Behind the failure of Solana SIMD-0228 proposal: Governance problems under the game of node interests

Reprinted from panewslab

03/16/2025·3MAuthor: Frank, PANews

The most controversial SIMD-0228 proposal in Solana's governance history ultimately failed with less than 66.6% of votes in favor. This vote is not only a technical debate on inflation reform, but also a war of interests among the validator class.

The top players try to promote the upgrade of ecological efficiency, while small and medium-sized verifiers resist fiercely for the right to survive. When the "democratic cloak" of on-chain governance is torn apart by data, Solana exposes not only the inflation problem, but also the realistic crack of interests between validators of all sizes. How will this storm reshape the ecological future? The answer may be hidden in the game between the code and the ballot box.

The game of interest between large and small validators makes the

proposal fail

The main content of the SIMD-0228 proposal is to increase the network staking rate by dynamically adjusting the inflation rate. Previously, PANew gave a detailed interpretation of the content of the proposal (related reading: Solana inflation revolution: SIMD-0228 proposal triggered community controversy, and the risk of "death spiral" hidden behind the 80% reduction in additional issuances )

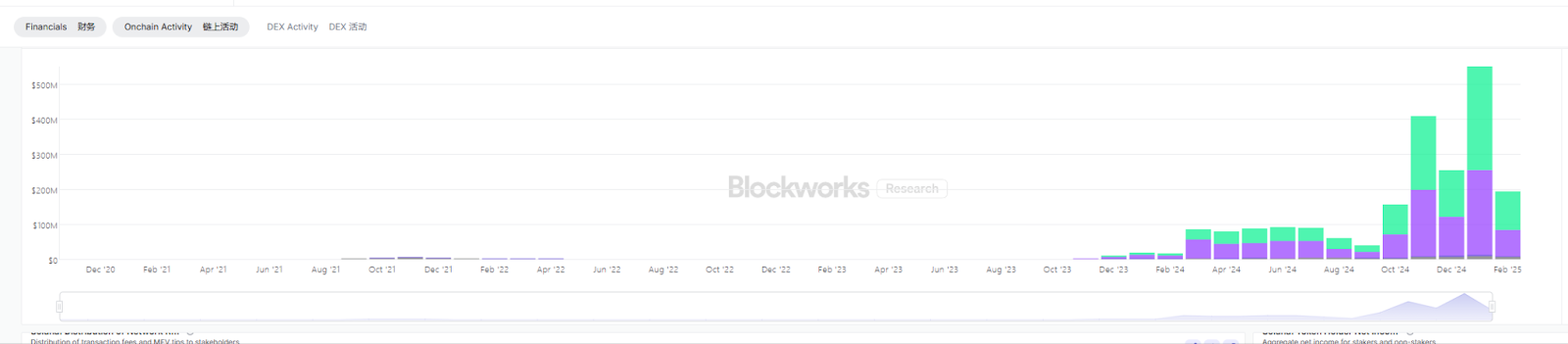

In general, when the proposal is passed, the reduction in Solana block rewards will be a high probability event. When the proposer proposed this idea, he believed that it would not have much impact on the validator's income. The basis is that validators' MEV revenue has increased significantly in the fourth quarter of 2024. Even if inflation is reduced, reducing block rewards will not affect the overall income level of validators.

But in fact, as data from February 2025 shows, MEV revenue on the Solana chain has shrunk significantly. Compared with the overall revenue of US$550 million in January, it fell to US$195 million in February, a month-on-month decline of 64%. The foreseeable result of income in March is to be lower than in February.

That is, the prerequisites proposed in the 0228 proposal no longer exist, and the one that is most affected is the small and medium-sized nodes.

Therefore, this polarized attitude can be clearly seen in this vote. The voting results show that the proportion of small nodes with pledged less than 100,000 SOL voted against the votes was 67.5%, while more than 60% of small and medium-sized nodes with pledged less than 500,000 SOL voted against the votes, while 51.6% of the verifiers with pledged 500,000 to 1 million SOL voted against the votes, while the proportion of nodes with pledged more than 1 million SOL voted against the votes was 65.8%.

