Dragon Slayer's Dilemma: Bitcoin has become a new scepter of capital?

Reprinted from panewslab

03/15/2025·3MWritten by: Ignas, DeFi Research

Compiled by: Glendon, Techub News

Surprisingly, cryptocurrencies have such a weak impact on life outside our crypto community.

Unless you actively contact the encrypted world, your daily life can be almost completely insulated from it - you can still go to work, shop, and watch TV shows normally, and blockchain technology hides under the superficial world like the undercurrent of the deep sea.

The problem, however, is that when an event of "minimum exposure to cryptocurrency" occurs, the public receives almost always targeted feeding with negative images. Just imagine a scenario like this:

In the second season of the Netflix hit TV series "Squid Game", you see a character set as "crypto scam KOL". The label setting given to him by the screenwriter is that he cannot do without checking the coin price for a minute and strongly demanding the return of his phone. He has a nearly pathological paranoia - but it must be admitted that this portrayal makes me empathize with it.

And when you browse news pushes, you will see the following (all negative) titles:

-

North Korean hackers steal $1.5 billion: The biggest robbery in cryptocurrency history

-

Trump issued Meme coins and was ridiculed by the crypto community angrily denounced "Presidential Rug Pull"

-

Bitcoin scam caused a woman to lose £154,000

-

Cryptocurrency trader "MistaFuccYou" commits suicide during live broadcast

Fraud, pyramid schemes, high shipment... All financial crime scripts you can think of can find corresponding events in this industry. This reflects a cruel reality: society's perception of cryptocurrencies is being torn apart by two extreme narratives. Within the crypto community, we talk about the "blockchain revolution" and the "decentralized financial paradigm transfer"; but in the outside world, media related reports have been dominated by negative events such as fraud and pyramid schemes for a long time.

The public image of cryptocurrencies can be said to be terrible. But to be fair, even we "cryptocurrency natives" know that this circle is indeed full of garbage.

But at the same time, we also know why we are still here: we want to become rich in the process of subverting the outdated traditional financial system. Yes, the “get rich quickly” tag is one of the reasons why cryptocurrency Aboriginals are often unpopular, but who can deny this fact? After all, investors in any field are eager to make big money.

Cryptocurrencies are still one of the few industries where ordinary people can start from scratch. In today's economic environment, it is very difficult to slowly get rich by relying on wages. Generation Z realizes this and (quietly) exits the job market, only they know what cryptocurrencies can bring to their lives…

Unfortunately, our industry is quite clumsy in conveying its core mission, explaining the need for cryptocurrencies, and clarifying that “making money with cryptocurrencies is not the original sin”. A highly praised comment from a report by the Financial Times accurately summarizes the general mentality of skeptics: "Bitcoin has zero intrinsic value, and the computing power consumed is increasing the load on world electricity production and carbon emissions."

Some even skeptics claim that “cryptocurrencies are the alchemy of the 21st century – converting electricity into speculative bubbles and packaging greed into technological innovation.”

If you've read the posts on Reddit, you'll know how disliked cryptocurrencies are, but I hope to see more constructive narratives of cryptocurrencies and technology in mainstream media.

Objectively speaking, the Financial Times has always looked at the crypto industry with a skeptical filter, but Bloomberg’s coverage has been improving over the years – they are starting to introduce real industry insights. But ironically, Bloomberg recently had a seemingly harmless report "Meeting the Seven Top Personal Financial Influencers in the United States", which actually included a certain cryptocurrency KOL on the list. The KOL focuses on Memecoins and is committed to promoting its Memecoin Telegram group.

People hate cryptocurrencies

Since this is a "research-based" article, let's use several sets of key data to understand the public's negative sentiment towards cryptocurrencies. Multiple surveys show that non-cryptocurrency investors generally regard cryptocurrencies as high-risk speculation tools rather than legal financial assets.

