Arthur Hayes: How Trump’s New Deal and Countries’ Responses Affect Cryptocurrency

Reprinted from jinse

12/18/2024·6MOriginal title: [Trump Truth](https://cryptohayes.medium.com/trump-truth- fdcbd31f2e26)

Author: Arthur Hayes, founder of BitMEX; Compiler: 0xjs@金财经

Four steps: that is, the distance between the position where the vertical board is fixed on the movable bracket and the wall. My yoga teacher taught me to place the heels of my hands where the board and support meet. I curled up like a cat, making sure the back of my head was level with the board. If the distance is right, I can move my feet up the wall behind me, turning my body into an L shape with the back of my skull, back, and sacrum touching the board. I have to fight the tendency of my ribs to flare out by engaging my abdominal muscles and tightening my tailbone. Phew - I'm already sweating just from keeping my body in the right position. But the real work hasn't begun yet. The challenge is to lift one leg to a fully vertical position while maintaining alignment.

The stick is like an antidote to bad posture. If your posture is incorrect, you'll notice right away that you can feel parts of your back and butt lifting away from the stick. All my musculoskeletal issues were exposed as I lifted my left foot, with my right foot still against the wall. My left lat is everted and my left shoulder is everted, looking like an asymmetrical curling iron. But I already knew this because both my athletic trainer and chiropractor discovered that the muscles in my left back were weaker than those in my right, which caused my left shoulder to sit higher and roll forward. Doing handstands on sticks only made my imbalances more obvious. There were no quick fixes to my problems, just a long road and sometimes painful exercises to slowly correct my imbalance.

If the vertical plank is my body-aligned truth potion, US President-elect Donald Trump has served a similar purpose on various geopolitical and economic issues facing the world today. The reason the global elite hates Trump is because he tells the truth. The Trump truth I’m referring to is limited to a narrow range of topics. I’m not talking about whether Trump will tell you the truth about the size of his dick, his net worth, or his golf handicap. Instead, Trump Truth is about the actual relationship between different nation-states and the opinions of ordinary American voters away from the safe space of political correctness Nazis.

As a macroeconomic forecaster, I try to make predictions based on public data and current events to guide the asset mix of my portfolio. I love The Truth About Trump because it serves as a catalyst, forcing other heads of state to acknowledge the problems facing their countries and take action. It is these actions that ultimately bring about the future state of the world that Maelstrom hopes to profit from. Even before Trump returned to power, countries were behaving in the ways I predicted, further reinforcing my confidence in how to print money and implement financial repression methods. This end-of- year article aims to provide a step-by-step overview of the major changes taking place within and between the four major economic blocs and nation- states: the United States, the European Union (EU), China, and Japan. For my near-term stance, it will be important to note whether I believe money printing will continue and accelerate after Trump's coronation on January 20, 2025. This is because I think there is a gap between crypto investors having high expectations for how quickly Trump can change the status quo, but Trump not having a politically acceptable solution to quickly effectuate that change. Big gap. Markets will immediately realize that Trump has at best a year around January 20 to implement any policy changes. This realization will lead to a massive sell-off in cryptocurrencies and other Trump 2.0 stock trades.

Trump has a year to act, as most elected U.S. lawmakers will begin campaigning for the November 2026 U.S. midterm elections in late 2025. The entire House of Representatives and a large number of senators must run for re-election. The Republicans' majorities in the House and Senate are so weak that they are likely to lose power after November 2026. The American people are rightly outraged. Yet it will take even the savviest and most powerful politicians more than a decade, not just a year, to resolve the underlying domestic and international problems that negatively affect them. As a result, investors are bracing for severe buyer's remorse. But can a wall of money printing and a slew of new regulations aimed at discouraging savers overcome the “buy the rumor, sell the fact” phenomenon and keep the crypto bull market alive in 2025 and beyond? I believe it can, but this post is my venting attempt to convince myself of the possibility.

currency stage changes

I will quote Russell Napier in my very simple timeline of post-WWII monetary structures.

1944–1971 Bretton Woods System

Countries peg their currency exchange rates to the U.S. dollar, which trades at $35 per ounce of gold.

1971–1994 Petrodollar

US President Richard Nixon abandoned the gold standard, allowing the dollar to float against all currencies because the country could not maintain a peg to gold while funding a larger welfare state and the Vietnam War. He struck a deal with the oil-exporting Persian Gulf states (particularly Saudi Arabia) that they would price oil in dollars, extract as much oil as required, and recirculate their trade surpluses into U.S. financial assets. If you believe some reports, the United States manipulated certain Gulf countries to increase the price of oil in order to use it as support for this new monetary structure.

1994–2024 Petroyaun

China has sharply devalued its yuan against the dollar in a bid to combat inflation, a collapse of its banking system and revive its export industry. China and other Asian Tigers (such as Taiwan, South Korea, Malaysia, etc.) pursue mercantilist policies and provide cheap exports to the United States, resulting in the accumulation of U.S. dollars overseas as foreign exchange reserves, thereby being able to afford U.S. dollar-denominated energy and high-quality manufactured goods and ultimately introduced more than a billion low-wage workers into the global economy, thus suppressing inflation in developed Western countries and allowing central bankers in these countries to keep interest rates at rock-bottom levels because they mistakenly believed that endogenous Inflation has been declining for a long time.