It can be said that the failure of the SIMD-0228 proposal is actually the game of interests between large validators and small validators in Solana network.

Survival dilemma of small and medium-sized validators, MEV revenue has

dropped sharply, and 90% of validators have been affected

A core reason for this is that the business model of large verifiers and small verifiers is different.

The operating logic of large validators is to provide customers with better on-chain services by increasing the share of leadership blocks. Therefore, it can be clearly seen in the list of validators that the top-ranked large validators draw fewer MEV commissions, many of which are 0. These validator operators were not centralized exchanges or were providers like Helius that provide RPC services.

Small and medium-sized validators rely more on block rewards and MEV revenue. The reasonable source of income for most small and medium-sized validators mainly relies on block rewards and MEV income. Once this revenue drops sharply, you can either choose to launch validators, or increase gray revenue by running sandwich attack robots, etc.

Before analyzing the specific impact of the proposal on small and medium-sized validators, it is necessary to clarify its operating cost structure.

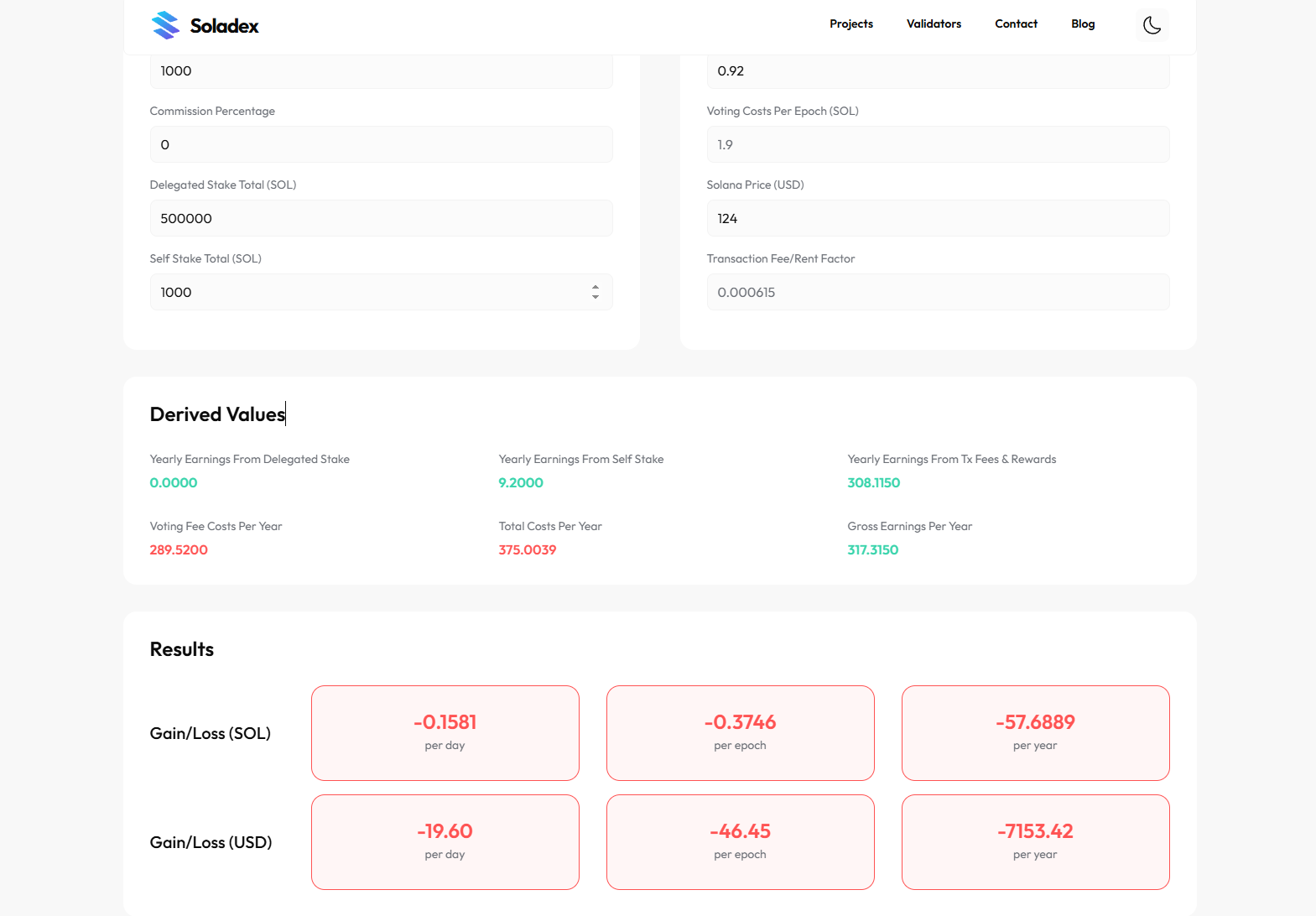

In terms of the smallest unit of verifiers, the current recommended devices suitable for running verifiers require several important configurations, 512GB of memory and 10GB of bandwidth. These two are the most expensive parts, and the servers configured with this configuration require a minimum expenditure of about $800 per month. In addition, it has a pledged equity of at least 1,000 SOL. A total investment of approximately US$134,000. If the block reward drops to 0.92% (proposed expected inflation rate), the daily net loss will reach US$19.6, and the value loss risk of the decline of SOL tokens will be affected.