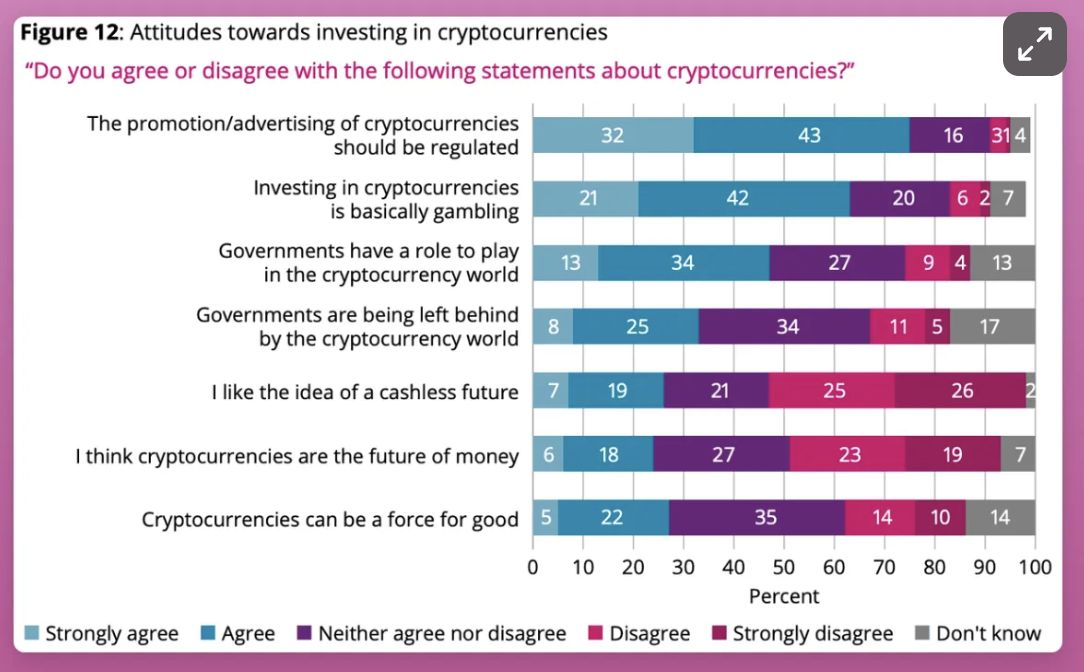

According to the UK Financial Services Compensation Scheme (FSCS) Consumer Research: Attitudes to Invest in Cryptocurrencies, 64% of consumers surveyed with cryptocurrencies believe that “Investing in crypto assets is essentially gambling.”

A 2024 survey by Pew Research Center found that 75% of Americans do not trust the reliability and security of cryptocurrencies, mainly due to frequent fraud and violent market fluctuations.

