Bankless: How has Polymarket performed since the US election?

Reprinted from jinse

04/29/2025·14DAuthor: David C, Bankless; Translated by: Wuzhu, Golden Finance

The 2024 U.S. election season sparked a real craze in the forecast market, and Polymarket jumped to the undisputed center of gambling. Bloomberg integrates Polymarket on its terminals. It has been reported that the Trump campaign is actively monitoring Polymarket’s odds in real time. Throughout the year, there are approximately US$3.7 billion in election contract transactions in the entire market.

This success triggered a gold rush, with entrepreneurs and developers launching their own predictive market clones in hopes of getting a share of the pie. However, despite the tide of new entrants, none of them can make substantial breakthroughs in front of mainstream platforms.

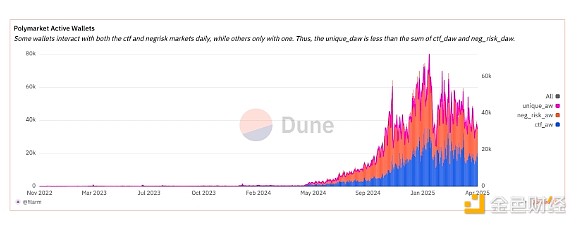

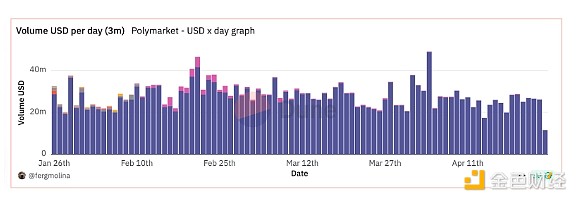

Of the total predicted market lock-in value (TVL) currently tracked by DefiLlama DefiLlama, Polymarket still ranks as of about 85% of the share. However, its total lock-in value (TVL) has fallen back from the peak of the election cycle. At that time, the number of daily active wallets reached 500,000, and the daily transaction volume exceeded 500,000, and the daily transaction volume reached 350 million US dollars on November 6 alone. Faced with such amazing data, many observers have questioned whether Polymarket can maintain this momentum after the vote count is over.

Now six months after the election, Polymarket’s trajectory has broken doubts and demonstrated resilience to lay the foundation for the next stage of development.

How has Polymarket performed since the election?

2025 is approaching, and the clouds of Augur's prediction market platform are shrouding Polymarket. For those with poor memory, Augur had once been in a glorious position during the 2020 election, but suffered a catastrophic collapse after the vote count. With the massive withdrawal of users, Augur's total value plummeted 20 times as ETH calculated - from 19,000 ETH to 700 ETH. Worse, due to legal disputes and design flaws, market resolutions have been dragged down, frustrating a few remaining users and watching the platform exit.

But Polymarket has never encountered such a problem.

Instead of watching the user base evaporate, Polymarket achieved a more impressive achievement: a real transformation. Users initially attracted by Trump and Harris’ predictions have smoothly turned to Fed rate decisions, geopolitical conflicts, token price trends, and - perhaps most importantly - the sports betting market.

It is particularly noteworthy that the number of daily wallets that have never participated in related markets in the United States has increased dramatically. These users now account for about a quarter of all Polymarket’s activity—a significant and healthy shift in user structure has helped the platform maintain surprising stability with natural decline in election- focused bettors.

Other interesting data are as follows:

-

The cumulative number of users is roughly the same as when the election activities heated up in mid-to-late October last year.

-

The number of monthly active traders as of April 1 was the same as last November.

Trading volumes have also shown a similar situation, with daily trading volumes remaining between $20 million and $30 million in the past three months. Although it has declined since its highs, it is still roughly the same as last September.

How accurate is Polymarket’s prediction?

In addition to retaining user base after the election, analysis by data scientist Alex McCullough shows that Polymarket has recently gained a lot of attention for its prediction accuracy.

McCullough claims Polymarket has a high accuracy rate of up to 94% , which excludes bets that are almost certain (more than 90%) or extremely unlikely (more than 10%), as the results of these bets are basically clear but have not been officially announced. His research results (all recorded here) include:

-

Market overestimate the probability of events: The platform sometimes overestimates the probability of events, which may be caused by group bias, insufficient liquidity or speculative risk appetite, which has raised questions about its reliability.

-

Sports betting is the most accurate: the sports market is the fastest growing sector on the platform. With balanced betting, clear standards and nearly US$4.5 billion in trading volume, it has become Polymarket's most stable forecast. This may distort the platform's overall predictive power for other markets.

-

Long-term forecasts seem more accurate than they actually are: Long-term markets usually contain some results with a clear answer of "no" over time. In an interview with Polymarket, McCullough gave an example, such as “Will Gavin Newsom become president in 2024?”, a market that lasted for months but eventually became increasingly clear that this would not happen. These extremes make the overall accuracy of Polymarket look better than it actually is, as these almost certain results are counted on the platform's predicted records.

Overall, Polymarket’s ongoing activity shows that it is not a flash in the pan, but its reliability as a predictor deserves caution optimism, awaiting further scrutiny.

Are these insights actionable?

While we may need more analysis to really prove the accuracy of Polymarket, McCullough’s analysis reveals some interesting and actionable trends in these market operations that anyone can use to improve their betting strategies. Here are some key points from his research that I hope to inspire active users of Polymarket:

-

Most markets end with a "no". About three-quarters of the questions will answer “No”. Keep this in mind when looking for opportunities for “no” stocks that may be undervalued.

-

Bet on the best price for "no". When the price of "yes" is between $0.20 and $0.50, history shows that the real chance is lower. Buy "No" stocks at this time to get the most profit. This advantage will narrow down, but it will still exist until around $0.80.

-

The price close to the edge is reasonable. If the "yes" price is below $0.10 or above $0.95, it is close to the correct price. Once the fee is paid, any gains are small.

-

Time can give you an advantage.

-

More than four hours before the market closes: “Yes” is usually overvalued → Buy “No”.

-

Last four hours: Prices tighten and tend to be accurate → Buy now only if you are optimistic about the direction of "yes".

-

If you hold "No", consider selling before the last hour - the price may rebound at the last minute.

-

Data for the sports market may vary.

-

Day before the game: The accuracy rate is about 66%. This is a good time to buy "No".

-

After the game started: the accuracy rate increased, reaching about 94% in two hours.

-

Prices usually fluctuate every 30 minutes (30, 60, 90, 120 minutes), which means these times may be a good time to adjust or place bets.

-

Traders like to bet "yes". Traders like to bet on what is coming, follow the hype, and the market may be lighter. Careful placement of limit orders can help you avoid overpaying fees.

chaincatcher

chaincatcher

panewslab

panewslab