White is USD/RMB, yellow is China's GDP in constant US dollars.

White is USD/RMB, yellow is China's GDP in constant US dollars.

2024 — now?

I don't know the name of the system currently under development. However, Trump’s election was the catalyst that changed the global monetary system. To be clear, Trump is not the cause of the realignment; rather, he has been outspoken about the imbalances he believes must change and is willing to enact highly destructive policies to quickly achieve what he believes will be the first U.S. Changes that benefit people. These changes will end the petro-yuan. Ultimately, as I argue in this article, these changes will increase the supply of global fiat currencies and financial disincentives. Both of these things must happen because no leader in the US, EU, China or Japan wants to de- leverage their system into a new sustainable equilibrium. Instead, they will print money and destroy the real purchasing power of long-term government bonds and bank savings deposits so that the elite will continue to run the new system.

I will begin by outlining Trump’s goals and then assess how individual groups or countries respond.

Trump truth

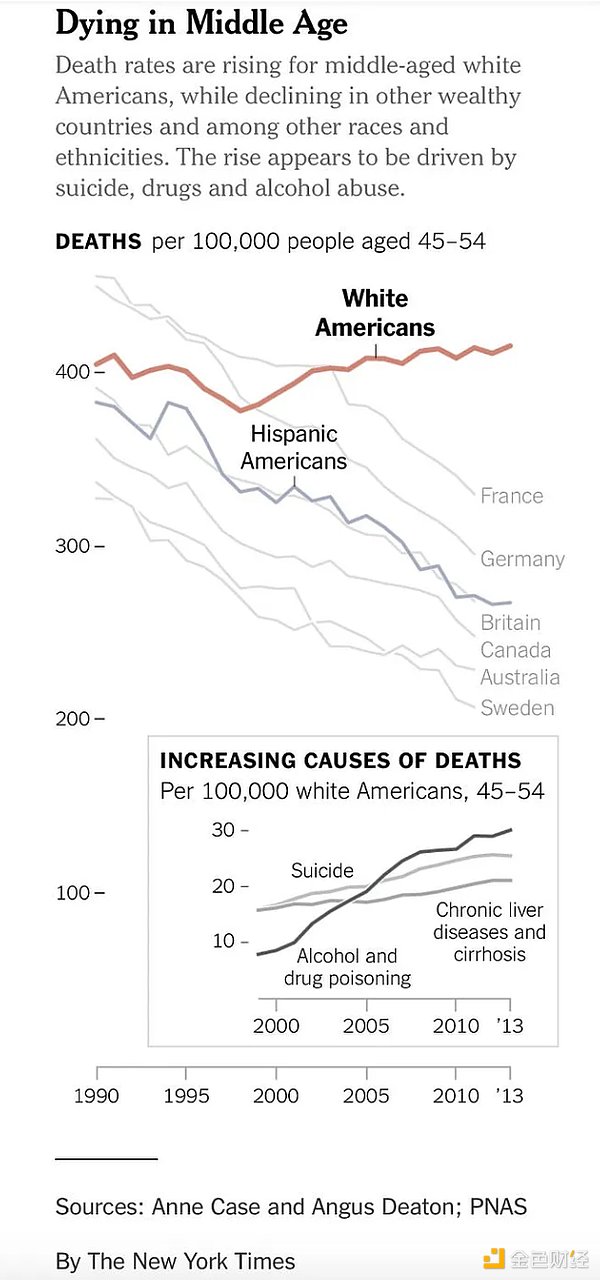

To function properly, the United States must maintain current and trade account surpluses in the petro-yuan system. The result was the deindustrialization and financialization of the American economy. If you want to understand how this works, I recommend reading all of Michael Pettis's works. I don't think this is why the world should change its economic system, but since the 1970s, white American men (whom American governance is supposed to serve) have lost their place. The key word here is "Average"; I'm not talking about high-flying people like Jamie Dimon and David Solomon, the CEOs of JPMorgan Chase and Goldman Sachs, or the wage cheats who toil for them. I'm talking about the brother who once worked for Bethlehem Steel, had a house and a spouse, and now the only women he sees are nurses at the methadone clinic. This is obvious because this group of people in the United States are slowly killing themselves with alcohol and prescription drugs. Everything is relative, relative to the higher standard of living and job satisfaction they enjoyed after WWII, relative to the rest of the US/world things are not that good right now. We all know this is Trump's base, and he talks to them in a way that no other politician dares to do. Trump promised to bring industry back to America to give meaning to their miserable lives.

For bloodthirsty Americans who are keen on playing war video games, they are a

very powerful political group, and the current situation of the US military is

embarrassing. The myth of U.S. military supremacy vis-à-vis near-neighbors or

peer adversaries (only Russia and China currently meet this criterion) begins

with the idea that American troops liberated the world from Hitler’s

onslaught. This is not true; the Soviets sacrificed tens of millions to defeat

the Germans. The Americans were just a suppression force. Stalin was

distraught that it had taken the United States so long to launch a major

offensive against Hitler on the Western European front. U.S. President

Franklin Delano Roosevelt bled the Soviets in order to reduce the deaths of

American soldiers. In the Pacific Theater, although the United States defeated

Japan, they never faced a full-scale Japanese onslaught because Japan devoted

most of its combat power to mainland China. Instead of promoting D-Day in

movies, Hollywood should show the Battle of Stalingrad, the heroic deeds of

General Zhukov and the millions of Russian soldiers who died.

