Wanzi parses the operating logic of traditional payment systems. How can Cryptorails become the "superconductor" of payment?

Reprinted from panewslab

03/16/2025·3MAuthor: Dmitriy Berenzon

Compiled by: Felix, PANews

When Satoshi released the Bitcoin White Paper in 2009, his vision was to use crypto networks to make payments so that it can flow freely on the Internet like information. Although the direction was correct, the technology, economic models and ecosystems at that time were not suitable for commercializing use cases.

By 2025, the market has witnessed the convergence of several important innovations and developments that have made this vision inevitable: Stablecoins have been widely adopted by consumers and businesses, market makers and OTC counters can now easily hold stablecoins on their balance sheets, DeFi applications create a strong on-chain financial infrastructure, a large number of inbound and outgoing channels exist around the world, faster and cheaper block space, embedded wallets simplify user experience, and a clearer regulatory framework reduces uncertainty.

There is a great opportunity to build a new generation of payment companies today, leveraging "Cryptorails" to achieve significant economic benefits over traditional systems, which are dragged down by multiple rent-seeking agencies and outdated infrastructure. These Cryptorails are becoming the backbone of the parallel financial system, which operates 24/7 and is essentially global.

This article will:

- Explain the key components of traditional financial systems

- Overview of the main use cases of Cryptorails

- Discussing challenges that hinder continued adoption

- Share your forecast for market prospects in five years

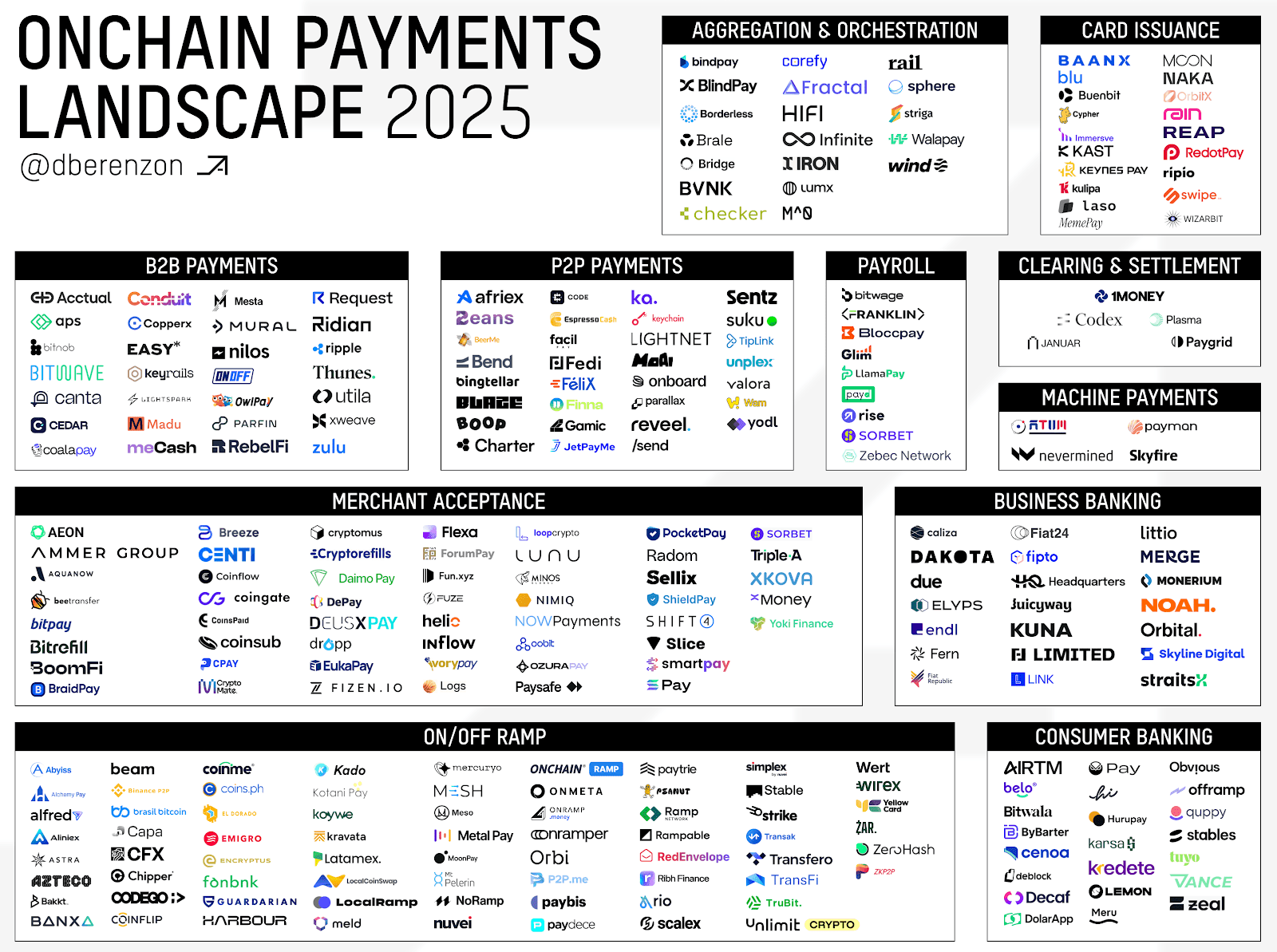

It is worth noting that there are currently about 280 payment companies built on Cryptorails:

Source: [Link](https://docs.google.com/spreadsheets/d/1qck-bL-sjsj9VABtVTV9i6wu33YyjqJYrPNPAIwOl_Q/edit?usp=sharing)

Existing channels

To understand the importance of Cryptorails, it is first necessary to understand the key concepts of existing payment Rails and the complex market structure and system architecture in which it operates.

