Coingecko: Which listed companies are large BTC holders?

Reprinted from jinse

04/09/2025·1MAuthor: Tharmaraj Rajandran, CoinGecko; Translated by: Tao Zhu, Golden Finance

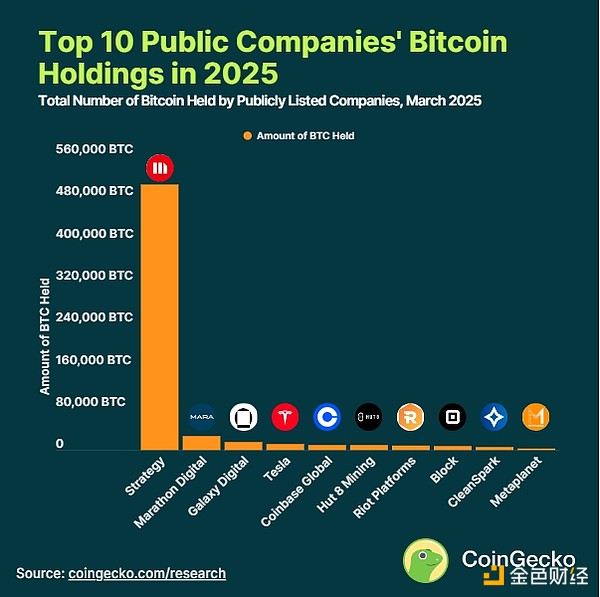

Which companies hold the most Bitcoin?

Strategy, Inc. is the largest publicly owned company in Bitcoin (BTC), and has acquired 506,137 BTC since 2020 through a combination of bond issuance and stock sale. Marathon Digital Holdings followed closely behind, with amassing 26,842 BTC through its mining operations. Meanwhile, Galaxy Digital Holdings ranks third, holding 15,449 BTC as part of its diversified crypto investment strategy.

The remaining seven listed companies in the top ten, including Tesla, Block Inc., Coinbase and Metaplanet, hold a total of approximately 55,364 BTC, accounting for only 12.5% of Strategy's total BTC holdings. This concentration highlights Strategy's dominance and its firm commitment to Bitcoin as a core asset.

The cryptocurrency bull market in 2021 marked a turning point for BTC, with listed companies increasing their investments as institutional adoption surges and El Salvador defines BTC as fiat currency. This momentum pushed Bitcoin’s price to rise to $69,044.77 on November 10, 2021, which was a record high. However, by November 9, 2022, the collapse of cryptocurrency giants such as Voyager, Celsius and FTX plunged its price by 77.4% to $15,602.

As of March 2025, the price of Bitcoin was approximately $87,000, down from the peak of $108,786 on January 20, 2025. Bitcoin’s 2025 journey is full of turning points, and by far the most important thing is the US government establishing strategic Bitcoin reserves. On March 2, President Donald Trump unveiled the reserve plan, sparking a wave of excitement in the cryptocurrency space, pushing BTC prices to a high of about $94,261. On March 6, an executive order formally consolidated the move, although initial optimism faded, causing BTC prices to fall back to about $88,000.

How much Bitcoin does Strategy, Inc. own?

Michael Saylor's MicroStrategy, Inc. (recently renamed Strategy, Inc.) currently has 506,137 BTC as of March 27, 2025, worth more than US$44.2 billion at current prices. Its holdings have increased significantly over the past few years, up 290.2%, from 129,699 BTC in 2021 to 506,137 BTC at present. Saylor, an active advocate of Bitcoin as a “digital gold” and inflation hedging tool, positioning Strategy as a pioneer in corporate financial management, using debt issuance and stock sales to fund its aggressive Bitcoin purchases since 2020. Strategy, Inc. has successfully acquired 2.4% of the total supply of Bitcoin, or 2.5% of the total supply of circulation today.

Therefore, it remains the top public company with the largest Bitcoin portfolio. They executed the only asset sell-off to date, selling 704 bitcoins on December 22, 2022 at an average BTC price of $16,776 for tax benefits.

Interestingly, as of March 2025, Strategy accounted for 83.8% of its total BTC holdings among the top 10 listed companies holding Bitcoin. This concentration not only highlights Strategy's aggressive acquisition strategy, but also its unrivalled commitment to Bitcoin as a core asset, even among other cryptocurrency forward-looking companies.