For bloodthirsty Americans who are keen on playing war video games, they are a

very powerful political group, and the current situation of the US military is

embarrassing. The myth of U.S. military supremacy vis-à-vis near-neighbors or

peer adversaries (only Russia and China currently meet this criterion) begins

with the idea that American troops liberated the world from Hitler’s

onslaught. This is not true; the Soviets sacrificed tens of millions to defeat

the Germans. The Americans were just a suppression force. Stalin was

distraught that it had taken the United States so long to launch a major

offensive against Hitler on the Western European front. U.S. President

Franklin Delano Roosevelt bled the Soviets in order to reduce the deaths of

American soldiers. In the Pacific Theater, although the United States defeated

Japan, they never faced a full-scale Japanese onslaught because Japan devoted

most of its combat power to mainland China. Instead of promoting D-Day in

movies, Hollywood should show the Battle of Stalingrad, the heroic deeds of

General Zhukov and the millions of Russian soldiers who died.

After World War II, the US military drew a draw with North Korea in the Korean War, lost to North Vietnam in the Vietnam War, retreated hastily in Afghanistan after ten years in 2021, and now lost to Russia in Ukraine. The only decent record of the US military was the use of extremely advanced and extremely expensive weapons against third world countries such as Iraq in the two Gulf Wars.

The key point is that victory in the war is a reflection of the soundness of the industrial economy. If you care about the war, the American economy is in shambles. Yes, Americans can do LBOs just like other countries. However, their weapons systems are a mixture of Chinese imports sold at inflated prices to captive customers such as Saudi Arabia, who are required to purchase the systems under geopolitical agreements. Russia's economy is less than one-tenth the size of the United States' on paper, but it produces unstoppable hypersonic missiles at a fraction of the cost of conventional U.S.-made missiles.

Trump is no peace-loving hippie; he fully believes in American military supremacy and exceptionalism, and is happy to use that military power to slaughter human beings. Remember, during his first term, he assassinated Iranian General Qasem Soleimani on Iraqi soil, to the delight of large swaths of the American public. Trump paid no heed to violating Iraqi airspace and unilaterally deciding to murder a general of another country with which the United States is not officially at war. Therefore, he wants to properly rearm the Empire so that its capabilities live up to the hype.

Trump advocates reindustrializing America to help those who want good manufacturing jobs and those who want a strong military. To do this, the imbalances created under the petro-yuan system need to be reversed. This would be accomplished by devaluing the dollar, providing tax benefits and subsidies to produce domestically, and deregulation. All these factors combined will make it an economically sensible choice for companies to move production domestically, as China is currently the best place to produce their products due to the pro-growth policies enacted over the past three decades.

In my article “ Black or White? ”, I talked about quantitative easing (QE) for the poor and how it would fund the reindustrialization of the United States. I believe that the incoming US Treasury Secretary Bessent will pursue such an industrial policy. However, this will take time, and Trump will need to deliver immediate results in his first year in office that he can sell to voters as progress. Therefore, I think Trump and Bessant must devalue the dollar immediately. I want to discuss how this is achieved and why it must be achieved in the first half of 2025.

Strategic Bitcoin Reserve

“Gold is money, everything else is credit.” – JP Morgan

Trump and Bessant have repeatedly discussed the need to weaken the dollar to achieve U.S. economic goals. The question is, against what currency should the dollar depreciate, and when?

Apart from the United States, the countries with the largest exports in the world are China (currency: RMB), the European Union (currency: Euro), the United Kingdom (currency: British Pound) and Japan (currency: Japanese Yen). The dollar must weaken against all of these currencies to encourage lucrative companies to move production within the United States. Companies do not necessarily need to be registered in the United States; Trump has allowed Chinese manufacturers to set up factories in the United States and sell their products locally. But Americans must buy products made in American factories.

Coordination of monetary agreements dates back to the 1980s. Currently, relative to other countries in the world, the U.S.'s economic and military strength is not as strong as it was then. Therefore, Bessant does not have the ability to unilaterally dictate the exchange rates of other countries. Of course, Bessant could use carrots and sticks to coax each country into agreeing to devalue its currency against the dollar. This can be accomplished through the use of tariffs or the threat of tariffs. However, this will take time and a lot of diplomacy. There is an easier way.

The United States holds 8,133.46 tons of gold, the most of any sovereign nation, at least on paper. As we all know, gold is the true currency of global trade. The United States had only been off the gold standard for 50 years. The gold standard has been the rule throughout history, while the current fiat currency system is the exception. The path of least resistance to achieving Bessant's goal is to depreciate the dollar relative to gold.

Currently, the value of gold on the U.S. balance sheet is $42.22 per ounce. Technically, the Treasury Department issues gold certificates to the U.S. Federal Reserve (Fed), which the Treasury Department values at $42.22 per ounce. Suppose Bessant could convince the U.S. Congress to change the legal price of gold, thereby devaluing the dollar against gold. In this case, the Treasury's general account (TGA) at the Federal Reserve would receive dollar credits that could be used in the economy. The greater the depreciation, the higher the TGA balance will immediately increase. This makes sense because, essentially, the dollar is created out of thin air by valuing gold at a specific price. For every $3,824/ounce increase in the legal price of gold, the TGA will increase by $1 trillion. For example, adjusting carrying costs to the current spot price of gold would generate $695 billion in TGA credits.