Card network

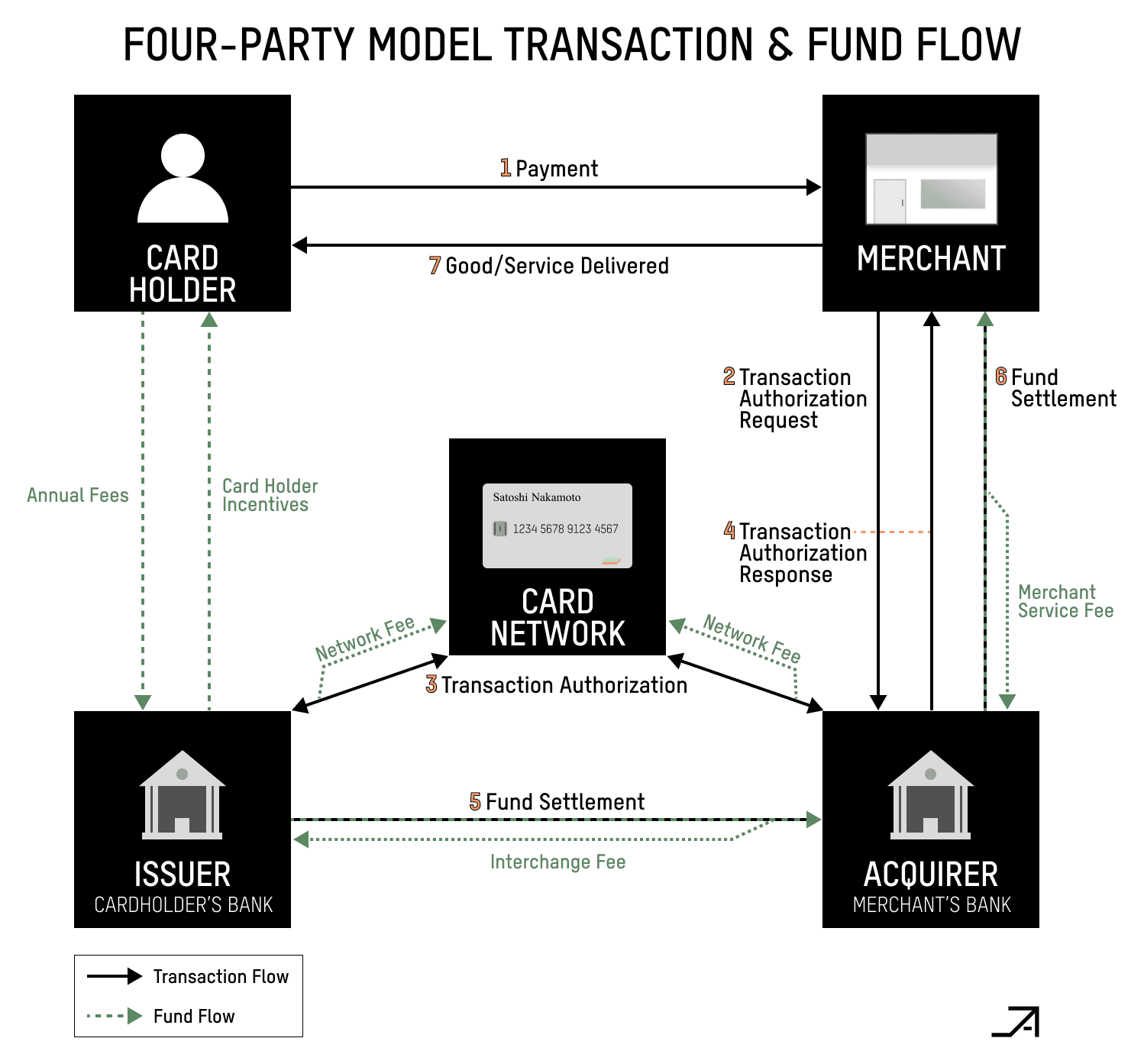

Although the topology of Card Networks is complex, the key players in the transaction have remained the same for the past 70 years. Essentially, card payment involves four main players:

- Merchant

- cardholder

- Issuing bank

- Acquisition bank

The first two are simple, but the last two are worth explaining.

The issuing bank or issuer provides a credit or debit card to the customer and authorizes the transaction. When a transaction request is made, the issuing bank decides whether to approve by checking the cardholder’s account balance, available credit limit and other factors. Credit cards are essentially borrowing funds from the issuing agency, while debit cards are transferred directly from the customer's account.

If a merchant wants to accept credit card payments, they need a collection agency (which can be a bank, processor, gateway, or independent sales organization) that is an authorized member of the card network.

The card network itself provides channels and rules for credit card payments. It connects the acquiring agency with the issuing bank, provides clearing functions, formulates participation rules and determines transaction fees. ISO 8583 remains the main international standard, which defines how credit card payment information (such as authorization, settlement, refund) is constructed and exchanged between network participants. In an online environment, card issuers and acquiring agencies are like their distributors—the card issuers are responsible for delivering more cards to users, while acquiring agencies are responsible for delivering as many card terminals and payment gateways as possible to merchants so that they can accept card payments.

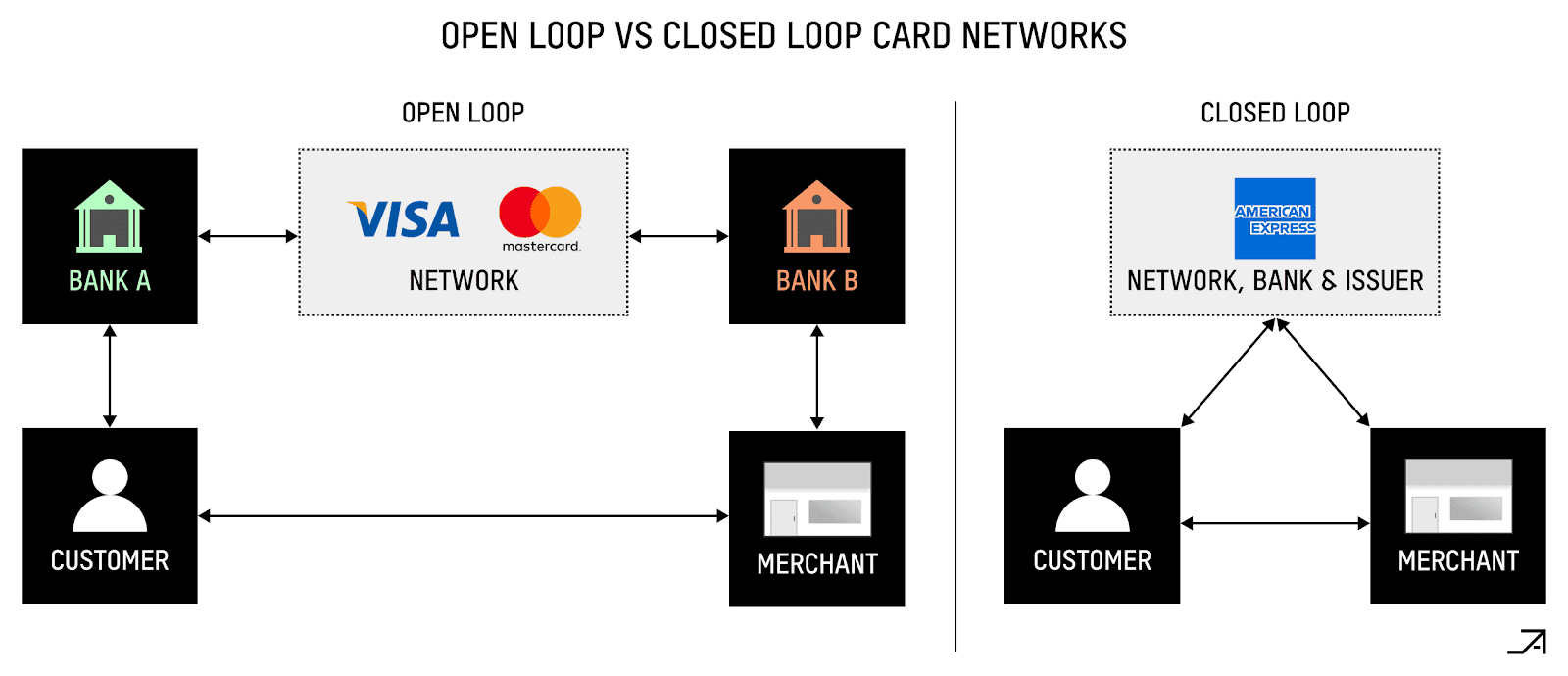

In addition, there are two types of card networks: "open loop" and "closed loop". Open-loop networks like Visa and Mastercard involve multiple parties: card issuing banks, acquiring banks and card networks themselves. Card networks facilitate communications and transaction routing, but are more like a market that relies on financial institutions to issue cards and manage customer accounts. Only banks are allowed to issue cards for open-loop networks. Each debit or credit card has a bank identification code (BIN) provided by Visa to banks, and non-bank entities such as PayFacs require a "BIN sponsor" to issue a card or process transactions.

In contrast, a closed-loop network like American Express is self-sufficient, with a company handling all aspects of the transaction process—issuing its own cards, owning its own bank, and providing its own merchant acquiring services. The closed-loop system provides more control and better profits, but at the cost of more limited merchant acceptance. Instead, open-loop systems offer wider adoption at the expense of control and revenue sharing among participants.

Source: [Arvy](https://arvy.ch/third-wheel/)

The economic principle of payment is complex, and there are multiple layers of fees in the network. Transaction fees are part of the payment fees charged by the issuing bank to provide access to its customers. Although technically, the acquiring bank pays the transaction fee directly, the cost is usually passed on to the merchant. Card networks usually set transaction fees, which usually account for the majority of the total payment costs. These fees vary widely across regions and transaction types. In the United States, for example, consumer credit card fees range from ~1.2% to ~3%, while in the European Union, the upper limit is 0.3%. There are also settlement fees, which are paid to the acquiring agency, usually a percentage of the transaction settlement amount or transaction volume.

