Canary Capital frequently submits ETF applications, and is the application of counterfeit ETFs a disguised advertising business?

Reprinted from panewslab

03/22/2025·2M

Author: Weilin, PANews

On March 20, Canary Capital, a US financial institution, submitted a Canary PENGU ETF application to the U.S. Securities and Exchange Commission (SEC), planning to launch ETFs that hold both Fat Penguin NFT and $PENGU tokens. According to the submitted plan, the ETF fund plans to hold 80-95% of the $PENGU tokens, and 5-15% of the Pudgy Penguins NFT. As soon as the news came out, it sparked widespread discussions within the Fat Penguin community and in the wider crypto market, and even Canary’s avatar on social media was Fat Penguin NFT.

Canary Capital, which has been established for only 6 months, has intensively submitted multiple altcoin ETF applications. However, this approach has also caused a lot of doubts about how big the real demand for these altcoin ETFs is? Or, it's more of a gimmick and marketing tool.

PENGU ETF news has led to the rise in the currency price and then fall.

Will traditional investors enter the market?

After the announcement of the PENGU ETF, the price of $PENGU initially soared to $0.0075, up nearly 10%, reflecting the market's short-term optimism about the news. However, as of 7:30 pm on March 21, its price had fallen back to US$0.0062, a 24-hour overall decline of 8.63%, indicating that the market's enthusiasm for the news has not been maintained for a long time. Although capital inflows increased significantly after the news was announced, with 24-hour trading volume reaching $135 million, the price trend failed to remain strong.

The PENGU ETF submitted this time has caused some controversial voices within the Fat Penguin community. For example, Fat Penguin Community user @beast_ico said that $PENGU ETF is probably the most outrageous thing I have seen recently. We don’t even need ETFs for the “ghost chain”, let alone a memecoin that has been in less than 6 months. If those "Boomers" (traditional investors) are not even interested in ETH (not to mention SOL), then why would they touch something called PENGU?

But digital artist @Tuteth_ said, "We're really going to be over, brothers. I've seen the hot talk about $PENGU and Pudgy Penguin ETFs, it's just a junk view. Some of them are still my friends. But you don't even realize that you're promoting 'high poppy' (jealous of successful people, suppressing the leader). Bitcoin was also ridiculed as the stupidest thing in the world. The meaning of staying in this circle is to enjoy these seemingly absurd but ultimately come true because we've seen them happen. We've come all the way to this day and then we've seen this ETF instead, and you're just saying, 'Hey, that's crossing'? Think about it, your avatar is an animal, and you talk to your friends online about cryptocurrencies every day. It's all ridiculous -you just draw a line here and laugh to death."

It can be seen that the Fat Penguin community has different attitudes on this ETF application. Some opponents believe that this is a ridiculous hype, while others regard it as an inevitable step in the evolution of NFT culture.

Is the threshold for submission of S-1 documents low? Canary Capital

applies for counterfeit ETFs one after another

PANews once introduced Canary Capital, a crypto investment company, in October 2024, when it was only one month old. The founder and CEO of Canary Capital is Steven McClurg, who is also the co-founder of Valkyrie Funds. It is worth mentioning that Justin Sun is also an investor of Valkyrie. In October 2021, Valkyrie was approved to launch the first batch of Bitcoin futures ETFs in the United States. Steven McClurg left Valkyrie Funds in August 2024 and established crypto investment company Canary Capital in September. On October 1, Canary Capital announced the launch of the first HBAR trust in the United States. Canary subsequently applied for SUI ETFs, ETFs that track Axelar (AXL) prices, Litecoin (LTC) ETFs, AXL Trust, Solana ETFs, and XRP ETFs.

Some analysts pointed out that the low cost of submitting S-1 documents may be one of the reasons for the recent large number of applications for altcoin ETFs. According to analyst Chen Jian and Jason on March 7, "S-1 is the first step in registering an ETF, and what is the S-1 threshold for submitting an ETF? There are only two hard thresholds. First, it is a company registered in the United States including asset management and financial services, and secondly, it costs about US$100,000 to cover the cost of drafting S-1 documents."

Previously, on March 6, Canary Capital applied to the US SEC to launch an ETF that tracks the cross-chain protocol Axelar. At that time, Chen Jian pointed out, "After Canary submitted the S-1 of AXL's ETF, AXL also rose. I know the AXL project. I have written two long articles before. The fundamentals are OK, but they are completely unable to meet the qualifications for ETFs and are far away. The Canary company that submitted the materials was established in September 2024, a small company that has been established for less than half a year. So a small company that has been established for half a year submitted a coin that obviously does not meet the requirements of ETFs, and was reported by major media. Can you believe that there is nothing tricky about it?"