Under government fiat, dollars can be created by changing the holding cost of gold, which can then be used to purchase goods and services. This is the definition of fiat currency devaluation. Since all other fiat currencies also have an implicit gold value based on the amount of gold held by their respective governments, these currencies will automatically appreciate relative to the US dollar. Overnight, without consulting any other country's treasury, the United States could achieve a significant devaluation of the dollar for all of its major trading partners.

The most important question is, couldn't the largest exporting country recover from the weakness of its currency by depreciating more than the dollar against gold? Sure, they could try, but none of these currencies are global reserve currencies and don't have the inherent demand that comes with trade and financial flows. Therefore, they cannot match the depreciation of gold in the United States, which will quickly lead to hyperinflation in their economy. Hyperinflation is inevitable because none of these countries/groups are as self-sufficient in energy or food as the United States is. This is politically unacceptable because the social unrest caused by inflation will force the ruling elite out of office.

Tell me how much dollar weakness it will take to re-industrialize the U.S. economy and I'll tell you the new gold price. If I were Bessant, I would invest heavily. A big investment would mean a revaluation of $10,000 to $20,000 per ounce. Luke Gromen estimates that a return to the ratio of gold to the Fed's dollar liabilities back to the 1980s would result in gold prices rising 14x from current levels, to a depreciated price close to $40,000 an ounce. This was not what I expected, but illustrates how overvalued the USD is relative to gold's current spot price of around $2,700/oz.

As many of you know, I'm a little gold bug. I own physical gold bars and junior gold mining exchange-traded funds (ETFs) in vaults because the easiest way for the dollar to lose value is against gold. Politicians always push the easy button first. But this is Cryptocurrency Trader’s Digest, so how does a $20,000/oz gold price drive up the price of Bitcoin and cryptocurrencies?

Many cryptocurrency hopefuls focus first on discussions of the Bitcoin Strategic Reserve (BSR). U.S. Senator Lummis has introduced legislation that would require the Treasury Department to purchase 200,000 BTC annually over five years. Interestingly, if you read the bill, she proposes to fund the purchases by raising the price of gold held on the government's balance sheet, as I stated above.

The case for the BSR is similar to the case for the United States to store more gold than any other nation-state; it enables the United States to assert financial hegemony over all other countries in both the digital and physical realms. If Bitcoin is the hardest currency ever, then the strongest government fiat currency is the one whose central bank owns the most Bitcoin. Additionally, a government whose finances rise and fall with the price of Bitcoin will enact policies conducive to expanding the Bitcoin and cryptocurrency ecosystem within its borders. This is similar to how governments encourage domestic gold mining and create robust gold trading markets. Looking at how China is encouraging domestic gold ownership through the Shanghai Gold Futures Exchange is an example of a national gold-friendly policy aimed at increasing the financial strength of the country and its citizens in real currency terms.

If the U.S. government creates more dollars through the devaluation of gold and uses some of those dollars to buy Bitcoin, its fiat price will rise. This in turn would spur competing sovereign purchases by other countries, which must catch up to the United States. Then the price of Bitcoin will gradually increase because no one will sell Bitcoin and get fiat currency that the government is actively devaluing. Of course, long-term holders will sell their Bitcoins at a fiat price, but that price won't be $100,000. The argument is logical, but I still don't believe BSR will happen. I think politicians would rather spend their newly created dollars on the welfare of the people to ensure they win the next upcoming election. However, it does not matter whether BSR occurs in the United States, as the mere threat of it creates buying pressure.

While I don’t believe the U.S. government will buy Bitcoin, that doesn’t affect my optimism about Bitcoin’s price. Ultimately, gold's depreciation creates dollars, which must find a home in real goods/services and financial assets. We know from experience that because Bitcoin has a limited supply and a shrinking supply in circulation, its price rises faster than the global supply of U.S. dollars.

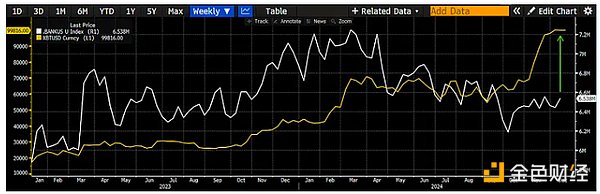

The Fed’s balance sheet is in white and Bitcoin is in yellow. Both indices were 100 on January 1, 2011. The Fed’s balance sheet increased by 2.83 times, while Bitcoin increased by 317,500 times.

All in all, a rapid and sharp devaluation of the dollar is the first step for Trump and Bessent to achieve their economic goals. It's also something they can do overnight, without consulting domestic lawmakers or foreign finance ministers. Given that Trump has a year to show progress on some of his goals to help Republicans maintain control of the House and Senate, my base case is for the dollar to depreciate against gold in the first half of 2025.

Next, let’s take a slow look at China and speculate on how they might respond to the “Trump truth.”

Choyna

China is facing two major problems recently. There is a need to create employment opportunities for the over 20% of unemployed educated youth and to arrest the fall in real estate prices. Trump’s truth creates problems because the United States also needs to provide better-paying jobs for civilians and greater financial investment in productive capacity. I discussed in the previous section that the big sticks Trump and his deputies will wield are a weak dollar and tariffs. What are the weapons in China’s hands?

