Keeta Network: "Ripple Killer" reappears? VC coins are no longer marketing

Reprinted from chaincatcher

03/19/2025·2MAuthor: Bright, Foresight News

Recently, the payment public chain Keeta Network announced that its token $KTA has ushered in "value discovery" after several days of correction to US$6 million FDV, and soared by 1,000% in the past week. On March 19, $KTA reached a maximum of $160 million in FDV, with prices rising from $0.006 to $0.16.

This increase is not an exaggeration for Meme. However, Keeta Network, which was previously unknown and the token launch is full of Fud doubts, is a payment public chain with real "bloodiness" in Silicon Valley.

Payment Layer 1, but surprises Base to issue coins, "zero" marketing

messes with Fud

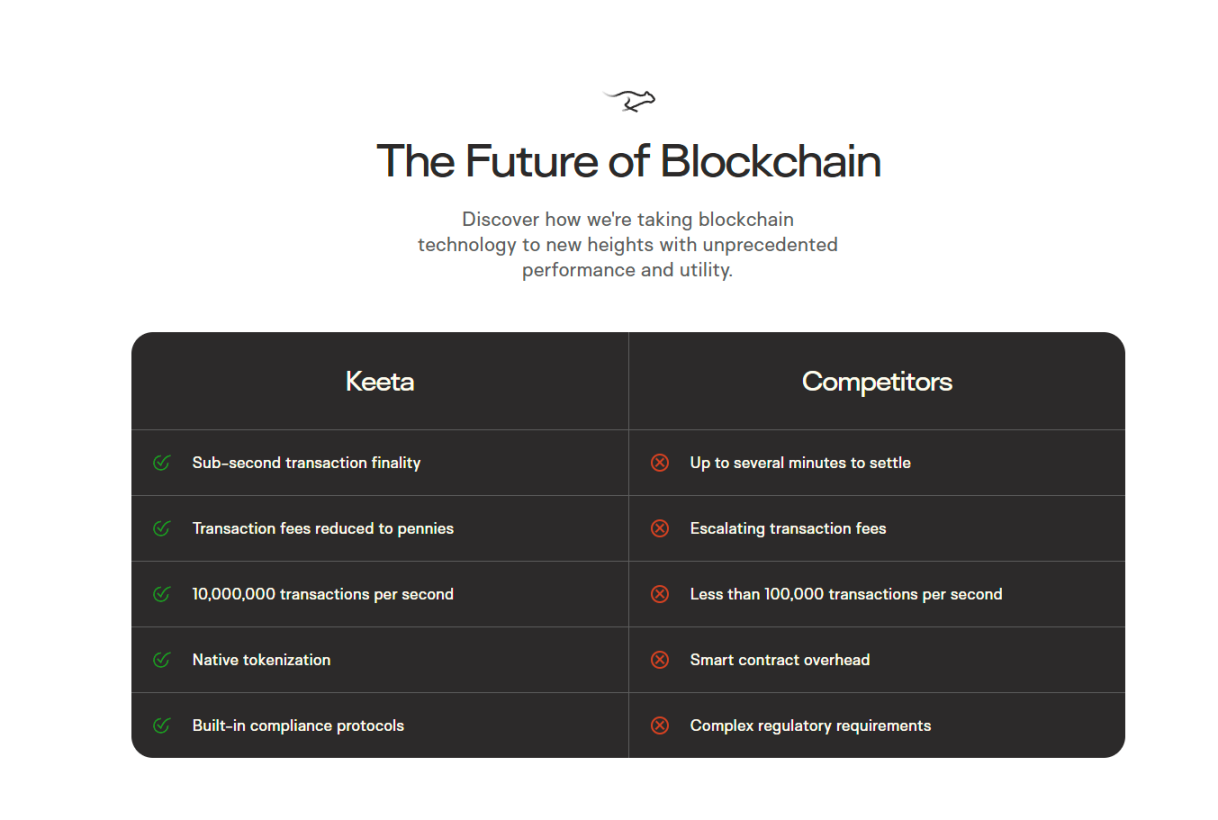

According to the official white paper, Keeta Network is a commissioned proof of stake (dPoS) blockchain system that powers blockchain banking business around the world and provides an ideal intermediate platform for Tradfi and Defi. Its electronic ledger is said to be able to process more than 50 million transactions per second. Financial institutions can connect to Keeta Network via APIs or custom integrations, and the platform provides a real-time payment track network that can quickly process cross-border remittances within a clock, at a cost of 50% to 70% less than traditional remittance channels. Today, Keeta has announced on its official website that its L1 can support 10M TPS and 400ms settlement. In early June 2023, Keeta began to officially launch in the United States, Canada, Mexico, Brazil, the United Kingdom and the European Union, and adopted an invitation-based system to pilot B2B payments.

