The cryptocurrency market has been revived overnight. Has the era of pro-crypto government officially begun in the United States?

Reprinted from panewslab

03/03/2025·2M

Original text: The Kobeissi Letter

Compiled by: Yuliya, PANews

US President Trump officially announced the establishment of the "US Strategic Crypto Reserve" last night. This historic move not only marks a further improvement in the position of cryptocurrencies in the global financial system, but also triggers violent market fluctuations. Bitcoin price returned to above $94,000, and the overall market value of cryptocurrencies surged by more than $300 billion in just a few hours. This article will deeply analyze the background, market reactions and potential impact of this announcement, and look forward to the future direction of US crypto policy.

Market reaction

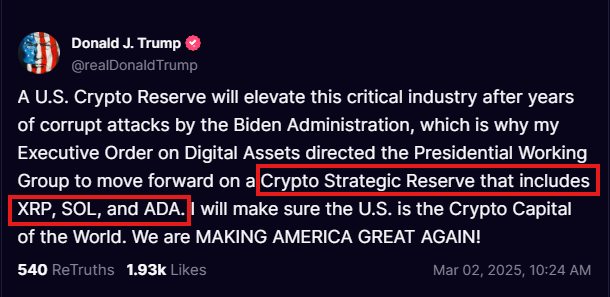

In addition to announcing the establishment of a "strategic cryptocurrency reserve", Trump promised to "ensure that the United States becomes a global cryptocurrency hub." The news quickly sparked market frenzy, especially some of the digital currencies mentioned in the statement, such as Ripple ($XRP), Solana ($SOL) and Cardano ($ADA).

Since the announcement, these tokens have all seen significant increases, with ADA rising as much as 64%, XRP rising 30%, and SOL also rising 21%.

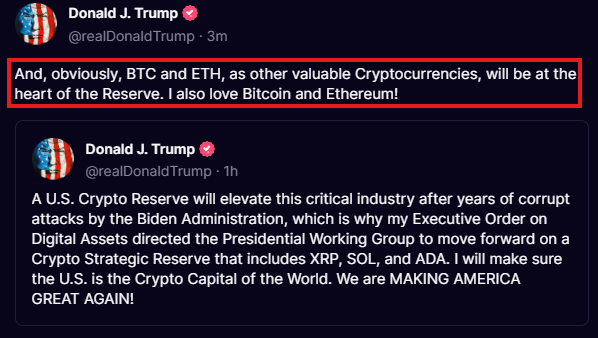

However, in the initial statement, the two leading currencies, Bitcoin (BTC) and Ethereum (ETH), were not mentioned. But soon after, Trump made it clear in an updated statement: "Obviously, Bitcoin (BTC) and Ethereum (ETH), as other valuable cryptocurrencies, will become core components of the reserves."

The supplementary statement further boosted market sentiment, with Bitcoin price rebounding rapidly to $94,000, up nearly 20% from its recent lows. Since last Friday, the price of Bitcoin has soared from $78,200 to over $94,000, completely breaking away from the bear market, and is currently only about 16% away from its all-time high.

Background and potential impact

This move by the Trump administration is not without warning. As early as January 16, the New York Post reported that Trump was expected to propose to establish an "America-first" crypto reserve, focusing on supporting crypto assets originating from the United States, including Solana, USD Coin and Ripple.

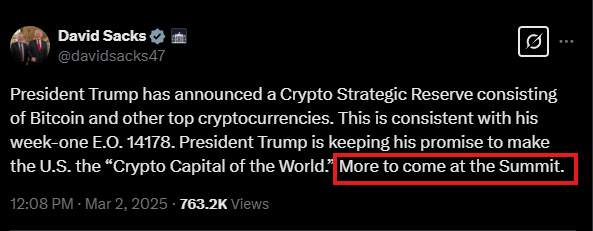

A few days ago, Trump's son Eric Trump also posted a post about " ₿uy the dips ". Meanwhile, Trump's crypto adviser David Sacks also said on social media yesterday that "more news will be announced at the upcoming crypto summit." It is reported that Trump will host the first cryptocurrency summit at the White House on March 7, and the outside world generally speculates that more digital currencies may be included in the reserve list by then.