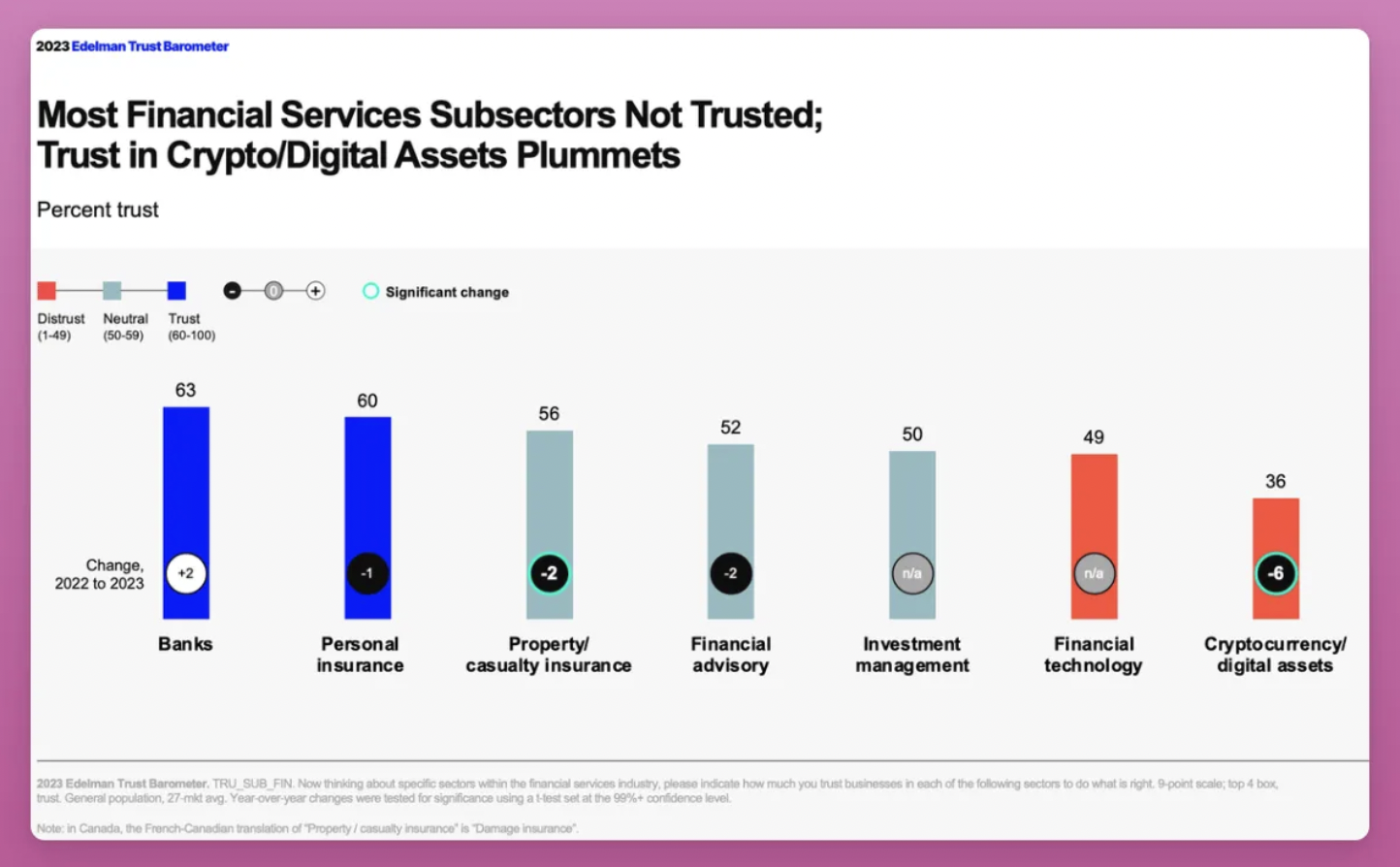

In Edelman's 2023 Global Trust Survey Report, cryptocurrencies are at the bottom of trust in all demographic dimensions, far lower than the traditional banking system we claim to be completely reformed - this is undoubtedly a fatal blow to the narrative of the "decentralized financial revolution".

Granted, the FTX crash hit the cryptocurrency industry’s reputation in 2023, but the crazy hype of Memecoin in 2024 is also increasing public disgust.

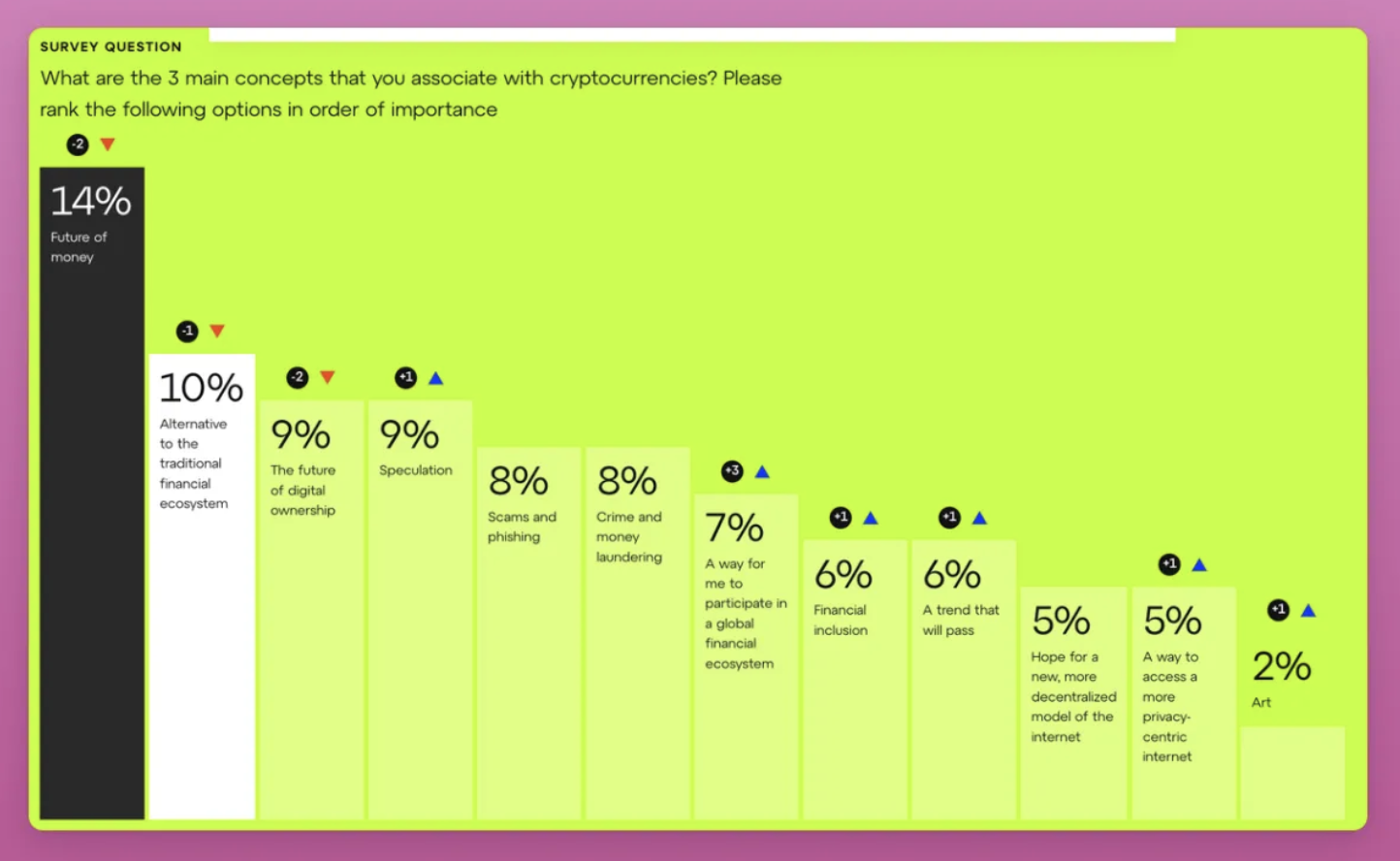

Consensys' 2024 report shows that the cryptocurrency "the future of currency" narrative is declining. The rate of mention of negative labels such as speculation, fraud and phishing, crime and money laundering is in line with the perception that cryptocurrency is "a substitute for traditional finance."

