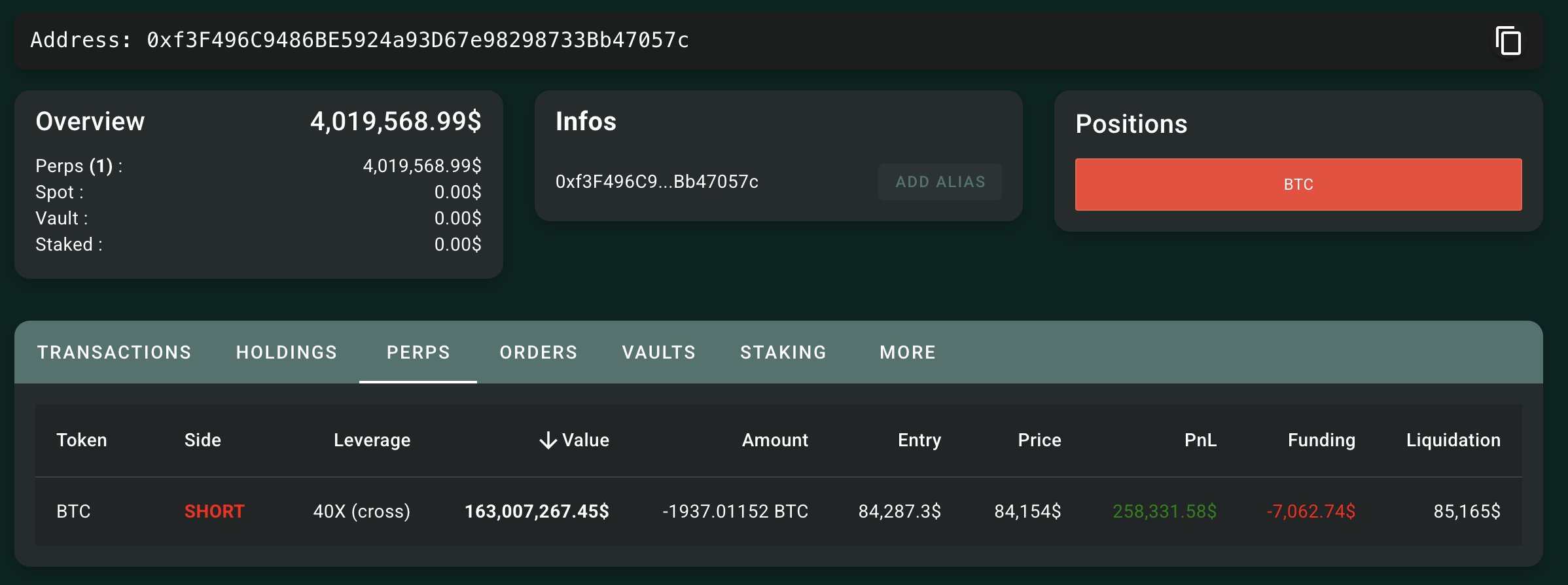

March 15-17: BTC 's short positions dominate and tighten rules

Starting from March 15, Giant Whale focused on BTC short positions and built positions on Hyperliquid with 40 times leverage, increasing its scale to US$330 million, and its floating profit once reached US$6.2 million, and then took profit of US$5.6 million through TWAP. He also opened 44.97 times BTC short orders on GMX, with a total scale of US$194 million, and this stage clearly took profit of US$3.05 million. Hyperliquid announced trading volumes exceeded $1 trillion on March 15 and raised the margin ratio from 5% to 20%, aiming to constrain highly leveraged players. Market sentiment fluctuates accordingly, and investors begin to worry about the platform's liquidity risks.

Deconstruction of operation techniques

Giant Whale's trading methods are like precision machinery, both bold and delicate, integrating high-risk strategies and clever exploitation of rule loopholes. The following is a detailed analysis of its core techniques:

High leverage drive and event capture

- Leverage Choice: The giant whale takes 50x leverage as the core, which is the highest multiple allowed by Hyperliquid, and can convert small fluctuations into huge returns. For example, ETH/BTC made a profit of $6.83 million at the end of February, showing his skillful control of high leverage. Even though the platform later lowered its leverage, it still adjusted flexibly to 40 times (such as BTC short orders on March 15), maintaining high yield potential.

- Event-driven: He responded very quickly to macro events, such as the ETH/BTC long position after Trump's remarks at the end of February, making a profit of $6.83 million in 24 hours. This ability may come from an early perception of news or a deep understanding of market sentiment, and even triggers speculation on "insider trading".