I think China has made it clear that ideologically it must implement quantitative easing and allow the yuan to float freely. So far, China has implemented little fiscal stimulus paid for with currency printed by the central bank. I think it's because they don't want to exacerbate domestic economic imbalances. Furthermore, they are on the sidelines until a new American emperor is elected. But over the past few weeks, it has become clear that China will unleash massive stimulus through the proven financial channel of quantitative easing, allowing the yuan to float freely.

For those who don’t understand why QE causes the yuan to depreciate, remember that QE expands the supply of yuan. If the supply of RMB grows faster than another fiat currency, then mathematically the RMB depreciates relative to that currency. In addition, RMB holders may rush ahead of the central bank and sell RMB today in exchange for a fixed supply of financial assets such as Bitcoin, gold, and U.S. stocks to protect their future purchasing power. This can also lead to currency devaluation.

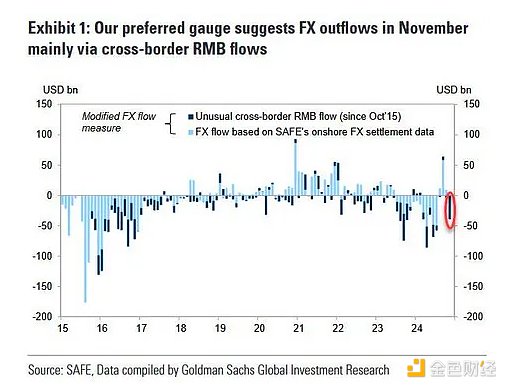

Comrades have already begun to withdraw money from China.

Comrades have already begun to withdraw money from China.

As I explained before, because of China's food and energy shortages, they cannot afford to go tit-for-tat with the United States and devalue the yuan against gold. This will lead to hyperinflation. But that doesn't mean China can't significantly increase its supply of yuan to support real estate, whose slump has led to deflation. Recent headlines are that the People's Bank of China (PBOC) is willing to let the yuan depreciate in response to Trump's tariff threats, signaling that China is ready to go full-scale quantitative easing.

With Donald Trump back in the White House, top Chinese leaders and policymakers are considering allowing the yuan to depreciate in 2025 in response to rising U.S. trade tariffs. – Reuters, December 11, 2024

I think the reason the People's Bank of China is being vague about why it has to allow the yuan to float freely and ultimately depreciate against the dollar in the short term is because they don't want to exacerbate the rate of capital flight. Telling your wealthy comrades directly that the People's Bank of China's policy is now explicitly focused on printing yuan and buying government bonds will only set off alarm bells in the minds of the investing public and cause capital to rush across the border, first into Hong Kong and then out to the world. other areas. The People's Bank of China hopes investors will take the hint and buy domestic stocks and real estate instead.

Eventually, as I predicted in my article “ Go Bitcoin, Let’s Go Bitcoin ,” the People’s Bank of China will do enough quantitative easing and monetary stimulus to stop deflation. If Chinese government bond (CGB) yields start to rise, we will know whether these policies are working. Currently, CGB yields are at historically low levels as investors would rather buy RMB principal-protected investment instruments (government bonds) than risk losing money in the stock and real estate markets. This suggests pessimism about the medium-term strength of the Chinese economy. Turning pessimism into optimism is easy, just print a lot of yuan and remove CGB from investors' portfolios through central bank open market operations. This is the definition of quantitative easing. See the T-chart in my " [Black and White?](https://cryptohayes.substack.com/p/black- or-white) " article to see how this process works.

The problem with money printing at the macro level has always been the external value of the renminbi. A strong yuan has some positive external effects. It helps Chinese consumers buy imported goods at cheaper prices. It increases the likelihood that China's trading partners will denominated goods traded with China in renminbi, because they can instead use the renminbi to purchase goods made in China and trust that the real value of the renminbi will remain stable over the long term. It also helps Chinese companies borrow yuan at affordable rates. However, all of these positives mean nothing in the face of Trump’s truth. Let me be clear: The United States can print more money than China without hyperinflation. Trump and Bessant have made clear that's what they intend to do. Therefore, China will allow the RMB exchange rate to float against the US dollar, which means that the RMB will depreciate in the short term.

A weaker yuan will allow Chinese manufacturers to export more products before Besant sharply depreciates the dollar against gold. In the short term, that would bring production forward and help position it in a stronger negotiating position with Trump, when China must agree to certain demands from the Trump team in exchange for better access to U.S. consumer markets for Chinese producers. .

The question crypto investors should be thinking about is how wealthy Chinese investors will react to a signal from the People’s Bank of China that it will increase the supply of yuan. Will capital flight through the various legal channels in Macau (casinos) and Hong Kong (companies registered in Hong Kong by Chinese owners) be allowed to operate normally, or will these channels be closed to sequester capital onshore? Given the U.S. path of limiting the ability of certain pools of capital, such as [Texas public university endowments](https://www.newsbreak.com/news/3703595295766-two-sigma-hillhouse- texas-cash-at-risk-on-new-china-curbs) , to invest in Chinese assets, why would newly minted yuan be allowed to flow into the U.S. via Hong Kong to help fund Trump’s economic goals? Printed yuan must be used to buy Chinese stocks and Chinese real estate. So while the door is open, I expect capital flight from RMB against the US dollar to intensify as sooner or later this opportunity will disappear.

