With 2 million Gas-free transactions per month, is the account abstraction a boom or a bubble?

Reprinted from panewslab

03/22/2025·2MAuthor: Stacy Muur, Crypto Researcher

Compiled by: DeepSeek

Editor's Note: The article summarizes the potential of Paymaster payment model to significantly enhance on-chain activity through the ERC-4337 smart wallet in 30 days. However, a surge in transaction volume may mask real user demand, with one-time activities such as NFT minting and airdrops leading to short-term increase in wallet counts but low retention rates, while a few gaming, DeFi and infrastructure applications exhibit deeper reuse. Data shows that although Gas sponsorship can attract users, continuous participation depends on attractive applications. ERC-4337 has promoted the popularization of Gas-free transactions, but faces technical complexity and cost challenges. In the future, EIP-7702 is expected to further simplify and accelerate its adoption.

The following is the original content (to facilitate reading comprehension, the original content has been compiled):

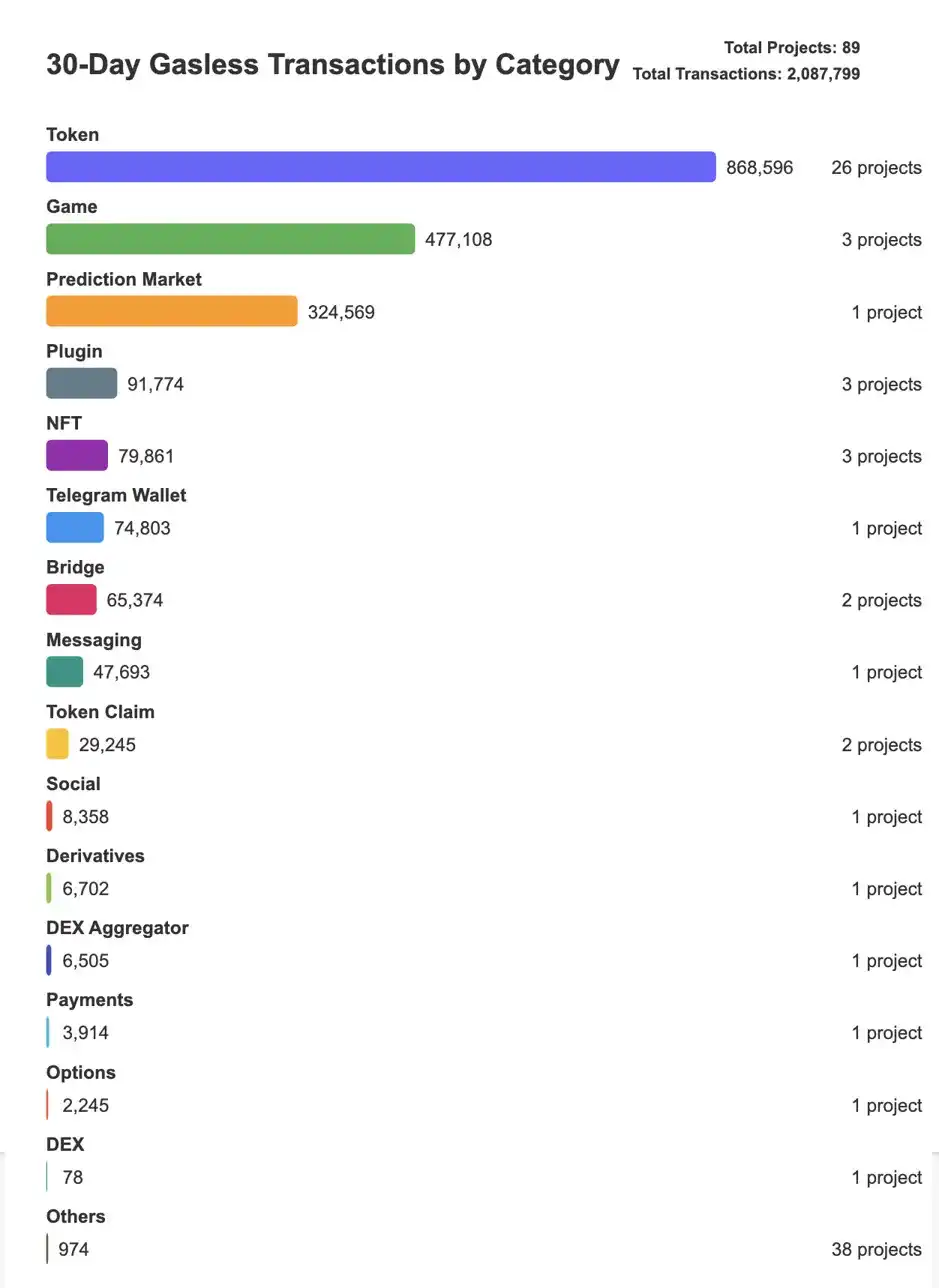

In just 30 days, 89 projects on nine blockchains supported over 2 million Gas-free transactions, saving up to $117,000 in Gas fees.

The wave of Gas-free transactions on multiple chains shows that solutions like Paymaster pays for their smart wallets in ERC-4337 can quickly boost on-chain activity.

Paymaster driver usage may mask real user needs

· A surge in transaction volume does not necessarily reflect the user's real interest, especially when a small number of wallets (such as traders, robots) repeatedly call contracts.