"Keeta wants to make international remittances as simple and fast as Venmo payments, so that both parties no longer need to worry about fund security." Schenk also added that compared with Swift's more suitable for large transfers of more than $1 million, Keeta has advantages in instant small payments.

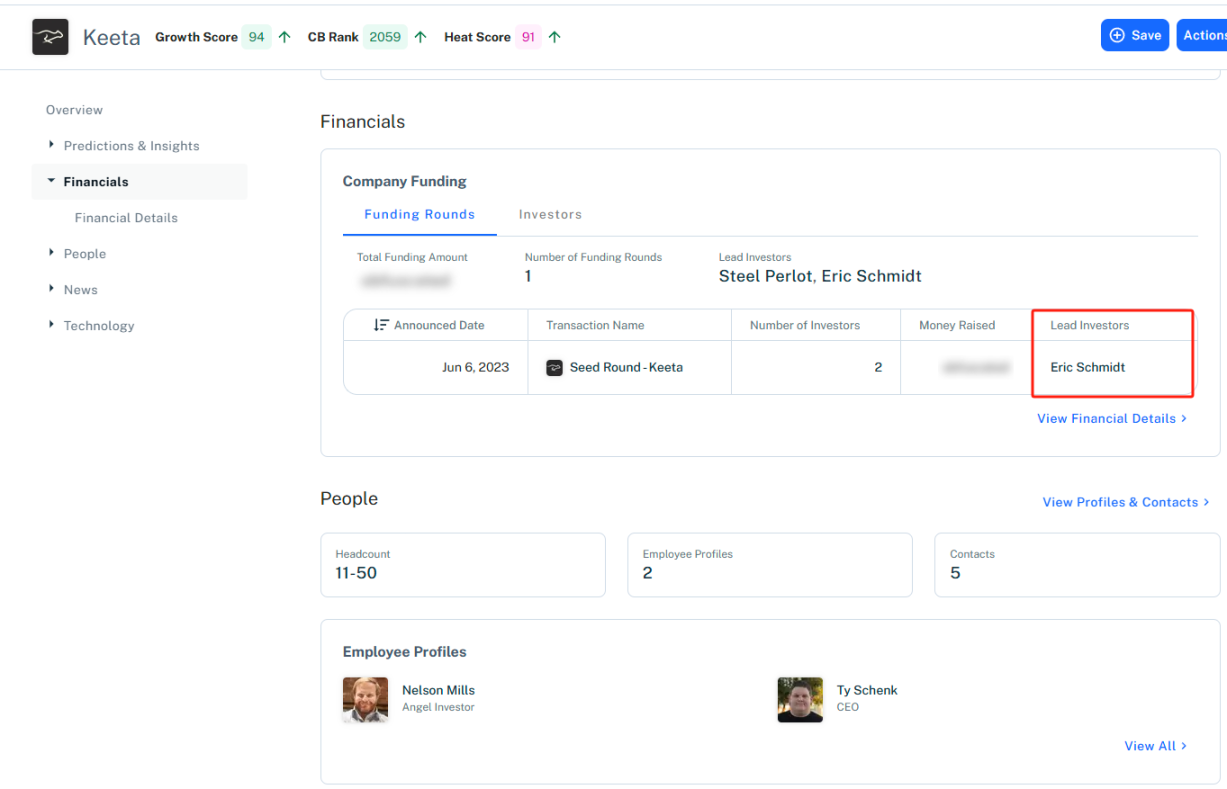

Judging from the technical background and financing situation, Keeta Network is by no means a straitor. Keeta Network's CTO is Roy Keene, former chief developer of Nano, who left the company with a FDV of 4 billion in 2021 because of his desire to change Nano's incentives and institutional adoption. In June 2023, Keeta Network announced it had received a $17 million financing led by former Google CEO Eric Schmidt. Ty Schenk revealed that the investment valued the company at $75 million.