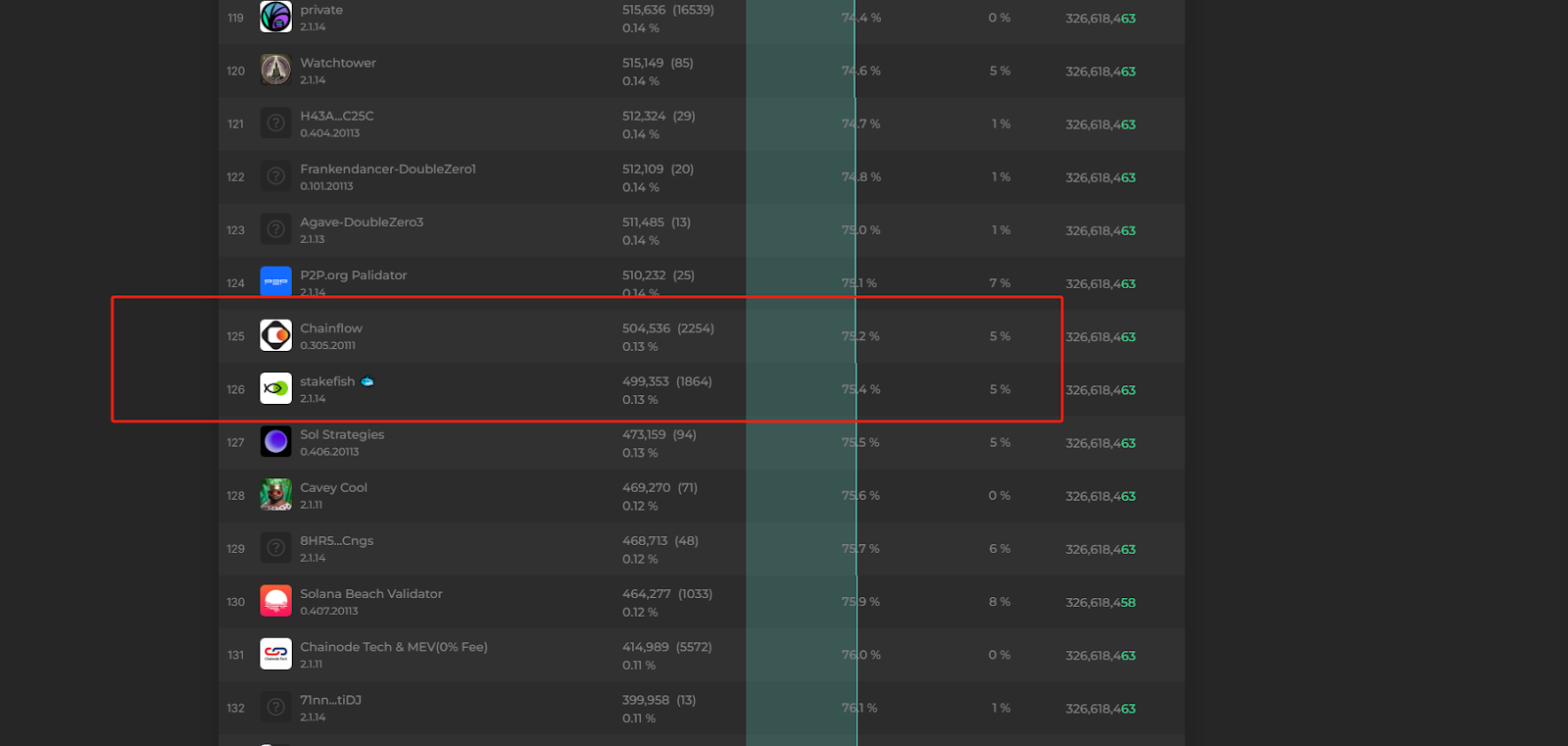

According to the current distribution of validator nodes, the number of validator nodes below 500,000 SOLs exceeds 90%. In order to obtain more pledges, these validators usually use a low commission level of 0~5%, which means they charge very little pledge commissions from the principals who support verification. The main income basically comes from pledges of their own funds.