· One-time airdrops, free casting or collection activities may lead to a surge in wallets in the short term, but subsequent usage is extremely low.

New wallets for NFT, gaming and token projects have surged, but many are used only for one-time operations (such as minting or receiving rewards) rather than continuing participation.

On the other hand, a small number of applications demonstrate deeper, repetitive use, often driven by more attractive game loops, repetitive DeFi operations, or infrastructure-level services.

These findings suggest that ERC-4337 smart wallets are reshaping on-chain activities, both demonstrating the power of Gas sponsorship to attract users and highlighting the need for attractive, reusable applications to keep users engaged.

@0xKofi builds an authoritative dashboard to track this explosive growth, data provided by @base.

Key indicators

- 89 standalone applications/protocols

- Approximately 724,000 active smart wallets

- About $117,000 Gas fee was waived

- Approximately 2,087,799 No Gas Transactions

Development of ERC-4337

Rapid growth in Gas-free trading is part of a larger trend. In 2024, the ERC-4337 account performed more than 103 million user operations (UserOps), more than 10 times that of 2023 (8.3 million). 87% of the transactions are paid by Paymaster, achieving a Gas-free experience.

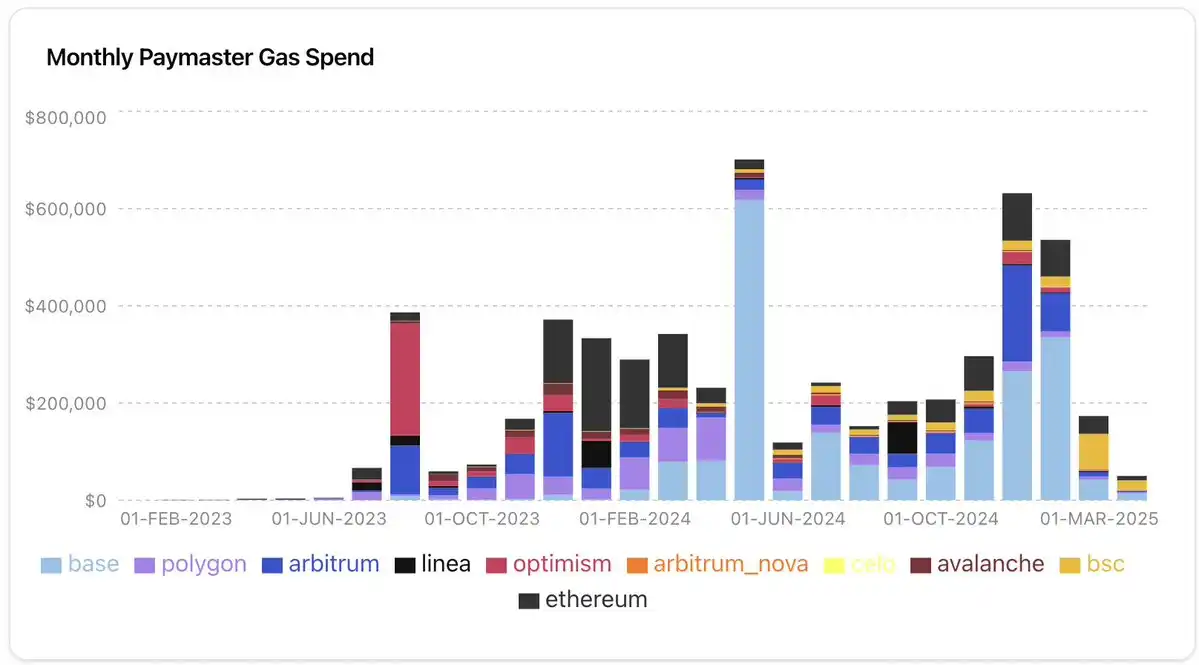

From the monthly Paymaster Gas spending chart, we can see the following evolution:

- Early adoption (2023): Optimism led the initial adoption by mid-2023.

