Can five major catalysts help ETH turn around this year?

Reprinted from panewslab

01/06/2025·5MWritten by: 1912212.eth, Foresight News

In 2024, for investors holding Ethereum, it can be said that they have tasted all the ups and downs, but no sweetness. From the perspective of return multiples, not only does it significantly underperform Bitcoin, but it is also lackluster in comparison to the public chain track. Solana has already hit a record high, with a return of more than 20 times from the bottom. SUI has soared from US$0.5 to a maximum of around US$5, with a return of nearly 10 times.

Ethereum has suffered from doubts this year and its ecosystem is weak. Compared with the prosperity of DeFi and NFT in the previous cycle, this round of innovation has been mediocre, and the comprehensive response is reflected in the currency price. Then 2025 will be the year of Ethereum’s turnaround. Year?

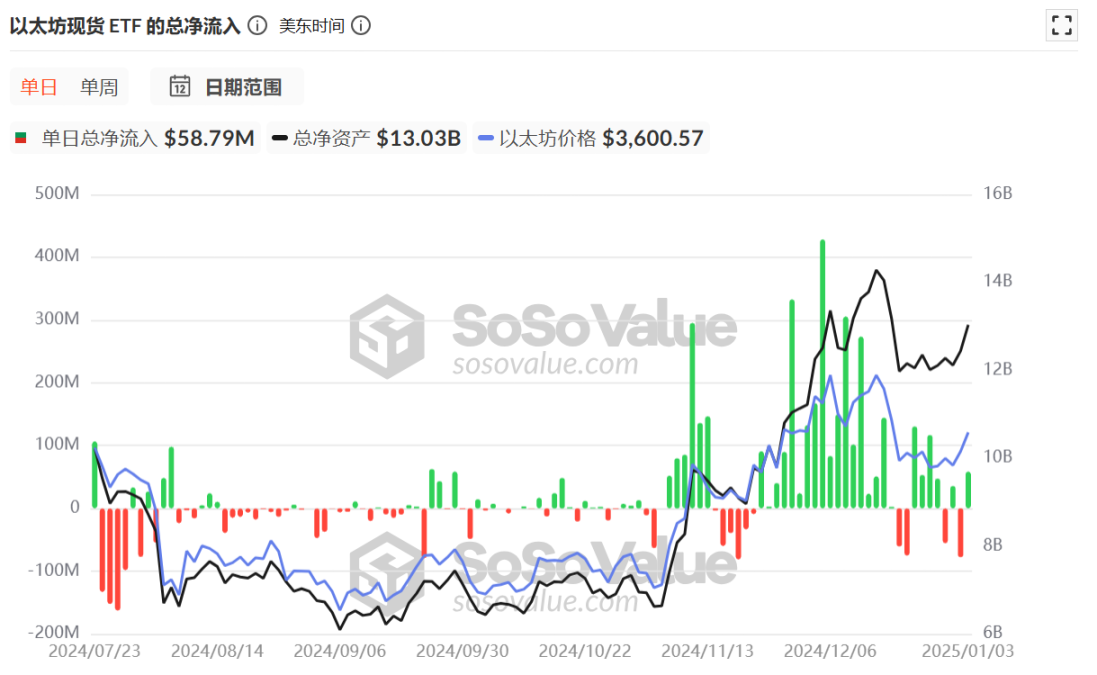

Ethereum spot ETF net inflow

After the U.S. Ethereum spot ETF was suddenly officially approved in mid-2024, the market did not buy it at first. The market conditions were relatively sluggish, so the inflow of funds showed a large negative value.

After three months of sluggishness, Ethereum finally began to see large inflows in early November due to factors such as the rebound in the market, and the net inflows were always far greater than the net outflows.

At the end of November, its Ethereum spot ETF even experienced a rare 18-day continuous net inflow, with the highest single-day net inflow once exceeding US$400 million. Adjusted for market cap, this equates to nearly $1.2 billion in daily inflows into Bitcoin, as Ethereum’s market cap is about a quarter of Bitcoin’s. This capital flow may reflect a realignment of investment direction or an expansion of scope, which coincides with the new fiscal year of U.S. mutual funds that usually starts on December 1, and also reflects the market’s optimistic expectations for 2025. If this demand continues, the price of Ethereum may rise significantly in 2025.

As of press time, the current Ethereum spot ETF has accumulated a total net inflow of US$2.64 billion.

