List of major interest-generating stablecoins

Reprinted from jinse

06/09/2025·10DAuthor: Stacy Muur, Web3 researcher; Translated by: Golden Finance xiaozou

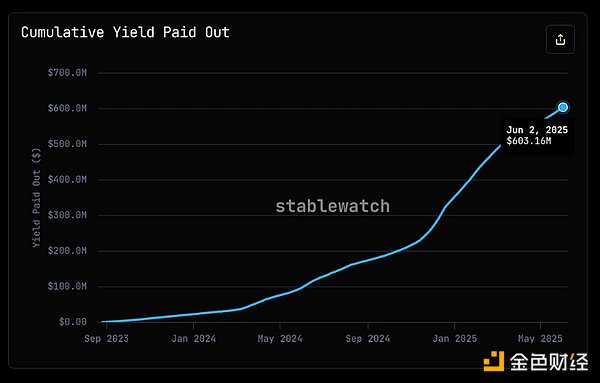

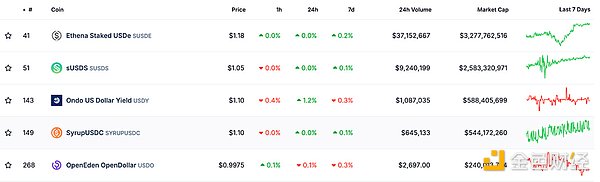

Ethena SUSDE and sUSDS account for about 77% of the liquidity of the yield stablecoins (YBS, interest-generating stablecoins), and the cumulative actual payment income has exceeded US$603 million. Will earning stablecoins become the next killer application adopted by Web2 users on a large scale?

Currently: the total market value of income stablecoins (YBS) is US$7.19 billion; the 24-hour trading volume is US$56.18 million (there is sufficient liquidity for the vault, but it is still thinner than USDT/USDC); it forms a monopoly pattern of giants, and Ethena's SUSDE and sUSDS control about 77% of the liquidity of YBS; the cumulative actual income is US$603 million (the cash income paid directly to holders, excluding token incentives).

1. The core characteristics of income stablecoins

YBS continues to generate passive returns while anchoring the US dollar. Currently, the four major revenue engines dominate the market:

Delta neutral hedging : Capture futures fund rates (such as SUSDE, sUSDS) while holding spot collateral.

Short-term Treasury Bonds (RWA Packaging) : Tokenized Treasury Bonds/Repurchase Agreements (such as USDY, USDO).

DeFi lending vault : Circularize idle collateral into Aave, Morpho or Pendle PT earnings ladder (such as SyrupUSDC, sDOLA).

Verifier pledge packaging : Package Ethereum or SOL pledge income into US dollar-denominated assets (such as SFRXUSD, SLVLUSD).

The result is that while maintaining the stability of the US dollar, it provides a net annualized return of 3%-15%, without the need to actively farm profits.

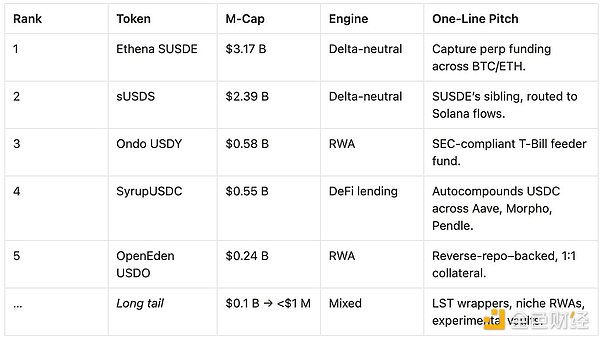

2. Current market leader

3. Macro trend insight

Betting on basis trading

Ethena's twin products (SUSDE/sUSDS) surged from less than US$500 million to over US$5.5 billion this year. This concentration makes the YBS sector extremely sensitive to perpetual contract funding rates.

RWA continuous penetration

USDY and USDO verify that short-term Treasury bonds are still the simplest and most regulated-recognized source of stable returns. More fund products under the framework of the Investment Advisory Act of 1940 are expected to emerge.

L2 ecological fragmentation

Rollup chains such as Fraxtal and Mode each deploy "customized version" SUSDE to attract locked volume (TVL) - although it creates liquidity islands, it accelerates the adoption process.

Rate of return compression risk

As U.S. interest rates peak, APY for Treasury products may decline; the Delta neutral model relies on a sustained positive futures premium. The yield may shrink below 3-4% after hedging.

Smart contract attack surface expands

Complex restaking and hedging levels increase protocol risks (oracle failure, serial liquidation). Audit and insurance coverage have become the standard entry configuration.

(1) Ethena sUSDe

Market position : sUSDe is currently the largest income stablecoin (YBS), with a market value of between about US$2.66 billion and US$4.3 billion, and it is firmly dominant in the income stablecoin market.

Operating mechanism : As a synthetic stablecoin that adopts Delta neutral hedging strategy, its income comes from Ethereum staking rewards (through stETH) and perpetual contract funding rates for short positions in ETH.

Rate of return : The latest data shows that the annualized rate of return is between 4.5% and 10%, depending on market conditions and the integration ecosystem.

Ecological integration : It has been logged in to Telegram and TON, covering more than 1 billion user groups, and has recently expanded to the decentralized perpetual contract exchange Hyperliquid.

Transparency : The custody and forensic report in May 2025 shows that its mortgage rate reaches 101.31%, ensuring full mortgage.

Risk : Highly relies on a continuously positive perpetual capital rate. If negative rates occur, it may affect profitability and anchor stability.

Recent progress : Expand to Hyperliquid and integrate with TON, further expanding its coverage in the DeFi ecosystem.