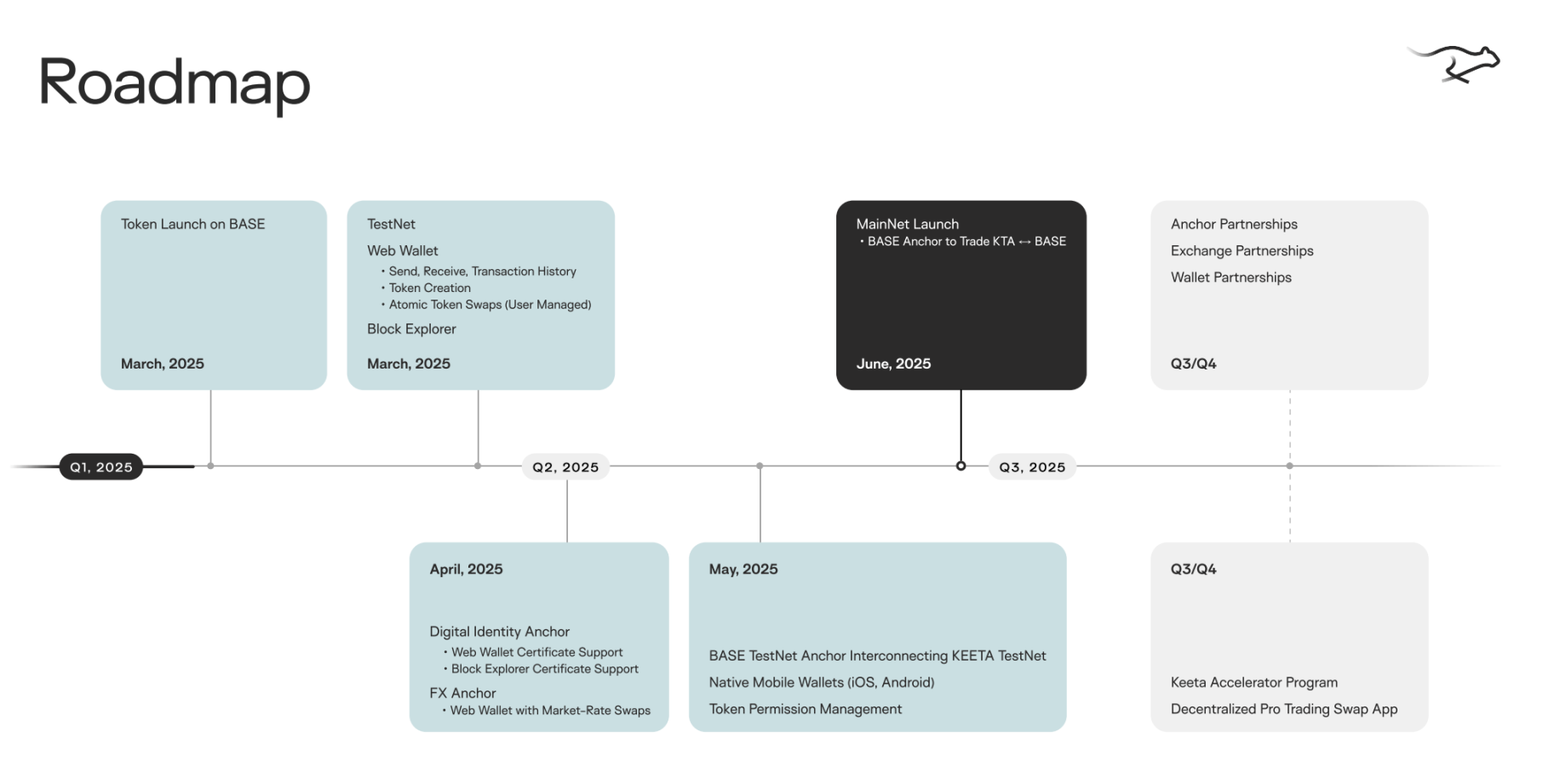

However, Keeta Network, which has a luxurious background, chose to make a sudden arrow on March 5 and completed TGE directly on Base without any prior disclosure. A few hours later, the links to token economics and Telegram community were announced on X, but Keeta's previous Twitter was a "hello world" on October 22, 2022.