Crypto KOL@qinbafrank recently expressed a similar view to Chen Jian: "In addition to the three largest mutual funds of BlackRock, Franklin and Fidelity, as well as the first fund companies such as Bitwise, Grayscale, and Ark that were approved for BTC ETFs, if we see some unknown fund companies announcing submission of inexplicable altcoin ETFs to the SEC, there is no doubt that these fund companies will charge advertising fees, and the main dealers behind them may take the opportunity to increase their shipments."

SOL futures are weak on the first day of listing, and small-cap

currencies may be difficult to maintain large demand

Meanwhile, Solana Futures was first traded on the Chicago Mercantile Exchange (CME) Group's U.S. derivatives exchange on March 17, which is considered a key step in applying for SOL spot ETFs and a test of market demand.

But according to preliminary data from the CME website, on March 17, the first trading day of the contract, SOL futures with a nominal value of approximately 98,250 SOL (about 12 million US dollars) changed hands on the exchange. This situation, compared with major cryptocurrencies such as Bitcoin and Ethereum, the early transactions performed poorly.

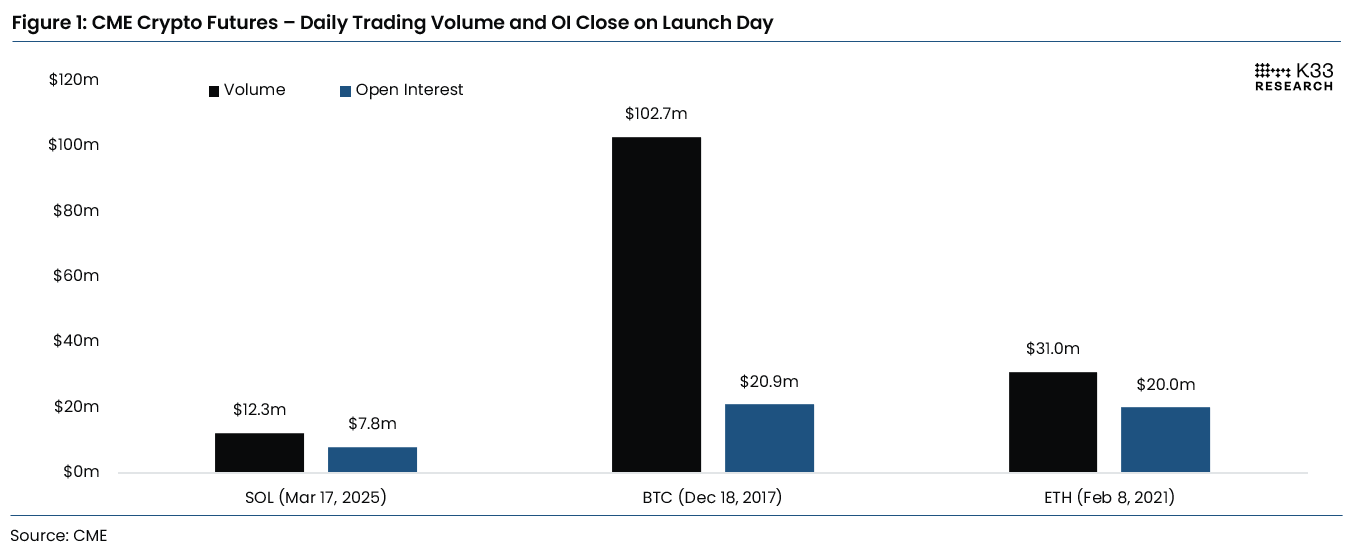

According to a report by research firm K33, the total trading volume on the first day of Solana futures trading was $12.3 million and the open interest was $7.8 million. This is in stark contrast to Bitcoin futures, which attracted $102.7 million in trading volume and $20.9 million in open contracts when it debuted on the Chicago Mercantile Exchange in December 2017. Ethereum also performed better, with its futures trading at $31 million when it launched in February 2021 and open contracts of $20 million.

K33 analysts Vetle Lunde and David Zimmerman attributed the tepid performance to a wider market situation, noting that Solana’s launch is a positive period of no strong bull market or altcoin rebound in a period of sluggish risk appetite. "Although Solana seems to have a more reasonable performance after market capitalization adjustment, its absolute figure is much lower than previous futures listings," the K33 report noted.

Despite a weak start, the listing does fit into the model that is usually associated with the final approval of spot ETFs, analysts added. However, they warned that Solana's lower trading activity suggests that any future ETF associated with the token may have a more modest impact on price than the uptrend triggered by Bitcoin's approval of spot ETFs in early 2024.

In general, the discussion of PENGU ETF reflects a collision between NFT, memecoin culture and traditional finance, and community users also hold their own views. Canary Capital frequently applies for counterfeit ETFs. Is it an innovative attempt or a pure marketing method? The future of altcoin ETFs is to be answered together in the future by crypto markets, users and regulators.

chaincatcher

chaincatcher