DeFi's new quality driving force: repurchase, dividends and fee switches

Reprinted from panewslab

03/12/2025·1MTitle: DeFi's Growing Focus on Token Value Accrual

Author: @ManoppoMarco, primitivecrypto Investor

Compiled: zhouzhou, BlockBeats

Editor's note: The DeFi protocol is accelerating the accumulation of value by token holders, and agreements such as Aave, Ethena, Hyperliquid and Jupiter are all implementing repo plans, fee switches and new incentive structures. Ethena plans to enable a fee switch to share revenue with pledges and is currently achieving key goals. Other protocols also enhance token value through repos, fee allocation and optimized governance.

The following is the original content (to facilitate reading comprehension, the original content has been compiled):

If you spend 8-9 figures on growth but don’t see at least linear growth in revenue, buybacks may not be a bad thing. The DeFi protocol is under increasing pressure to distribute some of its revenue to token holders. Major projects such as Aave, Ethena and Hyperliquid are already exploring how to introduce value accumulation mechanisms to their native tokens.

The key driver behind this trend? The election of Donald Trump has ushered in a more friendly regulatory environment for DeFi. Here are the latest updates to the economics of Aave, Athena, Jupiter and Hyperliquid, including their repo plans and fee adjustments.

AAVE

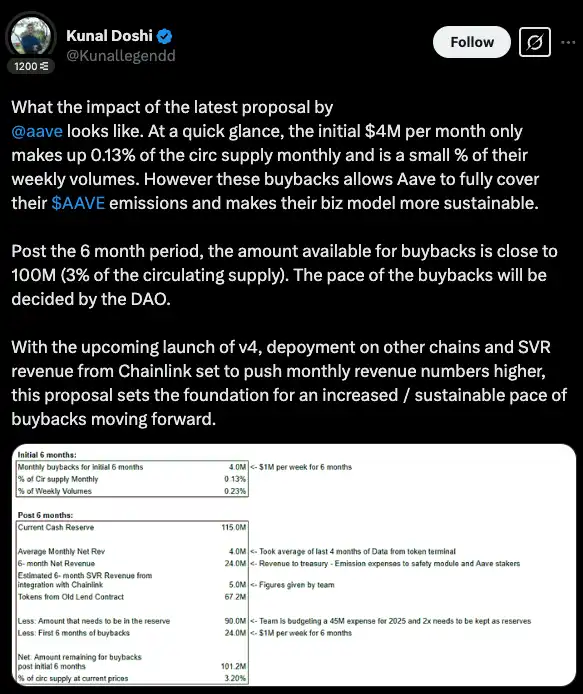

Aave has just launched a major token economics reform that focuses on repurchases, fee allocations, and providing better incentives for token holders. According to Marc Zeller, founder of Aave Chan Initiative (ACI), this is one of the most important proposals in Aave’s history.

Repurchase & Fee Adjustment

Aave launched a six-month buyback program that invests $1 million per week (about $4 million per month) to cover AAVE token emissions and improve the sustainability of the protocol. After six months, the repurchase fund pool may reach US$100 million (about 3% of the circulating supply), and the specific deployment pace will be determined by the DAO.

What is the goal? Control token emissions while enhancing Aave's vault strength.

New Finance & Governance Measures

Aave is setting up the Aave Finance Committee (AFC) to specialize in treasury fund management and liquidity strategies. In addition, Aave is completing the transition from LEND tokens, recovering 320,000 AAVEs (approximately US$65 million) for future uses.

Umbrella: Aave 's new risk management system:

Aave spends $27 million on liquidity costs per year, so it launched the Umbrella system to optimize capital efficiency and reduce risk. The system will be integrated into multiple blockchains, including Ethereum, Avalanche, Arbitrum, Gnosis and Base.

Anti-GHO: New reward mechanism for stablecoin holders:

Anti-GHO, as a brand new reward mechanism, will replace the old discount model of GHO holders. Tokens held can be destroyed in a 1:1 ratio to offset GHO debt or converted to StkGHO, allowing the incentive mechanism to be directly linked to Aave's revenue. The mechanism is still under development and may be launched as part of a future update of "Aavenomics Part 2".