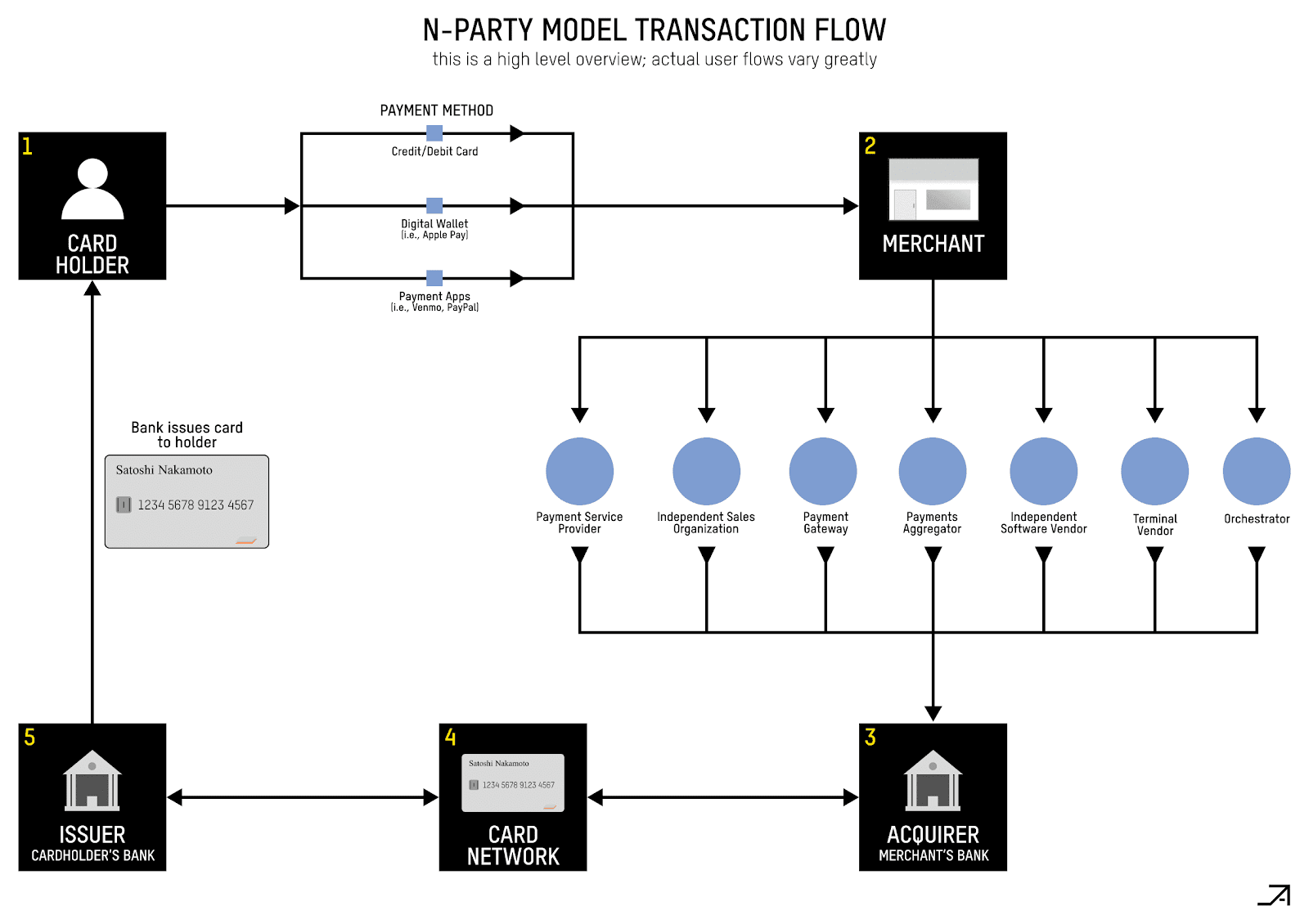

While these are the most important players in the value chain, the reality is that today’s market structure is much more complex in practice:

Source: [22](about:blank) nd

Although all participants will not be introduced one by one, there are several important needs to be pointed out:

The payment gateway encrypts and transmits payment information, connects with payment processors and acquiring agencies to obtain authorization, and communicates transaction approvals or rejections to the business in real time.

The payment processor processes the payment on behalf of the acquiring bank. It forwards the transaction details from the gateway to the acquiring bank, which then communicates with the issuing bank through the card network to obtain authorization. The processor receives the authorization response and sends it back to the gateway to complete the transaction. It also handles settlement, the process in which funds actually enter the merchant’s bank account. Typically, a business sends a batch of authorized transactions to the processor, which the processor submits to the acquiring bank to initiate the transfer of funds from the issuing bank to the merchant’s account.

Payment Service Provider (PayFac) or Payment Service Provider (PSP) was first launched by PayPal and Square around 2010, like a mini payment processor located between merchants and acquisition banks. It effectively acts as an aggregator, bundling many smaller merchants into their systems to achieve economies of scale and simplifying operations by managing fund flows, processing transactions and ensuring payments. PayFacs holds the merchant ID of the card network and assumes responsibilities such as compliance (such as the Anti-Money Laundering Act) and underwriting on behalf of the merchants they work with.

The orchestration platform is a middleware technology layer that simplifies and optimizes merchants' payment processes. It connects to multiple processors, gateways and acquisition agencies through a single API, improving transaction success, reducing costs and improving performance by routing payments based on factors such as location or fees.

ACH

Automatic Clearing House (ACH) is one of the largest payment networks in the United States and is actually owned by the banks that use it. It was originally founded in the 1970s, but it really became popular when the U.S. government began using it to send social security funds, which encouraged banks across the country to join the network. Today, it is widely used in wages, bill payments and B2B transactions.

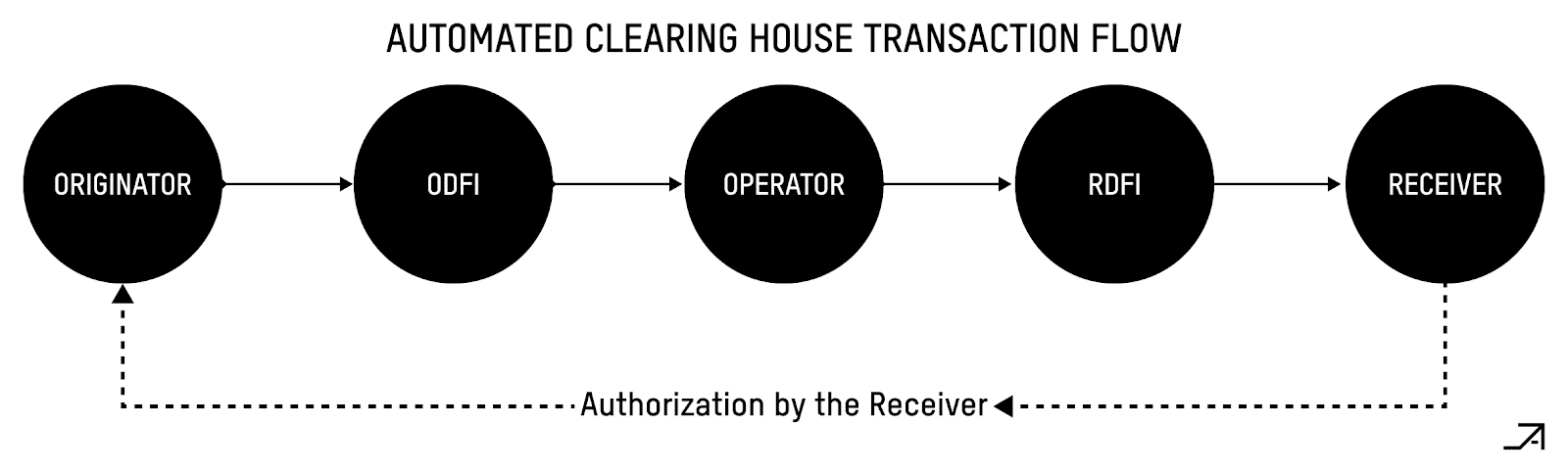

There are two main types of ACH transactions: "push" payment (you send money) and "pull" payment (someone withdraws money with your permission). You are using the ACH network when you get a salary through direct deposit or pay your bills online using your bank account. The process involves multiple participants: the company or individual that initiates the payment (the sponsor), their bank (ODFI), the receiving bank (RDFI), and the operator that acts as the flow controller for all these transactions. In the ACH process, the promoter submits a transaction to the ODFI, which then sends the transaction to the ACH operator, which then transfers the transaction to the RDFI. At the end of each day, the operator calculates the total net settlement for its member banks (the Federal Reserve is responsible for managing the actual settlement).