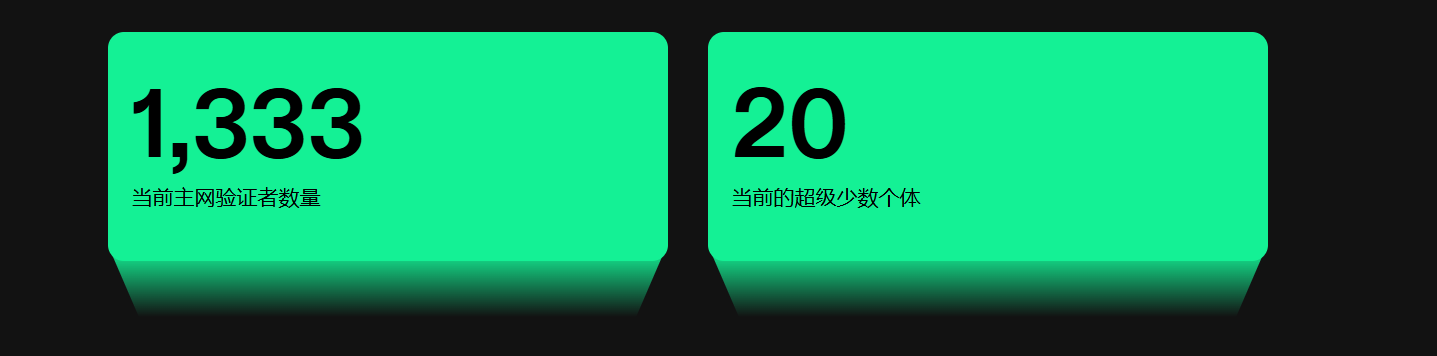

Let’s look at the allocation of priority fees. Currently, the total number of validators is 1,333, of which the top 125 large validators account for 75%. The remaining 1,208 small validators earn about 25% of the market share. Based on the total on-chain expenses of 195 million in February, these 1,208 validators can earn a total of $48.75 million, and on average each small validator can earn about $40,000 in revenue.