Fud comes immediately. Some people questioned whether Keeta was stolen by hackers and sent a fake CA, some people believed that the team was collectively committing evil and wanted to reap the benefits through a backdoor, and more were questioning that non-public TGE caused rat trading to be everywhere. So, at the beginning, Keeta's token price did not unexpectedly fall.

The Keeta project party immediately opened Space to prove its innocence. However, it seems that it has not considered Crypto's marketing at all. Keeta Network basically did not post positively respond to community questions, and its superficial community population and Twitter activity are also in the "very early stage". For a time, only Keeta official posters were left, saying "fastest payment public chain", "decentralization" and "complete compliance". There were not many comments that were confusing and insulting. In the short term, Keeta fell into a dilemma of double killing between coin price and Fud.

Simply put the good news, relying on "contrast" to pull the market?

But this unusual path has led to Keeta's "value discovery" coming a long time later.

When the price of the currency fell continuously, Keeta frequently made moves to prove the legitimacy, such as placing CA on the official website and asking the founder to repeatedly prove that TGE was indeed made by the official team. Then, while everyone was hesitating, locking the warehouse that was in line with the roadmap was carried out. Founder Ty Schenk first interacted with Aerodrome (Base DEX), and then frequently uploaded Keeta Testnet videos that were under development on his personal Twitter, which dispelled many of the doubts about Degen on the chain. As of March 19, Keeta's top eight personal addresses had a total of 6.48%, with net inflows of US$460,800 and net outflows of US$112,100, revealing the bullish sentiment of whales.