Source: [US Payment System: Guide to Payment Professionals](https://www.amazon.com/Payments-Systems-U-S-Third-Professional/dp/0982789742)

One of the most important things about ACH is how to deal with risks. When a company initiates ACH payments, its bank (ODFI) is responsible for ensuring everything is legal. This is especially important for withdrawing payments – imagine if someone uses your bank account information without permission. To prevent this from happening, regulations allow disputes within 60 days of receipt of the statement, companies such as PayPal have developed clever verification methods such as conducting small test deposits to confirm account ownership.

ACH systems have been trying to meet modern needs. In 2015, they launched the “Same-Day ACH”, allowing payments to be processed faster. Nevertheless, it still relies on batch processing rather than real-time transfers and has limitations. For example, you cannot send more than $25,000 in a single transaction, and it does not apply to international payments.

wire transfer

Wire transfer is the pillar of high-value payment processing. In the United States, there are mainly two systems: Fedwire and CHIPS. These systems handle secure payments that are time-intensive and require immediate settlement, such as securities transactions, major commercial transactions and real estate purchases. Once executed, wire transfers are usually irrevocable and may not be cancelled or revoked without the consent of the payee. Unlike conventional payment networks that process transactions in batches, modern Wire systems use real-time full settlement (RTGS), meaning that each transaction is settled separately when it occurs. This is an important feature because the system processes hundreds of billions of dollars a day, and the risk of intraday bank failure using traditional net settlements is too high.

Fedwire is an RTGS transfer system that allows participating financial institutions to send and receive same-day fund transfers. When a business initiates a wire transfer, its bank verifies the request, deducts money from the account and sends a message to Fedwire. The Fed then immediately deducts the money from the remittance bank's account and deposits the money into the account of the receiving bank, which then deposits the money into the final payee. The system operates on weekdays from 9 pm to 7 pm ET the day before, and is closed during weekends and holidays.

CHIPS is owned by large U.S. banks through clearing houses and is small in scale, serving only a few major banks. Unlike Fedwire's RTGS approach, CHIPS is a net settlement engine, which means the system allows the summary of multiple payments between the same party. For example, if Alice wants to send $10 million to Bob and Bob wants to send $2 million to Alice, CHIP will combine the payments into a $8 million payment made by Alice to Bob. While this means that CHIPS payments take longer than live transactions, most payments are still settled within the day.

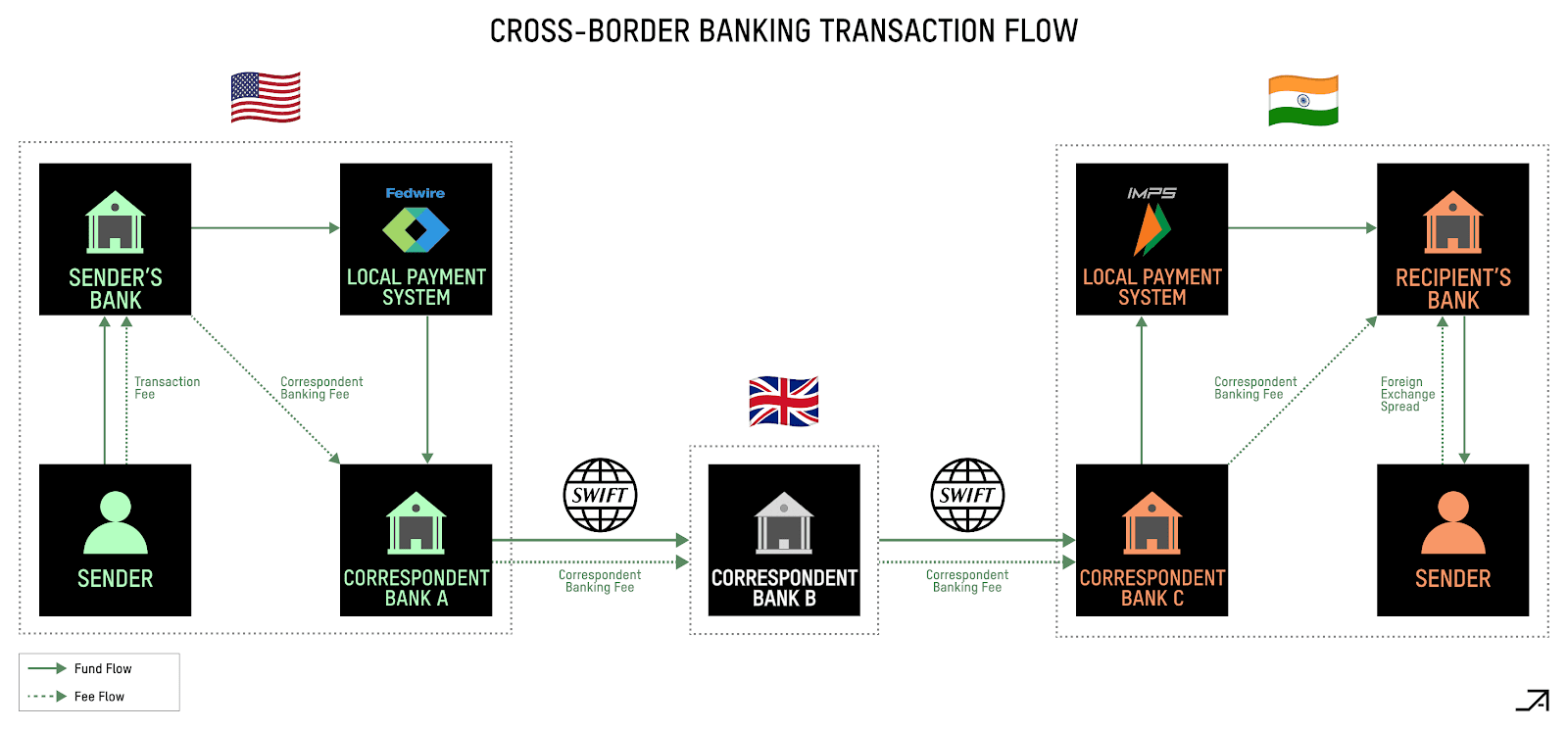

Complementing these systems is SWIFT, which is not actually a payment system, but a global messaging network of financial institutions. It is a member-owned cooperative with shareholders representing over 11,000 member organizations. SWIFT enables banks and securities companies around the world to exchange secure structured information, many of which initiate payment transactions over a variety of networks. According to Statrys, SWIFT transfers take about 18 hours to complete.

In a general process, the sender of the fund instructs its bank to send a wire transfer to the recipient. The value chain below is a simple situation where two banks belong to the same wire transfer network.

Source: [US Payment System: Guide to Payment Professionals](https://www.amazon.com/Payments-Systems-U-S-Third-Professional/dp/0982789742)

In more complex situations, especially cross-border payments, transactions need to be performed through agency banking relationships, and SWIFT is often used to coordinate payments.

Source: [Matt Brown](https://notes.mtb.xyz/p/cross-border-payments-1000-words)

Use Cases

With a basic understanding of traditional channels, the advantages of Cryptorails are explained below.

Cryptorails is most effective when traditional US dollar usage is limited but demand for the US dollar is strong. Think about places where people want dollars to keep their value but can’t easily get traditional dollar bank accounts. These countries are usually countries with economic instability, high inflation, monetary controls or underdeveloped banking systems, such as Argentina, Venezuela, Nigeria, Türkiye and Ukraine. In addition, the US dollar is a superior store of value compared to most other currencies, and consumers and businesses usually choose the US dollar because it can easily be used as a medium of exchange or converted into local fiat currency at the point of sale.

The advantages of Cryptorails are also most obvious in the scenario of global payments, because encrypted networks do not distinguish between national boundaries. They rely on the existing Internet to provide global coverage. According to World Bank data, there are currently 92 RTGS (real-time full settlement) systems operating worldwide, each system usually owned by its respective central bank. While they are perfect for sending domestic payments in these countries, the problem is that they cannot “communicate with each other.” Cryptorails can act as an adhesive between these different systems, or it can be extended to countries without them.

Cryptorails are also best suited for payments with a certain level of urgency or a high usual time preference. This includes cross-border supplier payments and foreign aid payments. They are also helpful in the particularly inefficient channels of agency banking networks. For example, despite its close geographical location, sending money from Mexico to the United States is actually more difficult than sending money from Hong Kong to the United States. Even in developed countries such as the United States to Europe, payments usually go through four or more agency banks.