For cryptocurrencies, at least in the short term, Chinese capital will flow out of Hong Kong and be converted into dollars to buy Bitcoin and other junk coins. In the medium term, once China responds by banning the flight of Chinese capital through liquid and obvious channels, the question will be whether Hong Kong cryptocurrency ETFs will be allowed to accept southbound capital flows from mainland Chinese investors. If China believes that de facto control of cryptocurrency ownership through Hong Kong’s state-owned asset management company will strengthen China, or at least make China as competitive as the United States in cryptocurrency, then Hong Kong ETFs will quickly gather assets. This will add another pillar to the cryptocurrency bull market, as these ETF managers will have to purchase spot cryptocurrencies on the global open market.

On the other side of the Sea of Japan, the elites who run Japanese electronics companies, China’s export rivals, are pondering how to respond to the Trump truth.

Japan, the land of sunset

Even though Japan’s elite politicians are proud of their culture and history, they are still America’s “towel bitches.” Japan moved on after the nuclear attack, rebuilding itself into the world's second-largest economy by the early 1990s, aided by dollar loans and tariff-free access to American consumers. Most importantly for my lifestyle, Japan has built the most ski resorts in the world. Just like today, the trade and financial imbalances of the 1980s caused an uproar within elite American political and financial circles, forcing a rebalancing. Some argue that the currency accords of the 1980s weakened the dollar and strengthened the yen, ultimately popping the bubbles in Japan's stock and real estate markets in 1989. The logic is that in order to strengthen the yen, the Bank of Japan (BOJ) has to tighten monetary policy, causing the bubble to burst. As always, real estate and stock bubbles are blown by money printing and burst when easy monetary policy slows or stops. The problem is that Japanese politicians will engage in financial hara-kiri to please American daimyo.

Today, as in the 1980s, there is a huge financial imbalance between Japan and the United States. Japan is the largest holder of U.S. Treasury bonds of any country. Japan also implemented an aggressive quantitative easing policy that evolved into yield curve control (YCC), resulting in extreme weakness in the USD/JPY exchange rate. I talked about the importance of the USD/JPY exchange rate in these two articles: " I Don't Care " and " Spirited Away ."

Trump’s truth is that the dollar should appreciate against the yen. Trump and Bessant both know this has to happen. Unlike China, where there will be a confrontational currency adjustment, in Japan Bessent will dictate the direction of USD/JPY and the Japanese will follow.

The problem with a rising yen is that it means the Bank of Japan has to raise interest rates. In the absence of government intervention, the following will occur:

1. As interest rates rise and Japanese government bonds (JGB) become more attractive, Japanese companies, households, and pension funds will sell foreign stocks and bonds (mainly U.S. Treasury bonds and U.S. stocks) and convert the foreign exchange proceeds into Japanese yen. , and buy Japanese government bonds.

2. A rise in Japanese government bond yields means a fall in prices, which will have a significant negative impact on the Bank of Japan's balance sheet. In addition, the Bank of Japan holds large amounts of U.S. Treasuries and U.S. stocks, and as Japanese investors sell these bonds to repatriate capital, the prices of these bonds will also fall. Additionally, the Bank of Japan must pay higher interest on yen bank reserves. Ultimately, as this process unfolds, this is bad news for the Bank of Japan's solvency.

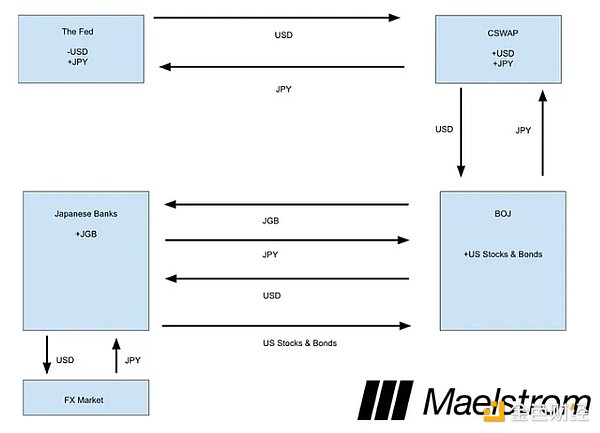

Trump hopes Japan's financial system can avoid collapse. A U.S. naval base in Japan could deter China’s maritime power, while Japanese-produced semiconductors help ensure that the U.S. has friendly supplies of critical components. Therefore, Trump will instruct Bessent to take necessary measures to ensure that Japan survives economically despite the appreciation of the yen. There are multiple ways to do this; one would be for Bessent to use the powers of the U.S. Treasury to offer a USD-JPY central bank currency swap to the Bank of Japan, so that any selloffs in U.S. Treasuries and U.S. equities would be absorbed on the sidelines . Below is a description of the process from my article [Spirited Away](https://cryptohayes.substack.com/p/spirited- away) .

The Fed - they increase the supply of dollars, or in other words, in return they receive the yen that was previously created by the increase in carry trades.

CSWAP — The Bank of Japan owes the Federal Reserve dollars, and the Fed owes the Bank of Japan yen.