What’s next?

With the release of Aave v4, more on-chain deployments, and additional revenue from Chainlink SVR, this update sets the stage for larger and more sustainable buybacks in the future.

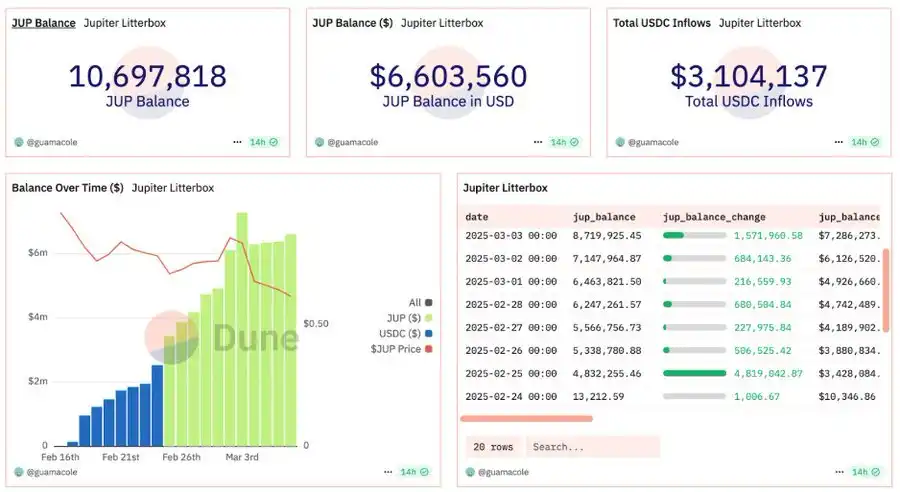

Jupiter

Jupiter has started to repurchase and lock JUP tokens for three years since February 17, 2025. The initiative aims to reduce circulation supply, enhance long-term stability, and promote user participation in the Solana ecosystem. In February this year, Jupiter completed its first buyback, purchasing 48,800 JUPs for US$3.33 million. At present, Jupiter's Litterbox Trust repurchase plan has repurchased more than 10 million JUPs (about 6 million US dollars).

What’s next?

On an annual basis, Jupiter's $3.33 million repurchase scale is equivalent to an annual repurchase volume of more than $35 million. If you follow more radical estimates, Jupiter's revenue in 2024 is $102 million, which means the repurchase may exceed $50 million.

Hyperliquid

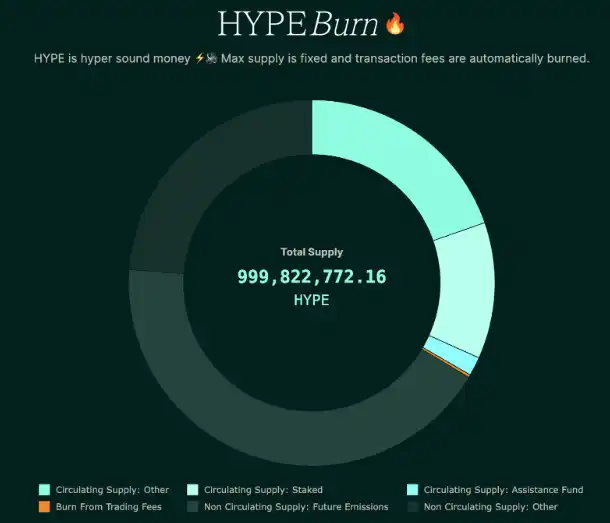

Token allocation

The total supply of Hyperliquid's native token HYPE is 1 billion, and there is no financing and no investor allocation. The specific allocations are as follows:

·31.0%: Airdrop to early users (full circulation)

·38.888%: reserved for future emissions and community rewards

·23.8%: Team allocation, locked for 1 year, most will be unlocked in 2027-2028

·6.0%: Hyper Foundation

·0.3%: Community funding

·0.012%: HIP-2

The team-to-community token ratio is 3:7, with the largest non-team holder being Assistance Fund (AF), which holds 1.16% of the total supply, accounting for 3.74% of the circulating supply.

