Binance Alpha airdrop threshold soars, is the good days for retail investors coming to an end?

Reprinted from chaincatcher

06/09/2025·9DAuthor: 1912212.eth, Foresight News

On June 8, Binance Alpha launched Open Loot (OL). The airdrop collection threshold requires at least 233 points, which is the highest point requirement since Binance Alpha adopts the points system. Since June this year, the threshold for participation in Binance Alpha airdrops has been rising, from early 200 points to 223, and finally to the current 233 points. What is rising is the score and threshold, and what is behind is the already "numb" mentality of market participants.

Since its launch in December 2024, Binance Alpha has attracted countless players with its low threshold, high-reward airdrops and TGE, but the continued rise in the points threshold now makes people ask: Is this point frenzy approaching the end? Will it continue to roll?

High-cost game: Why is it getting harder

The attraction of Binance Alpha is its potential for return. According to airdrops.io statistics, in May 2025, the five airdrops issued by the platform brought an average of US$270 in the first-day value to each user. If calculated at historical highs, the total value can reach US$656. For example, SIGN airdrops are worth about US$177, and BOOP and NXPC airdrops also bring considerable benefits to users. Compared with the uncertainty of airdrops on traditional chains, Binance Alpha's transparent rules and fast cashing mechanism have attracted players.

However, high returns come with high costs. The acquisition of points depends mainly on asset holding and token purchase. Taking transaction points as an example, you can get 1 point when purchasing $2 Alpha tokens, which adds 1 point for every doubling (3 points for $8 and 10 points for $1024).

Now suppose that an ordinary retail player has a exchange balance of between US$10,000 and US$100,000, and a daily balance point of 3. According to the calculation of trading volume points rules, if an ordinary player wants to get 15 points, the transaction volume needs to reach around 32,000 US dollars, and this is just a requirement for buying (selling does not count as points). If a new player starts to swipe the transaction volume from 0, he needs to persist in swiping the transaction volume for at least 13 days to be eligible for Binance Alpha airdrop. This undoubtedly puts a considerable test on the capital scale and patience of ordinary retail investors.

In addition, Binance Alpha also added additional points consumption during the airdrop of tokens. Usually, 15 points are required for each airdrop or participation in a wallet TGE activity. This means that if the points have just met the standard, after receiving this airdrop, the next airdrop will have nothing to do with you. This also tests players' judgment. If the quality of the airdrop targets in this issue is average, they will only be worth tens of dollars after receiving them, and when you miss the "next" airdrop or TGE hundreds of dollars, the time and opportunity cost will be very high.

The cost of "wearing" during the transaction process cannot be ignored. Foresight News noticed that when trading a certain token, even if it is sold quickly after buying, it may cause a "loss" of up to a few dozen dollars. Therefore, when choosing a currency, players need to consider the transaction volume, increase or decrease, etc., otherwise they may face a fierce operation, and the profit after getting the airdrop cannot support the cost.

MEV problems are also worth paying attention to. If you are not lucky and don’t turn on the MEV protection, you may suffer serious losses. According to AI Aunt Monitoring, on June 8, a user brushed KOGE/USDT, and a single transaction was clipped at $47,000, and spent $47,000 to buy only 0.009 KOGE, with a single purchase of $5.18 million.

However, as long as the airdrop returns exceed the wear cost, arbitrageurs will continue to pour in.

A studio carnival?

Binance Alpha was officially launched on December 17, 2024 and is positioned as a discovery platform for early stage projects of Web3, aiming to provide users with early participation opportunities for high-potential tokens. Its core mechanism is the Alpha Points system, which determines its qualification to participate in TGE and airdrop by evaluating users' asset holdings (Balance Points) and Alpha token purchases in the Binance Exchange and wallet ecosystem. Points are updated daily, based on asset snapshots and transaction behaviors over the past 15 days, with the validity period of 15 days.

Initially, the threshold for Alpha points was relatively low. For example, the April 2025 SIGN airdrop requires only lower points to participate. However, as the platform attracts more and more users, the threshold for points has risen. In May 2025, BOOP airdrop required 137 points, while Privasea TGE required 198 points. By June, Bondex (BDXN) airdrops required 213 points, and Open Loot pushed the threshold to 233 points. Some community users pointed out that the threshold of 220 points or above has become the norm, and if you don’t work hard, you may “can’t have enough food.”