The conclusion is clear: Outside the crypto community, there are widespread questions about whether digital assets can become a safe financial instrument.

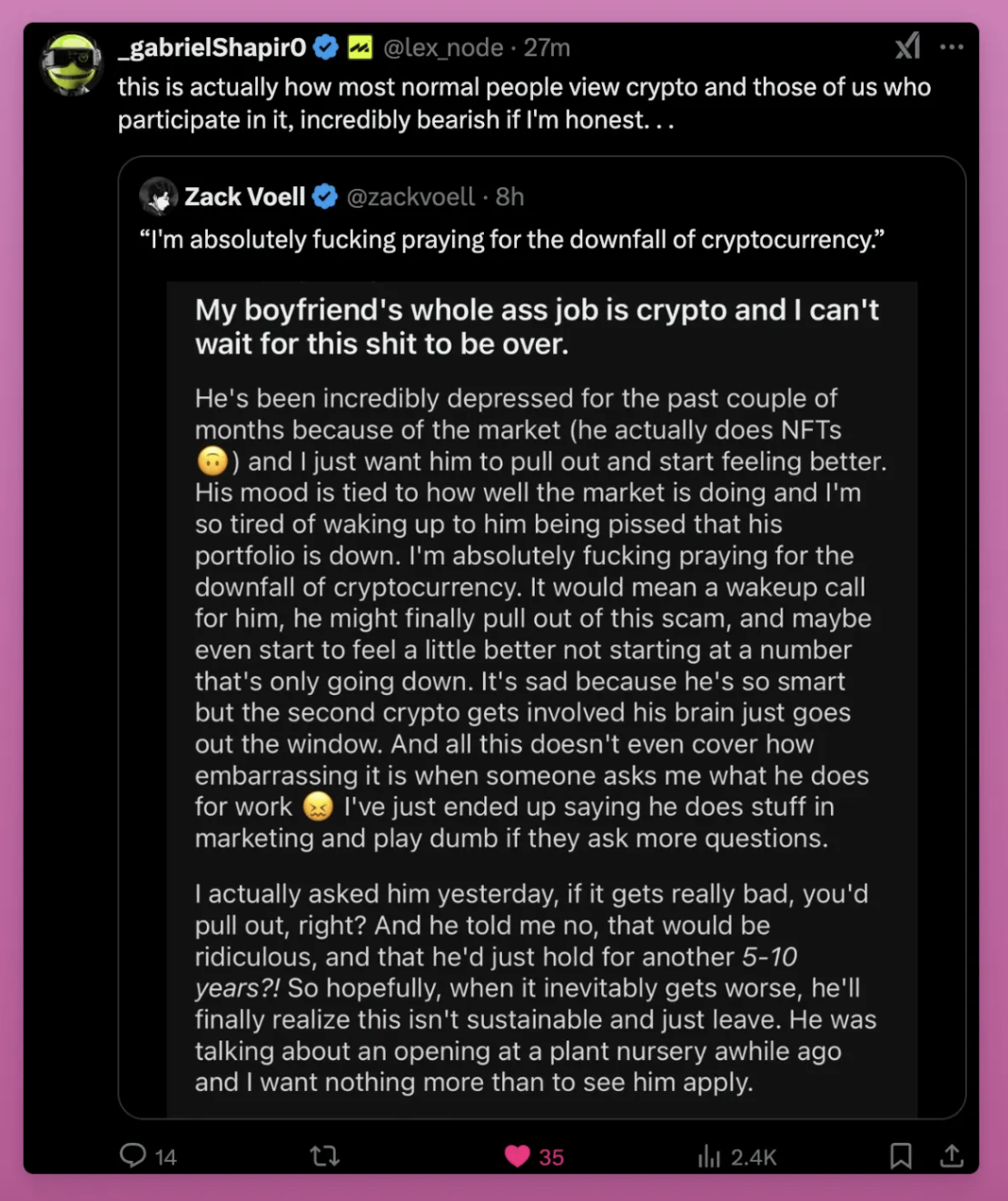

As I wrote this article, I happened to see a tweet that sums up public sentiment well: “I will definitely pray for the downfall of cryptocurrencies.”

