Bitfinex: BTC fell below $91,000 at a critical moment

Reprinted from jinse

02/25/2025·2MAuthor: Jesse Coghlan, CoinTelegraph; Translated by: Wuzhu, Golden Finance

Analysts at cryptocurrency exchange Bitfinex said Bitcoin fell below $91,000 at one point, and Bitcoin is at a "critical moment" after nearly 90 days of narrow range trading.

Analysts said in a February 24 Bitfinex Alpha report that Bitcoin was trading between $91,000 and $102,000 in three months when market momentum stagnated and “still be at the critical momentum after nearly 90 days of consolidation. time".

" The momentum required for a sustained breakthrough has been insufficient, which has resulted in a period of contraction and consolidation for almost all major crypto assets," analysts said.

According to CoinGecko, Bitcoin has fallen more than 4.5% in the past 24 hours, hitting a low below $91,000 — the lowest price since the end of November. The broader cryptocurrency market has also fallen 8% over the past day, from more than $3.31 trillion to about $3.09 trillion.

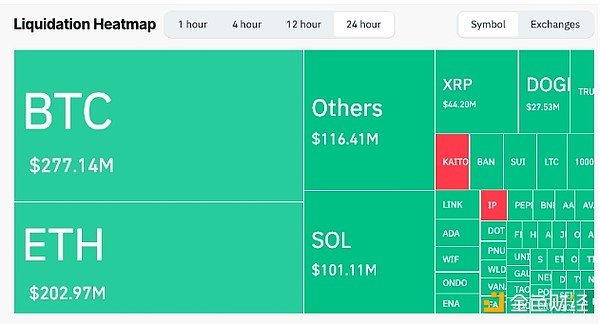

CoinGlass data shows that the plunge in the cryptocurrency market has triggered a series of liquidations, with liquidation amounts exceeding $961.65 million in the past day, of which the bulls bets of $891.52 million and the shorts bets of $70.14 million.

Bitcoin long bets accounted for the largest share of liquidation, with liquidation exceeding $277 million in the past day.

Over the past day, Bitcoin long bets have led the liquidation of the cryptocurrency market, with a total liquidation amount of nearly $1 billion. Source: CoinGlass

Bitfinex analysts say Bitcoin is becoming increasingly correlated with traditional markets, and a major factor affecting the stagnant cryptocurrency market is "a similar stagnation in traditional financial markets," which is caused by the "macross" "caused by uncertainty."

The S&P 500 has fallen 2.3% over the past five trading days, while the Nasdaq Composite has fallen 4% over the same period. "Broader stock market suppression has affected risky assets, including cryptocurrencies," Bitfinex said.

Analysts added that institutional demand for Bitcoin through spot exchange- traded funds also "slowed significantly", with total outflows of $552.5 million per trading day for the week ended February 21.

Bitfinex said weaker consumer confidence and further rising inflation expectations pose a challenge to the overall U.S. economy.

The company noted that the University of Michigan Consumer Survey on February 21 found that U.S. consumer confidence fell 10% from January, down to its lowest level in 15 months, reflecting “inflation and economic uncertainty” Concerns are growing," which may slow consumption.

Bitfinex analysts also said a series of tariffs proposed by President Trump “is increasing inflationary pressure” and offset some progress made in deflation over the past two years.

panewslab

panewslab