Taking the median node (729th place) as an example, the node's self-staking amount can be divided into $3.67 per day, but if the inflation rate is reduced to 0.92%, the node will likely lose $17 per day.

Solana proposes new plans to reduce inflation

In fact, there is another SIMD-0123 proposal conducted at the same time as 0228, which is similar to 0228, which is also designed to limit the revenue of validators. It is designed to upgrade the rewards that the verifier should allow to the principal are automatically allocated after the end of each cycle. Under the current mechanism, verifiers issue NFT or LST (liquidable staked tokens) as settlement vouchers, but this settlement method is not public and accurate. Previously, some verifiers have reduced the income to the principal by privately adjusting the commission rate.

However, although this proposal failed to trigger widespread discussions such as 0228, it finally received a 74.91% approval rating. Solana co-founder Toly commented on this on X: "Simd 228 failed, but 123 passed. Although both proposals are intended to reduce the revenue of validators. Opposing 228 is not just for their own benefit."

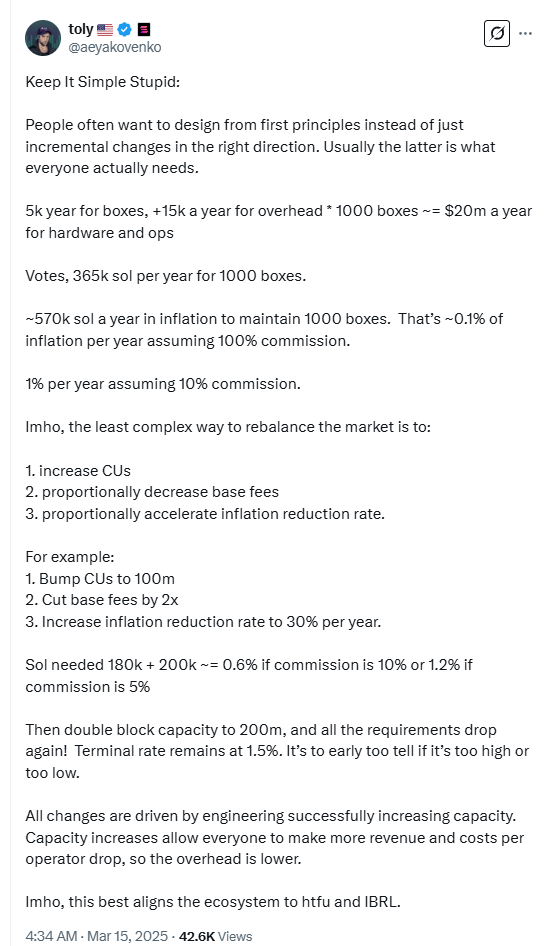

However, the failure of the 0228 proposal does not mean that the Solana inflation reform plan is stagnant. After the vote was over, Toly proposed another more modest solution on X, increasing the amount of block CU (computing unit), double the network throughput, and increasing the annual deflation rate to 30%.

Overall, Toly advocates the reduction of single transaction costs through engineering optimization and expansion, and reduces the dependence on inflation while improving network efficiency, and gradually realizes a sustainable model of "high throughput and low inflation". This solution avoids complex governance games such as SIMD-0228 and relies more on the natural evolution of technological upgrades.

However, this proposal has not yet been formally proposed in the developer forum, and is just a proposition. But in any case, SOL's inflation problem seems to be one of the key issues that Solana ecosystem must solve next.

The failure of the SIMD-0228 proposal reflects the complex interest pattern within the Solana ecosystem and the current situation where governance models need to be optimized urgently. Although the proposal ended in failure, it may have been a success of collective participation in Solana's governance process. Next, how to balance the interests of all parties while optimizing the token inflation model so that the ecosystem can continue to move forward with consistent goals, perhaps the most difficult problem for Solana's governance.

jinse

jinse