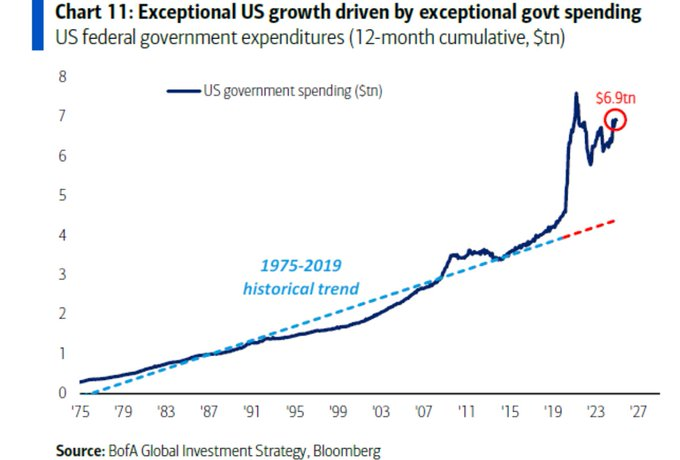

In addition, the establishment of this strategic reserve may pave the way for the transfer of annual US federal government spending to blockchain technology. Tesla CEO Elon Musk proposed a month ago to place $6.9 trillion in annual U.S. spending on decentralized ledgers to leverage blockchain technology to reduce billions of dollars in annual audit costs.

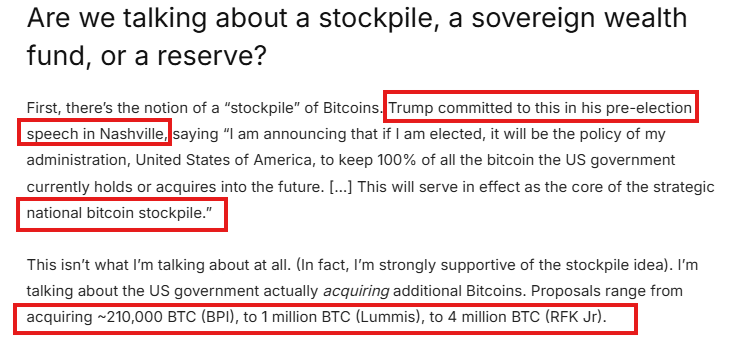

Pro-crypto government

It is worth noting that the initial proposal only involves Bitcoin reserves, with plans to acquire 2.2 million to 4 million Bitcoins. However, with the announcement of this strategic reserve, the reserve scope has expanded to multiple cryptocurrencies, but the government has not yet provided a specific explanation for this.

Driven by the Trump administration, the United States ushered in an unprecedented pro-crypto era. The following policies and events further consolidate this trend:

- pro-cryptocurrency Securities and Exchange Commission (SEC) leadership;

- President Trump’s pro-crypto stance;

- Announce crypto reserve plans;

- The SEC has withdrawn several lawsuits against cryptocurrencies;

- Trump launched his own "Meme Coin";

- The SEC clearly stated that Meme coins do not belong to securities.

This series of measures shows that the U.S. government is actively embracing cryptocurrencies and the blockchain technology behind them.

The next catalyst for the crypto market

Currently, the crypto market is looking for new catalysts to drive further development. Although Trump's multiple campaign promises have been fully digested by the market, there are still many uncertainties in the future. For example, the market is generally concerned about whether Bitcoin can hit record highs this month. In addition, as the Trump crypto summit approaches, disclosure of more policy details may have a profound impact on the market.

Against this background, the technology stock market also showed positive reactions. Last Friday, the Nasdaq 100 rose 2% in just three hours before the close, although there was no obvious positive news at the time. Market speculation that some people may have learned about the crypto reserves in advance. In addition, as news about cryptocurrency reserves ferment, technology stocks are expected to open higher when U.S. stock futures open.

chaincatcher

chaincatcher

jinse

jinse