Believe is backfired by traffic? The platform currency LAUNCHCOIN cannot hide the hidden concerns of the ecological system, and the community's sentiment has taken a sharp turn for the worse

Reprinted from panewslab

05/15/2025·24DAuthor: Nancy, PANews

Believe is experiencing a backlash in traffic. With the sharp pull-up of the platform currency LAUNCHCOIN, the successive appearance of the 10 million speed-through market and the appeal of a number of Web2 entrepreneurs, Believe once seized the C position of the topic in the recent Launchpad melee and became the focus of traffic. However, behind the excitement, with the gradual emergence of high pumping on the platform, frequent "scrapers" and the lack of sustainable narratives, the community's FUD sentiment has rapidly heated up.

YAPPER plunges into FUD fuse, Believe ecosystem faces multiple hidden

dangers

$YAPPER is the fuse of Believe Ecological FUD storm. According to reports, Yapper is a deep fake AI application used to create funny high-quality videos, and platform users have generated more than 100 million views. Its founder Emmet Halm, who has founded the online tutoring company The Massapequa Tutor and the university application platform Acceptitas, both of which have been acquired.

Halm's entrepreneurial experience in the Web2 field quickly attracted attention to its token $YAPPER, and even received support from Believe's official retweets, pushing its market value to exceed $28 million at one point. However, GMGN data shows that as of the time of publication, the maximum drop in $YAPPER price from its highs had reached 75.62%.

But this decline is not accidental, and there are multiple factors behind it: on the one hand, Halm was accused of participating in the operation of another token in Believe ecosystem, $STEALTH, which shares the same logo as Stealth Startup founded by Halm. In the face of controversy, $STEALTH officially responded vaguely, "This is not plagiarism, nor does it mean connection, because this logo itself is a common symbol of many "hidden entrepreneurs", just like a signal of an entrepreneur "invisible".

Not only that, Halm's entrepreneurial background has also caused controversy. According to foreign media The Harvard Crimson, Halm, who claims to be a Harvard dropout and a crypto entrepreneur, once played the slogan "Harvard students help you to go to school" when founding Acceptitas, attracting a large number of clients and tutors. However, after the company was acquired, Halm failed to hand over properly, resulting in a large number of tutor salaries being owed and the customer's refund was not available, which once caused legal and moral doubts.

On the other hand, the issuance of $YAPPER continues the high pumping and scraper phenomenon of Believe platform, resulting in retail investors taking over at high levels and causing serious losses. Among them, Believe's excessive pumping ratio not only causes serious capital outflows, but also leads to excessive user transaction costs. According to crypto researcher 0xLoki , Believe's core problem is highly consistent with FriendTech at that time: net pumping (which will not be retained within the ecosystem) is too high, and 4% will be gone if you buy and sell (Believe charges a 2% purchase and sale tax). If the simple estimate is based on (current Believe's cumulative transaction volume) of 16.78 billion * 2%, the net pumping has exceeded US$33 million. The internal and external trading ratio of Pump.fun is estimated at 1:3, and the actual net pumping rate (net pumping/total trading volume) = 1% * (1/4) = 0.25%. It looks like the transaction rate is 1:2, but the actual net pumping rate is 1:8.

"The trading volume is 100m+, and the market value is less than 10m. What does it mean? It means that the dealer directly poured it when the retail investors' trading volume is rising." Encryption KOL @xingpt pointed out. In addition, since Believe allows to quickly create tokens through social tags, this method causes the platform's new coins to be opened by "scratched" (the act of a robot rushing tokens at an extremely fast speed when token is issued or transactions are opened) to quickly seize low-priced chips, and then push up the market value in a short period of time and then "drink" (quickly pulling up and distributing) the market. After chasing the high, retail investors often become the target of taking over. Data shows that in the past 24 hours, more than half of the tokens on the Believe platform have fallen by more than 50%.

The main control drives a surge of more than 300 times, and LAUNCHCOIN

contributes more than half of the ecological market value

PANews previously reported that Believe's predecessor was PASTERNAK, a celebrity coin created by Clout founder Ben Pasternak, and was launched in January 2025. Clout is a SocialFi platform that combines the characteristics of platforms such as Friend.Tech, Pump.fun and Moonshot, allowing celebrities and creators to issue tokens named after themselves.

With the endorsement of Alliance DAO and other institutions, PASTERNAK's popularity soared and its market value once surged to tens of millions of dollars. However, with the overall market pullback and platform technology issues, PASTERNAK price then fell sharply, falling to hundreds of thousands of dollars at a low of slump. Not only that, the price of the second token issued on Clout, $IMRAN (the founder of Alliance DAO, also plummeted, which also exacerbated the market's loss of confidence in PASTERNAK.

After a period of silence, on April 29, PASTERNAK announced the rename to "Launch Coin on Believe" and regained traffic with the help of LAUNCHCOIN violently pulling the market.