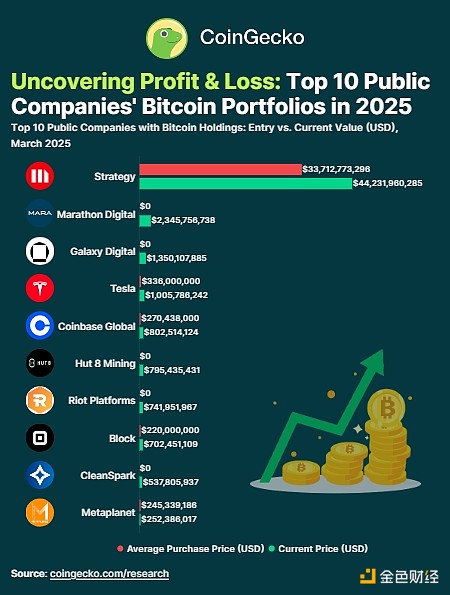

How are listed companies that own Bitcoin performing?

Strategy, Inc. remains an undisputed leader. As of January 2025, the company held 506,137 BTC. At current value, it is worth $44.2 billion, with unrealized profits of 31.2%, or $13.8 billion, which is higher than its average purchase price of $66,608.

Meanwhile, mining companies such as Marathon Digital Holdings, Galaxy Digital Holdings and Hut 8 Mining Corp have more than $2.3 billion, $1.3 billion and $1 billion in BTC holdings, respectively. Given the nature of their cryptocurrency mining businesses, their entry price is actually $0 per Bitcoin, but this does not include the costs of labor, facilities and electricity required for Bitcoin mining. As institutions and sovereign states accumulate BTC intensifies, these mining giants have become one of the biggest direct beneficiaries of Bitcoin’s long-term appreciation.

Of the seven companies not engaged in crypto mining in the top 10, Block Inc. (NYSE:XYZ) currently holds the highest percentage of unrealized profits at 236.3%, up from an estimated entry value of $220 million to $739,929,198 today, and currently holds a total of 8,038 bitcoins.

Tesla's Bitcoin legend is eye-catching. In February 2021, Elon Musk's innovative car company bought about $1.5 billion worth of Bitcoin at an average price of $36,000 per coin. Shortly after introducing Bitcoin to the balance sheet, Tesla announced the cryptocurrency payment option, with some products accepting Bitcoin and Dogecoin. By mid-2021, Tesla suspended Bitcoin payments, citing concerns about the environmental impact of Bitcoin mining, which relies heavily on energy-intensive processes.

However, in its second quarter 2022 financial statements, the company announced it had sold 75% of its total holdings and made a profit of $64 million, citing environmental issues and the need to rebalance assets as its main reasons. Since then, they have held the remaining 25% (about 11,509 BTC) and have not bought or sold anything.

Other notable corporate Bitcoin holders include companies such as Coinbase Global, Inc., which uses Bitcoin as part of its vault and operating reserves, as well as Tokyo-based investment firm Metaplanet Inc., which has rapidly risen as a key player in the Bitcoin space, amassing a reserve of 2,888 BTC. Commonly known as the “Japanese micro-strategy”, Metaplanet has been pursuing an active Bitcoin accumulation strategy since mid-2024, emulating Saylor’s strategy.

Video sharing platform Rumble Inc. (Nasdaq: RUM) is also joining this growing list of corporate adopters, which announced on March 12, 2025 that it has invested $17.1 million in Bitcoin to acquire 188 BTC at an average of $91,000 per coin. The acquisition is in line with the Rumble plan, which allocates up to $20 million in cash reserves to Bitcoin, a strategy originally hinted in November 2024 by CEO Chris Pavlovski. Pavlovski sees the move as a way to hedge inflation and integrate cryptocurrencies deeper into Rumble’s identity. After Tether invested $775 million in late 2024, Rumble’s entry into the Bitcoin market reflects its ambition to position itself as a crypto-friendly alternative to large tech platforms.

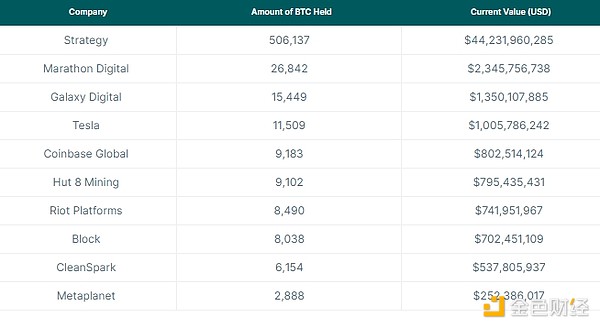

Top 10 listed companies by Bitcoin holdings

The top 10 listed companies by Bitcoin holdings are as follows:

chaincatcher

chaincatcher

panewslab

panewslab