On the other hand, Cryptorails is less attractive for domestic transactions in developed countries, especially where card usage is high or real-time payment systems already exist. For example, European intra-payment proceeds smoothly through SEPA, while the stability of the euro eliminates the need for alternatives denominated in USD.

Merchant adoption

Merchant adoption can be divided into two different use cases: front-end integration and back-end integration. On the front end, merchants can directly accept cryptocurrencies as a payment method for customers. While one of the oldest use cases, there hasn't been much transaction volume historically because few people hold cryptocurrencies and fewer want to spend it, and for those holding cryptocurrencies, there are limited options to use. The market is different today, as more and more people hold crypto assets, including stablecoins, and more merchants accept them as payment options because they can reach new customer bases and eventually sell more goods and services.

From a geographical point of view, most of the transaction volume comes from businesses selling products to consumers in early adopters of cryptocurrency countries, often emerging markets such as Vietnam and India. From a merchant perspective, most of the demand comes from online gambling and retail stock brokers that want to reach users in emerging markets, Web2 and Web3 markets such as watch suppliers and content creators, and betting games such as fantasy sports and sweepstakes.

The "front-end" merchant acceptance process is usually as follows:

- PSP usually creates wallets for merchants after KYC/KYB

- Users send cryptocurrency to PSP (Payment Service Provider)

- PSP converts cryptocurrencies into fiat currencies through liquidity providers or stablecoin issuers and sends funds to the merchant’s local bank account, possibly using other authorized partners

The main psychological challenge to prevent this use case from continuing to gain adoption is that cryptocurrency does not seem “real” to many. There are two main user roles that need to be addressed: one does not consider its value at all, hoping to keep everything as a magical internet currency, and the other is pragmatic, depositing funds directly into the bank.

In addition, in the United States, it is more difficult for consumers to adopt cryptocurrencies because credit cards can actually pay consumers a 1-5% rebate for shopping. There have been attempts to convince merchants to promote cryptocurrency payments directly to consumers as an alternative payment method for credit cards, but so far has not been successful. Merchant Customer Exchange was launched in 2012 and failed in 2016 because it could not enable the consumer adoption flywheel. In other words, it is difficult for merchants to directly incentivize users from card payments to using crypto assets, because payments are already "free" to consumers, so the value proposition should be addressed first at the consumer level.

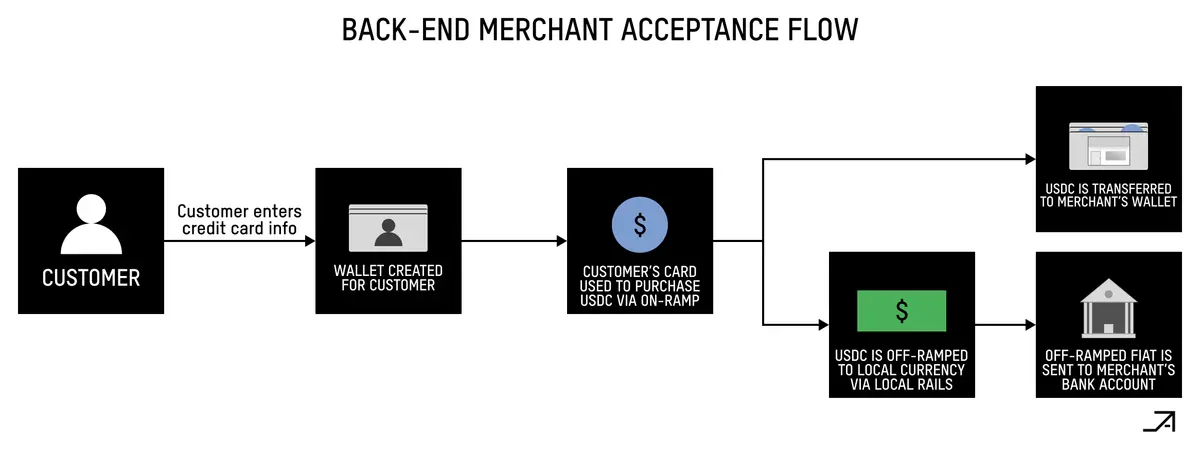

On the backend, Cryptorails provides merchants with faster settlement times and access to funds. Settlement for Visa and Mastercard can take 2-3 days, American Express can take 5 days, international settlements are even longer, for example, about 30 days in Brazil. In some use cases, such as Uber, merchants may need to inject capital into their bank accounts in advance to make payments before settlement. Instead, people can deposit money effectively through credit cards, transfer funds on the chain, and transfer them directly into the merchant’s bank account in local currency. Since there is less money being bound during the transfer process, this flow not only improves working capital, but merchants can also further improve fund management by freely and instantly exchanging digital dollars and earning assets (such as tokenized US Treasury bonds).

Specifically, the "backend" merchant acceptance process may look like this:

- Customer enters card information to complete the transaction

- PSP creates a wallet for the customer, and users use the entrance to accept traditional payment methods to fund the wallet

- Credit card transactions to purchase USDC and then send from the customer's wallet to the merchant's wallet

- PSP can choose to transfer to the merchant’s bank account through the native channel T+0 (i.e. the same day)

- PSP usually receives funds from the acquiring bank at T+1 or T+2 (i.e. within 1-2 days)

Debit Card

The ability to link debit cards directly to unmanaged smart contract wallets creates a powerful bridge between the block space and the real world, driving the organic adoption of different user roles. In emerging markets, these cards are becoming the main consumer tools, increasingly replacing traditional banks. Interestingly, even in countries where currency is stable, consumers are using these cards to gradually accumulate dollar savings while avoiding foreign exchange fees when purchasing. High net worth individuals are also increasingly using these cryptocurrency-pegged debit cards as effective tools for consuming USDCs worldwide.

Debit cards are more attractive than credit cards because of two factors: debit cards face fewer regulatory restrictions (such as MCC 6051 being completely rejected in Pakistan and Bangladesh, where capital controls are strictly controlled), and the risk of fraud is lower because of the serious liability issues for credit cards due to settlement of refunds for crypto transactions.

In the long run, a card bound to a crypto wallet for mobile payments may actually be the best way to combat fraud, as there is biometric verification on your phone: scan your face, spend, top up from your bank account to your wallet.