- Growth Phase (end 2023): By October 2023, monthly spending has steadily increased to approximately US$400,000.

- Peak Activity (April 2024): Spending surged to about $700,000, mainly driven by Base.

- Recent Trends (end of 2024 to early 2025): After reaching a new high (about $630,000) from November to December 2024, monthly Gas spending fell sharply in early 2025, down to about $150,000 in February.

Through Paymaster, applications and users spend more than $3.4 million on UserOp fees, and major providers include @biconomy, @pimlicoHQ, @coinbase and @Alchemy. Despite the market contraction, overall spending in the first quarter of 2025 was on a downward trend, @base ($391,117), @ethereum ($121,053) and @BNBCHAIN (approximately $112,493) remained the dominant players.

Ranking of activities by chain

- Base (43.2%): Entertainment and social centers – dominant gaming (76.8%).

- Polygon (21.4%): Community participation layer-NFT (50.7%) and Telegram wallet (42.3%).

- Optimism (8.5%): Focus on security – emphasizes restoration of infrastructure.

- Celo (7.4%): Niche Experts – Forecasting the Market.

- BSC (4.2%): Value transfer layer – focus on tokens, Gas is the highest cost.

Data Analysis

Before you dig deeper into the data, it is crucial to understand two key metrics:

- Tx/Wallet (number of transactions per wallet) - Measures the average number of transactions completed by each wallet. Low values (such as ~1.0) indicate single use (such as casting NFTs or claiming airdrops). High values (eg ~25) indicate repeated participation (eg active trading, gaming, or robotic operations).

- Cost/Tx (cost per transaction) – represents the average cost per transaction. In a Gas-free system, it reflects the fees waived per transaction, not the fees paid by the user.