Bank of Japan - They now hold more U.S. stocks and bonds, and their prices will rise due to an increase in the amount of dollars due to growing CSWAP balances.

Bank of Japan - they now hold additional Japanese government bonds.

This is important for cryptocurrencies as the amount of dollars will increase to fund the unwinding of massive USD/JPY carry trades. The unwinding will be slow, but trillions of dollars will be printed to keep Japan's financial system solvent.

Correcting the Japan-U.S. trade and financial imbalances is fairly easy because Japan ultimately has no say and is currently so politically weak that it cannot raise any real objections. The ruling Liberal Democratic Party (LDP) has lost its parliamentary majority, throwing Japan's governance into turmoil. Elites are as incapable of political opposition to the Trump truth as they are secretly disgusted by uncivilized Americans.

EU, the last and the last

While many Europeans (at least those not named Muhammad) are somewhat Christian in their leanings, the biblical statement "the last will be first" definitely does not apply to the EU economically. The last will be the last. Whatever the reason, Europe's elite politicians continue to hold this position and accept Uncle Sam's relentless blows. Europe should do everything it can to integrate with Russia and China. Russia provides the cheapest energy through pipelines and provides food to feed its people. China offers cheap, high- quality manufactured goods and is willing to buy European luxury goods in quantities that would make Marie Antoinette blush. Instead of trying to integrate into the huge and unstoppable Eurasian common prosperity circle, the European continent has long been confused by the two island countries of Britain and the United States.

The German and French economies are in trouble because of Europe's unwillingness to buy cheap Russian gas, abandon its green energy transition scam, or enter into mutually beneficial trade with China. Germany and France are the economic engines of Europe - the rest of the continent is probably just a resort for Arabs, Russians (well, maybe not anymore) and Americans. It's ironic considering how much European elites hate people in these areas, but those with money have the final say and those without money stand aside.

This year, Super Mario Draghi ( [The Future of European Competitiveness, September 2024](https://commission.europa.eu/document/download/ec1409c1-d4b4-4882-8bdd-3519f86bbb92_en?filename=The+future+of+European+competitiveness_+In- depth+analysis+and+recommendations_0.pdf) ) and Emmanuel Macron ( [European Speech, April 2024](https://www.elysee.fr/en/emmanuel- macron/2024/04/24/europe-speech) ) delivered two extraordinary Important speech. What’s frustrating about these speeches, if you’re European, is that both politicians correctly identify the problems facing Europe – namely expensive energy and a lack of domestic investment – but offer solutions that ultimately amount to “we need Print more money to fund the green energy transition and engage in more financial repression.” The right solution is to abandon staunch support for American elite risk-taking, achieve détente with Russia to access cheap gas, embrace nuclear energy, trade more with China, and radically deregulate financial markets. Another frustrating fact is that many European voters who think that the current policy portfolio does not meet their best interests participated in the voting and chose a political party who wanted to achieve these changes. But the elites of power are using their best to weaken the will of most people. As France and Germany have no ruling government, political turmoil is still continuing.

The truth of Trump is that the United States still requires Europe to avoid Russia, restrict trade with China, and purchase weapons made in the United States to resist Russia and China attacks and prevent strong integration of Eurasia. Due to the negative impact of these policies on the economy, the EU must resort to financial suppression and printing money to maintain the balance of income and expenditure. I will explain the future of European financial policies through Macron's words, and explain why you should be scared if you hold capital in Europe. You should worry that your ability to escape from European capital basement will be closed. The only thing you can buy in retirement accounts or bank deposits is a bad long -term EU government bond.

Before I quoted Macron's words, I would like to quote a paragraph of former Italian Prime Minister and the current director of the Institute of Think Tank Jacques Delol, Ericko Laita:

The EU has a private savings of up to 33 trillion euros, mainly holding (34.1%) in the form of frequent accounts. However, these wealth did not make full use to meet the strategic needs of the European Union; a worrying trend is that European resources are switched to the US economy and US asset management companies every year. This phenomenon highlights the serious low efficiency of the EU savings utilization. If these savings are effectively used in its own economy, it will greatly help achieve its strategic goals. ——Much [More than a Market](https://www.consilium.europa.eu/media/ny3j24sm/much-more-than-a- market-report-by-enrico-letta.pdf)

Leita did not doubt that he thought the problem was; Macron's subsequent remarks reiterated these views. European capital should not be funded by US companies, but should be funded by European companies. The authorities know more about how to deal with your capital than you, and they can force you to hold a poorly performing European assets in various ways. For example, for those who deposit money on institutional fund managers through pension funds or retirement accounts, EU financial regulatory agencies can define the appropriate scope of investment so that your investment manager can only purchase EU stocks and bonds legally. For those who deposit money into banks, regulators can ban banks from providing non -EU stocks and bond investment, because they are not "appropriate" for stores. At any time, your money is placed at the trustees supervised by the European Union, and you will be faced with Kristin Lagad and her happy puppet band. Maybe you like her, but please don't misunderstand. As the President of the European Central Bank (ECB), her job is to ensure the survival of the European Union project in the finance, rather than helping your savings growth rate that exceeds her bank maintenance. Need inflation speed.