money transfer

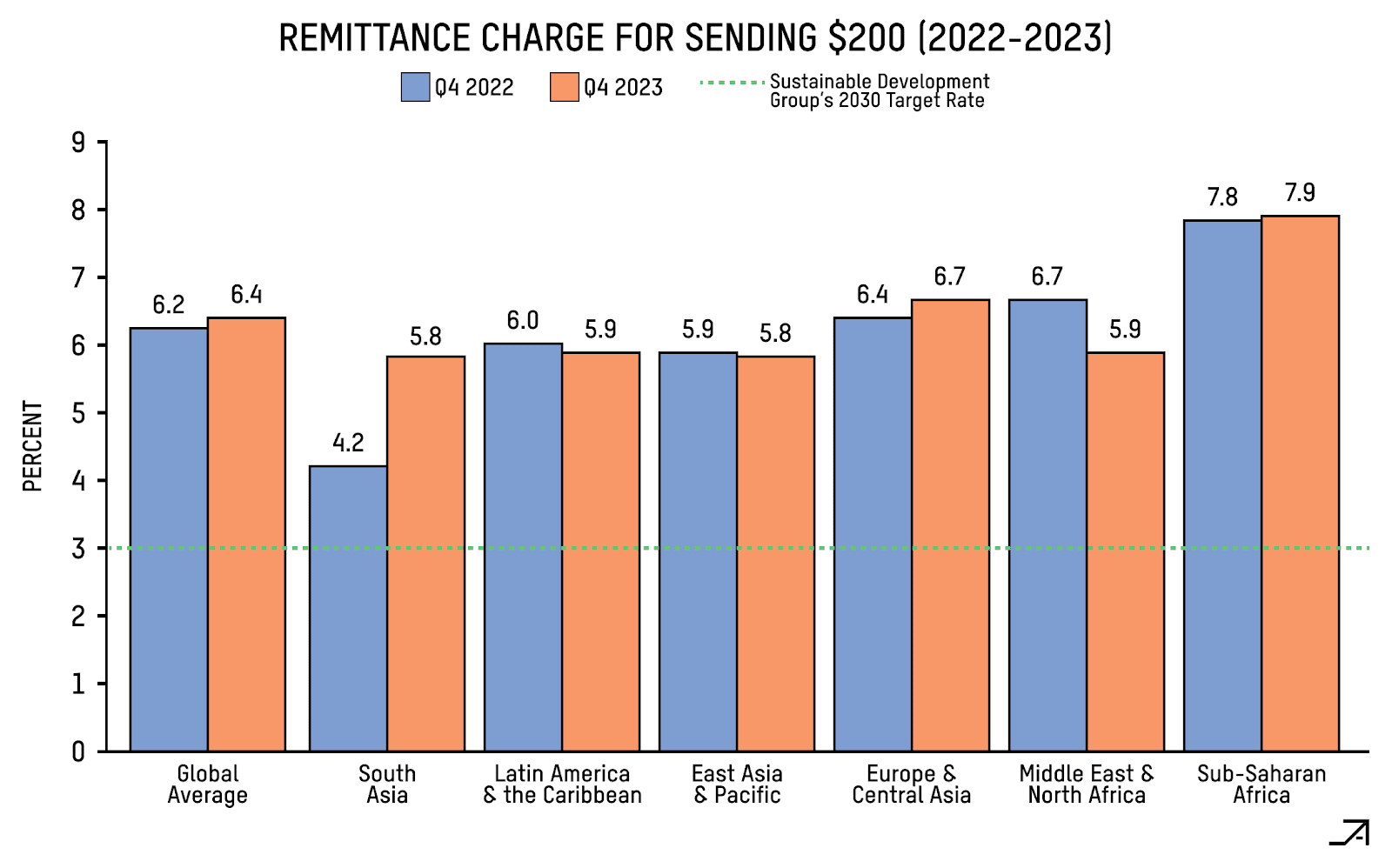

Remittance refers to those who move abroad to find a job and want to send money home, transferring funds from their working country to their home country. According to World Bank data, the total remittances in 2023 are approximately US$656 billion, equivalent to Belgium's GDP.

Traditional remittance systems are expensive. On average, the fees for cross-border remittances are 6.4% of the amount of the transfer, but these fees can vary greatly – the transfer fee from Malaysia to India is 2.2% (for large traffic channels like the United States to India, the fees are even lower). Banks tend to have the highest fees, around 12%, while remittance operators (MTOs) such as MoneyGram charge an average of 5.5%.

Source: [World Bank](https://documents1.worldbank.org/curated/en/099714008132436612/pdf/IDU1a9cf73b51fcad1425a1a0dd1cc8f2f3331ce.pdf)

Cryptorails provides a faster and cheaper way to send money. The development of a company using Cryptorails depends largely on the broader remittance market size, with the largest transaction volumes ranging from the United States to Latin America (particularly Mexico, Argentina and Brazil), the United States to India and the United States to the Philippines. An important factor driving this development is unmanaged embedded wallets such as Privy, which provide users with a Web2-level user experience.

The process of using Cryptorails for remittances may be as follows:

- The sender enters the PSP through a bank account, debit card, credit card or directly to the on-chain address; if the sender does not have a wallet, a

- PSP converts USDT/USDC to the local currency of the payee, and can be exchanged directly or with a market maker or OTC partner.

- PSP pays fiat currency directly to the recipient's bank account, or through a local payment gateway; or PSP can first generate a non-custodial wallet for the recipient to collect the funds, giving them the option to keep it on the chain

- In many cases, the payee needs to complete the KYC first to receive the funds

That being said, the road to going online for crypto remittance projects is still difficult. One problem is that people are often motivated to transfer from MTO (remittance operator), which can be expensive. Another problem is that transfers on most Web2 payment applications are already free, so local transfers alone are not enough to overcome the network effects of existing applications. Finally, while the on-chain transfer component works well, it still needs to interact with TradFi (traditional finance) at the "edge", so it may end up with the same or worse problems due to costs and friction. In particular, payment gateways converted to local fiat currency and paid through mobile phones or self-service terminals will account for the maximum profit.

B2B payment

Cross-border (XB) B2B payment is one of the most promising applications of Cryptorails. Payments through the agency banking system can take weeks to settle, and in some extreme cases even longer – a founder said it took them 2.5 months to send supplier payments from Africa to Asia. To give another example, cross-border payments from Ghana to Nigeria (two border countries) can take weeks and transfer costs up to 10%.

In addition, cross-border settlement is both slow and expensive for PSPs. For companies like Stripe that make payments, it can take up to a week to pay international merchants, and they have to lock in capital to deal with fraud and refund risks. Shortening the conversion cycle will release a large amount of working capital.

Cryptorails gained significant appeal on B2B XB payments, mainly because merchants care more about fees than consumers. A 0.5-1% reduction in transaction costs doesn’t sound like a lot, but when trading volumes are large, especially for businesses with small profits, the money is considerable. In addition, speed is also important. Complete payments within a few hours rather than days or weeks have a significant impact on the company's working capital. In addition, businesses are more tolerant of worse user experiences and more complex experiences than consumers who expect to experience smoothly.

Meanwhile, the cross-border payment market is huge – estimates vary greatly from sources, but according to McKinsey data, the cross-border payment market revenue in 2022 was about US$240 billion and transaction volume was about US$150 trillion. Having said that, building a sustainable business is still difficult. While the "stable currency sandwich" - converting local currency into stablecoins and then converting it back - is definitely faster, but it is also expensive, because foreign exchange exchanges on both sides will erode profits. While some companies are trying to solve this problem by establishing internal market making departments, it is very expensive and difficult to scale up. In addition, customers are also concerned about regulation and risks and require a lot of education. That being said, forex costs could drop rapidly over the next two years as stablecoin legislation opens the door for more businesses to hold and use digital dollars. As more cash out channels and token issuers will have direct banking relationships, they will be able to effectively provide wholesale foreign exchange rates on the Internet scale.

XB Supplier Payment

For B2B payments, most cross-border transactions revolve around import payments from suppliers, usually in the United States, Latin America or Europe, and in Africa or Asia. These channels are particularly troublesome because local channels in these countries are underdeveloped and companies are difficult to access because they cannot find local banking partners. Cryptorails can also help relieve pain points in specific countries. In Brazil, for example, you cannot use traditional channels to pay millions of dollars, making it difficult for businesses to make international payments. Some well-known companies, such as SpaceX, have used Cryptorails in such use cases.

XB Accounts Receivable

Businesses with clients around the world often find it difficult to collect funds in a timely and efficient manner. They usually work with multiple PSPs to collect funds locally, but require a quick way to receive funds, which can take days or even weeks, depending on the country. Cryptorails is faster than SWIFT transfers and can compress time to T+0.

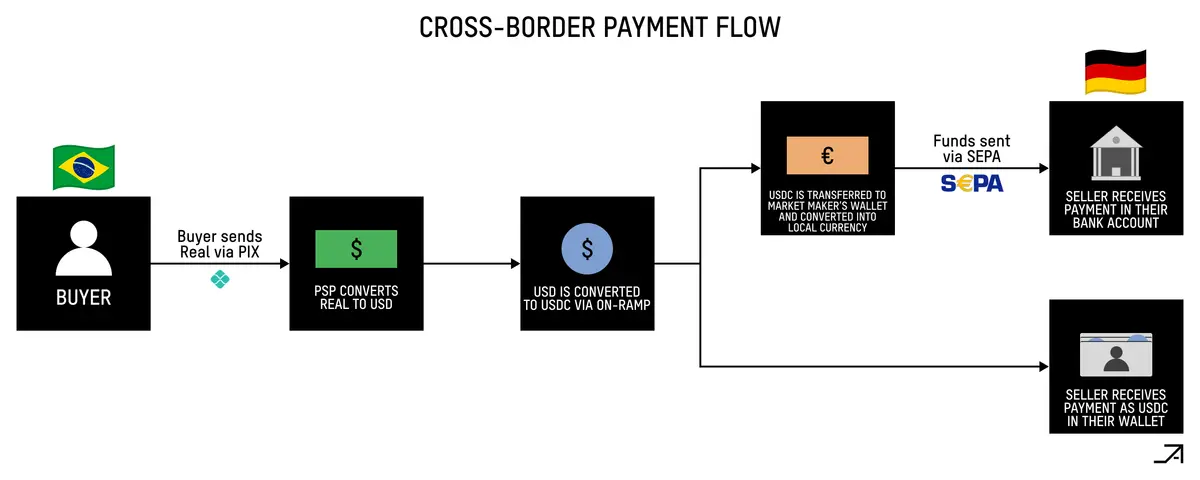

Here is a sample payment process for Brazilian companies to purchase goods from German companies:

-

Buyer sends Real to PSP via PIX

-

PSP converts Real to USD, and then to USDC

-

PSP sends USDC to seller's wallet

-

If the seller wants local fiat currency, the PSP will send USDC to the market maker or trading counter to convert it to local currency

-

If the seller has a license/bank account, the PSP can send money to the seller through local channels, and if not, the local partner can be used

Financial Operations

Companies can also use Cryptorails to improve financial operations and accelerate global expansion. They can hold USD and use local deposits and withdrawals to reduce Forex risks and enter new markets faster, even if local bank providers support them. They can also use Cryptorails to reorganize and repatriate funds between countries in which they operate.