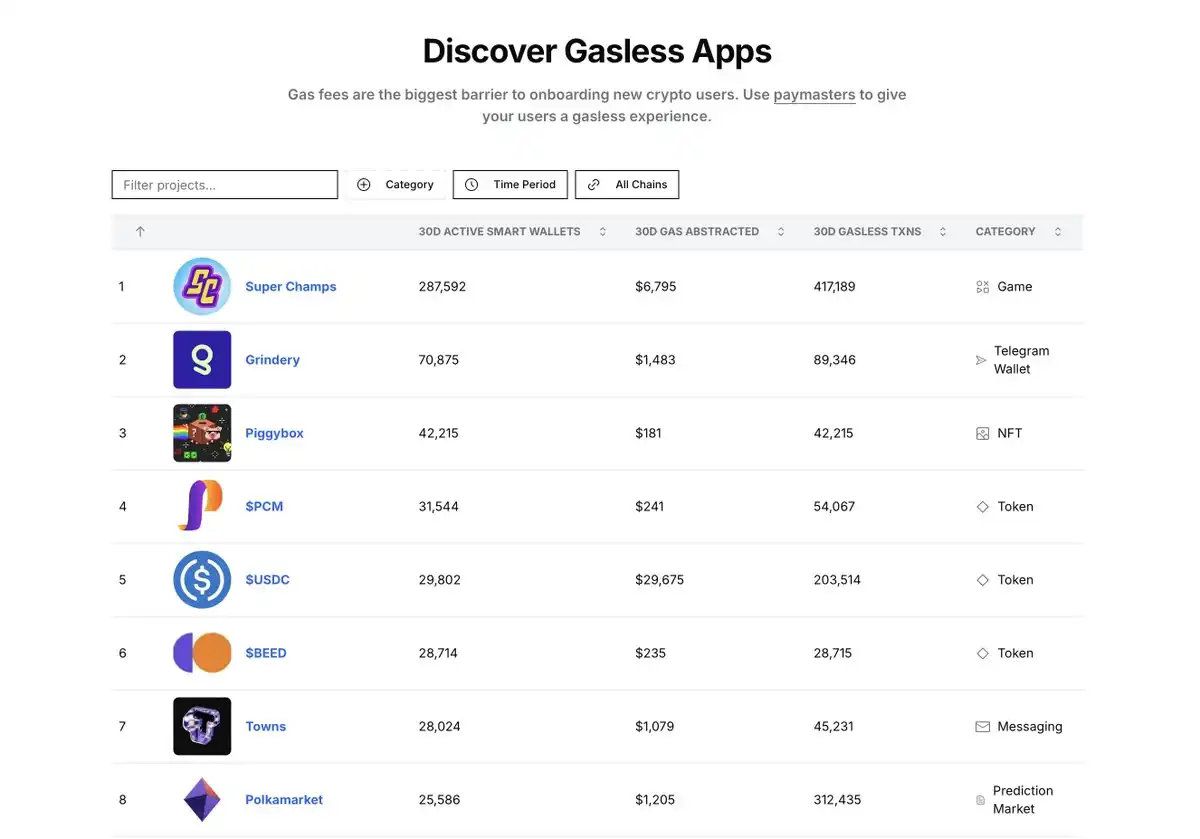

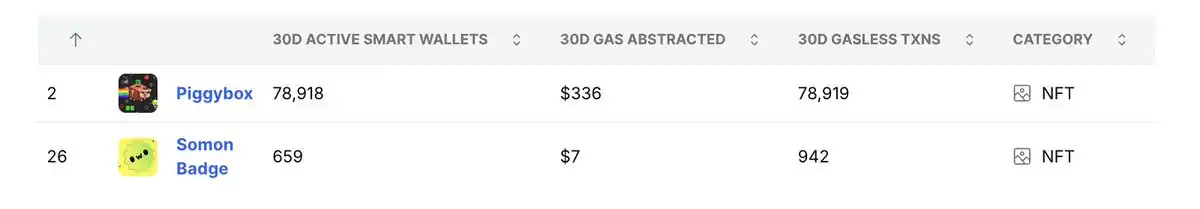

1.NFT Project: Large Wallets Usually = One-time Account

- Piggybox: → About 1 tx/wallet, ~$0.004/transaction.

- Somon Badge: → About 1.4 tx/wallet, ~$0.007/transaction.

Interpretation: The ratio of wallet to transaction 1:1 (Piggybox) strongly indicates that it is a casting or collection activity. Piggybox is an NFT obtained when registering EARN'M, plus a draw box that may receive EARNM tokens.

One-time surge: Many wallets make only one transaction (initial minting/collection) and no longer return afterwards, thus approaching a perfect 1:1 ratio.

Ranking: Piggybox ranks at the top of the overall rankings thanks to many new wallets being minted. But if you filter out the disposable wallet, it could fall from the top five, with extremely low retention rates.