Revenue Model & Repurchase Mechanism

Hyperliquid's main sources of revenue include transaction fees (spot + derivatives) and HIP-1 auction fees. Since Hyperliquid L1 does not currently charge a Gas fee, Gas-related income is not included.

Income distribution

·46% of perpetual contract transaction fees are allocated to HLP holders (supply side rewards)

·54% for repurchasing HYPE via Assistance Fund (AF)

In addition, HIP-1 auction fees and spot transaction fees (USDC part) are currently all used in HYPE token repurchases.

Double deflation mechanism

·Repurchase: AF uses part of its revenue to repurchase HYPE tokens, but it is not destroyed, but is held by AF

·destroy:

1. All HYPE-denominated spot transaction fees (such as HYPE-USDC trading pairs) will be directly destroyed.

2. After the HyperEVM main network is online, all Gas fees will be paid in HYPE and will be destroyed.

Repurchase impact & pledge mechanism

Based on publicly available Hyperliquid transaction fee data, based on March 2025, AF repurchases through 54% of perpetual contract revenue, with an estimated monthly purchase of approximately 2.5 million HYPEs worth approximately US$35 million. HYPE staking was launched on December 30, 2024, adopting a PoS reward mechanism (similar to Ethereum), with the current annualized rate of return of about 2.5%. Currently, 30 million HYPEs have been pledged (excluding the 300 million tokens held by the team/foundation).

Future Outlook

Hyperliquid may introduce a fee sharing model, allowing some on-chain transaction fees to be distributed directly to HYPE holders to create a more sustainable incentive system. However, some people believe that the current model can form a stronger flywheel effect during the market ups and downs.

Hyperliquid's revenue mainly comes from transaction fees and HIP-1 auction fees, and it is possible to expand revenue sources such as HyperEVM transactions in the future. Currently, in addition to being used for repurchase and incentives, some handling fees are also possible:

·Assign to HYPE holders by position or pledge quantity.

·Reward long-term pledgers and promote deeper community participation.

·Distribute it into the community vault and hand it over to the governance to determine the purpose.

Possible allocation patterns:

· Direct handling fee sharing:

A portion of the transaction fee is converted to USDC or HYPE and is regularly distributed to coin holders (similar to dividends).

·Staking enhancement rewards:

Users who only pledge HYPE can receive a share to incentivize long-term holdings.

·Mixed mode:

Combined with handling fee allocation + HYPE repurchase, balance price support and coin support incentives.