Payment of foreign aid

Another common use case for B2B is time-critical payments, which can be used to get to payees faster. An example is the payment of foreign aid—allowing NGOs to use Cryptorails to remit money to local export agents that can individually make payments to eligible individuals. This is especially effective in economies with very poor local financial systems and/or governments. For example, in countries like South Sudan, central banks are collapsing and local payments may take more than a month. But as long as you have a mobile phone and internet connection, there is a way to bring digital currency into the country, and individuals can convert digital currency into fiat currency, and vice versa.

The payment process for this use case might be as follows:

- NGOs send funds to PSP

- PSP sends bank transfers to OTC partners

- OTC partners convert fiat currency to USDC and send it to local partner's wallet

- Local partners transfer USDC out through peer-to-peer (P2P) dealers

Payroll

From a consumer perspective, one of the most promising early adopters is freelancers and contractors, especially in emerging markets. The value proposition of these users is that more money ends up in their pockets rather than going to intermediaries, and that money can be digital dollars. This use case also brings cost-effectiveness to the other party's businesses sending large-scale payments, and is especially useful for crypto-native companies such as exchanges, which have already held most of their funds in cryptocurrency.

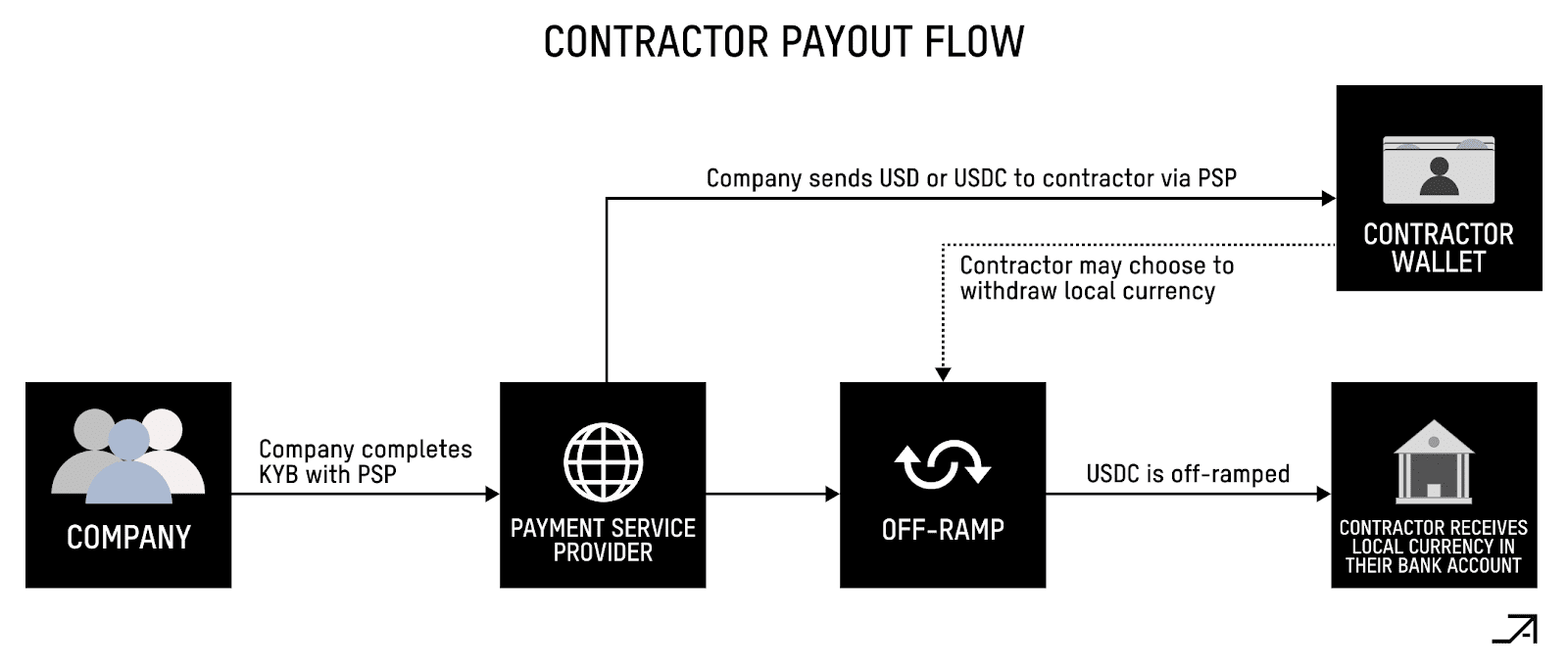

The payment process for contractor payments is usually as follows:

- The company conducts KYB/KYC with PSP

- The company sends USD to PSP or USDC to the wallet address bound to the contractor

- The contractor may decide whether to keep it as cryptocurrency or withdraw it to a bank account, and the PSP typically enters some master service agreement with one or more off-site partners who hold relevant licenses within their respective jurisdictions for local payments.

Inlet and withdrawal

The deposit and withdrawal is a crowded market. While many early attempts have failed to scale, the market has matured over the past few years, with many companies operating sustainably and offering local payment channels worldwide. While deposits and withdrawals can be used as standalone products (such as simply buying crypto assets), they can be arguably the most critical part of the payment process for bundled services (such as payment).

Establishing a deposit and exit channel usually has three components: obtaining the necessary licenses (such as VASP, MTL, MSB), ensuring local banking partners or PSPs access to local payment channels, and connecting with market makers or OTC counters for liquidity.

Deposits were initially dominated by exchanges, but nowadays, more and more liquidity providers, from smaller forex and OTC counters to large trading companies like Cumberland and FalconX, are offering deposit channels. These companies can usually handle up to $100 million in transaction volumes per day and are unlikely to deplete liquidity from popular assets. Some teams may even prefer these channels because they can promise spreads.

Due to licensing, liquidity and orchestration complexity, non-US withdrawal channels are often much more difficult than US deposit channels. This is especially true in Latin America and Africa, where dozens of currencies and payment methods are available. For example, you can use PDAX in the Philippines because it is the largest cryptocurrency exchange there, but in Kenya you need to use several local partners like Clixpesa, Fronbank and Pritium based on payment methods.

The P2P channel relies on a network of “agents” – local individuals, mobile payment providers and small businesses like supermarkets, pharmacies – who provide fiat and stablecoin liquidity. These agents are particularly common in Africa, where many people already operate mobile currency stalls for services like MPesa, whose main motivation is economic incentives – making money through transaction fees and forex spreads. In fact, it is more profitable for individuals in high-inflation economies such as Venezuela and Nigeria to become agents than traditional service jobs such as taxi drivers or meal delivery. They can also work from home on their phones, usually only need a bank account and mobile payments to get started. What makes this system particularly powerful is that it can support dozens of local payment methods without any formal permission or integration, as the transfer occurs between personal bank accounts.