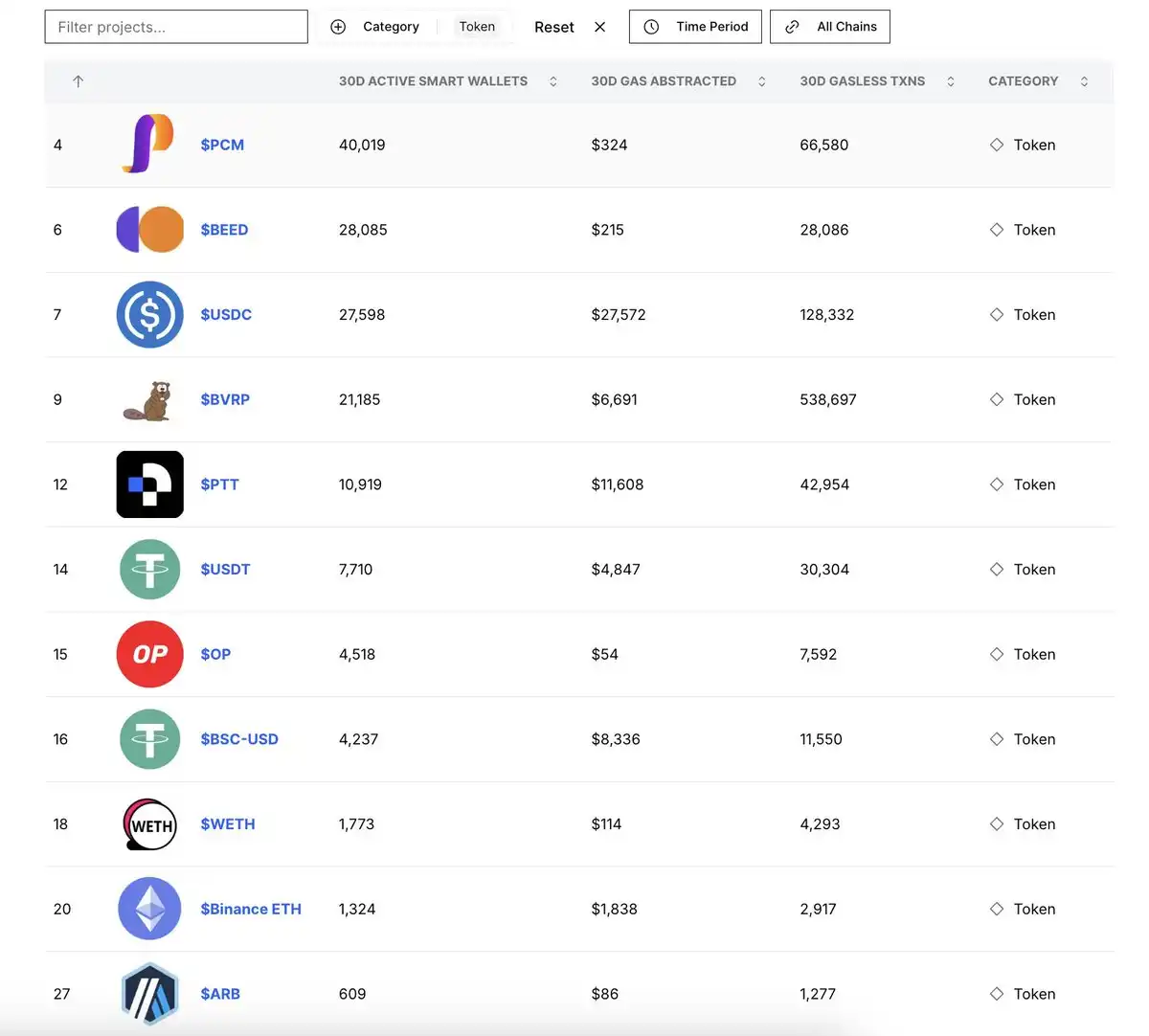

2. Tokens: Concentrate on token trading in a few projects

There are 26 token items on the list, far exceeding the other categories. Two of the tokens, $BVRP and $USDC, exceeded 667k transactions, accounting for most of the transaction volume.

- $BVRP: → ~25 tx/wallet at $0.012/tx.

- $USDC: → ~4.6 tx/wallet at $0.21/tx.

Interpretation:

- This concentration shows that not all "token" projects are equally active, but a few heavyweight projects drive the total.

- $BVRP shows high transaction activity relative to the number of wallets, indicating that these platforms have high user engagement and frequent automated or repeated transactions.

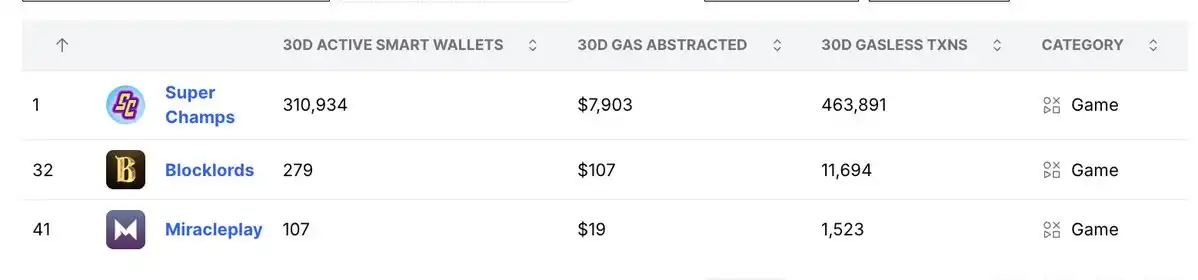

3. Game: a "hot product", but you need to pay attention to the wallet/transaction ratio

- @SuperChampsHQ: → About 1.49 tx/wallet, ~$0.017/transaction.