(2) sUSDS

Market position : The second largest YBS with a market value of approximately US$2.39 billion is a core component of Sky Ecosystem (former MakerDAO).

Operating mechanism : represents USDS deposited into the Sky Savings Rate System (SSR), maintaining USD anchorage and obtaining profits through pledge.

Liquidity : Active trading is in Curve, Aerodrome and Uniswap V3, with an average daily trading volume of approximately US$27.8 million, and is supported by the Sky Ecosystem's US$6.2 billion liquidity layer.

Risk : There are smart contract vulnerabilities and market volatility risks, but hedged through excess mortgages and real-world assets (RWA) investments.

Horizontal comparison : Because of its fusion design with RWA, it is often classified and discussed with YBS such as USDY and USDM.

(3) Ondo USDY

Market position : RWA-backed YBS with a market value of approximately US$580 million is mainly aimed at non-US investors.

Operating mechanism : Supported by short-term US Treasury bonds and bank deposits, supporting daily minting/redemption (40-50-day transfer delay is required for compliance).

Rate of return : About 5% annualized returns after deducting fees, derived from returns on U.S. Treasury bonds.

Accessibility : Ethereum, Aptos and Stellar chains have been launched, and are only open to non-US users due to regulatory restrictions.

Compliance : Registered in SEC and comply with institutional-level standards.

Application scenario : Applicable to vault management, DeFi mortgage and cross-border payment.

Recent progress : Log in to the Aptos chain to broaden the use channels for non-US residents.

(4) SyrupUSDC

Market position : Market value is approximately US$550 million, focusing on DeFi lending through Maple Finance.

Operating mechanism : Provide fixed interest rates, excess mortgage loans for institutional borrowers, and automatically reinvest USDC to Aave, Morpho and Pendle agreements.

Liquidity : It is listed on Coinbase and integrated with Balancer and Uniswap to ensure adequate liquidity in the market.

Risk : Faces the risk of loan default and the potential vulnerability risks of integrated DeFi protocols such as Aave and Morpho.

Application scenario : Introduce traditional financial returns into DeFi to attract institutional and retail investors to participate.

(5) OpenEden USDO

Market position : Launched in February 2025, it is a regulated RWA- supported YBS with a market value of approximately US$240 million.

Operating mechanism : Fully mortgaged by tokenized US Treasury bonds, maintained at 1:1 USD anchorage, issuance through Bermuda's Independent Account Company (SAC).

Yield : Provides annualized returns of about 4% to 5%, linked to U.S. Treasury performance.

Compliance : Licensed by the Bermuda Digital Assets Business Act (DABA).

Ecological integration : Use Chainlink's CCIP to implement cross-chain functions of Ethereum and Base chains.

Transparency : Ensure credibility and accountability through on-chain real-time reserve proof.

Recent Progress : As the first regulated YBS to be fully secured by tokenized US Treasury bonds, it is a milestone.

(6) YPO - actual income payment snapshot

Core Value : YPO is a tracker for on-chain profit distribution. Only real payments can make sense for high yields. SUSDE leads the way with a cumulative payment of US$286 million, while sDAI's US$117 million demonstrates the durability of the Maker protocol.

4. **Why is income stablecoins (YBS) a "killer application" of cash

management**

Idle funds become productivity: Delta neutral synthetic assets (such as SUSDE) provide 7-8% annualized returns, and treasury bond packaging products (such as USDY, USDO) provide 4-5% returns, far exceeding the savings interest rates of most banks.

TVL grew 4 times in 12 months: the industry's total locked position soared from $1.7 billion to $7.1 billion, synchronizing with the Federal Reserve's interest rate hike cycle.

Reduced friction cost: Through high-quality entrances such as Circle, Coinbase, and Hashnote, retail investors can achieve second-level casting/redemption.

The transparency difference is significant: the collateral audit standards are uneven, and the on-chain reserve proof standards are still in the process of forming.

5. Transparency and risk considerations

The upcoming "Earning Stablecoin Transparency Framework" aims to establish a standardized evaluation system through the following dimensions:

Collateral transparency: asset holding details and third-party audit reports.

Redemption convenience: Assess the redemption frequency, potential slippage, lock-up period and KYC requirements.

Source of income: Clearly the income comes from fixed income assets, capital rate arbitrage, validator rewards or combination strategies.

Risk disclosure: Fully covers oracle dependence, counterparty risks, smart contract vulnerabilities and regulatory considerations.

Key risks :

Regulatory Reclassification: Some jurisdictions may consider earnings as securities dividends.

Smart contract attacks: risk of reentry attacks, oracle failure or serial liquidation.

Liquidity restrictions: The daily trading volume of some tokens is low, and it is difficult to redeem large amounts.

Macroeconomic shock: Fed rate cuts or inverted capital rates may impact multiple income mechanisms at the same time.

Market value classification quick look

Market (>$500 million): SUSDE, sUSDS, USDY, SyrupUSDC

Mid-market (US$100 million to US$500 million): USDO, SDEUSD, SLVLUSD

Small plate (< USD 100 million): SFRXUSD, sDOLA, Solayer SUSD, DUSD, SUSDE- Fraxtal, YTRYB

6. Conclusion

Earnings stablecoins are converting idle digital dollars into interest-bearing assets, but the field is still in its early stages, with high market concentration and sensitive volatility. It is recommended to diversify the income engine, monitor the price difference of funds and rate, and continuously require increased transparency.

This article is for educational purposes only and does not constitute financial advice. Be sure to study it yourself (DYOR).

chaincatcher

chaincatcher