It is worth noting that the foreign exchange rates in the P2P channel are usually more competitive. For example, Sudan’s Khartoum Bank typically charges up to 25% forex fees, while local crypto P2P channels offer 8-9% forex fees, which is actually market interest rates, not bank mandatory rates. Similarly, the P2P deposit channel can provide a foreign exchange rate of about 7% lower than the exchange rate of Ghana and Venezuelan banks. Generally speaking, in countries with large US dollar supply, interest rate spreads are smaller. In addition, the best markets for P2P deposits are those with high inflation, high smartphone penetration, weak ownership rights, and unclear regulatory guidelines, as financial institutions do not have access to cryptocurrencies, which creates an environment for self-custody and the booming P2P.

The payment process for P2P deposits may be as follows:

- Users can select or automatically designate a counterparty or “agent” that already owns USDT, which is usually hosted by the P2P platform.

- Users send fiat currency to agents through local channels

- Agent acknowledges receipt and sends USDT to the user

From a market structure perspective, most deposits and withdrawals are commoditized and customer loyalty is low because they usually choose the cheapest option. To stay competitive, local channels may need to expand their reach, optimize for the most popular channels, and find the best local partners. In the long run, it may be seen that each country integrates into several funding channels, each with a comprehensive license to support all local payment methods and provide maximum liquidity. In the medium term, aggregators will be particularly useful as local providers are generally faster and cheaper, while combination options will often provide consumers with the best pricing and completion rates.

From a consumer’s perspective, the good news is that fees may tend to zero. Now that I have seen this on Coinbase, the instant transfer cost from USD to USDC is $0. In the long run, most stablecoin issuers may provide such services to large wallets and fintech companies, further reducing fees.

license

The license is a painful but necessary step to expand Cryptorails adoption. For a startup, there are two ways: partner with an already licensed entity or obtain a license independently. Working with licensed partners can allow startups to bypass the massive costs and long time it takes to get a license themselves, but since most of the revenue goes to licensed partners, profit margins can be reduced. Alternatively, startups can choose to invest upfront (possibly hundreds of thousands to millions of dollars) to obtain licenses independently. While the road usually takes months or even years (a project says it took them 2 years), it enables startups to deliver more comprehensive products directly to users.

While there are established strategies for obtaining licenses in many jurisdictions, achieving global licensing coverage is extremely challenging and even impossible, as each region has its own unique fund transfer regulations and you need more than 100 licenses to achieve global coverage. For example, in the United States alone, a project requires a currency transfer license (MTL) in each state, a BitLicense in New York, and a Money Services Business (MSB) registration for the Financial Crime Enforcement Network. Getting MTL in all states alone costs $500,000 to $2 million, and can take up to a year.

challenge

Payment methods are often difficult to adopt because they are a question of whether they have chickens or eggs. You either let consumers adopt a payment method widely and force merchants to accept it; or you let merchants use a specific payment method to force consumers to adopt it. For example, credit cards have been a niche market in Latin America before Uber became popular in 2012; everyone wanted a credit card because it allowed them to use Uber, which is safer than a taxi and (initially) cheaper. This makes other on-demand apps like Rappi popular because people now have smartphones and credit cards. This has formed a virtuous cycle, and more and more people want a credit card because there are more cool apps that require credit cards to pay.

This also applies to mainstream consumers' adoption of Cryptorails. There are no use cases where using stablecoins to pay is particularly favorable or completely necessary, although debit cards and remittance applications are closer. If the P2P app can unlock entirely new online behavior, it also has a chance—and micropayments and creator payments seem to be exciting candidates. This is generally the case in general consumer applications, and these applications will not be adopted without step-by-step improvements to the status quo.

There are still some problems with deposits and withdrawals:

- High failure rate: If you have tried using a credit card deposit, you will understand

- User Experience Friction: While early adopters can accept the pain of accessing assets through exchanges, early adopters may use them directly in specific applications. To support this, smooth in-app access is required, preferably via Apple Pay

- High Fees: Access is still very expensive – depending on the provider and region, the fees can still be as high as 5-10%

- Different quality: Reliability and compliance still vary too much, especially non-dollar currencies

One issue that has not been discussed in depth is privacy. While privacy is not a serious problem for individuals or companies at present, it becomes a problem once Cryptorails is adopted as the primary mechanism for business. When malicious actors begin monitoring individual, corporate and government payment activities through public keys, serious negative consequences will arise. One way to solve this problem in the short term is to "protect privacy through concealment", and start a new wallet every time you need to send or receive funds on the chain.

In addition, building banking relationships is often the most difficult part because it is another question of whether there is chicken or egg first. If a bank partner gets transaction volume and makes money, they will accept you, but you need the bank to get those transaction volumes first. In addition, only 4-6 small U.S. banks currently support crypto payment companies, and several of them have reached their limits in their internal compliance. Part of this is that today's crypto payments are still classified as "high-risk activities" similar to marijuana and online gambling.

The reason for this problem is that compliance is still inferior to traditional payment companies. This includes AML/KYC and travel rule compliance, OFAC screening, cybersecurity policies and consumer protection policies. What is even more challenging is to directly incorporate compliance into Cryptorails rather than relying on external solutions and companies.

Outlook

On the consumer side, it is currently in the stage where some groups are beginning to accept stablecoins, especially freelancers, contractors and remote workers. By connecting to the card network and providing consumers with US dollar exposure and daily consumption capacity, it is also getting closer to the demand for the US dollar in emerging economies. In other words, debit cards and embedded wallets have become the "bridges" that bring cryptocurrencies off-chain in the intuitive form of mainstream consumers. In business, it is in the infancy of mainstream adoption. Companies are using stablecoins at a large scale and will increase significantly over the next decade.

Based on this, here are 20 forecasts that may appear in the industry in 5 years:

- The amount paid through Cryptorails is between $200 and $500 billion each year, driven primarily by B2B payments.

- More than 30 new banks are launched on Cryptorails

- Dozens of crypto companies are acquired as fintech companies race to stay relevant

- Some crypto companies (probably stablecoin issuers) will acquire troubled fintech companies and banks that are struggling with high CAC and operating costs

- About 3 crypto networks (L1 and L2) appear and scale up, with architecture designed for payments. Such networks are spiritually similar to Ripple, but will have a reasonable technology stack, economic model and way to go public

- 80% of online merchants will accept cryptocurrencies as a means of payment, whether it is expanding their product range through existing PSPs or providing them with a better experience through crypto-native payment processors.

- The card network will expand to cover approximately 240 countries and regions (currently around 210), using stablecoins as a last-mile solution

- Most of the transaction volumes in more than 15 remittance channels around the world will be conducted through Cryptorails

- On-chain privacy will eventually be adopted, driven by businesses and countries (not consumers) using Cryptorails

- 10% of all foreign aid spending will be sent via Cryptorails

- The deposit and withdrawal market structure will be solidified, with 2-3 suppliers in each country receiving most of the transaction volume and partnerships

- The number of P2P liquidity providers will be as large as the number of food delivery workers. As transaction volume increases, agents will become economically sustainable and continue to be at least 5-10% cheaper than the foreign exchange rate quoted by banks.

- More than 10 million remote workers, freelancers and contractors will receive service compensation through Cryptorails (paid directly in stablecoins or local currency)

- 99% of AI agent commerce (including agent-to-agent, agent-to-people and person-to-agent) will be conducted on-chain via Cryptorails

- More than 25 well-known US cooperative banks will support companies running on Cryptorails

- Financial institutions will try to issue their own stablecoins to facilitate real-time global settlement

- Standalone "encrypted Venmo" apps are still not popular because user roles are still too niche, but large messaging platforms like Telegram will integrate Cryptorails and start using P2P payments and remittances

- Loan and credit companies will begin collecting and paying money through Cryptorails to improve their working capital as less funds are taken up during the transfer process

- Some non-USD stablecoins will begin to be tokenized on-chain forex market

- Due to government bureaucracy, CBDC is still in the experimental stage and has not yet reached commercial scale

in conclusion

As Patrick Collison suggests, Cryptorails are payment superconductors that form the basis of parallel financial systems that provide faster settlement times, lower fees, and the ability to operate seamlessly across borders. The idea took a decade to mature, but today sees hundreds of companies working to make it a reality. In the next decade, Cryptorails will be seen as the core of financial innovation and driving global economic growth.

Related reading: 20,000-word research report on crypto payment: From electronic cash, tokenized currency, to PayFi in the future