Why is crypto-cultural narrative so important

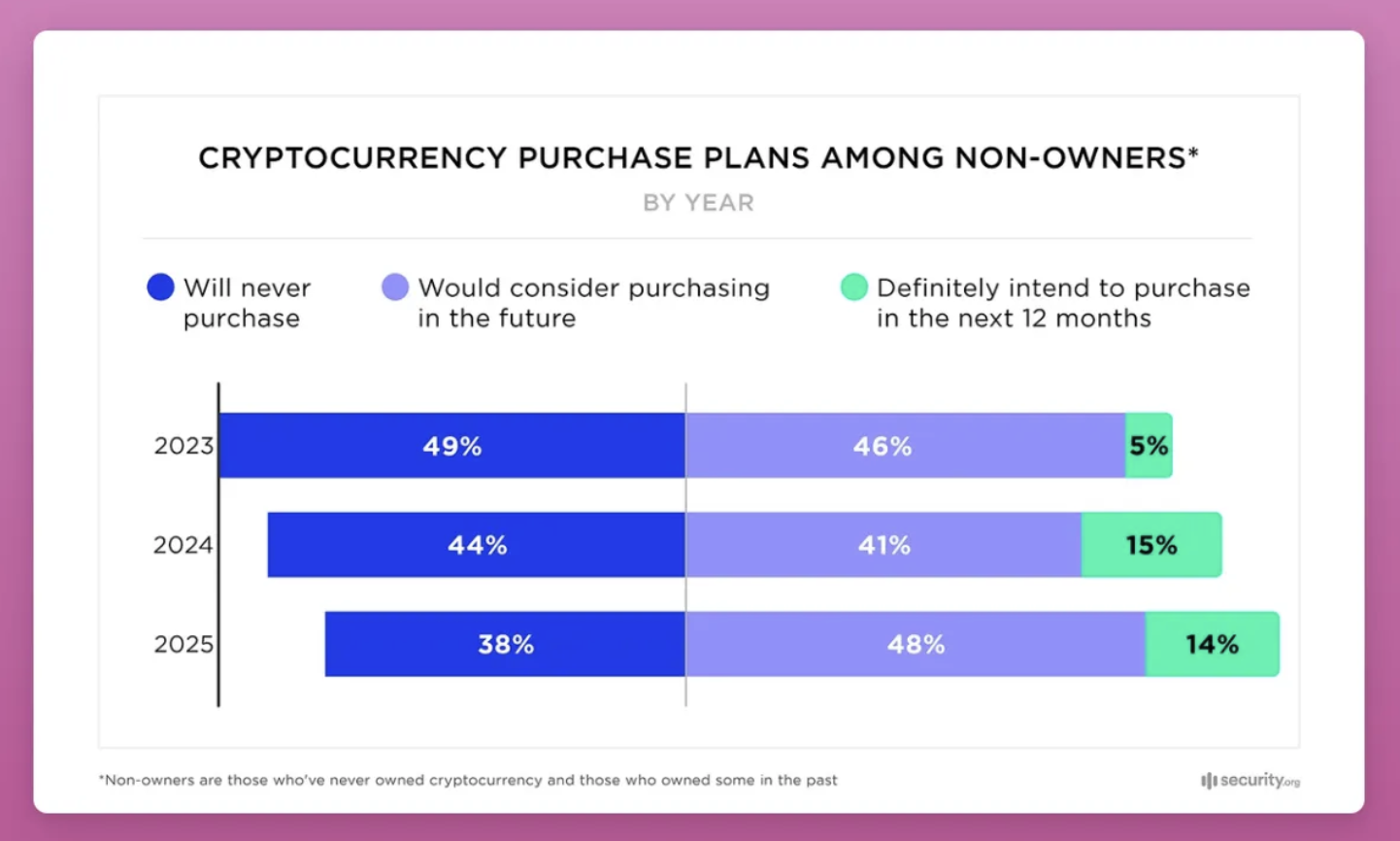

Although the public image of cryptocurrencies is not good, more and more people are trying to get involved in cryptocurrencies. I believe that with the continuous improvement of cryptocurrency concepts, the crypto industry is likely to attract millions of new members.

So, we should and must do better. The original intention of cryptocurrencies is to build a decentralized financial system: "In this system, individuals have complete control over their assets and are not disturbed by intermediaries such as banks or governments. It aims to create a boundary-free, censored, and minimized trust ecosystem where anyone can trade, store value and build an economic system without relying on centralized institutions."

However, this vision is being overwhelmed by Memecoin noise and speculative fanaticism.