If you think that only people in the Davos World Economic Forum will advocate such a thing, there is a saying from the infamous racial, fascists, [filling the blanks] from the infamous racial, fascists, [filling the blanks] ... they say ... Marina Le Pang's words:

Europe should be awakened ... because the United States will defend its own interests more strongly.

"Trump Truth" has also attracted attention in the EU's left and right -wing politics.

Back to the EU politicians, they refused to take simple and small economic losses to solve their problems. The following are Macron's blunt saying: Macron:

"Therefore, it is over to buy energy and fertilizer and outsourcing from Russia to China and rely on the United States to ensure security."

Macron continues to emphasize that EU capital must not be guided to show the best financial products, but to be cast in a barren land in Europe:

"The third disadvantage: Every year, our savings are about 300 billion euros to fund the Americans, whether it is Treasury voucher or capital risk. This is too ridiculous."

In the end, Macron said in the last blow that he would suspend the Basel AII bank supervision. In essence, this will allow banks to purchase high -priced and low -income EU government bonds. People holding the euro denomination assets will be losers, because this actually allows the euro to increase infinitely.

"Secondly, we need to re-examine the application method of Basel and the standards for solvency. We cannot become the only economic region in the world to apply these standards. The United States is the root cause of the financial crisis of 2008-2010, but they choose not to apply these standards ”

Macron correctly pointed out that Americans do not comply with these global banking rules and conclude that Europeans do not need to follow. Hello, legal finance collapses the collapse of Bitcoin and gold.

In its latest report, Draggi continued to point out that in addition to providing funds for huge welfare countries (for example, the proportion of government expenditures in France accounts for GDP is the highest among developed countries, 57%), the EU also needs to invest 800 billion yuan each year EUR. Where does these money come from? These money will be printed from the European Central Bank's banknote, and the EU reserved households buy bad long -term EU government bonds under financial pressure.

I am not making these nonsense. These are the direct quotes of the left and right factions of the EU political spectrum. They tell you that they know how to invest in the EU savings best. They tell you that banks should be able to use unlimited leverage to purchase bonds of EU member states. In the end, the European Central Bank will issue these bonds after issuing pan -euro bonds. The reason behind this is the truth of Trump. If the United States under the leadership of Trump will weaken the US dollar and suspend the prudent bank supervision, and forcing Europe to sever contact with Russia and China, then the EU storage households must accept rewards and financial suppression below standards. The EU coward should sacrifice their capital and their real living standards to maintain EU projects. I dare to be sure, you noticed a large number of white eyes in this festival, but if you want to reduce Europe's living standards, I will not have your anger. I dare to bet. Many of you like to wield a banner in public, but you will hurried to the computer at home and try to leave as soon as possible. You know, the way to escape is to purchase and keep it yourself before Bitcoin is banned . But EU readers, this is your choice.

Globally, with the increase of the volume of euro and the increasing bondage of the European Union 's domestic capital, Bitcoin will rise sharply. This is the established policy of the elites. However, I believe this will be "do what I said, not what I do". The authority transferred the secret to Switzerland and Liechtenstein, and bought cryptocurrencies. At the same time, those who refuse to obey and protect their savings will suffer under the inflation approved by the government. This is the way of peeling off the horns.

Truth end

Our truth ending is the 24/7 free cryptocurrency market. After the victory of Trump in early November, the rise in Bitcoin was the leading indicator of the accelerated growth of the legal currency supply. In order to cope with the truth of Trump, each major economic group/country must respond immediately. The reaction is to depreciate currency and increase financial suppression.

Bitcoin (yellow) is leading the increase in bank credit (white).

Does this mean that the price of Bitcoin will rise directly to $ 1 million without any significant callback? Absolutely not.

I don't think the market does not realize that Trump actually has only a little time left to complete anything. The market believes that Trump and his team can immediately create economic and political miracles. The issue of Trump's popularity has been brewing for decades. Therefore, no matter what Elon Musk tells you on X, there is no immediately solution. Therefore, Trump is almost unlikely to fully soothe his supporters to prevent the Democratic Party from regaining two legislature in 2026. People are impatient because they are desperate. Trump is a savvy politician who knows his supporters. For me, this means that he must do a big job as soon as possible, and this is why I bet on the gold club for the $ 100 of his first 100 days after he took office. This is a simple way to make the production cost of the United States rapidly global competitiveness. It will lead to the immediately return of production capacity, which will lead to an increase in today's recruitment instead of an increase in recruitment five years later.

Before we entered the collapse of the cryptocurrency bull market, I believe that the cryptocurrency market will experience a painful plunge before and after the Trump inauguration ceremony on January 20, 2025. Maelstrom will reduce some positions in advance, hoping to buy some core positions at a lower price at a lower price in the first half of 2025. Obviously, each trader will say so and believe that they can seize the market timing. And in most cases, they will eventually sell them prematurely, and then lack confidence in buying a higher price than they just hold. Then, during the remaining time of the bull market, the investment of the above traders will be insufficient. Knowing this, if the bull market is unstoppable on January 20, we will admit failure, lick the wound, and return to the bull market. Trump shows the structural defects of global order to me. The truth of Trump told me that the best way to maximize the return is to hold bitcoin and cryptocurrencies. Therefore, I will buy it at dips.

Yahtzee (Note: Yahtzee is a classic dice game, combined with the unique combination of luck and strategy)! ! !

panewslab

panewslab

chaincatcher

chaincatcher