Multi-platform collaboration and fund scheduling

- Cross-platform layout: Giant whales do not rely solely on Hyperliquid. On March 13, he opened ETH short orders on GMX and also longed the ETH/BTC exchange rate on Hyperliquid to form an arbitrage combination. On March 14, he borrowed 110,000 LINKs (US$1.54 million) from Aave for spot and contract operations, demonstrating the ability to integrate resources across multiple platforms.

- Funding scheduling: His funding management is efficient and flexible. Before "breaking the position" on March 12, he added USDC margin of 10 million to push ETH positions to 140,000; on March 15, he added USDC of 3 million to BTC short orders to avoid liquidation risks. This dynamic method of adjusting margins ensures the stability of high leverage positions.

Dual-wheel drive of spot and contracts

- Strategy design: Giant whales often push up prices through spot trading and then use contracts to amplify returns. On March 14, he invested $14.98 million in LINK to buy 506,000 LINK (cost 13.93), and then the price rose to $14.6, and combined with 10 to 23 times long orders, he closed the position and made a profit of $1.27 million after operation. This combination of "spot pull-out + contract leverage" makes full use of market depth and leverage effect.

- Execution details: He bought LINK in batches (such as 5 million and 500,000 US dollars orders) at CowSwap to avoid a one-time impact on the market and ensure controllable costs. This delicate operation shows his deep understanding of liquidity.

Quick entry and exit and "travel" arbitrage

- Short-term rhythm: Giant whales are good at seizing short-term fluctuations and making quick profits. On March 13, he went long with 50 times leverage at Hyperliquid, earning $2.15 million in just 40 minutes; on March 16, BTC short orders took profit of $3.05 million. This fast-in and out pace maximizes returns and reduces risk exposure.

- "Walking through the warehouse" technique: The operation on March 12 is its most unique technique. When ETH's long position floating profit of $3.1 million, he withdrew $17 million USD, exceeding the margin of $15.23 million, resulting in the liquidation of the remaining positions. When HLP took over the position, it generated a $4 million loss due to the decline in ETH price, and he locked in a $2 million profit. This strategy uses Hyperliquid's rules that allow for the extraction of floating profits, passes liquidation risks to the platform, and becomes its "trump card" for plundering liquidity.

Risk management and strategy adjustment

- Take profit and stop loss: Giant whales are not blindly radical. After the long list was liquidated on March 14, he quickly reduced his leverage from 20 times to 10 times to avoid further losses. On March 17, he closed 108 BTC short positions through the TWAP (time-weighted average price) strategy, reducing market impact and ensuring that $5.6 million was put into pocket.

- Adaptive Adjustment: Faced with changes in platform rules (such as the margin ratio increase on March 15), he shifted from 50x leverage to 40x and added 44.97x positions at GMX, showing a flexible response to environmental changes.

Profit and loss details (only the profits that have been closed and put

into pockets)

A big tree attracts wind—a whale hunting team gathers

The huge profits and "cutting through positions" operations of giant whales have caused huge waves in the market. Rumors of "insider trading" at the end of February cast a mystery to it, and after HLP lost $4 million on March 12, the community exclaimed him as a "liquidity predator", worried that similar operations would shake the foundation of the market. Encrypted KOL @Cbb0fe quickly posted a call for the "Whale Hunting Team" to encircle the giant whale. Just half an hour later, he posted a picture saying that Tron founder Justin Sun joined the action, showing a strong rebound in the community's influence.

Hyperliquid took action one after another, first lowering the upper limit of BTC and ETH leverage to 40 times and 25 times on March 12, and then limiting LINK leverage to 10 times on March 14. On March 15, it announced that it would raise the margin ratio from 5% to 20%, trying to fix the loopholes in the rule. However, the liquidity of the platform has been hit hard: on March 13, HLP lost $3.23 million due to taking over 160,000 ETH long orders, and the fund pool plummeted from 486 million to $351 million, a drop of 27.7%. The loss of $4 million on March 12 further exposed its mechanism defects -allowing the withdrawal of floating profits and not restricting large leverage orders, making HLP a "cash machine" for giant whale.

Conclusion

From low-key testing in February to "cutting through warehouses" plundering in March, Hyperliquid's 50x leverage giant whale wrote a high-risk, high-reward legend with a net income of about $22.62 million, including $2 million plundered from HLP. He conquers the market and "flee" with high leverage, event-driven and rule loopholes, and is a predator of crypto trading. However, this game also sounded the alarm: LINK liquidation and HLP huge losses revealed the nature of the double-edged sword of high leverage. The community's "whale hunting" action and the adjustment of the rules of Hyperliquid indicate that the encirclement of such players has begun. In the future, it is still unknown whether the giant whales can continue to ride the wind and waves, or may fail in the encirclement and suppression. For ordinary investors, this is both an amazing performance and a profound warning: in the game between giant whales and platforms, retail investors may only be able to sigh.

chaincatcher

chaincatcher