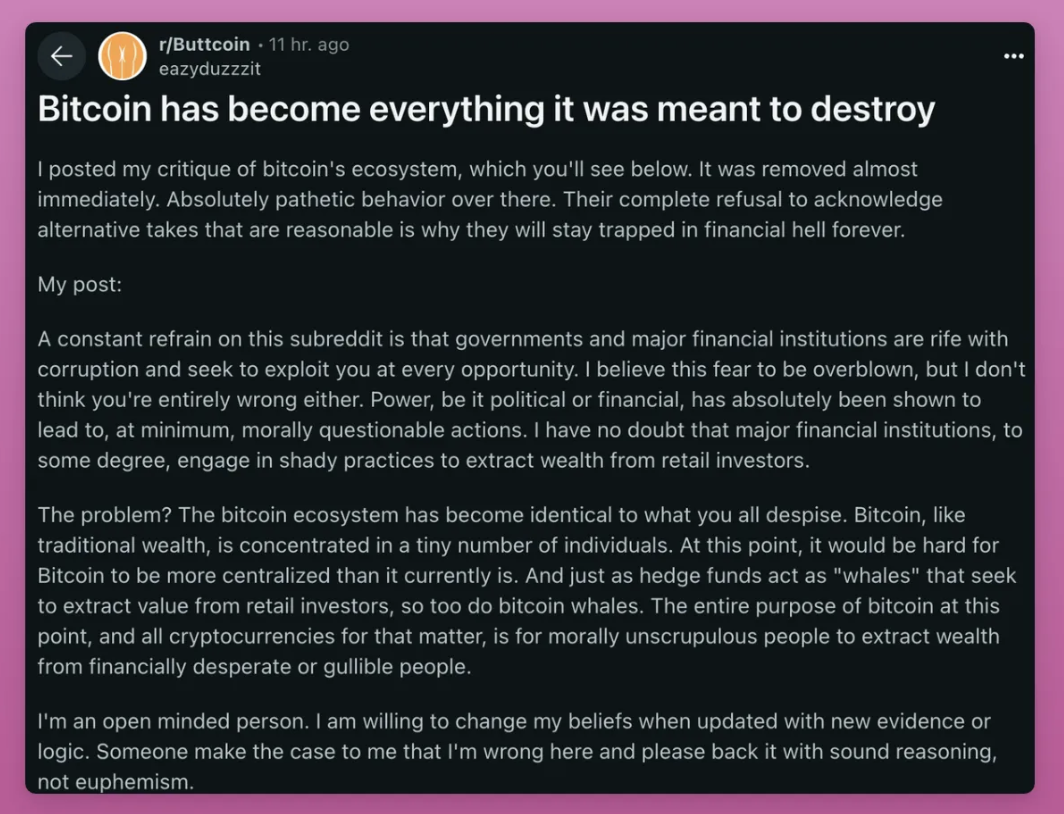

What's worse is that the public no longer regards cryptocurrencies as a weapon to innovate the financial system. As a post that sparked heated discussion, “The Bitcoin ecosystem has become no different from the traditional finance you once despised – money and power are concentrated in the hands of a few giant whales, who use contract leverage and project pre-sale to squeeze wealth from financial desperate people.”

In addition, cryptocurrencies are facing a political crisis, and Trump’s high-profile embrace of cryptocurrencies has also brought new risks - among non-supporters, cryptocurrencies are being labeled as “MAGA Movement” (make the United States great again). Unsurprisingly, this tendency to politicize quickly sparked international vigilance, with the EU seeing Trump’s support for cryptocurrencies as a threat to European currencies.

Of course, this matter also has a good side. Stopping the cryptocurrency regulation suppression by the last US government is undoubtedly a major benefit to the industry. But it has to be admitted that the current cryptocurrency industry is under the influence of the Trump administration's policies, like walking a tightrope.

How to change people’s perception of cryptocurrencies

The reputation of cryptocurrencies does not repair themselves, and if mainstream adoption is to be achieved, we must actively reshape the narrative framework—it is no easy task, and changes must be initiated from within the industry: because even cryptocurrency natives are beginning to lose confidence in the industry.

In this regard, we need to focus on three key directions.

Make cryptocurrency great again

In past cycles, novices in the cryptocurrency market can still make money by participating in projects early. However, Memecoin Group's over-issuance of low-circuit, high-FDV projects supported by venture capital firms (VCs) have made new entrants have no advantage.

And despite successfully resisting low circulation projects in this cycle, we fell into the collective madness of Memecoin. Projects such as Legion and Echo have tried to adopt a more fair financing model, but their entry thresholds still keep ordinary investors out.

Therefore, the industry needs to create and promote ecological game rules that can create real value (rather than destroy value) so that early participants can share growth dividends. The market reconstruction plan proposed by Kyle based on the "first principle" is worth learning from.

However, due to the prevalence of short-termism, the flood of extractive culture and the loss of the bottom line of integrity, we have fallen into the autophagy cycle of eternal financial nihilism - when everyone pursues fraud coins with the mentality of "I can escape before the liar runs away", the occurrence of this phenomenon has long been doomed to some extent.

In this regard, we must monitor bad actors. The industry should take more measures to expose the scam and hold influential people accountable for misleading publicity. On-chain Detective ZachXBT has done this once, but the level of crime is beyond the control of individuals. As practitioners, we ourselves need to stay away from value extraction, and investors should really make money while expanding the cryptocurrency market. After all, when new entrants continue to be harvested or even lose their bankruptcy, the industry will eventually lose its future.