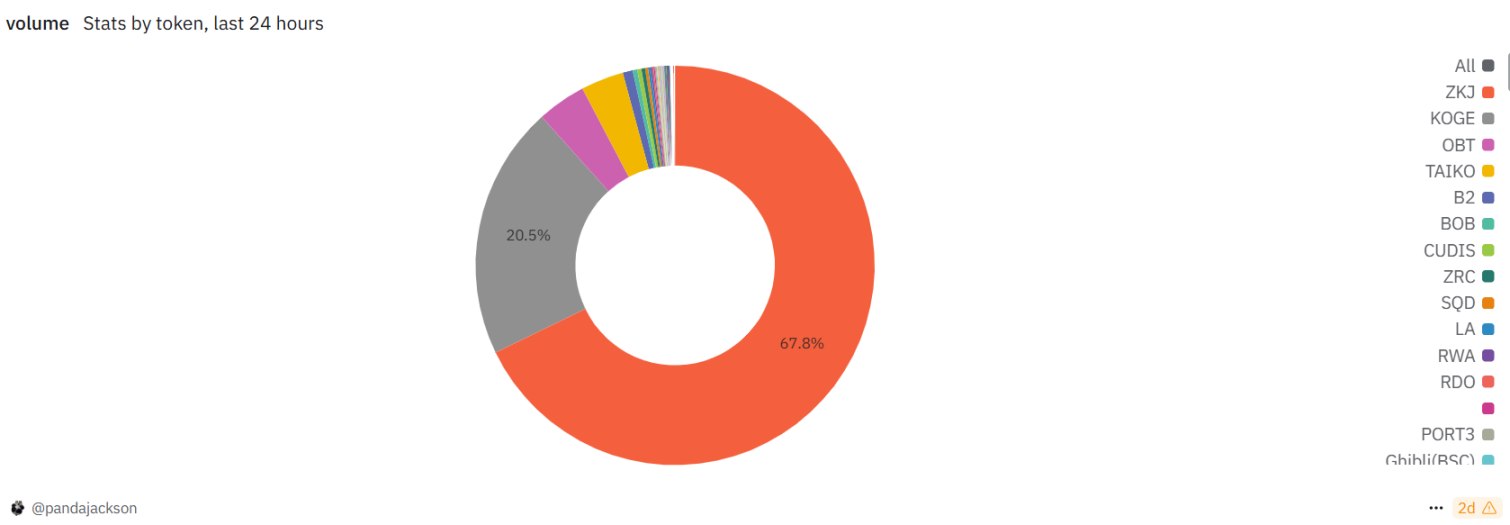

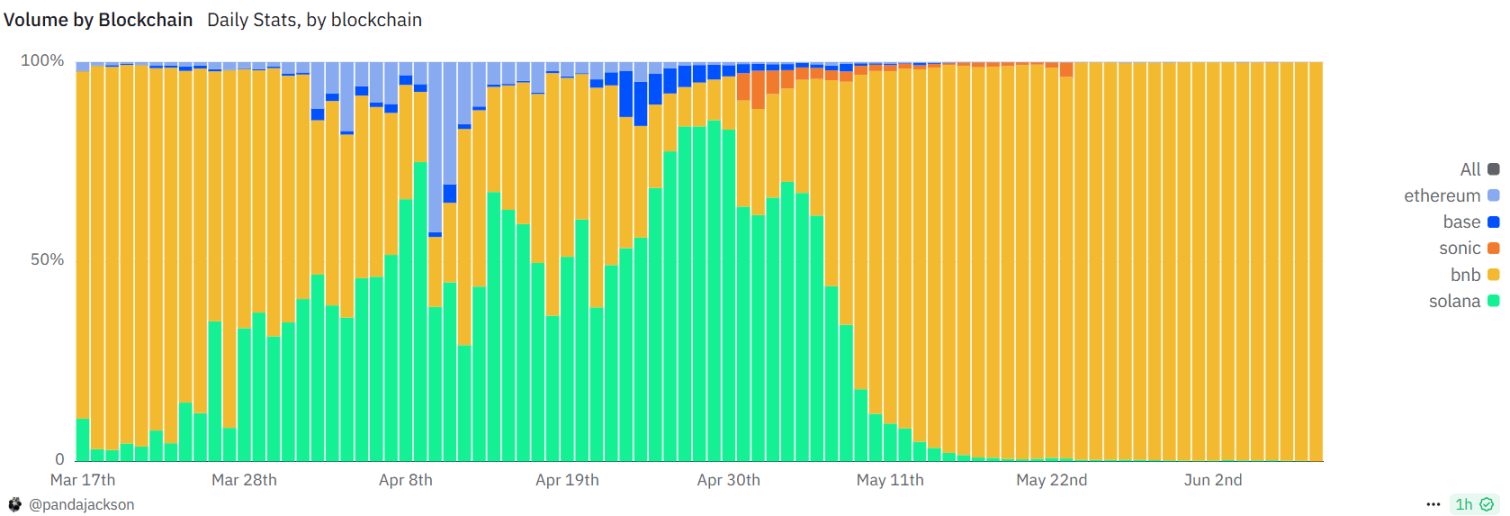

According to the Dune data panel, Binance Alpha's trading volume reached US$2.04 billion on June 8, a record high, and far surpassed competitors such as Solana Chain.

The root of this "involuntary" phenomenon lies in the imbalance of supply and demand. The threshold for airdrops and limited opportunities for Binance Alpha is rising, while the number of participants is surging. It is estimated that the number of qualified people who have airdropped Open Loot is about 10,000, and each person can get 1836 OL tokens. As arbitrage players flock in, the platform screens truly active users by raising the points threshold, while curbing the robot's score swipe behavior. In June 2025, Binance announced an upgrade to the risk control system, and any use of robots—including but not limited to scripts, automation tools or other non-manual methods—will be considered a violation.

From thousands to hundreds of dollars, the end of Binance Alpha?

In the early stages, because there are not many participating users and many projects with high returns, if ordinary retail investors take full airdrops, their returns will be above US$1,000 after removing the cost. However, as the number of users continues to increase and the threshold is getting higher and higher, the monthly income it earns has dropped from thousands of dollars to around $600. In mid-May, the airdrop income of a certain project was once as low as $25, far lower than user expectations. This shows that Alpha points game is shifting from "low threshold and high returns" to "high threshold and low returns", and its attractiveness to ordinary players is weakening.