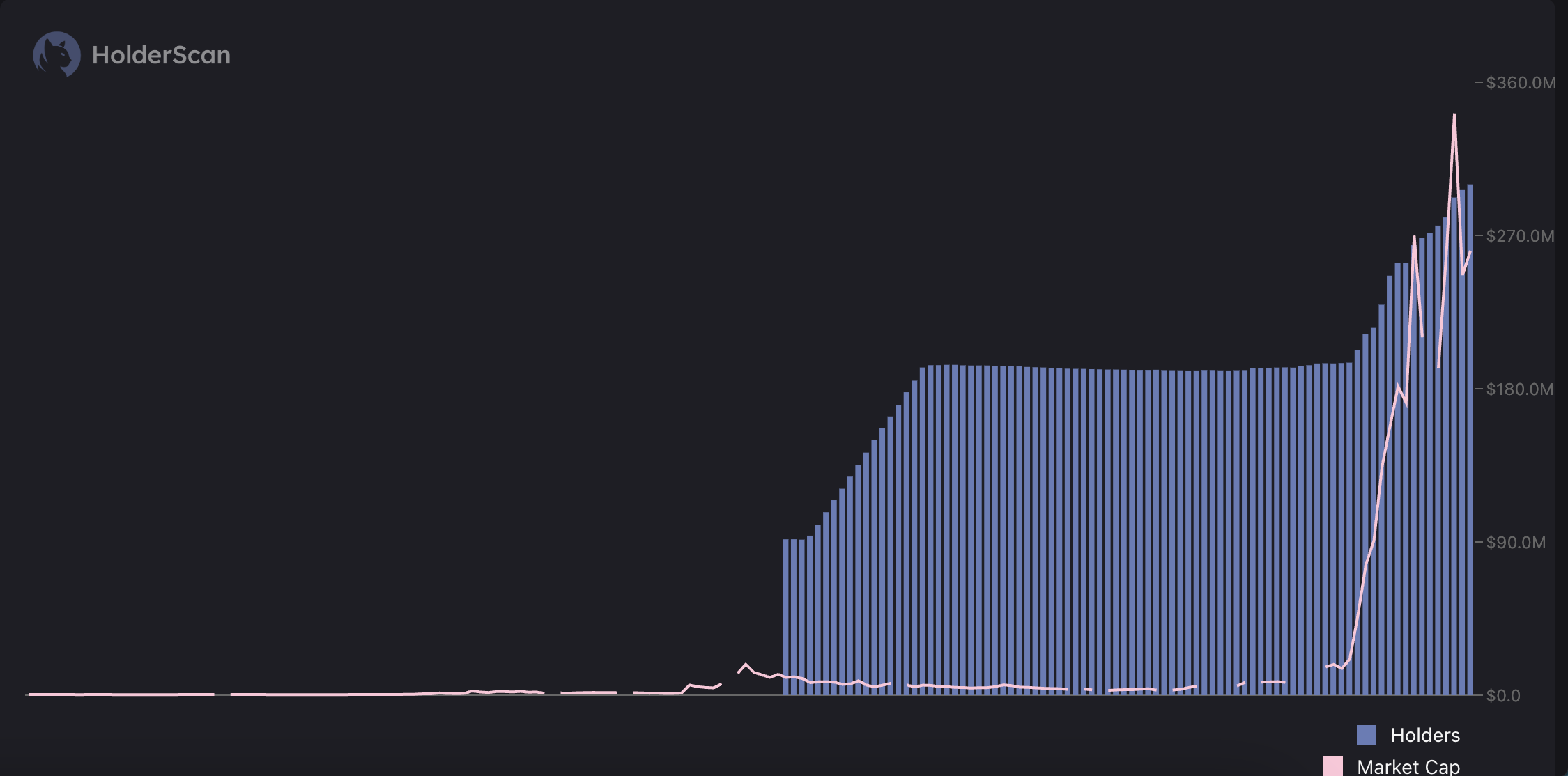

GMGN data shows that since the name change was announced on April 29, LAUNCHCOIN's market value once soared to over US$360 million, with a maximum return rate of nearly 321 times, showing extremely strong market explosiveness and capital pursuit.

Judging from the changes in the coin holding address, Holderscan data shows that the number of LAUNCHCOIN's holding addresses showed a significant turning point on May 1. At that time, the pace of entry of users with market value exceeded US$20 million was significantly accelerated, and the attention to funds increased significantly. After nearly ten days of sideways consolidation, LAUNCHCOIN began to accelerate its volume increase on May 11, and its market value quickly jumped and hit a stage high.

Judging from the on-chain data analysis, LAUNCHCOIN is currently in a highly controlled trend, with the top 100 addresses controlling more than 54% of the circulating tokens, showing obvious centralized holding characteristics. In a sense, this structure shows that there is a "artificial" dominant space for price fluctuations, and the top funds have strong trading capabilities and voice.

In terms of the distribution of coin holding amounts, the overall per capita holding amount is about US$9,100; if the top 100 addresses are excluded, the average holdings of the remaining nearly 29,000 address addresses will drop to approximately US$5,600, which indicates that the holdings of ordinary coin holders are relatively limited, and most investors are small and medium-sized retail investors.

Overall, LAUNCHCOIN shows a typical "main control + retail investors follow the trend" pattern. The main funds drive market popularity through trading, attracting a large number of retail investors and entering the market.

Judging from the overall situation of Believe ecosystem, the platform has issued more than 13,000 tokens so far, with a total market value of ecological tokens exceeding US$390 million, of which LAUNCHCOIN alone contributed about 67.2% of the market value share. At the same time, in the past 24 hours, LAUNCHCOIN's transaction volume accounted for 35% of the overall ecosystem. It can be seen that the popularity of platform coins is heavily dependent on LAUNCHCOIN's market performance. However, the platform currency is accused of lacking empowerment such as dividends and practical application scenarios, and the community has great doubts about its long-term sustainability. Once the market heat is difficult to maintain, investor confidence may decline rapidly, and there is a risk of stampedeship.

With multiple concerns in the market, Ben Pasternak has posted a message on social media to respond that he has been very crazy in the past few days and is very grateful for the energy behind the project vision. The team saw the founders’ interest surge, but will not launch new projects in the recommended sector for the time being, but will focus on supporting projects that are already under construction. Believe’s first priority is to make sure they have the tools and resources they need to succeed.

Overall, projects that truly have the ability to travel through cycles will eventually return to fundamentals: product experience, mechanism innovation and community trust. What Believe has to face next is not just how to maintain market heat, but how to take a sustainable path from the "minting fever".

jinse

jinse