Transform narrative from speculative carnival to practical value

Cryptocurrencies are by no means digital casinos – they also create real-world value.

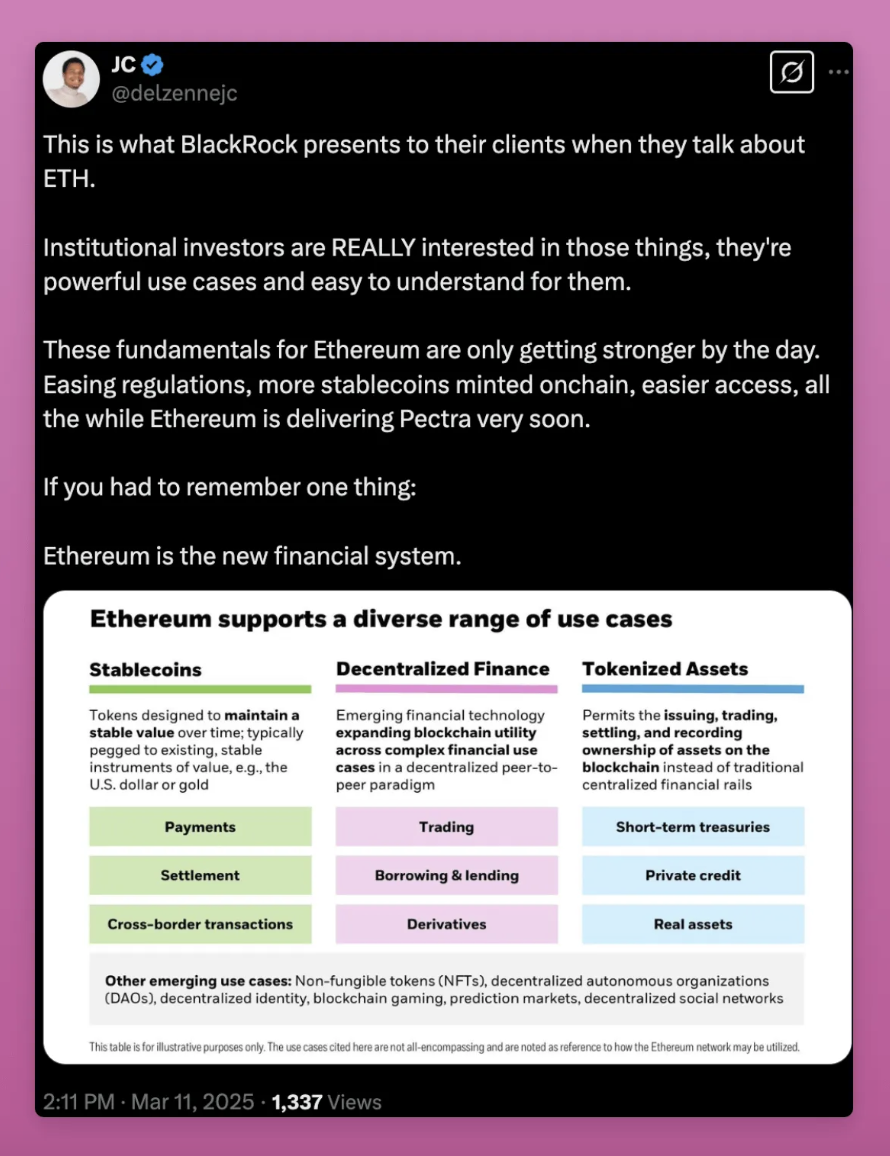

So what we really need to focus on is the use cases such as cross-border remittances, financial inclusion and transparent governance, rather than Memecoin culture.

At the same time, the DeFi ecosystem is continuing to expand, and new social networks are emerging with innovative profit models such as Lens, Abstract and Farcaster. Most importantly, the widespread adoption of stablecoins and RWA (real-world assets) helps to preserve and add value to wealth rather than destroying it.

However, cryptocurrency KOLs on X platform may be indifferent to these progresses – but we need to be clear that crypto Twitter is just the tip of the iceberg of the broader crypto industry culture.

On the other hand, Bitcoin’s advantage lies in gradually establishing its status as “digital gold”, but public chains such as Ethereum and Solana are still regarded as speculative tools rather than as basic platforms for opening up the digital economy.

If you have to define the cryptographic cultural output, I believe that IPs like Pudgy Penguins will penetrate into Web2 instead of introducing Web2 memes such as Doge and Pepe in reverse - the latter is accelerating the industry's incubation.

Redefine the narrative sovereignty of Bitcoin and Ethereum

Cryptocurrency culture is not a monolithic piece, but contains multiple subcultures, the most eye-catching of which are "Bitcoin Minimalism" and "Ethereum Diversity Ecology".