The popularity of Binance Alpha not only changed user behavior, but also had a profound impact on the entire industry ecosystem. On the one hand, Alpha's huge traffic has brought a "spillover effect" to other public chains. Since May, Solana's on-chain DEX trading volume has increased from US$2.2 billion to US$4.59 billion, thanks in part to the hot speculation of tokens such as $MOODENG on the Alpha platform. The NAVX tokens of Sui ecosystem also surged after Alpha was listed, and Alpha's points activity has also injected vitality into emerging public chains to some extent.

On the other hand, Alpha's success has also triggered the imitation of other exchanges. Twitter KOL@_FORAB revealed that exchanges such as Kraken and Bithumb have recognized the Alpha model and may launch similar activities. As competition intensifies, airdrop thresholds and costs will be further raised, and users may face higher barriers to participation. Binance itself is also constantly adjusting its strategies, such as launching a double-point campaign (you can get double-points by purchasing Alpha tokens through BSC chains or limit orders) to stimulate trading volume. However, this incentive further pushes up the threshold for points and exacerbates the "intra-volume".

Faced with high score thresholds and increasingly fierce competition, is Binance Alpha approaching the end? The answer may not be simple yes or no. User fatigue is emerging, and high thresholds and high costs are persuading newcomers to withdraw. If the profit continues to decline, ordinary users may choose to exit. Robots and arbitrageurs squeeze in space: Although Binance has upgraded its risk control system, the problem of robot score swiping has not been completely solved. This not only harms fairness, but also increases the operating costs of the platform. In addition, market saturation is also one of the negative factors, and the supply of high-quality projects of Alpha projects may tend to dry up. In the long run, it is difficult for the platform to maintain high-frequency and high-value airdrop activities.

jinse

jinse