- @BLOCKLORDS: → About 42 tx/wallet, ~$0.009/transaction.

- @miracleplay_cn: → About 14 tx/wallet, ~$0.012/transaction.

Interpretation:

- Super Champs dominates the total game usage (463k vs. ~13k sum of other projects), but only makes about 1-2 transactions per wallet.

- Blocklords has a small number of wallets, but the transaction rate per wallet is extremely high (~42). This is often related to the repetitive operation of the robot, as David Johansson of Blocklords said: "They are fighting the robot."

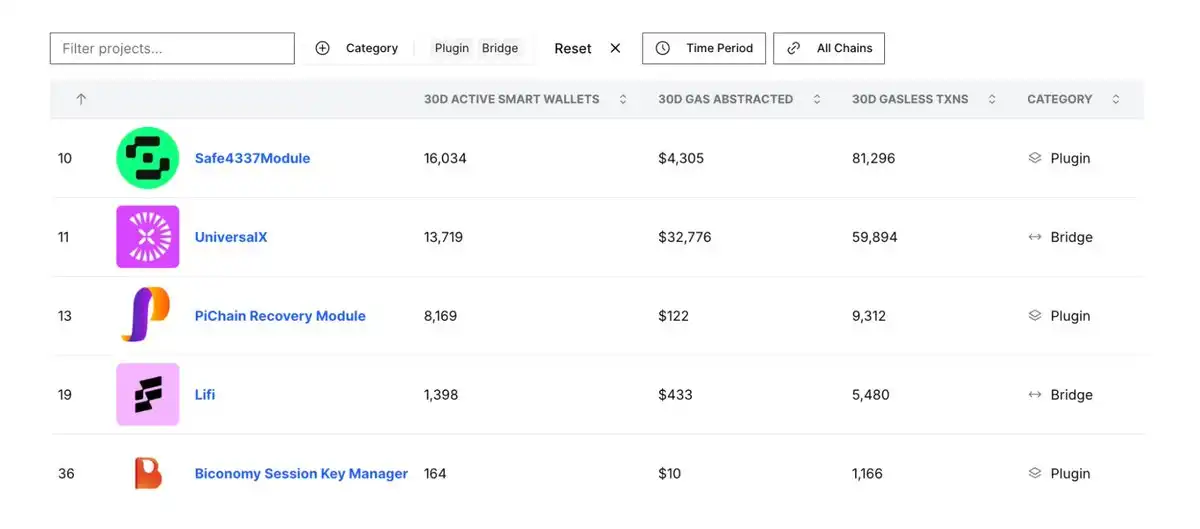

4. Bridges and plug-ins: Medium but stable usage, high cost of Gas

- UniversalX: → About 4.4 tx/wallet, ~$0.55/transaction.

- Safe4337Module: → About 5.1 tx/wallet, ~$0.053/transaction.

Interpretation:

- Behind the Scenes Tools: Bridges and plugins don't have "headline" transaction volume like tokens or games, but they remain stable for multiple dApp dependencies.

- Ecosystem health indicators: Medium usage of infrastructure services indicates their true utility, not a hype-driven surge.

5. Chain specialization is taking shape

- @base: 99.5% of game wallet activity (310,934 of 312,361 wallets).

- @0xPolygon: Dominates NFT/social activities (87% of ecosystem NFT wallets).

- @BNBCHAIN: Leading in high value bridge transactions (23.2% of all exempt Gas).

- @Celo: Strong performance in the forecast market (25,574 wallets, 12.7 tx/wallet).

6. Cross-chain cost difference

The 100-fold cost difference between different chains drives specific application categories to specific chain sets:

- Ethereum: $2.41 per Gas transaction (up to the maximum).

- BSC: $0.50 per Gas transaction.

- Base: $0.02 per Gas transaction (lowest in the main chain).

- Polygon: $0.03 per Gas transaction. Argument: 100 times the cost structure difference between different chains will drive specific application categories toward specific chains, regardless of technical similarity. Games and social applications are economically unfeasible on high-cost chains.

Overall situation

- NFT uses potentially displaying tens of thousands of wallets for a single minting (such as Piggybox), but has extremely low reuse.