"Bitcoin is becoming the financial system it should have destroyed" - this argument made me indignant. Only those who deposit Bitcoin in a cold wallet can truly understand the peace of mind brought by "self-custody and separation from the system".

ETFs are undoubtedly a good thing for our wallets, but it is also a double-edged sword that prevents ETF buyers from experiencing the sense of freedom that comes with self-custody.

More importantly, we need to be alert to the binding of Bitcoin to the MAGA movement, which is global and should remain absolutely neutral.

This is also the reason why I like Ethereum. Even though many critics accuse the Ethereum Foundation of failure to approach the Trump team, it will prove to be a successful strategy in the long run.

In this era of privacy demise, AI confusing virtual and real, and digital ownership cannot be guaranteed, Ethereum provides not only technical solutions, but also a refuge of value with its credible neutrality, depoliticization, decentralization and global characteristics.

Unfortunately, people outside the cryptocurrency field don’t know about this, so the job of practitioners is to spread this kind of information and create products that truly demonstrate the value of Ethereum.

**Optimistic Outlook: The Road to Return to Value in the Crypto

Industry**

As of the time of writing, CoinMarketCap data shows that the total market value of cryptocurrencies is about US$2.7 trillion, but can this report card withstand the torture of value?

Cryptocurrencies have changed since Vitalik published this post in 2017. Although speculation and zero-sum games still exist, the industry has also nurtured a real value core.

As I once wrote in my post, there are 1.4 billion people worldwide who do not have bank accounts. Even in the United States, this proportion is only 4.5%. The Federal Reserve research found that high-income people regard cryptocurrencies as investments, but are used for trading in a low degree. Among those who trade in cryptocurrencies, 60% earn less than $50,000, and 13% have no bank accounts.

In addition, Venezuela ranked 40th in the Chainalysis cryptocurrency adoption index in 2023, and stablecoins have become the lifeline to resist hyperinflation. This is similar to Argentina, where stablecoin purchases soar as the country’s currencies depreciate – a sign of widespread adoption of cryptocurrencies.

In addition to resisting inflation, cryptocurrencies are also used to resist oppressive regimes. For example, during the COVID-19 pandemic, cryptocurrencies were used to directly aid doctors and nurses in Venezuela without being disturbed by corrupt regimes; at the beginning of the war, Ukraine raised $225 million in cryptocurrency donations, etc.

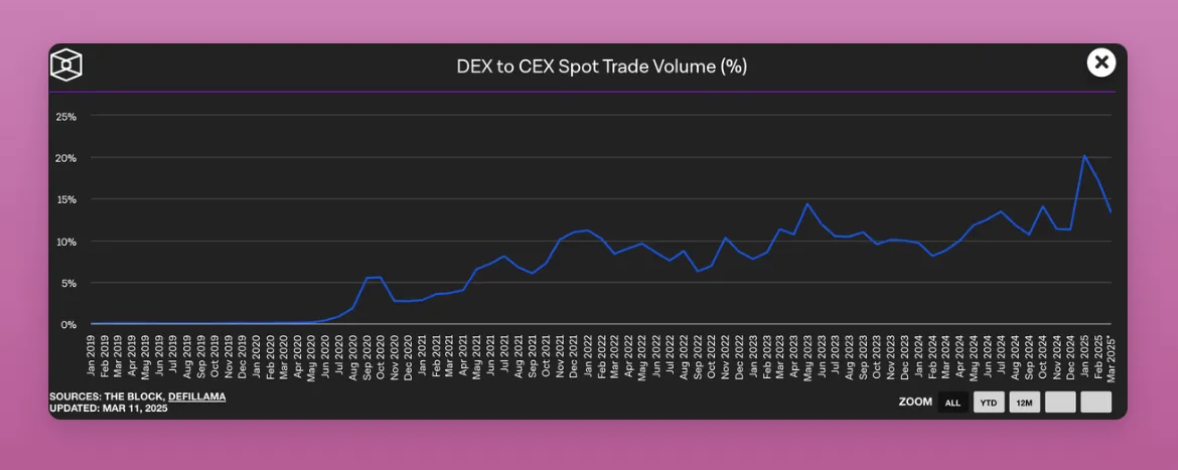

As DeFi TVL rebounds to $88 billion, DEX is gradually challenging CEX, and Maker and others are also introducing RWA to the chain.

It is worth mentioning that the adoption rate of non-speculative decentralized social applications is increasing, such as Farcaster and Polymarket having more than 10,000 daily active users, and the number is still growing. We now have DApps that are really available, but these progress seems to have disappeared on X's timeline, and we have to say that we are not doing satisfactorily in communication.

Nevertheless, the current market is undergoing a value cleaning, and a plunge is not necessarily a bad thing. It will help the industry recover and continue to improve. The same old saying is that the cold winter will eventually pass, and when speculators leave, the real builder will stay and will export the positive side of cryptocurrency.