Ethena

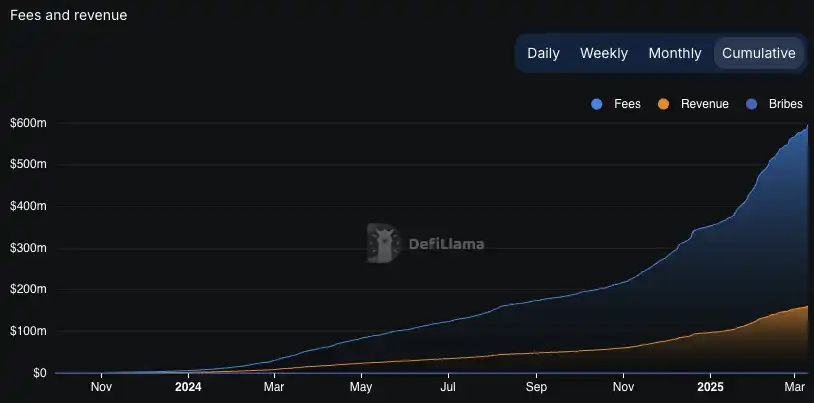

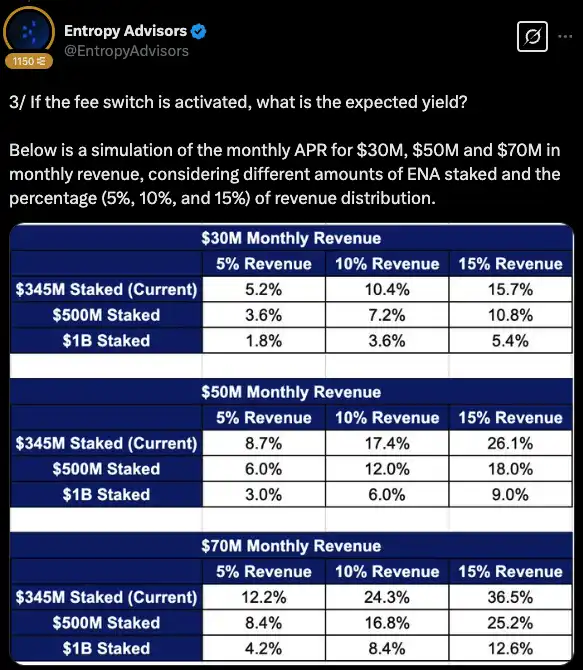

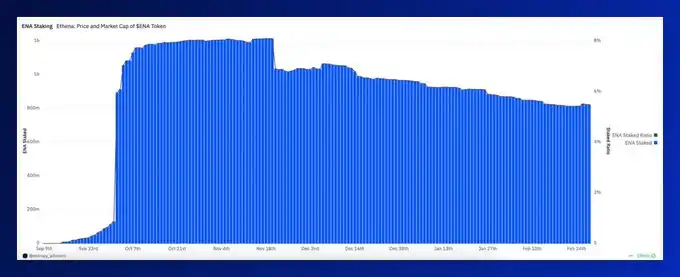

Ethena Labs is now among the top five DeFi protocols in TVL, with annual revenue of over $300 million. As the agreement grows, Wintermute’s proposal for fee allocation has been approved by the Ethena Risk Committee. Currently, 824 million ENAs (valued at US$324 million) are pledged, accounting for 5.5% of the total supply, but the pledgers can only receive points rewards and unreceived ENA airdrops, and do not enjoy the revenue share generated by Ethena.

Ethena fee switches and future plans:

The activation of the fee switch will provide pledges with direct revenue sharing opportunities and enhance the effectiveness of DAO governance through incentive consistency with ENA holders. Ethena's revenue comes primarily from perpetual contract market capital rates. Currently, 100% of the revenue is distributed to USDe pledgers and reserve funds. The average monthly income for the past three months has been $50 million.

Preparation before enabling the fee switch: The Risk Committee sets five key indicators to ensure Ethena is in a solid position until it is shared.

Current indicator progress:

·USDe Supply Target: 6B – The target gap is only 9%.

·Cumulative revenue: 250M+ – It reached US$330M in January, exceeding the amount.

·Exchange Integration: Binance/OKX – There is no timetable yet, but Binance currently holds USD 4 million.

· USDe supply with reserve funds accounting for ≥ 1% – USD 61M reserves support USD 6.1 billion.

·The gap between sUSDe and sUSDS APY ≥ 5% – The gap has narrowed due to the market downturn, but it may expand again in the future.

Future Outlook

Ethena is close to reaching its target, but the fee switch will continue to remain paused until all indicators are met. During this period, the team will focus on USDe supply growth, ensuring more exchange integration and monitoring market conditions.

Once the conditions are met, the ENA pledger can start to enjoy income sharing.

Summarize

DeFi major protocols are accelerating the transition to token holder value accumulation, with Aave, Ethena, Hyperliquid and Jupiter all implementing repo programs, fee switches and new incentive structures that make their tokens more valuable outside of speculation.

This trend reflects the overall shift to sustainable token economics in the industry, with projects focusing more on real income distribution than inflationary incentives.

Aave uses its deep reserves to support repo and governance improvements, Ethena is committed to providing stakeholders with direct revenue sharing, Hyperliquid optimizes repo and fee allocation models, and Jupiter locks up repurchase tokens for stable supply.

With the gradual improvement of the regulatory environment and the maturity of DeFi, those protocols that successfully align with community incentives will flourish.

chaincatcher

chaincatcher

jinse

jinse