Binance Labs is renamed Yzi Labs. What is the meaning of the transition family wealth management office?

Reprinted from panewslab

01/24/2025·5MWritten by: Peter, Foresight News

In the field of cryptography, Binance has always been a name that every practitioner cannot avoid. As a leader in primary investment, Binance Labs’ influence on the field of cryptography is self-evident. A few months after Changpeng Zhao was released from prison in Long Beach, his net worth reached $70 billion due to the frantic rise in cryptocurrency.

In such a general environment, Binance Labs officially announced its name change to YZi Labs on January 23, completing the transformation from a cryptocurrency venture capital institution to Changpeng Zhao’s private family office. As the on-chain market is booming, what impact will the transformation and expansion of Binance's pedigree and new investment strategy carried by YZi Labs have on the entire ecosystem?

Invest in expansion

Although CZ has stepped down from Binance, he will continue to play an important role in YZi Labs, directly providing one-on-one guidance and strategic advice to entrepreneurs to help them optimize their business models and investment strategies.

CZ emphasized that his investment philosophy focuses more on social impact than short-term returns. The return of Ella Zhang also supports this belief. Ella served as the first head of Binance Labs and will return to lead the strategic development of YZi Labs. She has successfully incubated more than 40 projects including Polygon, Injective Protocol and CertiK, and her experience will bring more innovation power to YZi Labs.

During Zhao Changpeng's journey after his release from prison, he has repeatedly stated that he will pay more attention to applications in "human welfare", and he has previously been deeply involved in the education field to a certain extent (K12 type education through Giggle Academy). In the investment context that has been disclosed, YZi Labs’ investment areas cover Web3 infrastructure, DeFi, etc., and will subsequently expand from the original cryptocurrency and blockchain to Web3, artificial intelligence (AI) and biotechnology (biotech).

- Web3: YZi Labs will continue to support blockchain and decentralized technology projects, including its previously incubated BNB Chain "Most Value Creator (MVB) Program." As one of its core investment areas, Web3 will continue to promote the development of dApps and blockchain infrastructure, and investments in this area will mainly empower the Binance ecosystem.

- AI: AI is regarded as an important driver of future technology, and YZi Labs plans to invest in start-ups in the AI field and explore its combination with blockchain technology. For example, it has invested in AI infrastructure such as Sahara AI and MyShell, which are projects dedicated to decentralizing AI through blockchain technology. But for users, their perception may be more concentrated in the Agent field, so they may focus on it in subsequent investments.

- Biotechnology (biotech): Investments in the biotechnology sector will focus on projects with transformative potential, especially innovative applications that intersect with AI and Web3 technologies. Changpeng Zhao had previously attended the DeSci conference in Bangkok and conducted relevant discussions, and this preference was also shown in subsequent investments. For example, in previous investments, BIO Protocol provided a financing paradigm for decentralized science, and its expansion in this field reflects YZi Labs' focus on interdisciplinary technology integration.

After YZi Labs transforms into a family office, it will manage the wealth of Changpeng Zhao and his family members, including the assets of Binance co-founder He Yi. This transformation makes its investment strategy more flexible while maintaining a focus on high-potential projects. YZi Labs currently manages approximately $10 billion in cryptocurrency-related assets and plans to further expand the portfolio.

YZi Labs also plans to expand its team from the current nine to 20 people and recruit experts in AI and biotechnology to enhance its investment capabilities in emerging areas. After breaking away from Binance, we can foresee that YZi Labs will have greater freedom and breadth in decision-making. At the same time, the VC department after the complete spin-off will be more affected by the personal preferences of the Zhao Changpeng family.

complement each other

YZi Labs plans to optimize its incubation program and launch a 12-week offline Bootcamp program to create an immersive collaborative environment for entrepreneurs. This initiative not only strengthens face-to-face communication between entrepreneurs, but also accelerates the growth and innovation of start-ups through direct guidance from mentors. It aims to help entrepreneurs achieve the leap from concept to market, while exploring the benefits brought by the integration of these fields. Innovation possibilities.

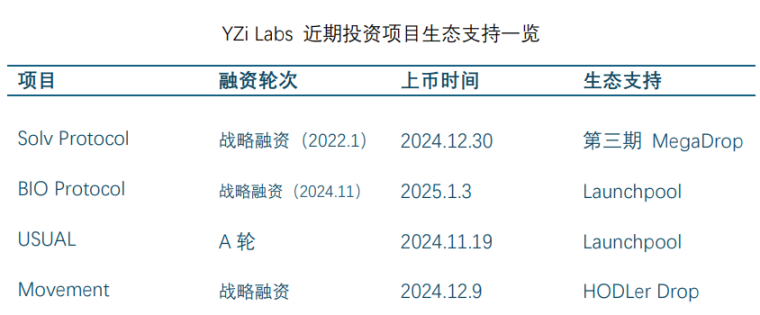

Judging from Binance's previous ecology, it needs to empower its public chain BNB CHAIN and related applications. As for the on-chain ecology, the existing pure on-chain liquidity is concentrated in the Solana and Base ecology. For the BNB ecology, a certain post-investment driving effect is needed to support it. As an industry-leading exchange, Binance can provide resources that others cannot match. It can be seen from the many products launched in recent years (Binance Alpha, HODLER Drop, etc.) that Binance is promoting user aspects of many projects, including projects invested by YZi Labs (such as Solv Protocol and BIO Protocol, etc.) .

The name change and transformation of YZi Labs is not only a brand upgrade, but also a comprehensive expansion of its investment strategy. By focusing on Web3, AI and biotechnology, and relying on the leadership of CZ and Ella Zhang, YZi Labs is expected to become an important driver of cross-domain innovation in the coming years. Its positioning as a family office also provides it with greater flexibility and a long-term investment horizon.

chaincatcher

chaincatcher