- Infrastructure (bridges, plug-ins) maintains stable, medium transaction volume, usually with high cost per transaction (bridges) or stable behind the scenes (plugins).

- The difference in the number of transactions per wallet in all categories highlights different usage patterns: some are highly repetitive, others are purely one-time operations.

- Finally, the participation of a large number of projects is close to zero, indicating that free Gas alone is not enough to generate demand; dApps require real value propositions to retain users.

Summarize

Account abstraction and Gas sponsorship can indeed increase transaction volume and user registration, but the real test is repeated participation. Combining the number of wallets, exempt Gas fees and Gas-free transaction volume, the data highlights the centralized use in each category, usually only from one or two celebrity dApps or large-scale single-collection events. Projects like Piggybox show how the wallet to transactions is near 1:1 to push NFT projects to the top of the list, but can quickly fall after filtering out one-time accounts. Meanwhile, the bridging and plug-in solutions show a more stable, medium transaction volume, reflecting the real needs of the ecosystem rather than a brief hype.

ERC-4337 The function of smart wallet

All these trends—Gas-free gaming, seamless DeFi, chain specialization—are powered by ERC-4337 smart wallets.

Unlike traditional EOA (external owned account), smart wallets introduce automation, security and flexibility, significantly improving the user experience.

What is ERC-4337 Smart Wallet?

A smart contract wallet or smart wallet is a programmable Ethereum account that enhances the user experience with the following features:

Bulk Transactions – Users can combine multiple operations (such as Approval + Exchange on DEX) into one transaction.

Gas fee abstraction – Users do not need to hold ETH to pay Gas fees; fees can be paid by the sponsor or with other tokens.

Security – Users can authenticate with passwords, social recovery, or multi-factor authentication rather than using higher risk seed phrases.

How does Gas-free transaction work?

When a user initiates a transaction, Paymaster (a special smart contract) can step in paying Gas fees or allow the user to pay with any ERC-20 tokens it holds. This greatly lowers the entry barrier for new users and makes blockchain applications as seamless as Web2 applications.

However, ERC-4337 also faces major adoption challenges, and the above retention issues may stem directly from the following key limitations:

- Technical barriers: Complex components such as UserOperations, Bundlers, and EntryPoint contracts have a steep learning curve for average users and developers.

- Cost issue: While Gas-free transactions can be helpful to users, achieving a full stack can be expensive and Bundler's profitability is unstable during Gas fluctuations.

- Reliability issues: Network congestion can lead to transaction delays, while complex verification logic introduces potential security vulnerabilities.

- User experience gap: Multi-chain fragmentation leads to inconsistent wallet experience, hindering seamless cross-chain management.

Summarize

Account abstraction and Gas sponsorship successfully boosted transaction volumes and new wallet registrations, but the real challenge is ongoing participation. Data shows:

- Many dApps have seen a surge in one-time use (such as NFT casting, airdrops) rather than long-term retention.

- A few projects drive most of the activities, while many others struggle to attract real users’ needs.

- Bridging and infrastructure solutions show more stable usage, highlighting real utility rather than hype.

While ERC-4337 enables Gas-free transactions and improves user experience, its complexity and cost barriers limit mainstream adoption. EIP-7702 resolves these issues by:

- Allow EOA to perform account abstraction: The core problem of ERC-4337 is to exclude EOA and require users to switch to smart contract wallets. EIP-7702 solves this problem by allowing EOA to temporarily adopt smart contract code, allowing access to features such as Gas sponsorship (pay fees with ERC-20 tokens) and bulk transactions (such as approving and spending ERC-20 tokens in one transaction).

- Simplify complexity and cost: Allows EOA to temporarily adopt smart contract capabilities, reduces the need for permanent wallet contracts, reduces Gas overhead, and reduces dependence on EntryPoints or Bundlers.

- Improved efficiency: Introduce transaction type 0x04 for batch EOA operations, providing a more streamlined alternative to UserOps for ERC-4337.

- Simplify infrastructure: limit smart contract code to transaction execution, reducing dependency on alternative memory pools and Bundlers.

- Empowering developers: Integrate with ERC-4337 while providing flexible, low-friction upgrade paths.

ERC-4337 lays the foundation, but EIP-7702 will make smart wallets cheaper, simpler, and easier to access, accelerating the next wave of adoption of Web3.

chaincatcher

chaincatcher