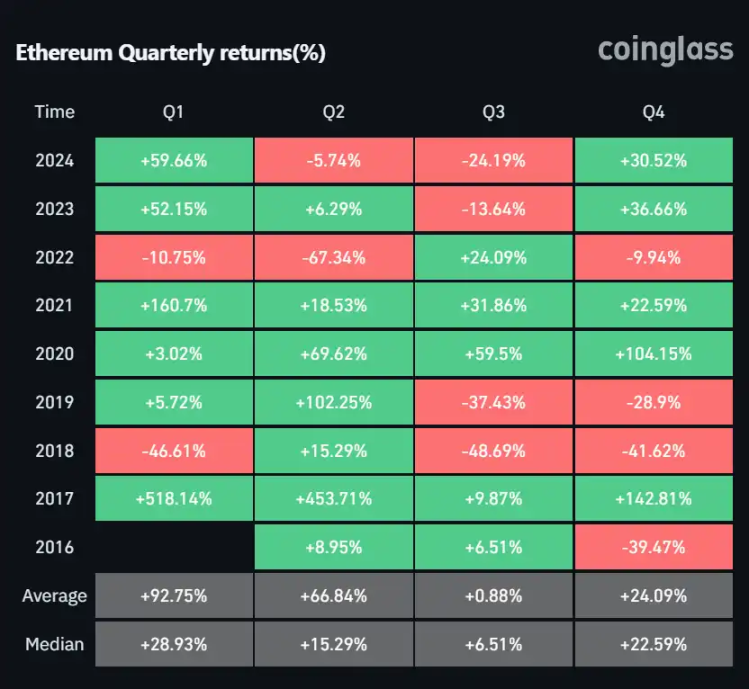

Ethereum has performed well in Q1 over the past few years

Ethereum's first-quarter performance has risen in six of the past eight years. Especially in the first quarter of the new year after the US election, for example, in 2017 and 2021, Ethereum achieved quarterly gains of 518.14% and 160.7% respectively.

The crypto market often has self-fulfilling prophecies. If history repeats itself, Ethereum’s performance in Q1 this year may once again attract the market’s attention.

The price performance of Ethereum also often resonates with the market. In the Q1 quarter, when the market generally performs well, it often benefits from DeFi, liquidity and other factors to achieve an increase.

Long-term ETH holders are still accumulating

Observing the dynamics of long-term holders is one of the means of gaining insight into the market. Long-term holders continue to significantly reduce their holdings, which often means that the currency price is approaching the top. When the price drops sharply or is optimistic about the future trend, long-term holders often increase their holdings, selling high and buying low. And so on.

The data in the chart below shows that long-term BTC holders are continuously reducing their holdings, which may be because the psychological estimates of some long-term investors have reached their profit-taking zone. On the other hand, Ethereum data is relatively optimistic. The total proportion rose from less than 60% in the middle of the year to a maximum of over 80%, and is now partially declining.

It can be seen from the chart data that there is no big return on Bitcoin currently above US$100,000, but long-term market holders believe that Ethereum will still have good opportunities next year.

Pledge and re-pledge data still maintain a stable upward trend

Ethereum pledge and re-pledge data can also be used as an indicator of market confidence.

Ethereum's pledged amount has increased from less than 35 million ETH at the beginning of 2024 to 55 million at the end of the year. In terms of re-pledge data, it has entered a stable period after explosive growth at the beginning of the year and remains above 4 million ETH.

Ethereum spot ETF expected to support staking

Currently, the market only trades Ethereum spot ETFs and does not support its staking income. However, "Ethereum ETF staking" may be launched in the future. For investors in Ethereum spot ETFs, currently holding ETH in the form of ETFs means missing out on the staking yield, in addition to paying an additional management fee of 0.15% to 2.5% to the issuer of the ETF.

SEC Commissioner Hester Peirce recently stated that the possibility of physical redemptions and Ethereum ETFs starting to be pledged is expected to be reconsidered. Unlike last time, when under the leadership of Chairman Gary Gensler, the implementation of these two measures was almost zero, but Hester Peirce expressed optimism about the possibility of these changes under the new management.

Cynthia Lo Bessette, head of Fidelity’s digital asset management department, also said in an interview that the launch of Ethereum ETF staking is only a matter of time, not if.

It is foreseeable that once the Ethereum spot ETF supports staking to earn interest, it will have a boosting effect on the price of Ethereum.

summary

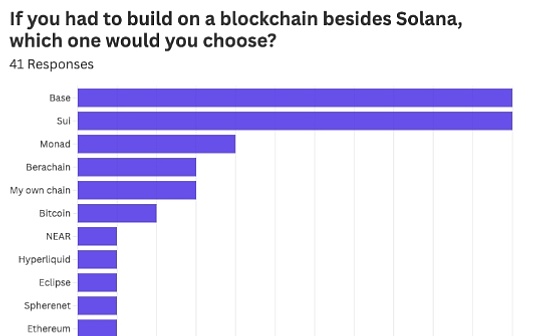

Although Ethereum is still worth looking forward to, there are also many challenges to face. Observing its Gas fee data, we can find that the activity of its ecosystem is sluggish in 2024, and its transaction volume is also stagnant. Facing strong challenges from Solana and Sui, Ethereum needs to think about whether its core narrative positioning is still accepted by the public. .

jinse

jinse