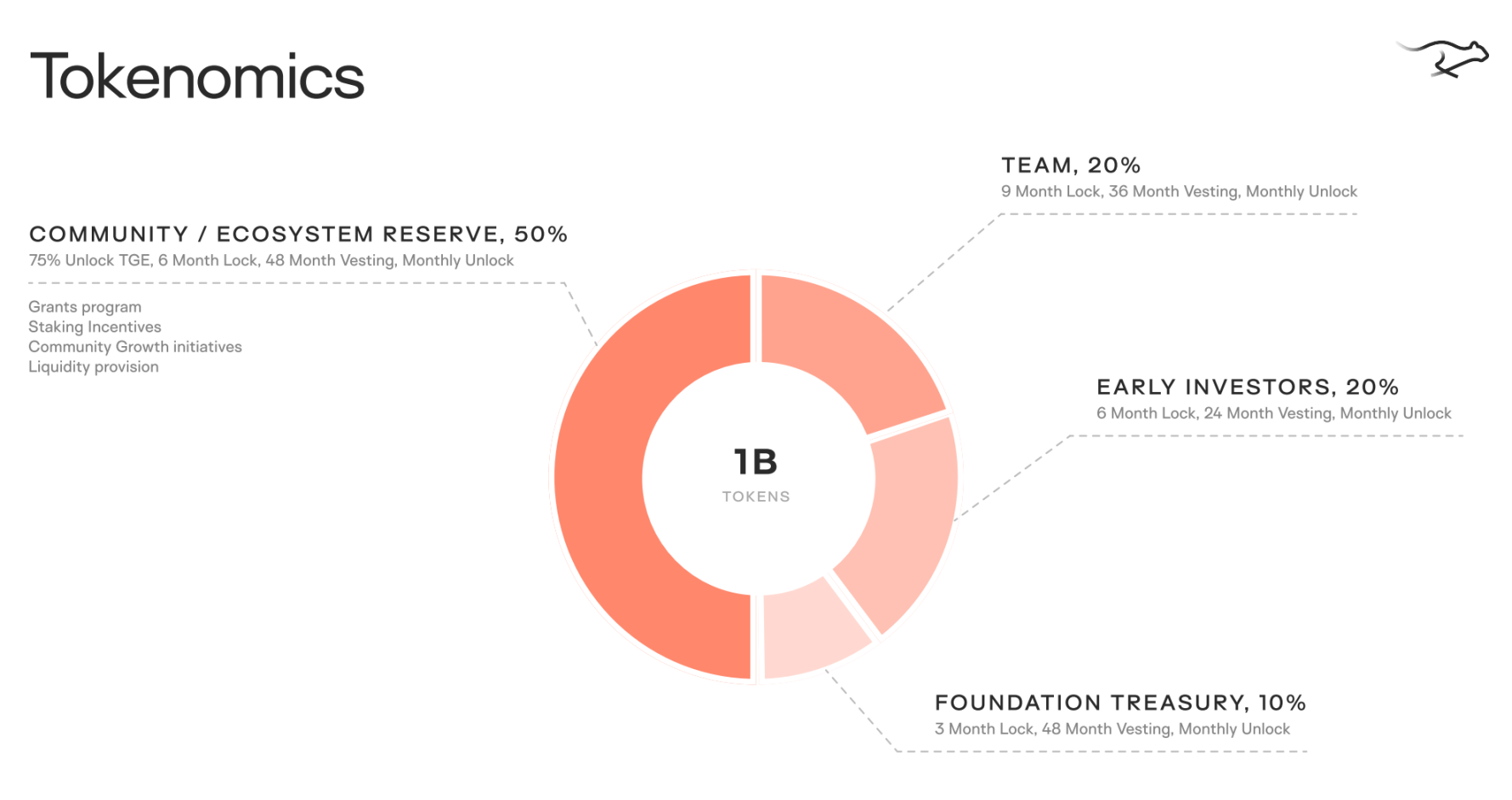

Moreover, Keeta's token economics is also very simple and "rough". Team share is 20%, locked for 9 months, unlocked linearly within the last 36 months, and allocated monthly. Early investors share is 20%, locked for 6 months, unlocked linearly within the last 24 months, and allocated monthly. The foundation shares are 10%, locked for 3 months, unlocked linearly within the last 48 months, and allocated monthly. Community/Ecosystem Share 50%: 75% Unlocked on TGE, remaining locked for 6 months, linear unlocked within the last 48 months. Relatively speaking, Keeta's low circulation leaves enough space for subsequent pull-up actions.

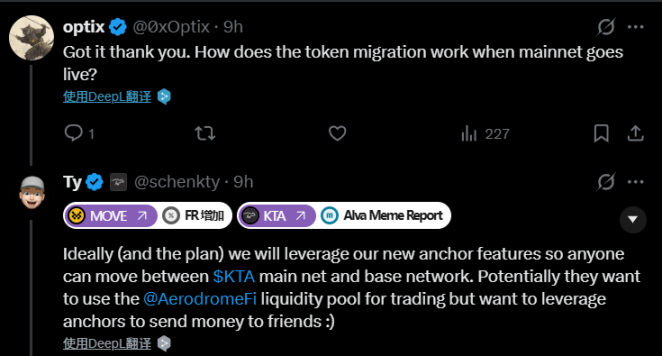

When answering the community's question "Why does Keeta Network, as L1, have to issue coins on Base, L2", Ty Schenk made it clear that the handling fee for Base is significantly lower than that of the ETH main network, and Keeta does not want to be confused with other Memes. Ideally (and Keeta's plan), Keeta will take advantage of the new anchoring feature that allows $KTA to cross-chain from Base to the mainnet.

As the founder kept answering community questions down-to-earth, $KTA made a move to the independent VC currency market in the Meme market of "the day is over". This unique success once again proves the importance of "DYOR". Does this provide an unconventional success for many VC projects that have launched CEX and dropped by 90%?

In an era of rampant demons and monsters, a small white flower (even if it only looks pure) can evoke Crypto's geek atmosphere and decentralized vision, allowing the market to press the buy button. When all projects are homogeneously marketing, attracting new products, and converting, shouting "The big one is coming", it may mean a switch in market style. I don’t know whether Keeta makes a fool of himself or is wise or foolish, but the facts really give Keeta.

When marketing is bleak and when FOMO recedes, how should we measure value? Perhaps, it is time to repeatedly cultivate the "fire eyes" in the boring market.

panewslab

panewslab

jinse

jinse